Unveiling new insights about the influence of oil prices on GDP in OAPEC nations: MMQR investigation

DOI:

https://doi.org/10.35945/gb.2025.19.009საკვანძო სიტყვები:

Oil price fluctuations, GDP, method of moments quantile regression, Population, OAPECანოტაცია

Employing the methodology of moments quantile regression with fixed effects (MM-QR), this research examines the influence of variations in oil prices on economic development within Arab oil-exporting nations that are affiliated with the Organisation of Arab Petroleum Exporting Countries (OAPEC). Comprehensive data from 1990 to 2021 for eleven OAPEC member countries are analyzed. The empirical findings derived from the analysis reveal a significant and positively correlated association between the fluctuations in oil prices and economic growth, particularly when examined within the context of nations exhibiting higher Gross Domestic Product (GDP) quantiles, which suggests that countries possessing elevated GDP levels tend to derive greater economic advantages from increases in oil prices. Nevertheless, it is noteworthy that the impact of this correlation diminishes considerably for countries situated within the lower GDP quantiles. Additionally, population growth positively affects GDP but exhibits diminishing returns over time, while exchange rate fluctuations show negligible impact on overall economic stability and growth.

Keywords: Oil price fluctuations, GDP, method of moments quantile regression, population, OAPEC.

Introduction

Strong turbulences marked by abrupt variations in oil prices have rocked the global oil market during the past few decades. The times of highest oil price volatility were 1973, 1979, 2008, and 2020, which followed the 2019–2020 coronavirus epidemic. Because the US has run out of storage space, the West Texas Intermediate futures crude oil price saw negative trading for the first time in April 2020. The global oil market’s past indicates that macroeconomic success and fluctuations in oil prices have historically been closely correlated. Both nations that import oil and nations that export oil may experience economic instability as a result of oil shocks. Furthermore, in some oil-dependent economies, sudden and severe swings in oil prices may be the cause of financial and economic crises. Since it can have an impact on producers, governments, and consumers, the volatility of global oil prices and how it affects macroeconomic performance have become more of an issue for economies.[1]

For centuries, oil has pulsated through the veins of the Arab world, fueling not only its cars and industries but also its societies and political landscapes. The OAPEC members have witnessed an intricate and influential interaction between their oil wealth and economic fortunes. This relationship dances to the rhythm of the up-and-down nature of oil prices, a volatile melody that can uplift economies to soaring heights or plunge them into the abyss of stagnation.

Hence, this investigation endeavors to enhance the existing literature in twofold. Initially, this paper measures the influence of fluctuations in oil prices on the trajectory of economic expansion in Arab nations that export oil. This involves analyzing historical data to identify patterns and correlations between oil prices and economic indicators such as Gross Domestic Product growth. The choice of these nations is according to its importance in the oil market since they contain leader countries such as Saudi Arabia, Iraq, Libya and Algeria. Second, for the first time, this analysis uses the modern MMQR procedure to allow us to track the effect of oil prices on several quantiles of GDP. This procedure will help us to determine and estimate what role oil prices play in low, medium and high GDP levels among the nations of the study.

- Literature Review

The oscillations observed in oil prices exert significant ramifications on economic development within Arab nations, especially those that exhibit a pronounced dependence on oil exports. The link between oil price variations and GDP growth is complicated and varied, impacted by different economic, political, and social factors.

To begin with, real GDP in the GCC countries, which include Saudi Arabia, Bahrain, Qatar, Kuwait, United Arab Emirates, and Oman, reacts asymmetrically to oil price changes, specifically, positive oil price shocks exert a more pronounced positive influence on GDP than negative shocks. This asymmetry suggests that while rising oil prices can stimulate economic activity, falling prices may not have an equally detrimental effect, particularly in nations like Kuwait and Qatar, where the negative impacts of price declines are more pronounced.[2]

Moreover, the interconnectedness of oil prices, electricity consumption, and GDP in the GCC region further complicates this relationship. The petroleum sector constitutes the essential foundation of the economies in these countries, accounting for a substantial proportion of the Gross Domestic Product (GDP). Consequently, fluctuations in oil prices possess the capacity to trigger significant modifications in governmental revenue streams, which in turn affect public spending and investment endeavors. This cyclical interdependence engenders a situation wherein elevated oil prices may result in augmented government spending on infrastructure and social initiatives, thus facilitating economic development.[3]

However, the fluctuations inherent in oil prices may concurrently generate a degree of unpredictability within the economic landscape, potentially impeding both investment activities and the formulation of economic strategies. Oil price shocks explain a significant portion of the variation in governmental income and gross domestic product within the Sultanate of Oman, indicating that fluctuations can lead to budgetary constraints during periods of low prices. This volatility can create a challenging environment for policymakers, as they must navigate the impacts of fluctuating revenues on fiscal policy and economic stability.[4]

In addition to direct impacts on GDP, oil price volatility can also influence inflation rates and the overall economic climate. Oil shocks can lead to inflationary pressures, which can further complicate economic growth. In nations that derive substantial revenue from oil exports, escalating oil prices may result in heightened production costs, which may be passed on to consumers, thereby affecting consumption and investment decisions. This inflationary effect can dampen the positive impacts of rising oil prices on GDP growth.[5]

Furthermore, the historical context of oil price shocks provides insight into their long-term effects on economic growth. The twin oil crises of the 1970s, resulted in significant economic transformations in Gulf oil exporters, as they utilized their increased revenues to invest in foreign aid and domestic development. This historical perspective underscores the potential for both beneficial and adverse outcomes stemming from oil price fluctuations, depending on how governments choose to manage their oil revenues.[6]

The situation in Iraq exemplifies an additional aspect of the repercussions of oil price fluctuations on economic development. Rodhan’s research indicates that although elevated oil prices typically exert a beneficial influence on gross domestic product, the ramifications of decreasing prices are significantly more acute in nations such as Kuwait and Qatar, suggesting that the economic resilience of these nations is closely tied to their oil revenue stability.[7]

An other study analysed the level of dependency between petroleum prices and the expansion of economic activity in four member states of OPEC during the timeframe spanning from September 3, 2000, to December 3, 2010. The study results indicate that fluctuations in oil prices during times of global economic fluctuations and financial instability impact the correlation between oil and economic development in OPEC nations.[8]

Research has examined the significant influence of fluctuations in crude oil prices and their volatility on the economic expansion of countries in the MENA region. Additionally, the researcher examined the bidirectional and fluctuating correlation between economic development and oil prices. In addition, a distinct study was carried out for each MENA country that exports oil and each country that imports oil. The study employed a panel quantile regression methodology using alternative linear models. The research findings revealed that fluctuations and volatility of oil prices have differing impacts on countries that export and import oil. Across various quantiles, the effects of oil price variations and the level of uncertainty associated with them differed.[9]

In conclusion, the influence of fluctuations in oil prices on the economic advancement of Arab countries is characterized by a complex interplay of positive and negative effects. While increasing oil prices may invigorate economic expansion and government revenues, volatility introduces uncertainty that can hinder investment and fiscal planning. The historical context and the specific economic structures of these nations further influence how they respond to fluctuations in oil prices. As such, there is a critical need for these countries to pursue economic diversification strategies to reduce their dependence on oil revenues and enhance their resilience to price shocks.

2.2. Data

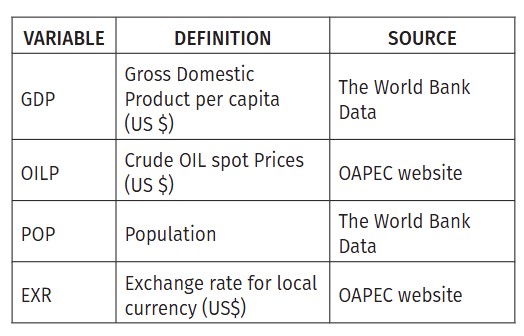

Table 1 provides an overview of the various variables, while Table 2 describes statistics for the sample.

Table 1: Variable Description

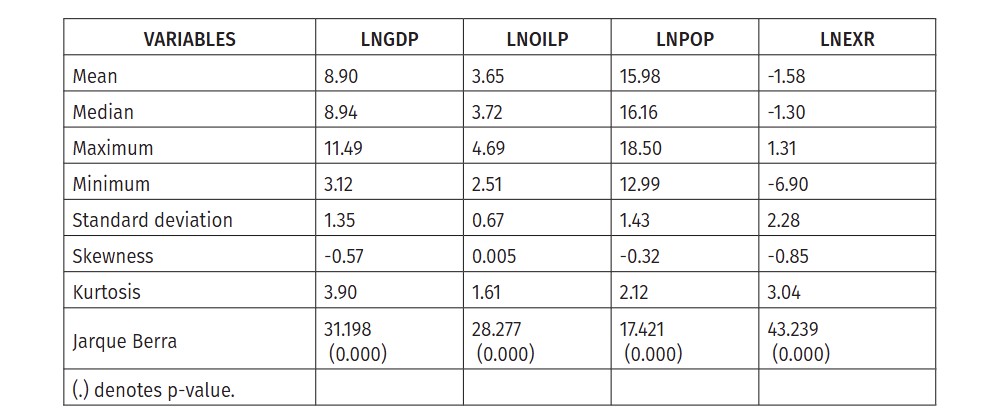

Table 2: Descriptive statistics

Source: EViews 12 program output

According to the data presented in Table 2, the skewness values for three variables (GDP, POP, and EXR) are negative and significantly different from zero, indicating a pronounced left skewness. The Skewness value for the variable OILP is close to zero, but its Kurtosis value is far from three. The Jarque-Bera statistical test unequivocally rejects the null hypothesis of normality, providing further confirmation that using OLS estimation will be unreliable, while adopting quantile regression is more appropriate and resilient for this investigation.

- Empirical Results

3.1. Correlation matrix / Variance inflation factor:

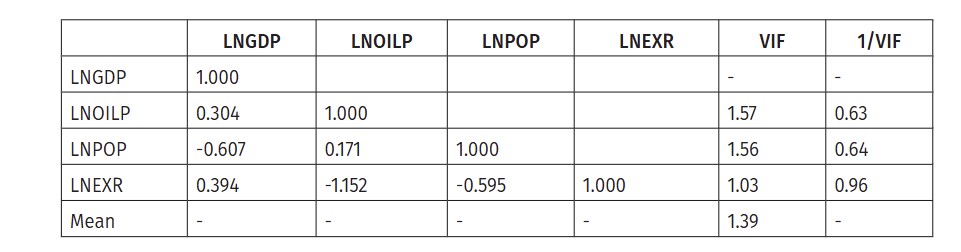

Table 3: Correlation matrix - Variance inflation factor

Source: STATA 17 program output

Table 3 displays the correlation coefficients between the different variables, along with the findings of the variance inflation factor. The absolute values of all correlation coefficients between independent variables are below 0.7. The VIF test findings demonstrate that there is no multicollinearity among the independent variables, as the average value of 1.39 is below 5. The VIF findings support our perspective of including OILP, POP, and EXR in the same model.

3.2. Slope homogeneity test:

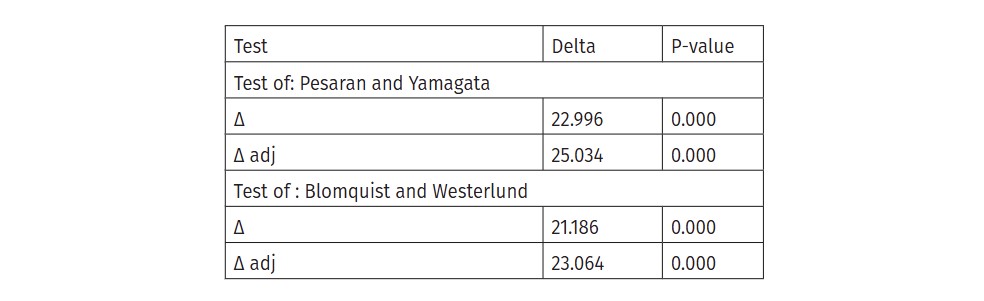

Table 4: Slope homogeneity test results:

Source: STATA 17 program output

Before continuing, it is essential to perform a crucial test to verify the accuracy of the Slope homogeneity hypothesis for the provided data. Therefore, we will utilise two tests for analysis: (Pesaran & Yamagata, 2008)[15] and (Blomquist & Westerlund, 2013).[16] The findings delineated in Table 4 demonstrate the rejection of the null hypothesis of uniformity in the slope across different nations. Thus, it is crucial to take into account the limitations imposed by variability on the slope to guarantee reliable outcomes in estimating techniques.

3.3. Cross-section dependence tests

Table 5: Cross-section dependence test results:

*** Indicates the null hypothesis being rejected with a significance level of 1%

Source: EViews 12 program output

We utilize four distinct examinations: the Breusch-Pagan LM (BP) test suggested by (Breusch & Pagan, 1980),[17] the Pesaran Scaled LM (PS) test presented by (Pesaran M. , 2004),[18] the Bias corrected scaled LM (BCS) test proposed by (Baltagi et al., 2012)[19] and the Pesaran CD (PE) test (Pesaran, 2007)[20] The findings showed that the null hypothesis of “no CSD” is not accepted, they unequivocally affirm that any shock impacting a variable in one country would propagate its impact to the same variable in other nations.

3.4. MM-QR results and discussion:

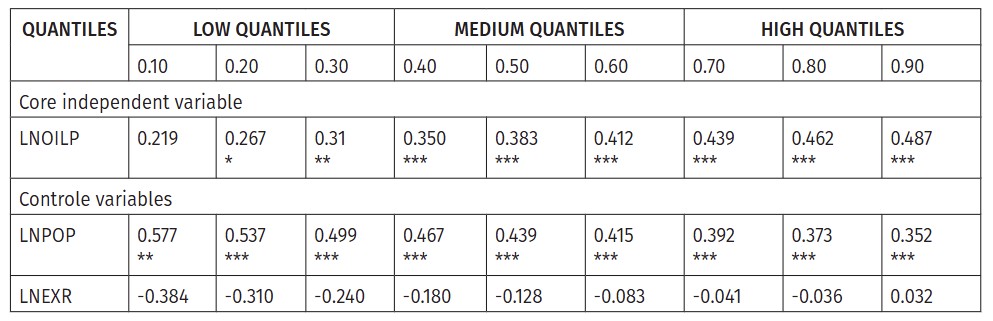

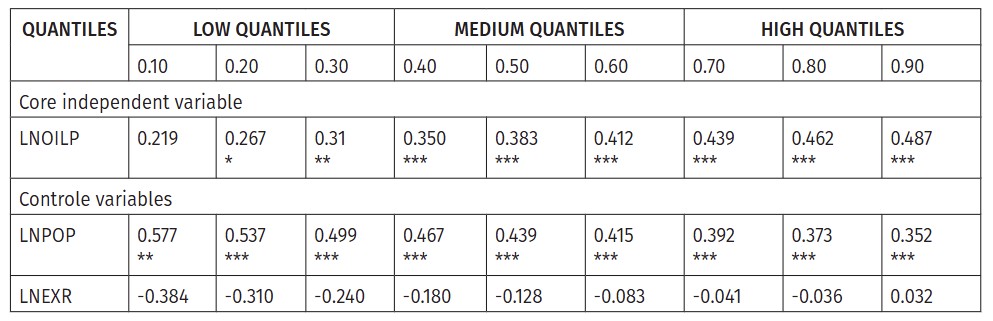

Table 6: The findings of the MMQR approach

Notes: The symbols ***, **, and * represent statistical significance at the 1%, 5%, and 10% levels, respectively.

Source: STATA 17 program output

The findings of MM-QR across different quantiles have flourished in Table 6; the coefficient related to OILP is positive, significant and gradually increased from 0.2 to 0.9 quantiles and remains insignificant for the first quantile. Notably, this outcome is in line with findings for GCC members. [21] This heterogeneous impact across income levels is likely driven by several factors. MM-QR allows us to isolate these dynamics by revealing how oil price changes differentially affect various quantiles of the GDP distribution. The results indicate that as GDP increases from the 0.2 to the 0.9 quantiles, the impact of oil price fluctuations becomes stronger and more positive. This means that countries with higher GDP tend to benefit more from increases in oil prices in terms of economic growth. The insignificance of the coefficient for the lowest GDP quantile indicates that changes in oil prices have a minimal impact on the poorest sectors of the economy. This might be because they’re not as connected to global markets or rely more on industries other than oil for their economy.

This outcome can be attributed to the fact that high-income countries (those with elevated GDP levels) benefit from a more robust economy through strategic investment projects yielding substantial economic returns. Nations such as Saudi Arabia, Qatar, and the UAE, when experiencing a rise in oil prices, acquire additional revenue that is subsequently channeled into local investments. This process directly and significantly impacts economic growth. Conversely, countries with lower GDP levels are characterized by limited and weak investment opportunities. In these nations, oil revenues are primarily allocated towards bolstering infrastructure and funding social expenditures, which do not contribute as substantially to economic growth.

Population has a positive and significant impact on GDP and decreases gradually from the low to high quantiles confirming prior findings.[22] Accordingly, this outcome can be explained by the fact that when the population grows further, resources like land, infrastructure, and skilled labor might become relatively scarce, leading to diminishing marginal returns from additional population growth. This could explain the decreasing effect in higher quantiles.

The effect of exchange rate for local currency on GDP is negative but insignificant across all quantiles, which aligns with previous research.[23] The insignificant effects could be explained by the fact that a substantial portion of oil exports from these nations are denominated in US dollars, meaning they receive a fixed income regardless of their local currency’s exchange rate. This reduces the direct impact of fluctuations on overall GDP.

Conclusion

In summary, our paper gives us a clearer picture of how oil prices affect the economies of Arab countries that export oil. The study’s duration was from 1990 to 2021 using a special analysis method called Moment of Quantile Regression (MM-QR).

Our results support what we suspected: there’s a strong and positive connection between oil prices and economic growth in these countries. But what’s interesting is that this connection isn’t the same for everyone. We found that as a country’s wealth (measured by GDP) goes up, the impact of oil prices on its economic growth gets stronger. However, for the poorest parts of these countries, the impact is much smaller. This suggests that poorer areas might not be as affected by changes in oil prices, perhaps because they’re not as connected to the global economy or they rely more on industries other than oil.

We also looked at how population growth and changes in exchange rates affect economic output. It turns out that while a growing population initially boosts economic growth, the effect decreases as a country becomes wealthier. This tells us that the correlation between population and economic growth is significantly more complicated than it seems. Similarly, changes in exchange rates don’t seem to have a big impact on overall economic output, likely because these countries mostly trade oil in foreign currencies.

Recommendations:

According to our research, we may provide some suggestions:

- Leaders should prioritise diversifying their sources of revenue, particularly in economically disadvantaged regions, to reduce their reliance on oil revenues and enhance their ability to rebound from challenging circumstances;

- Make strong plans to handle changes in money value, like saving money and being careful with spending, to protect against sudden changes in how much money is worth.

- Spend time and money learning about how money and economies work better, so we can make smart plans for when oil prices go up and down and keep our economies strong in the long term.

Bibliography:

- Al Jabri, S., Raghavan, M., Vespignani, J. (2022). Oil prices and fiscal policy in an oil-exporter country: Empirical evidence from Oman. Energy Economics, 111(106103). Doi: <https://doi.org/10.1016/j.eneco.2022.106103>;

- Ayad, H., Ben-Salha, O., Ouafi, M. (2023). Do oil prices predict the exchange rate in Algeria? Time, frequency, and time‐varying Granger causality analysis. Economic Change and Restructuring, 56(5). Doi: <https://doi.org/10.1007/s10644-023-09545-1>;

- Baltagi, B., Feng, Q., Kao, C. (2012). A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. Journal of Econometrics, 170(1). Doi: <https://doi.org/10.1016/j.jeconom.2012.04.004>;

- Benlaria, H., Almawishir, N. (2024). The Relationship between Electricity Consumption, Price of Oils, and Gross Domestic Product in the Gulf Cooperation Council Countries. International Journal of Energy Economics and Policy, 14(1). Doi: <https://doi.org/10.32479/ijeep.15108>;

- Blomquist, J., Westerlund, J. (2013). Testing slope homogeneity in large panels with serial correlation. Economics Letters, 121(3). Doi: <https://doi.org/10.1016/j.econlet.2013.09.012>;

- Breusch, T., Pagan, A. (1980). The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. The Review of Economic Studies, 47(1). Doi: <https://doi.org/10.2307/2297111>;

- Canay, I. (2011). A simple approach to quantile regression for panel data. The Econometrics Journal, 14(3). Doi: <https://doi.org/10.1111/j.1368-423X.2011.00349.x>;

- Ftiti, Z., Guesmi, K., Teulon, F., Chouachi, S. (2016). Relationship between crude oil prices and economic growth in selected OPEC countries. The Journal of Applied Business Research, 32(1). Doi: <http://dx.doi.org/10.19030/jabr.v32i1.9483>;

- Gómez-Loscos, A., Gadea, M., Montañés, A. (2012). Economic growth, inflation and oil shocks: are the 1970s coming back? Applied Economics, 44(35). Doi: <https://doi.org/10.1080/00036846.2011.591741>;

- Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1). Doi: <https://doi.org/10.1016/j.jmva.2004.05.006>;

- Koenker, R., Bassett Jr, G. (1978). Regression Quantiles. Econometrica, 46(1). Doi: <10.2307/1913643>;

- Machado, J., Silva, J. (2019). Quantiles via moments. Journal of Econometrics, 213(1). Doi: <https://doi.org/10.1016/j.jeconom.2019.04.009>;

- Maestas, N., Mullen, K., Powell, D. (2023). The Effect of Population Aging on Economic Growth, the Labor Force, and Productivity. American Economic Journal: Macroeconomics, 15(2). Doi: <10.1257/mac.20190196>;

- Mamdouh, A. (2023). Oil price fluctuations and economic growth: the case of MENA countries. Review of Economics and Political Science, 8(5). Doi: <http://dx.doi.org/10.1108/REPS-12-2019-0162>;

- Marimoutou, V., Raggad, B., Trabelsi, A. (2009). Extreme Value Theory and Value at Risk: Application to oil market. Energy Economics, 31(4). Doi: <https://doi.org/10.1016/j.eneco.2009.02.005>;

- Pesaran, M. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge Working Papers in Economics No. 0435, Faculty of Economics, University of Cambridge;

- Pesaran, M. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal Of Applied Econometrics, 22(2). Doi: <http://dx.doi.org/10.1002/jae.951>;

- Pesaran, M., Yamagata, T. (2008). Testing slope homogeneity in large panels. Journal Of Econometrics, 142(1), pp. 50-93. Doi: <http://dx.doi.org/10.2139/ssrn.671050>;

- Rodhan, M. (2024). Macroeconomic impacts of oil price shocks: evidence from Iraq by using vector autoregressive model. International Journal of Energy Economics and Policy, 14(3). Doi: <https://doi.org/10.32479/ijeep.15681>;

- Werker, E., Ahmed, F., Cohen, C. (2009). How Is Foreign Aid Spent? Evidence from a Natural Experiment. American Economic Journal: Macroeconomics, 1(2). Doi: <10.1257/mac.1.2.225>;

- Zmami, M., Ben Salha, O. (2020). Oil price and the economic activity in GCC countries: Evidence from quantile regression. Equilibrium. Quarterly Journal of Economics and Economic Policy, 15(4). Doi: <https://doi.org/10.24136/eq.2020.028>.

Footnotes

[1] Marimoutou, V., Raggad, B., Trabelsi, A. (2009). Extreme Value Theory and Value at Risk: Application to oil market. Energy Economics, 31(4), pp. 519-530. Doi: <https://doi.org/10.1016/j.eneco.2009.02.005>.

[2] Zmami, M., Ben Salha, O. (2020). Oil price and the economic activity in GCC countries: Evidence from quantile regression. Equilibrium. Quarterly Journal of Economics and Economic Policy, 15(4), pp. 651-673. Doi: <https://doi.org/10.24136/eq.2020.028>.

[3] Benlaria, H., Almawishir, N. (2024). The Relationship between Electricity Consumption, Price of Oils, and Gross Domestic Product in the Gulf Cooperation Council Countries. International Journal of Energy Economics and Policy, 14(1), pp. 66-75. Doi: <https://doi.org/10.32479/ijeep.15108>.

[4] Al Jabri, S., Raghavan, M., Vespignani, J. (2022). Oil prices and fiscal policy in an oil-exporter country: Empirical evidence from Oman. Energy Economics, 111(106103). Doi: <https://doi.org/10.1016/j.eneco.2022.106103>.

[5] Gómez-Loscos, A., Gadea, M., Montañés, A. (2012). Economic growth, inflation and oil shocks: are the 1970s coming back? Applied Economics, 44(35), pp. 4575-4589. Doi: <https://doi.org/10.1080/00036846.2011.591741>.

[6] Werker, E., Ahmed, F., Cohen, C. (2009). How Is Foreign Aid Spent? Evidence from a Natural Experiment. American Economic Journal: Macroeconomics, 1(2): 225-44. Doi: <10.1257/mac.1.2.225>.

[7] Rodhan, M. (2024). Macroeconomic impacts of oil price shocks: evidence from Iraq by using vector autoregressive model. International Journal of Energy Economics and Policy, 14(3), pp. 162-170. Doi: <https://doi.org/10.32479/ijeep.15681>.

[8] Ftiti, Z., Guesmi, K., Teulon, F., Chouachi, S. (2016). Relationship between crude oil prices and economic growth in selected OPEC countries. The Journal of Applied Business Research, 32(1), pp. 11-22. Doi: <http://dx.doi.org/10.19030/jabr.v32i1.9483>.

[9] Mamdouh, A. (2023). Oil price fluctuations and economic growth: the case of MENA countries. Review of Economics and Political Science, 8(5), pp. 353-379. Doi: <http://dx.doi.org/10.1108/REPS-12-2019-0162>.

[10] Machado, J., Silva, J. (2019). Quantiles via moments. Journal of Econometrics, 213(1), pp. 145-173. Doi: <https://doi.org/10.1016/j.jeconom.2019.04.009>.

[11] Koenker, R., & Bassett, Jr., G. (1978). Regression Quantiles. Econometrica, 46(1), pp. 33-50. Doi: <10.2307/1913643>.

[12] Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1), pp. 74-89. Doi: <https://doi.org/10.1016/j.jmva.2004.05.006>.

[13] Canay, I. (2011). A simple approach to quantile regression for panel data. The Econometrics Journal, 14(3), pp. 368-386. Doi: <https://doi.org/10.1111/j.1368-423X.2011.00349.x>.

[14] Machado, J., & Silva, J. (2019). Quantiles via moments. Journal of Econometrics, 213(1), pp. 145-173. Doi: <https://doi.org/10.1016/j.jeconom.2019.04.009>.

[15] Pesaran, M., Yamagata, T. (2008). Testing slope homogeneity in large panels. Journal of Econometrics, 142(1), pp. 50-93. Doi: <http://dx.doi.org/10.2139/ssrn.671050>.

[16] Blomquist, J., Westerlund, J. (2013). Testing slope homogeneity in large panels with serial correlation. Economics Letters, 121(3), pp. 374-378. Doi: <https://doi.org/10.1016/j.econlet.2013.09.012>.

[17] Breusch, T., Pagan, A. (1980). The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. The Review of Economic Studies, 47(1), pp. 239-253. Doi: <https://doi.org/10.2307/2297111>.

[18] Pesaran, M. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge Working Papers in Economics No. 0435, Faculty of Economics, University of Cambridge.

[19] Baltagi, B., Feng, Q., Kao, C. (2012). A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. Journal of Econometrics, 170(1), pp. 164-177. Doi: <https://doi.org/10.1016/j.jeconom.2012.04.004>.

[20] Pesaran, M. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of applied econometrics, 22(2), pp. 265-312. Doi: <http://dx.doi.org/10.1002/jae.951>.

[21] Zmami, M., Ben Salha, O. (2020). Oil price and the economic activity in GCC countries: Evidence from quantile regression. Equilibrium. Quarterly Journal of Economics and Economic Policy, 15(4), pp. 651-673. Doi: <https://doi.org/10.24136/eq.2020.028>.

[22] Maestas, N., Mullen, K., Powell, D. (2023). The Effect of Population Aging on Economic Growth, the Labor Force, and Productivity. American Economic Journal: Macroeconomics, 15(2): 306-32. Doi: <10.1257/mac.20190196>.

[23] Ayad, H., Ben-Salha, O., Ouafi, M. (2023). Do oil prices predict the exchange rate in Algeria? Time, frequency, and time‐varying Granger causality analysis. Economic Change and Restructuring, 56(5), pp. 3545-3566. Doi: <https://doi.org/10.1007/s10644-023-09545-1>.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .