Islamic Banking and Economic Growth: A Bibliometric Analysis of Research Trends (2007–2024)

DOI:

https://doi.org/10.35945/gb.2025.20.006საკვანძო სიტყვები:

Islamic finance, Islamic banks, economic growth, bibliometric analysis, VoSviewer, Scopusანოტაცია

This article aims to provide an in-depth analysis of the global scientific output on the relationship between Islamic banking and economic growth. Adopting a bibliometric approach, the study covers the period from 2007 to 2024 using data retrieved from the Scopus database, a leading source for tracking academic production. The analysis was conducted with VoSviewer software, which enabled the identification of key research themes, influential authors, countries, institutions, and journals shaping the literature in this area.

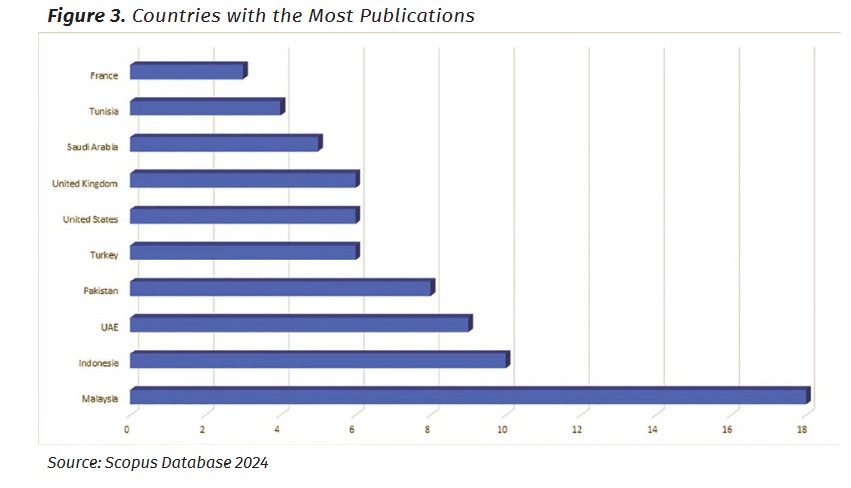

The results reveal that Malaysia stands out as the most productive country, followed by other Asian and Middle Eastern economies, reflecting the regional importance of Islamic finance. The findings further highlight an evolution in research focus: while early studies were mainly concerned with the resilience of Islamic banking during the global financial crisis, more recent contributions emphasize emerging issues such as financial inclusion, governance, and sustainability.

Overall, the study demonstrates the diversification of research directions and the growing academic interest in Islamic finance, underscoring its potential contribution to inclusive and sustainable economic development.

Keywords: Islamic finance, Islamic banks, economic growth, bibliometric analysis, VoSviewer, Scopus.

Introduction

Economic growth is a fundamental metric for assessing the overall performance of national economies. It’s intrinsically linked to aggregate productivity, efficient resource allocation, and the achievement of macroeconomic balances in employment, investment, and financial stability. Within this context, the financial sector is seen as a key engine of growth due to its role in financial intermediation, reducing transaction costs, mitigating information asymmetries, and ensuring the efficient allocation of capital.

The banking system holds particular importance within the financial structure, providing mechanisms to mobilize financial resources and channel them toward productive projects. According to finance-led growth literature, a sound banking structure promotes capital accumulation, stimulates savings, and fosters technological innovation, thereby contributing to higher potential growth rates.

However, the 2008 global mortgage crisis highlighted the fragility of the conventional financial system, which is based on traditional lending mechanisms. The uncontrolled expansion of interest-based credit led to a loss of confidence in conventional banking systems, paving the way for alternative financing models based on risk-sharing and a link to the real economy. Within this framework, Islamic finance emerged as a promising alternative, characterized by financing mechanisms based on participation (Musharakah), profit-and-loss sharing (Mudarabah), and cost-plus-profit sales (Murabahah), which makes it more conducive to achieving economic justice and financial stability.

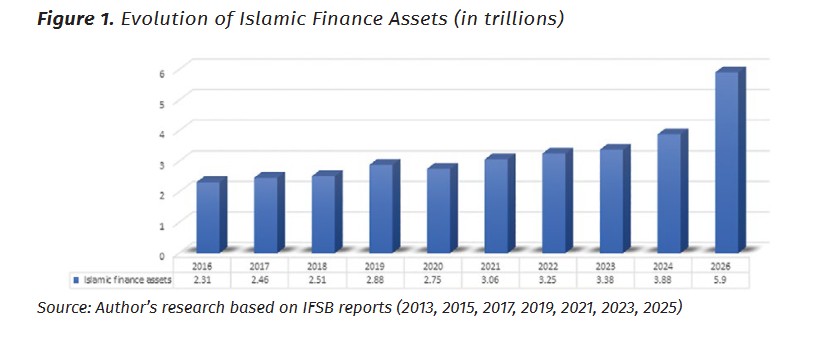

The Islamic finance industry has witnessed significant expansion over the last two decades, driven by high annual growth rates and the emergence of leading Islamic banking models. Data from the Islamic Financial Services Board (IFSB) indicates that the assets of Islamic banks reached $2.1 trillion in 2024, distributed among more than 529 financial institutions, with a clear dominance of Murabahah-based financing.

The recent decades have seen a notable increase in the number of studies exploring the relationship between Islamic banks and economic growth, attempting to test the effectiveness of these tools in achieving sustainable development. However, this growing research momentum highlights the need for bibliometric studies capable of providing a comprehensive overview of the evolution of knowledge in this field and identifying key trends and research schools, as well as mapping knowledge gaps that still require deeper exploration.

From this perspective, this study aims to conduct a bibliometric analysis of scientific research published in the Scopus database during the period (2007–2024) using the VoSviewer software. This study represents a systematic attempt to reconstruct the knowledge map of this research field and provide a solid foundation for researchers and policymakers to guide financial policies toward more equitable, efficient, and sustainable models.

Despite the clear expansion of studies related to Islamic banking, the question remains about the extent of this type of finance’s impact on economic growth, especially given the variance in applications and practices across Islamic countries. The diversity in approaches and methodologies, and the disparity in results, necessitate a comprehensive bibliometric analysis to understand the nature and trends of this scientific field. Accordingly, the main research question is formulated as follows: To what extent has scientific output related to Islamic banking and its relationship to economic growth evolved during the period (2007–2024), and what are its main characteristics and trends?

Objectives:

- To provide a quantitative analytical overview of the growth of scientific literature on Islamic banking and economic growth;

- To identify the key players (researchers, countries, institutions) in this research area;

- To explore the main keywords that reflect the interests of scientific research in this field;

- To evaluate the most influential articles based on the number of citations.

Significance of the Study

The importance of this work lies in its treatment of a timely and strategic topic in finance and development. Employing a bibliometric methodology offers a comprehensive picture of research trends, allowing researchers and financial and economic policymakers to understand the accumulated knowledge and direct their efforts toward new research avenues with a tangible impact on the design of sustainable development models.

Methodology

This study adopts a bibliometric analysis methodology, which is a quantitative approach used to analyze bibliographic data extracted from scientific databases. Its purpose is to evaluate the dynamics of scientific publishing and identify active knowledge networks in a specific subject. The international Scopus database was chosen for its wide coverage and high accuracy in indexing peer-reviewed articles. The VoSviewer software was used to build knowledge networks and analyze keywords, authors, countries, institutions, and citation networks.

- Theoretical Framework

1.1. The evolution of Islamic finance

Islamic finance has been proposed as a key solution to conventional financing, especially in Muslim-majority economies, and has demonstrated remarkable growth rates globally.[1] The total assets of the Islamic finance industry were estimated at $3.88 trillion in 2024, representing a 14.9% increase.[2] This financial system is built upon fundamental principles, including profit-and-loss sharing, directing investments towards ethical activities, and asset-backed financing, which requires a deep understanding of operational mechanisms compliant with Islamic Sharia law.[3]

The Islamic finance sector consists of four key components: Islamic banks, Sukuk (Islamic bonds), investment funds, and Takaful (Islamic insurance). These financial instruments are distinguished by their direct link to real economic activity, with most Islamic financial institutions concentrated in Gulf Cooperation Council (GCC) countries, Malaysia, Indonesia, and Pakistan, in addition to their gradual expansion into non-Muslim countries like the United Kingdom and Luxembourg.[11]

1.2. The relationship between Islamic finance and economic growth

The first attempt to document the relationship between finance and economic growth dates to Schumpeter (1911), who highlighted the role of financial institutions in using intermediation to mobilize and allocate funds and record transactions essential for economic development.[12] Since then, economic literature has extensively debated this relationship, whether within the context of conventional or Islamic finance.

Studies on Islamic finance have approached the subject from two perspectives:[13]

- Macro-level: Analyzing the impact of the entire sector on economic growth;

- Micro-level: Examining specific instruments like Murabahah or Mudarabah and their effect on macroeconomic variables.

Empirical results have identified three patterns of relationships between the two variables:

- A bidirectional causal relationship;

- A “supply-leading” relationship, where finance drives economic growth;

- A “demand-following” relationship, where economic growth stimulates finance.

Despite the growing body of literature on Islamic finance and its effect on economic growth, this field still suffers from a lack of coherence, topical integration, and systematic evaluation. Academic contributions remain scattered across various scientific journals, geographic regions, and research traditions, with limited efforts to synthesize findings or trace the chronological evolution of key topics. This highlights the importance of bibliometric analysis as a quantitative methodology capable of providing a holistic view of the research trajectory in this area. It can reveal publishing patterns, identify active knowledge networks, and track recent research trends, thereby enabling researchers and interested parties to form a clearer picture of the future of studies related to Islamic finance and economic growth.[14]

- Methodology

Data was systematically retrieved from the Scopus database, a comprehensive and high-quality database for abstracts and citations in the social sciences.[15],[16]

The data set creation process involved two main steps:

- Initial Search: A search was conducted on April 1, 2024, using the keywords “banking AND finance AND economic AND growth” on the Scopus platform. This initial query yielded 128 documents published between 1990 and 2024;

- Exclusion/Refinement: To enhance the study’s focus and analytical precision, the initial set of documents underwent a strict filtering process. This involved limiting the scope to journals in economics, business, and social sciences, and to publications in English only. Furthermore, the search was restricted to research articles, excluding books, conference proceedings, and other non-journal-related document types. As a result of this refinement, the final data set comprised 83 documents, with the publication period narrowed to 2007–2024. It is worth noting that this adjusted timeframe remarkably coincides with the onset of the subprime mortgage crisis.

Results and discussion

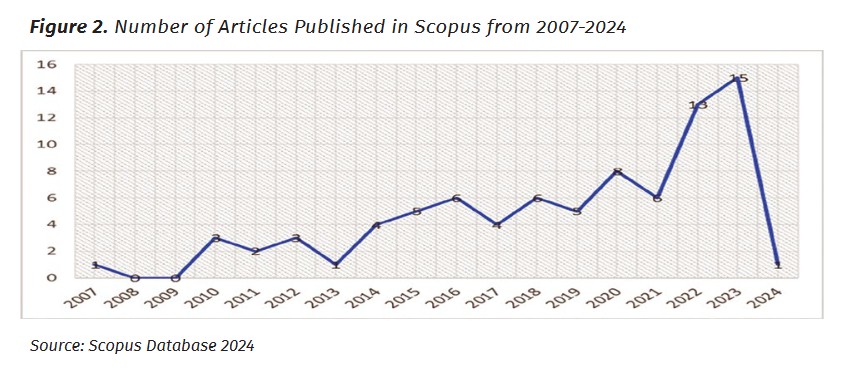

The curve demonstrates a growing research interest in the topic of Islamic finance and economic growth over the years. The evolution of research can be divided into the following phases:

- Inception (2007–2009): Research activity was very limited, coinciding with the beginning of the subprime mortgage crisis. This period marks the initial interest in Islamic finance as an alternative solution to conventional global financing;

- Gradual Growth (2010–2019): A slow and steady increase in the number of articles with minor fluctuations;

- Major Leap and Peak (2020–2023): This period saw a significant rise in publications, peaking in 2023 with 15 articles, indicating a substantial increase in academic interest in this field;

- 2024: Only one article is shown up to April, which does not reflect a decline but rather represents incomplete data for the current year.

The curve shows a general upward trend in the number of publications, which suggests a growing academic interest in this vital field that links Islamic finance and economic growth. Upon examination, it’s clear that a few years after the 2008 crisis, there was a gradual increase starting from 2010 and beyond. This rise aligns with the hypothesis that the financial crisis prompted researchers to explore alternative financial models, with Islamic finance being one of them.

Figure 3 shows the countries with the most publications during the study period, revealing centers of power and a significant expansion of intellectual influence in the field of Islamic finance. This reflects the economic and intellectual leadership of this sector. Malaysia and Indonesia are considered global knowledge hubs for Islamic finance. Their dominance (Malaysia with 8 articles, Indonesia with 10) reflects long-term strategies in building a strong financial and legislative infrastructure, along with intensive investment in specialized human capital. This superiority confirms that a conducive economic environment is key to intellectual output.

Emerging countries like Gulf states (UAE, Saudi Arabia), Pakistan, and Turkey have made moderate contributions, reflecting an economic evolution that views Islamic finance not just as a religious commitment but as a driver for economic development and financial diversification. The presence of Western countries such as the United Kingdom, the United States, and France, albeit with a small contribution, reflects the transformation of Islamic finance from a local phenomenon into a global economic player. This Western interest is not necessarily religious but is driven by research that explores new market opportunities, giving the topic a global dimension and greater scientific acceptance.

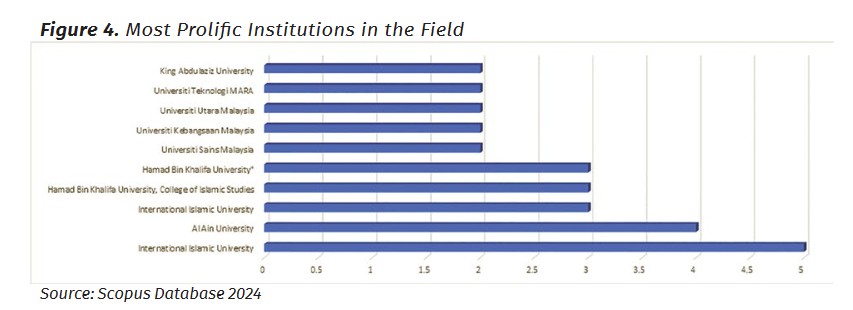

The institutions dominating research on Islamic finance and economic growth can be categorized into two levels:

- Geographical Level: Malaysia and Indonesia lead the research landscape, a result of legislative and institutional support for such research. They are followed by an increasing presence from Gulf states (UAE, Saudi Arabia), Pakistan, and Turkey. Notably, the presence of Western countries (France, the United States, and the United Kingdom) confirms the global nature of Islamic finance and its attractiveness as an alternative economic model sought for financial stability, particularly after the 2008 crisis;

- Institutional Level: Leading global Islamic universities emerge as key research centers, followed by a group of Malaysian universities that reflect Malaysia’s commitment to becoming a knowledge hub in Islamic finance. The appearance of Hamad Bin Khalifa University and Al Ain University also indicates a growth in academic research investments in the region to support the Islamic financial sector.

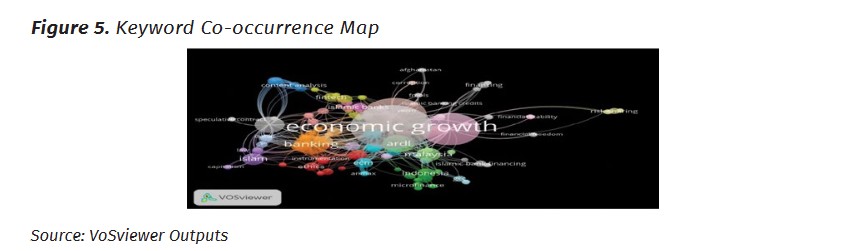

The keyword map provides a strategic overview of the most common concepts in academic research on Islamic finance and economic growth. The map reveals clusters of concepts that can be divided into five main groups, highlighting the methodological evolution and temporal trends in this field:

- Core Concepts: “economic growth”, “Islamic banks”, and “banking”. Economic growth emerges as the largest central node, confirming its status as the core concept for most research. Other key nodes, particularly for Islamic banks, indicate their central role in the relationship with economic growth;

- Methodological Dimensions: Solidifying the Econometric Nature: The light green cluster is the most prominent in giving this subject its rigorous economic and scientific character. The presence of terms like “ARDL”, “ECM”, “VECM”, and “ARIMAX” clearly indicates a widespread adoption of advanced econometric models to study the relationship between Islamic finance and economic growth. These models are more than just statistical tools; they are analytical frameworks that:

- Allow Causal and Dynamic Analysis: Instead of mere correlation, they enable researchers to explore whether Islamic finance leads to economic growth, or vice versa, and whether there are long-term and short-term relationships;

- Address Complex Economic Issues: Such as cointegration and the reciprocal dependence between macroeconomic variables;

- Add Scientific Credibility: The use of these models enhances the strength and generalizability of the results, elevating research from a descriptive level to an analytical and predictive one.

The link between these methodologies and countries like Malaysia and Indonesia confirms that these nations not only contribute to quantitative knowledge production but also to the development and application of modern econometric methods to understand the dynamics of Islamic finance within their economic contexts.

- Core Dimensions of Islamic Finance: Stability and Risk-Sharing: Concepts such as “risk sharing” and “financial stability” emerge as fundamental research components. These concepts are at the heart of the economic principles of Islamic finance. Their connection to economic growth confirms that research explores how the inherent features of Islamic finance can provide a more resilient and sustainable model for economic growth, which has gained particular importance after the global financial crisis.

- Recent Trends and Challenges: Technology and Ethics: Concepts like “fintech” indicate a growing interest in how technological innovations can be integrated into Islamic financial services to enhance efficiency and financial inclusion. Conversely, terms such as “ethics” and “Islam” highlight the normative and value-based dimensions that continue to form the foundation of this sector. The concept of “corruption” also appears, possibly as a factor whose impact on the effectiveness of Islamic finance and growth is being studied.

The network map provides a comprehensive picture of a multifaceted research field where “economic growth” is intertwined with “Islamic banks” through sophisticated econometric models. This methodological evolution reflects a concerted effort to lend scientific and quantitative credibility to studies on Islamic finance, moving beyond descriptive analyses to a deep understanding of causal relationships. This integration of robust economic methodologies with Sharia-compliant foundations, in addition to exploring ethical and innovative dimensions, confirms the increasing academic maturity of this field and its role in shaping the future of global financial systems.

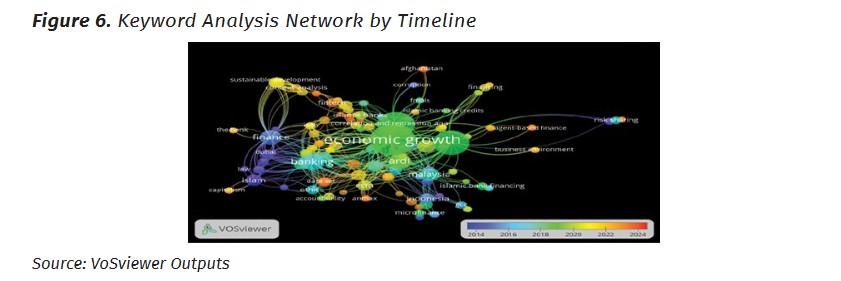

This map illustrates the chronological sequence of keywords, colored according to the average year of publication (from blue/2014 to red/2024), providing a comprehensive view of how research interests have evolved and expanded over time. It can be divided into the following phases:

- Phase of Theoretical Foundations and Basic Concepts (in purple and blue): The early period focused on fundamental concepts of Islamic finance and the laws governing it (Islam, law, ethics, finance, banking);

- Linking Islamic Finance to Economic Growth using Economic Theories and Quantitative Models (2017–2019): In this phase, there was an intensive emergence of concepts related to economic development and applied models. This makes research more objective and measurable, giving it a more academic and scientific character and a wider intellectual resonance, especially in Western countries, beyond the religious aspect;

- Phase of Innovation and Sustainability (2020–2024): This phase coincided with the COVID-19 pandemic, which led to a reliance on technology and remote interactions. This introduced modern variables into academic research, such as fintech, which reflects the rapid digital transformation the world witnessed during the pandemic and the drive to enhance the efficiency and financial inclusion of Islamic financial institutions. The term “sustainable development” indicates an increased awareness of climate and the need for sustainable finance. The term “corruption” also highlights an interest in governance standards to increase the effectiveness of Islamic finance. “Risk sharing” and “financial stability” reflect a search for more resilient financial models to face recurring economic and even health-related shocks that could later turn into a financial and economic crisis.

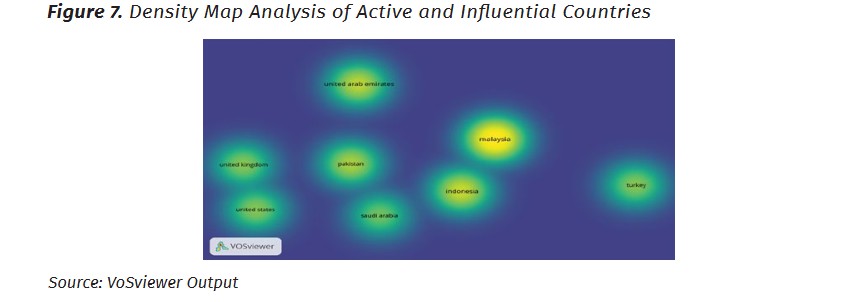

The map highlights the most active and influential areas in terms of scientific output and citations. Malaysia appears as the most active and “hottest” point on the map, shown in bright yellow. This indicates Malaysia’s status as a central hub in the research field represented by this network, meaning it has the highest number of publications, is the most cited, and has the highest density of collaborations in this context. Indonesia follows, confirming it is another key center of activity and influence.

The United Arab Emirates shows a very high density, confirming its role as an important research center and an effective bridge between different country clusters. Pakistan also shows high density, reinforcing its role as a key player and an important node in the network.

Medium Density Areas (Green): The United Kingdom and the United States show good density, indicating strong and sustained contributions to the field, even if they are not as “hot” as the Asian hubs. Saudi Arabia also shows good density, confirming its role as a key partner and research center in the region.

Lower Density Areas (Dark Green/Blue): Turkey shows a slightly lower density compared to other countries in the green cluster (Malaysia and Indonesia), but it is still part of an active area.

This density map conclusively confirms that Malaysia and Indonesia are the two driving forces and focal points of research activity in this field. It also highlights the importance of the United Arab Emirates and Pakistan as high-density centers for collaboration and production. This map provides strong visual confirmation of the previous analyses regarding the importance of these countries, especially Malaysia and Indonesia, in contributing the most cited articles in the relevant discipline.

Conclusion

This bibliometric study offers deep insights into the dynamic and intellectual evolution in the field of Islamic finance. By analyzing publication patterns, collaboration networks, and geographical activity centers, we were able to draw a comprehensive map of research development.

The results show that the field of Islamic finance has undergone a notable shift in its research agenda, moving from focusing on responses to financial crises to studying its impact on economic growth, and eventually to integrating contemporary issues such as governance, sustainable development, and financial technology. This reflects an increasing maturity in understanding the role of Islamic finance as an active component of the global economic system.

Furthermore, the study revealed the emergence of leading research centers, particularly in Malaysia and Indonesia, which are no longer merely markets but have become key intellectual hubs driving innovation and knowledge production. It also highlighted the role of intermediary countries like the United Arab Emirates and Pakistan in facilitating cross-border collaboration and knowledge exchange.

In conclusion, identifying research gaps, such as the neglect of studying “Islamic windows”, not only provides evidence for the need for more specialized research but also opens new avenues for future scientific contributions. This study affirms the analytical value of the bibliometric approach in understanding scientific developments and providing a solid knowledge base for researchers and policymakers to direct research efforts toward issues with a greater impact on comprehensive and sustainable economic development.

References:

Ghorab, H., Others. (2023). The Impact of the Murabaha Formula on Economic Growth: A Standard Study on a Sample of Islamic-Financed Countries from 2013-2020. Journal of Economics and Sustainable Development, 6(2);

Hanif, M., Zafar, K. (2020). Developments in Islamic finance literature: Evidence from specialized journals. Journal of King Abdulaziz University, 33(2). <doi:https://doi.org/10.4197/Islec.33-2.1>;

IFSB. (2013, 2015, 2017, 2019, 2021, 2023, 2025). Islamic Financial Services Industry Stability Report;

Kayani, U. N. et. al. (2023). Examining the Relationship between Economic Growth,Financial Development, and Carbon Emissions: A Review of the Literature and Scientometric Analysis. International Journal of Energy Economics and Policy, 13(02);

Khamis, F., Isa, M., Yusuff, N. (2024). Perceived inclusion of Islamic finance: The effects of attitudes, experience, literacy, religiosity, and social influences. International Journal of Applied Economics, Finance and Accounting, 18(2). <doi: https://doi.org/10.33094/ijaefa.v18i2.1398>;

Loso, J. (2025). Islamic Finance and Economic Growth: A Bibliometric Analysis of Scholarly Contributions. West Science Islamic Studies, 3(3). <doi:http://dx.doi.org/10.58812/wsiss.v3i03.2117>;

Omar, A., Omer, M. (2022). Testing Effeciency of sudan s Islmic banks for funding socio-economics Development Using World rankings indices. Interational journal of Islamic Economics, 04(01);

Siti, I. et. al. (2022). Unlocking the Power of Creative Thinking: A bibliometric analysis of the 21st Century. Journal of ASIAN Behavioural Studies (jABs), 7(22).

Footnotes

[1] Hanif, M., Zafar, K. (2020). Developments in Islamic finance literature: Evidence from specialized journals. Journal of King Abdulaziz University, 33(2), pp. 3-23. <doi:https://doi.org/10.4197/Islec.33-2.1>.

[2] Ifsb. (2025). Islamic Financial Services Industry Stability Report 2025: Need for Coordinated Action to Deepen Markets and Sustain Growth Momentum. Available at: <https://www.ifsb.org/press-releases/islamic-financial-services-industry-stability-report-2025-need-for-coordinated-action-to-deepen-markets-and-sustain-growth-momentum/>.

[3] Khamis, F., Isa, M., Yusuff, N. (2024). Perceived inclusion of Islamic finance: The effects of attitudes, experience, literacy, religiosity, and social influences. International Journal of Applied Economics, Finance and Accounting, 18(2), pp. 321-338. <doi: https://doi.org/10.33094/ijaefa.v18i2.1398>.

[4] IFSB. (2013). Islamic Financial Services Industry Stability Report.

[5] IFSB. (2015). Islamic Financial Services Industry Stability Report.

[6] IFSB. (2017). Islamic Financial Services Industry Stability Report.

[7] IFSB. (2019). Islamic Financial Services Industry Stability Report.

[8] IFSB. (2021). Islamic Financial Services Industry Stability Report.

[9] IFSB. (2023). Islamic Financial Services Industry Stability Report.

[10] Ibid.

[11] Loso, J. (2025). Islamic Finance and Economic Growth: A Bibliometric Analysis of Scholarly Contributions. West Science Islamic Studies, 3(3), pp. 240-249. <doi:http://dx.doi.org/10.58812/wsiss.v3i03.2117>.

[12] Omar, A., Omer, M. (2022). Testing Effeciency of sudan s Islmic banks for funding socio-economics Development Using World rankings indices. Interational journal of Islamic Economics, 04(01), pp. 1-17.

[13] Ghorab, H., Others. (2023). The Impact of the Murabaha Formula on Economic Growth: A Standard Study on a Sample of Islamic-Financed Countries from 2013-2020. Journal of Economics and Sustainable Development, 6(2), pp. 20-38.

[14] Loso, J. (2025). Islamic Finance and Economic Growth: A Bibliometric Analysis of Scholarly Contributions. West Science Islamic Studies, 3(3), pp. 240-249. <doi:http://dx.doi.org/10.58812/wsiss.v3i03.2117>.

[15] Kayani, U. N. et. al. (2023). Examining the Relationship between Economic Growth,Financial Development, and Carbon Emissions: A Review of the Literature and Scientometric Analysis. International Journal of Energy Economics and Policy, 13(02), pp. 489-499.

[16] Siti, I. et. al. (2022). Unlocking the Power of Creative Thinking: A bibliometric analysis of the 21st Century. Journal of ASIAN Behavioural Studies (jABs), 7(22), pp. 55-70.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .