Sustainability Disclosure, CEO Duality, and Ownership Concentration: Evidence from Georgia

DOI:

https://doi.org/10.35945/gb.2025.19.001საკვანძო სიტყვები:

Sustainability disclosure, ESG, determinants, ownership structure, corporate governance, emerging marketანოტაცია

This study examines the determinants of corporate sustainability disclosure in Georgia, emphasizing the influence of CEO duality and ownership concentration. The absence of significant external demand for sustainability information and a robust regulatory framework often limits the voluntary release of such information. This research utilizes a sustainability disclosure scorecard developed in accordance with the EU Corporate Sustainability Reporting Directive, encompassing key environmental, social, and governance dimensions. Analyzing annual reports from all listed companies in Georgia from 2018 to 2021 through descriptive statistics and hierarchical multiple regression, findings highlight that board chair/CEO role duality and concentrated ownership significantly undermine sustainability disclosure. Specifically, CEO duality adversely affects social and governance metrics, while concentrated ownership primarily diminishes environmental transparency. These insights enhance understanding of the factors influencing corporate sustainability disclosure in emerging economies. The findings of this study may also provide valuable implications for local policymakers, who could use this information to develop more detailed and rigorous draft laws concerning sustainability disclosure requirements.

Keywords: Sustainability disclosure, ESG, determinants, ownership structure, corporate governance, emerging market.

Introduction

It has long been recognized that business is about more than just making money, and corporate sustainability disclosure plays a significant role in enabling firms to communicate and engage with stakeholders.[1] Therefore, society in general and capital providers in particular are increasingly interested in corporate sustainability disclosure to satisfy their demand for corporate sustainability performance.[2]

Previous research has extensively explored the drivers of sustainability disclosure, yet the prevailing insights predominantly emerge from markets with strong external legitimacy and agency pressures on sustainability. The generalizability of these findings to developing economies, which are marked by distinct institutional and socio-economic contexts, remains questionable.[3] In such markets, corporate disclosure practices are shaped by comparatively weaker sustainability pressures due to underdeveloped capital markets and limited influence of non-governmental organizations, media, civil society, consumer advocates, and activists. Moreover, these economies often display reduced legitimacy aspirations and lack the robust enforcement mechanisms and corporate governance frameworks necessary to protect human and environmental rights.[4]

Recognized conventional drivers of sustainability disclosure include firm size, which indicates a company’s resource capabilities, and industry sensitivity, which reflects the influence of stringent regulations.[5] The impact of other factors, such as ownership structure and corporate governance mechanisms, presents a more mixed picture.[6] For instance, dispersed ownership may encourage managerial commitment to sustainability disclosure as a strategy to reduce agency conflicts. Similarly, the separation of CEO and board chair roles, which reduces the concentration of power in the CEO, is linked to greater accountability and possibly more comprehensive sustainability disclosures.[7] These governance structures create internal pressures that can drive management to prioritize sustainability initiatives.

This study investigates the drivers of corporate sustainability disclosure among publicly listed companies in Georgia, a developing economy characterized by passive capital markets and modest media scrutiny.[8] According to the Law of Georgia on Accounting, Reporting, and Auditing (2016) (Article 7),[9] public interest entities employing over 500 individuals are required to report key non-financial indicators, including those related to environmental, social, employment, human rights, anti-corruption, and bribery issues, starting from 2018. Additionally, the evolving corporate governance landscape and significant ownership concentration in Georgia present a unique context for examining the effects of ownership structure and CEO duality on the extent of corporate sustainability disclosures.[10]

By presenting empirical evidence from a largely underexplored, developing economy, this study contributes to the sustainability disclosure literature. Unlike research focused on developed markets with robust legitimacy pressures, our findings suggest that in settings characterized by underperforming capital markets and minimal external demand for sustainability disclosures, corporate governance mechanisms play a crucial role. This paper not only provides a comprehensive conceptual framework for understanding the primary literature on sustainability disclosure, its origins, theoretical perspectives, and methodologies, but also aligns its approach with the EU’s Corporate Sustainability Reporting Directive (CSRD), laying the groundwork for future research replication. From a regulatory perspective, our results offer valuable insights for local regulators by evaluating the adoption levels and drivers of sustainability disclosure, informing ongoing discussions, and guiding future amendments to the accounting law to enforce stricter sustainability standards.

The next section outlines the theoretical background, the institutional framework of Georgia, and our hypotheses. Section 3 details the data and methodology, Section 4 presents the results, and Section 5 provides the conclusion and discussion.

- Theoretical Background and Hypotheses

1.1 Theoretical lens and conceptual framework

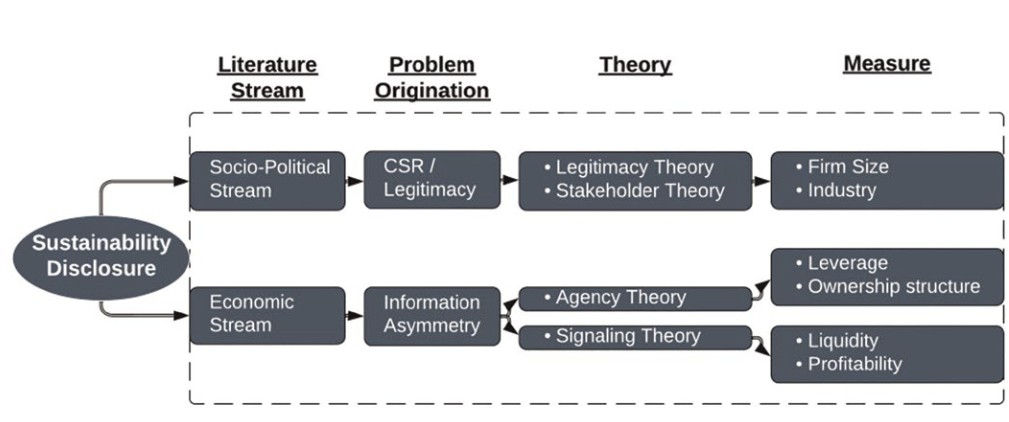

Corporate sustainability disclosure is a tool for communication between corporate managers and a wide range of external stakeholders: investors and other capital providers, the general public, civil society, professional associations, NGOs, regulators, employees, etc. In line with this complexity, the field uses a wide range of theories: resource-based,[11] legitimacy,[12] agency,[13] stakeholder,[14] signaling,[15] and voluntary disclosure,[16] among others. Due to the complementary and often overlapping nature of these theories, a more extensive understanding of sustainability disclosure practices is possible using a multi-theory lens to explain firms’ willingness to engage in sustainability disclosure.[17] Sustainability disclosure’s theoretical framework is conceptualized in Figure 1.

Figure 1. Conceptual framework for sustainability disclosure (author’s own)

Socio-political sustainability disclosure stream. The literature on corporate sustainability disclosure can be divided into two streams: socio-political and economic streams. The socio-political stream follows the corporate social responsibility (CSR) path and perceives the general public as the primary user of sustainability information, viewing environmental and social disclosure through the lens of the role of information in the organization-society dialogue, arguing that firms tend to disclose voluntarily to “legitimize” their activities and thus change public perception of the firm. A strong reputation in the social arena is thought to attract high-quality employees and reduce transaction costs (e.g., by reducing employee turnover) and distributional conflicts (e.g., by disclosure on the firm’s practices in terms of diversity, equal pay, fair trade conditions, etc.). By enabling a firm to attract more competent, capable, and productive human capital, build brand loyalty, and broaden the customer base, firms are said to be able to achieve sounder financial performance.[18]

The socio-political stream uses the lenses of legitimacy and stakeholder theories, whereby firms are willing to voluntarily engage in sustainability disclosure to, first, legitimize their maneuvers and, second, balance the expectations of various stakeholders. Legitimacy theory is perhaps the most widely used theory in the field. Developed in the organizational theory era, it argues that public and societal pressures lead to environmental and social disclosures aimed at gaining social legitimacy. According to this framework, a firm’s value system is congruent and aligned with society’s expectations. Stakeholder theory has a more specific focus on a particular group of stakeholders, suggesting that firms disclose information even when not required to meet stakeholder expectations. Sustainability disclosure in this case is a tool through which firms communicate with external stakeholders to gain attractiveness and ensure sustainable performance.[19]

The applicability of legitimacy and stakeholder theories is often tested by examining the importance of firm size and industry sensitivity as drivers of sustainability disclosure. These theories argue that legitimacy reasons are more visible for larger firms and those operating in environmentally sensitive sectors. Larger firms are subject to greater external public pressure, and sustainability disclosure helps these firms maintain a “social contract” and successfully attract resources. Similarly, environmentally sensitive firms, such as those in the mining, fossil fuel, oil, and coal sectors, face greater risks associated with environmental damage due to their propensity for carbon and other emissions.[20]

Economic sustainability disclosure stream. The economic stream builds on the information asymmetry problem embedded in the agency theory, with a focus on investor/capital market orientation. Information asymmetry between managers and shareholders is a product of insiders’ higher awareness of the firm’s fundamentals compared to outsiders. To balance such asymmetry, managers voluntarily disclose sustainability information as a source of communication with the external parties.[21]

This literature stream branches into agency and signaling theories. Agency theory suggests that because quantifiable and objective (i.e., “hard”) sustainability disclosure requires the use of sound management control systems to identify, measure, and report this information, such behavior is associated with increased and real economic production costs that only successful firms are likely to be willing to incur. Disclosing information about a firm’s environmental and social technologies, processes, practices, and performance may not only be commercially sensitive but may also entail regulatory, contractual, reputational, and opportunity costs. For example, the provision of objective sustainability information verifies a firm’s potential future (and current) actions or commitments, thereby reducing the management’s discretionary capacity and increasing costs. As such, firms with better financial performance should be more willing, ready, and able to incur such costs by providing more extensive sustainability disclosures.[22]

Instead, signaling theory suggests that managers disclose sustainability data to send a positive signal about the firm’s performance. Thus, firms with better environmental and social performance are more likely to voluntarily disclose sustainability data to differentiate themselves from their competitors and ultimately gain a competitive advantage by improving their market position.[23]

Under agency theory, scholars use financial leverage and ownership structure measures, arguing that more leveraged firms, as well as those owned by a broad range of owners, are subject to greater external pressures and therefore act more responsibly and disclose more information. As for signaling theory, scholars use liquidity and profitability measures, suggesting that “only” those firms with sound financial performance diligently disclose costly sustainability data.[24]

1.2 The context of Georgia

Demand for corporate (non)financial information in Georgia is limited. Georgia’s capital markets are only able to exert meaningful pressure on managers’ reporting diligence at a low level.[25] Moreover, the media and NGO sectors are associated with limited resources and high levels of political partisanship,[26] making them less likely to alter legitimacy aspirations.[27]

The Law of Georgia on Accounting, Reporting and Audit (2016) addresses non-financial disclosure, albeit superficially. Article 7 of the law requires that the management reports of the largest (“Category I” entities, as defined by the Law) Georgian public interest entities (PIEs) with an average number of employees exceeding 500 during the reporting period should include key non-financial information on the “development, performance, position and impact of the company’s activities with respect to environmental, social, employment matters, human rights, anti-corruption and bribery issues”. The largest PIEs have been required to file their sustainability information since 1 October 2018. All other entities are not required to file such information, and there is no direct (e.g., tax) benefit for them to do so.[28]

The Law of Georgia on Entrepreneurs was improved in 2021. By filling the gaps regarding supervisory board members, shareholder rights, meeting procedures, fiduciary duties, and capital reduction provisions, the awareness of corporate governance is increasing, but it will take time and patience to build a valid corporate governance culture. The board is a two-tier system that includes the supervisory board (board of directors) and the management board. Securities issuers are required to include a corporate governance report with a statement on compliance, internal control, risk management systems, and shareholder rights. The banks’ code, additionally, requires the governance of ESG-related components, including board discussions to address ESG risks and disclosures.[29]

Local companies are closely held by the owners, with board members often bypassed and decisions made directly between management and controlling shareholders. For example, the largest direct owner of securities issuers owns more than 90% of the capital, indicating a high degree of ownership concentration. Effective enforcement and compliance practices are needed to instill the values and awareness of effective corporate governance among corporate actors. Companies tend to disclose only at a level that is sufficient for compliance, and little effort is made to go beyond the basic requirements. A mechanism that would further incentivize healthy corporate governance is lacking. Shareholder (including minority) rights are relatively well protected on paper, but in practice, there are more concerns (e.g., in terms of related party transactions). In addition, in situations involving complex transactions or where simple arm’s length comparisons are not possible, supervisory boards may find it difficult to maintain objectivity due to the influence of controlling shareholders. There are instances where supervisory board members appear to put the company’s interests first in the absence of clear obligations to protect shareholder interests. The average number of supervisory board members among PIEs is around 5.1, while almost half show no evidence of female representation.[30]

Overall, considering the existing external demand for information,[31], [32] alongside the development and enforcement of regulatory frameworks, the corporate sustainability environment in Georgia is not yet poised for effective sustainability disclosure.

1.3 Hypothesis development

Ownership concentration. Ownership structure can have a significant impact on sustainability disclosure. Under the ownership structure, we focus on ownership concentration. An increase in the dispersion of ownership can lead to an increase in information asymmetries, which in turn can lead to more frequent conflicts of interest between management and stakeholders. Disclosure on environmental and social issues can play an important role in managing such agency conflicts. As corporate ownership becomes more widely dispersed, stakeholder demands for “extracurricular” corporate activities become more diverse. In contrast, firms with concentrated ownership have fewer incentives to disclose sustainability information, as they can obtain the required information directly from the firm.[33]

In addition, more concentrated ownership, ceteris paribus, may be a proxy for the public’s passive interest in the firm. Limited public interest, and thus limited external pressure, can only weakly motivate corporate managers to activate their inclinations toward social and environmental concern. In response to these increased demands, management is likely to disclose environmental information directly rather than communicating it separately to each investor.[34] Consequently, it is reasonable to expect that firms with more dispersed ownership will disclose a greater amount of corporate sustainability information. Therefore, we posit:

H1: Ownership concentration negatively affects corporate sustainability disclosure in Georgia.

CEO duality. As investors continue to ask for better information on how companies manage sustainability, corporate governance is seen as the foundation for building a firm’s sustainability disclosure habits. Corporate governance is a system that deals with the effectiveness of relationships between the board of directors, shareholders, stakeholders, and management. A sound corporate governance system focused on sustainability should help companies identify material sustainability information that enables them to properly consider the risks and opportunities related to sustainability issues and make strategic decisions.

The effectiveness of corporate governance is important in markets with weak legal frameworks, as it can serve as an effective substitute for mandatory sustainability disclosure. Accordingly, the literature suggests that firms with strong corporate governance are likely to be more responsible and demonstrate higher levels of social and environmental responsibility.[35] Scholars argue that regulators may be better served by focusing on improving corporate governance quality (rather than mandatory sustainability disclosure) as a way to increase CSR disclosure.[36] As such, boards of directors should (and do) prioritize the firm’s environmental performance because it is expected to be positively related to shareholder wealth and other non-financial benefits.[37]

Under corporate governance, we refer to CEO duality, namely, when the CEO also chairs the board. CEO duality implies a lack of distinction between decision control and decision management.[38] While evidence of the impact of CEO duality on voluntary disclosure is mixed, we suggest that CEO duality reduces overall accountability, resulting in less sustainability transparency. CEO duality can be detrimental to shareholder interests because a powerful CEO can override the necessary checks and balances within the organization.[39] Combining the CEO and board chair roles reduces conflicts of interest, in turn reducing accountability pressures. In contrast, when the roles are separated, the chair has the ability and motivation to create an environment where other board members can contribute effectively, leading to board independence. As such, CEO duality inhibits open and honest discussions about the firm’s performance. Therefore, we posit:

H2: CEO duality negatively affects corporate sustainability disclosure in Georgia.

- Method

We examine all Georgian public companies granted this status for the fiscal year 2021. These companies are allowed to publicly issue their shares on the local capital market. In addition, we expanded the sample to include companies that voluntarily expressed interest in participating in the Best Annual Reporting and Transparency Award (BARTA). In this way, we cover the entire population of listed companies and a significant portion of the largest Georgian companies that are likely to report at least some sustainability information.

The financial variables were manually extracted from the annual reports of the sampled firms, which we retrieved from the official website of the Ministry of Finance of Georgia (https://reportal.ge/en). The analysis covers the period 2018–2021. After eliminating observations with missing data, the final sample consists of 36 firms and 140 firm-year observations.

Our objective is to identify the drivers of corporate sustainability disclosure. In line with the literature, we construct a sustainability disclosure scorecard based on the EU’s CSRD (2022, Article 19b), which is aligned with the generally accepted framework and guiding principles of the Global Reporting Initiative (GRI).[40], [41]

Our sustainability disclosure scorecard includes general parameters and ESG indicators. General attributes focus on report content and presentation, covering regulatory basis, conciseness, reliability, completeness, consistency, and comparability. For instance, the regulatory basis assesses whether reports follow international frameworks. The environmental dimension evaluates corporate interactions with nature, including climate change mitigation, water and marine issues, resource efficiency, circular economy, air pollution, and biodiversity. The social dimension addresses diversity, equality, and workplace safety, covering equal opportunities (gender equality, pay equity, inclusion of people with disabilities, training), working conditions (wages, job security, social dialogue, work-life balance, safe work environments), and respect for human rights. The governance aspect assesses management’s role in sustainability, business ethics (anti-corruption, anti-bribery), political engagement (lobbying), stakeholder relationships (payment practices), and internal control systems for disclosure (CSRD, 2022).

We build a sustainability disclosure scorecard by manually going through the annual reports of each company and coding the content according to the sustainability disclosure scorecard. We code the relevant sections and sentences of each company’s annual reports for each year, paying attention to the use of graphic illustrations, as recommended by the CSRD framework.

We analyze 140 annual reports, classifying the text of each report according to its thematic content: a) whether the disclosure states a certain approach (e.g., a support for gender balance) at the policy level, b) whether concrete actions are shown that supports the stated policy (e.g., more women hired in the most recent recruitment to achieve the stated gender balance goal), and c) whether the final result (e.g., the “right” gender balance between men and women in the workforce) has been achieved and disclosed (at all levels of management). We used this classification for each of the aforementioned ESG sustainability disclosure indicators. We also considered linguistic attributes, such as the semantic nature of the information provided, and distinguished text units by type of measure, such as non-quantitative (e.g., support for climate change action) and quantitative (e.g., support for climate change action following the Paris Agreement threshold of 1.5ºC of global warming).[42]

To ensure the consistency and reliability of the classification procedure, we conducted a pre-test to verify the authors’ coding rules and approaches. We also re-tested the comparability of our results with the BARTA award scores for companies that participated in the competition. The coefficient of agreement, and thus the ratio of pairwise inter-judge agreement to total pairwise judgments, is above acceptable levels in both cases.

Our model incorporates the two commonly used independent variables: firm size (log of total assets)[43] and industry sensitivity (real estate, construction, and the financial sector).[44] Our variables of interest are ownership concentration (% of capital owned by the largest shareholder)[45] and CEO duality (dummy variable for CEO role duality that takes the value 1 if the CEO and board chair are the same person, and 0 otherwise).[46] In addition, we use some control variables that have been reported to be significant in driving sustainability disclosure in emerging economies, including regulation (a dummy variable for mandatory disclosure that takes value 1 for firms subject to mandatory sustainability disclosure according to the 2016 Law of Georgia, and 0 otherwise),[47] foreign ownership (dummy variable that takes value 1 if a firm is owned by a foreign shareholder, and 0 otherwise),[48] financial leverage (total liabilities over total assets),[49] profitability (net income over total revenues; with alternative values such as ROA and ROE),[50] Big 4 (a dummy variable that takes value 1 if a report was audited by one of the Big 4, and 0 otherwise), and language (a dummy variable that takes value 1 if the annual report was prepared both in Georgian and English, and 0 otherwise).[51]

- Results and Analysis

3.1 Descriptive statistics

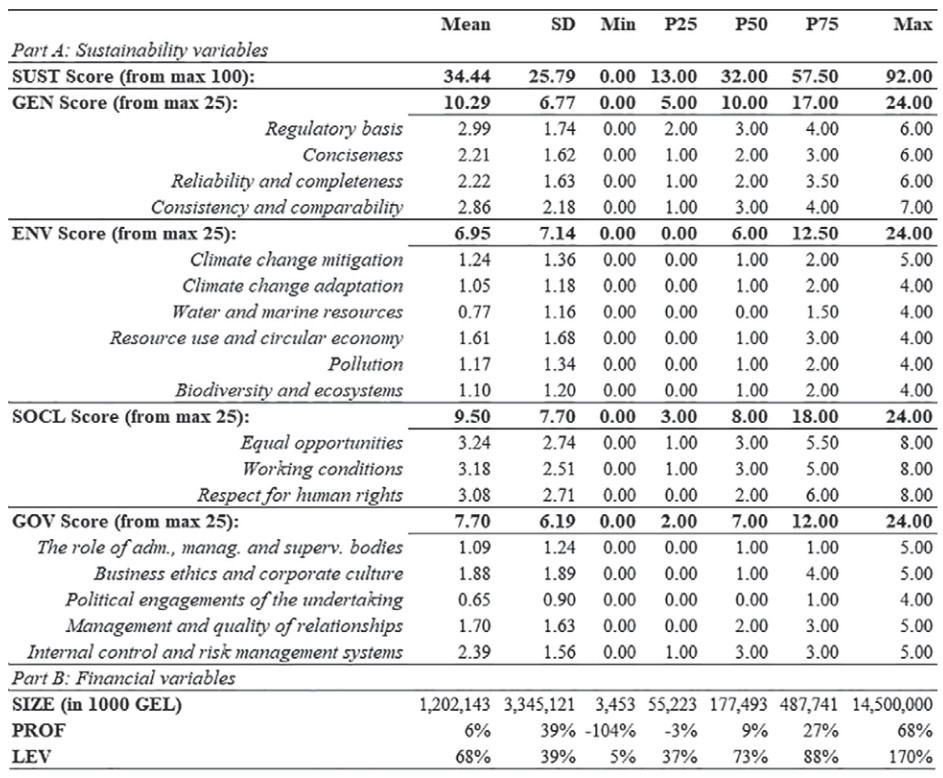

Table I presents descriptive statistics of the sustainability scorecard and financial variables for Georgian listed companies. The average sustainability score stands at 34%, highlighting relatively low disclosure practices compared to EU standards.[52] Notably, 22 observations (16%) completely lack sustainability information. Despite a nascent regulatory framework, certain foreign-listed entities, particularly banks, demonstrate robust reporting, adhering to international standards like the TCFD and disclosing comprehensive greenhouse gas emissions data.

The sustainability disclosure scorecard reveals an uneven emphasis across its dimensions, with the general criterion achieving the highest average at 10.3 points out of 25. This reflects a trade-off between conciseness and completeness, where efforts to provide thorough information might result in lower conciseness scores. The ESG pillars show varying levels of reporting depth: environmental issues scored the lowest at 7 points, governance at 7.7, and social issues at 9.5. Environmental disclosures are sparse, with 40% of reports omitting this data entirely, though some engagement in resource use and recycling is noted.

Social sustainability metrics are more consistently addressed, with similar scores across their sub-pillars. However, while companies often express a commitment to human rights and gender equality, actual reporting on relevant KPIs and detailed statistics on gender balance in leadership remains scarce and skewed. In one of the cases, although gender balance is postulated as a high priority, the figures show a female-to-male ratio of 4 to 1. Gender balance is often interpreted as having no less than 50% female employees, but the same does not apply to males.

In the governance dimension, Georgian companies fare better in areas like anti-corruption, bribery, customer relations, and internal control mechanisms; however, there is a notable lack of disclosure concerning political engagements and lobbying. This omission is particularly evident among major financial institutions with alleged political affiliations, suggesting a deliberate avoidance of disclosing such sensitive connections. Moreover, risk mitigation committees rarely address sustainability issues like climate change, except in the largest internationally listed banks.

Table I. Descriptive statistics of sustainability disclosure scorecard and financial variables

Notes: SUST_Score stands for a sustainability score that varies between 0 and 100 and incorporates general attributes and ESG metrics of the sustainability disclosure. SIZE is given in 1,000 GEL (3 GEL = 1 USD). SIZE, PROF, and LEV are winsorized at 5%. N=140.

Table I (Part B) details the financial characteristics of the sample, encompassing profitability, firm size, and leverage. The average profitability is 6%, with a median of 9%, indicating some variability in financial performance among the firms. The distribution of total assets, measured in thousands of Georgian Lari (GEL), is highly skewed: while the mean assets amount to GEL 1,202 million, influenced by large banks, the 75th percentile firm holds considerably less, at GEL 488 million. This skewness reflects the disproportionate impact of a few large entities on the sample’s average. The financial leverage across the firms is substantial yet typical for the sector, with total liabilities averaging 68% of total assets, displaying a normal distribution across the dataset.

A descriptive table (un-tabulated) drops down the sustainability disclosure score by industry and year. The dataset includes four primary industry groups: finance (39 observations), construction and real estate (22), manufacturing (32), and a diverse “other” category (47 observations), encompassing sectors like healthcare, electricity, accommodation, retail, and transport. Sustainability disclosure varies significantly across industries. The finance sector leads with a score of 49 out of 100, reflecting its pivotal economic role and stringent regulatory oversight. The environmentally sensitive construction and real estate sector scores 40, outperforming finance in environmental reporting. Manufacturing lags with an average sustainability score of only 12. The “other” sectors achieve a score of 35. Yearly data shows little variation, with scores slightly increasing from an average of 32-33 points in 2018-2019 to 36-37 in 2020-2021. Sustainability practices, once reported, tend to persist in subsequent reports, exemplified by repeated mentions of initiatives like the Green Box campaign.

Pearson correlations (un-tabulated) highlight associations between the model variables. The SUST_Score strongly correlates with its components (r > 0.88, p < 0.01) and general attributes (r = 0.97, p < 0.01). It also has significant correlations with firm size (r = 0.70), industry sensitivity (r = 0.38), mandatory disclosure (r = 0.38), CEO duality (r = -0.47), Big 4 (r = 0.37), and reporting language (r = 0.24), all at p < 0.01. No association is found between firm profitability and sustainability levels. Variance Inflation Factors (VIFs) remain below 2, confirming no multicollinearity concerns.

3.2 Regression analysis

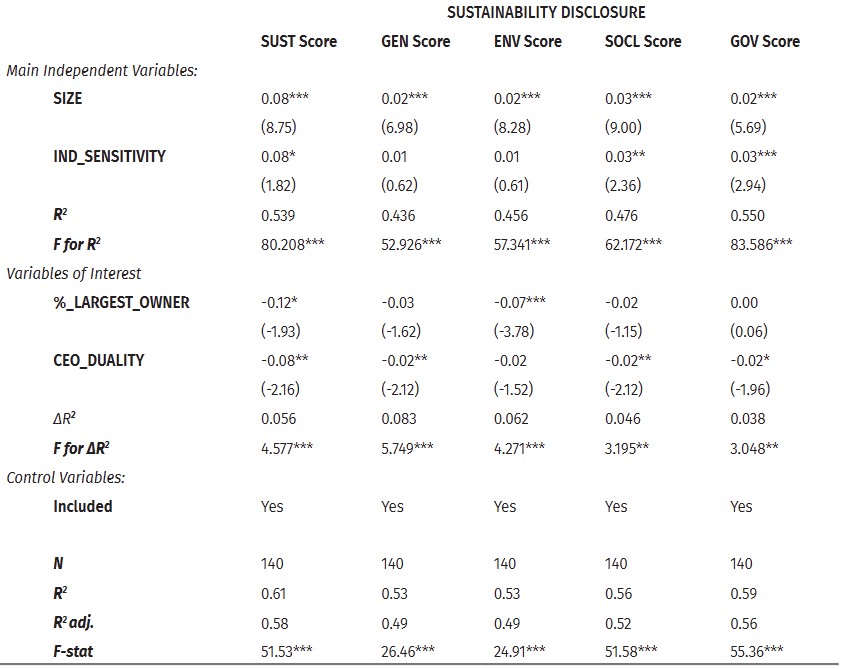

Table II presents the results of the OLS fixed effects regressions on the determinants of sustainability disclosure. The regression for sustainability disclosure (SUST Score) (column 1) is accompanied by the regressions for the sustainability pillars: general (GEN Score) and ESG (ENV Score, SOCL Score, and GOV Score) (columns 2-5).

The adjusted R-squared of the SUST Score model is 58%, implying good power in explaining the variation of the sustainability scorecard data points around their mean. The power of the model is higher compared to similar studies conducted in emerging markets.[53] The hierarchical model regressions show that firm size (SIZE_log: β = 0.08, p < 0.01) and industry dummy (IND_SENSITIVITY: β = 0.08, p < 0.1) are the main drivers of sustainability disclosure. They alone can explain 54% of the variation of the sustainability scorecard around its mean. Larger companies and those operating in more regulated sectors provide significantly more sustainability information than their counterparts. Larger firms, and hence with more resources, are more likely to disclose more scrupulous sustainability information, which is consistent with legitimacy theory. Size is a significant variable (p < 0.01) in all five regressions. Larger firms tend to disclose more on all four pillars: general, environmental, social, and governance. Including the variables of interest increases the adjusted R-squared of the model, but only by 2%.

Table II. Determinants of sustainability disclosure.

Control variables include: mandatory model of reporting, profitability, financial leverage, Big4 dummy, financial report language dummy, foreign ownership, and board diversity. Notes: t statistics in parentheses; *** p < 0.01; ** p < 0.05; * p < 0.10. VIF highest value = 2.14.

Observing the coefficients of the variables of interest, we note that the results support both H1 and H2. Ownership concentration (%_LARGEST_OWNER: β = -0.12, p < 0.1) and CEO duality (CEO_DUALITY: β = -0.08, p < 0.05) both have a negative impact on sustainability disclosure. This implies that companies with more concentrated ownership are likely to exert weaker controlling mechanisms, reducing transparency and accountability, and therefore tend to provide less detailed sustainability disclosure information. Similarly, companies where CEOs simultaneously serve as board members and key decision-makers are also inclined to provide less comprehensive sustainability disclosures, likely due to reduced oversight and checks on management. These findings align with prior studies, which suggest that dispersed ownership and independent board structures contribute to more robust sustainability reporting practices.

Conclusion, Discussion, and Limitations

This study investigates the role of CEO duality and ownership concentration on corporate sustainability disclosure in the context of Georgia. Based on 140 unique firm-year observations of the largest (listed) Georgian companies, our findings suggest a relatively limited prevalence of sustainability disclosure among firms listed on the Georgian capital market compared to more developed contexts.[54] The observed low level of sustainability disclosure is likely due to limited resources and a scarce awareness of the importance of sustainability disclosure as a tool for communicating with external stakeholders.

In the context of the pillars of sustainability disclosure, there is a comparatively stronger emphasis on social issues, while environmental issues receive relatively less attention. This finding is consistent with studies conducted in emerging markets, suggesting that firms in developing contexts often struggle to address both social and environmental dimensions simultaneously.[55] Limited resources coupled with the costs associated with sustainability disclosure appear to force firms in developing economies into a trade-off between the two dimensions. As a result, the social pillar tends to receive more disclosure, as there is greater public awareness and direct interest in working conditions, wages, workplace safety, and gender equality. This contrasts with the relatively indirect and distant perceptions of climate change. Societal focus in developing economies is often on short- and medium-term goals related to basic human needs, rather than the more future-oriented “premium” goals related to environmental protection, which tend to come to the fore only after immediate needs have been met.[56]

At the multivariate level, we show that firm size and industry sensitivity are the main drivers of sustainability disclosure, consistent with prior studies.[57] In a developing context with limited external demand, we show that it is the mandatory nature and thus the regulatory burden that pushes firms to engage in socially and environmentally responsible behavior.

Aligning with our hypotheses, we show that ownership concentration and corporate governance mechanisms play a significant role in the propensity of firms to report on sustainability. Our analysis also suggests that those firms with a more dispersed ownership structure and separate CEO/chair roles report more on sustainability issues. These findings are consistent with the existing literature, which suggests that ownership dispersion positively impacts the extent of sustainability disclosure.[58] Furthermore, our study supports previous research that has found a negative impact of CEO duality on the extent of sustainability disclosure.[59]

Better sustainability disclosure practices can be achieved not only by strengthening external demand for sustainability issues but also by improving internal corporate governance mechanisms. The local regulator can play an important role in improving the sustainability disclosure practices in Georgia. The current regulatory framework for non-financial disclosure is general and does not specify the details, format, and order of sustainability disclosure. With the development of the European Sustainability Reporting Standards, it is hoped that the next draft of the Accounting Law of Georgia will more specifically define the sustainability disclosure requirements.

Nevertheless, our study has some limitations. First, despite the detailed manual content analysis of the firm’s annual reports, it is difficult to assess whether the results can be generalized to the Georgian population or beyond. Our analysis considers four consecutive years (2018–2021), and the sample of the largest Georgian firms may not provide a holistic picture of sustainability disclosure in Georgia. Beyond listed companies (as is the case for Category III and IV companies), sustainability disclosure is likely to be even less common. Future research could extend our study using different samples to test our findings. Second, measuring the quality of sustainability disclosure by quantifying the notional information provided may be biased because codification is susceptible to the subjectivity of the context and the measurer. We evaluated all companies using the same matrix, with equal weighting given to the “general” and ESG components. It may be the case that for a group of companies, reporting on certain sustainability elements may be less relevant due to the nature of their operations. In addition, different ESG components in the matrix have different numbers of elements, but the same weight (25%) is assigned to each, resulting in an unbalanced score if the scorer assigns the lower points with less consideration and the higher points with more rigor. We compared our findings to the BARTA award results, and the analysis does not reveal any material differences. The comparative analysis across companies and sectors also remains valid. Finally, our models capture some potentially important determinants of sustainability disclosure, with explanatory power often exceeding 50%. Nevertheless, future studies could attempt to measure and include variables such as media coverage/reach, sustainability awareness, and so forth, at the firm level.

Bibliography:

- Ali, W., Frynas, J. G., Mahmood, Z. (2017). Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Corporate social responsibility and environmental management, 24(4);

- Belal, A. R., Cooper, S. M., Khan, N. A. (2015). Corporate environmental responsibility and accountability: what chance in vulnerable Bangladesh? Critical Perspectives on Accounting, 33(December);

- Ben-Amar, W., Chang, M., McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. Journal of business ethics, 142(2);

- Bhatia, A., Tuli, S. (2017). Corporate attributes affecting sustainability reporting: an Indian perspective. International Journal of Law and Management, 59(3);

- Brammer, S., Pavelin, S. (2008). Factors influencing the quality of corporate environmental disclosure. Business Strategy and the Environment, 17(2);

- Chan, M. C., Watson, J., Woodliff, D. (2014). Corporate governance quality and CSR disclosures. Journal of business ethics, 125(September);

- Cheng, E. C., Courtenay, S. M. (2006). Board composition, regulatory regime and voluntary disclosure. The international journal of accounting, 41(3);

- Ching, H. Y., Gerab, F., Toste, T. H. (2017). The quality of sustainability reports and corporate financial performance: Evidence from Brazilian listed companies. Sage Open, 7(2), 2158244017712027;

- Cormier, D., Ledoux, M. J., Magnan, M. (2011). The informational contribution of social and environmental disclosures for investors. Management Decision, 49(8);

- Cormier, D., Magnan, M. (1999). Corporate environmental disclosure strategies: determinants, costs and benefits. Journal of Accounting, Auditing & Finance, 14(4);

- De Villiers, C., Naiker, V., Van Staden, C. J. (2011). The effect of board characteristics on firm environmental performance. Journal of Management, 37(6);

- De Villiers, C., Venter, E. R., Hsiao, P. C. K. (2017). Integrated reporting: background, measurement issues, approaches and an agenda for future research. Accounting & Finance, 57(4);

- Desai, R. (2022). Determinants of corporate carbon disclosure: A step towards sustainability reporting. Borsa Istanbul Review, 22(5);

- Faisal, F., Situmorang, L. S., Achmad, T., Prastiwi, A. (2020). The role of government regulations in enhancing corporate social responsibility disclosure and firm value. The Journal of Asian Finance, Economics and Business (JAFEB), 7(8);

- Fama, E. F., Jensen, M. C. (1983). Separation of ownership and control. The journal of law and Economics, 26(2);

- Fernando, S., Lawrence, S. (2014). A theoretical framework for CSR practices: Integrating legitimacy theory, stakeholder theory and institutional theory. Journal of Theoretical Accounting Research, 10(1);

- Foundation, E. (2021). Georgia Media Landscape Assessment. Available at: <https://epfound.ge/static/file/202206134459-media-good-governance.-09.06.22.pdf>;

- Freeman, R. E., Harrison, J. S., Wicks, A. C., Parmar, B. L., De Colle, S. (2010). Stakeholder theory: The state of the art. Cambridge University Press;

- Gatti, L., Seele, P. (2014). Evidence for the prevalence of the sustainability concept in European corporate responsibility reporting. Sustainability Science, 9(May);

- Gray, R., Kouhy, R., Lavers, S. (1995). Corporate social and environmental reporting. Accounting, Auditing & Accountability Journal, 8(8);

- Hamad, S., Draz, M. U., Lai, F.-W. (2020). The impact of corporate governance and sustainability reporting on integrated reporting: A conceptual framework. Sage Open, 10(2);

- Haniffa, R. M., Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5);

- Hassan, A., Elamer, A. A., Fletcher, M., Sobhan, N. (2020). Voluntary assurance of sustainability reporting: Evidence from an emerging economy. Accounting Research Journal, 33(2);

- Healy, P. M., Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of accounting and economics, 31(1-3);

- Ismail, A. M., Latiff, I. H. M. (2019). Board diversity and corporate sustainability practices: Evidence on environmental, social and governance (ESG) reporting. International Journal of Financial Research, 10(3);

- Jensen, M. C., Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4);

- Kolsi, M. C., Attayah, O. F. (2018). Environmental policy disclosures and sustainable development: Determinants, measure and impact on firm value for ADX listed companies. Corporate social responsibility and environmental management, 25(5);

- Kumar, P., Firoz, M. (2018). Impact of carbon emissions on cost of debt-evidence from India. Managerial Finance, 44(12);

- Kuzey, C., Uyar, A. (2017). Determinants of sustainability reporting and its impact on firm value: Evidence from the emerging market of Turkey. Journal of Cleaner Production, 143(February);

- Lassoued, N., Khanchel, I. (2023). Voluntary CSR disclosure and CEO narcissism: the moderating role of CEO duality and board gender diversity. Review of Managerial Science, 17(3);

- Law of Georgia on Accounting, Reporting and Auditing, (2016). Available at: <https://saras.gov.ge/Content/files/bugaltruli-agricxvis-angarishgebis-da-auditis-shesaxeb-kanoni.pdf>;

- Li, D., Huang, M., Ren, S., Chen, X., Ning, L. (2018). Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. Journal of business ethics, 150;

- Masoud, N., Vij, A. (2021). The effect of mandatory CSR disclosure on firms: empirical evidence from UAE. International Journal of Sustainable Engineering, 14(3);

- Matuszak, Ł., Różańska, E. (2020). Online corporate social responsibility (CSR) disclosure in the banking industry: evidence from Poland. Social Responsibility Journal, 16(8);

- Orazalin, N., Mahmood, M. (2020). Determinants of GRI-based sustainability reporting: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 10(1);

- Pirveli, E. (2014). Accounting quality in Georgia: Theoretical overview and development of predictions. International Journal of Business and Social Science (USA), 5(3);

- Pirveli, E. (2015). Financial statement quality: First evidence from the Georgian stock exchange Shaker Verlag, Aachim, Germany;

- Pirveli, E. (2020). Earnings persistence and predictability within the emerging economy of Georgia. Journal of Financial Reporting and Accounting, 18(3);

- Pirveli, E. (2024). Corporate disclosure timing under IFRS: the case of emerging Georgia. Journal of Financial Reporting and Accounting, 22(5);

- Pirveli, E., Ortiz-Martínez, E., Marín-Hernández, S., Thompson, P. (2025). Influencing sustainability: the role of lobbyist characteristics in shaping the EU’s Corporate Sustainability Reporting Directive. Sustainability Accounting, Management and Policy Journal, 16(2);

- Pirveli, E., Thompson, P. (2022). ESG Indicators of Sustainability Reporting in Emerging Georgia: Application Levels, Determinants and the Impact. 5th International Conference on Applied Research in Management, Economics and Accounting, Barcelona, Spain;

- Pirveli, E., Zimmermann, J. (2015). Time-series properties of earnings: the case of georgian stock exchange. Journal of Business and Policy Research, 10(1);

- Qiu, Y., Shaukat, A., Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1);

- Ruhnke, K., Gabriel, A. (2013). Determinants of voluntary assurance on sustainability reports: an empirical analysis. Journal of Business Economics, 83(9);

- Russo, M. V., Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of management Journal, 40(3);

- Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3);

- Stacchezzini, R., Melloni, G., Lai, A. (2016). Sustainability management and reporting: the role of integrated reporting for communicating corporate sustainability management. Journal of Cleaner Production, 136(November);

- Verrecchia, R. E. (2001). Essays on disclosure. Journal of accounting and economics, 32(1-3);

World Bank. (2021). Georgia Corporate Governance Report on the Observance of Standards and Codes. Available at: <https://openknowledge.worldbank.org/server/api/core/bitstreams/100d9e33-fbd4-5086-a6c5-8c7d600ab360/content>.

Footnotes

[1] De Villiers, C., Venter, E. R., Hsiao, P. C. K. (2017). Integrated reporting: background, measurement issues, approaches and an agenda for future research. Accounting & Finance, 57(4), pp. 937-959.

[2] Pirveli, E., Ortiz-Martínez, E., Marín-Hernández, S., Thompson, P. (2025). Influencing sustainability: the role of lobbyist characteristics in shaping the EU’s Corporate Sustainability Reporting Directive. Sustainability Accounting, Management and Policy Journal, 16(2), pp. 415-442.

[3] Qiu, Y., Shaukat, A., Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1), pp. 102-116.

[4] Kuzey, C., & Uyar, A. (2017). Determinants of sustainability reporting and its impact on firm value: Evidence from the emerging market of Turkey. Journal of Cleaner Production, 143(February), pp. 27-39.

[5] Kolsi, M. C., Attayah, O. F. (2018). Environmental policy disclosures and sustainable development: Determinants, measure and impact on firm value for ADX listed companies. Corporate social responsibility and environmental management, 25(5), pp. 807-818.

[6] Ismail, A. M., Latiff, I. H. M. (2019). Board diversity and corporate sustainability practices: Evidence on environmental, social and governance (ESG) reporting. International Journal of Financial Research, 10(3), pp. 31-50.

[7] Hamad, S., Draz, M. U., Lai, F.-W. (2020). The impact of corporate governance and sustainability reporting on integrated reporting: A conceptual framework. Sage Open, 10(2), pp. 1-15.

[8] Pirveli, E., Zimmermann, J. (2015). Time-series properties of earnings: the case of georgian stock exchange. Journal of Business and Policy Research, 10(1), pp. 70-96.

[9] Law of Georgia on Accounting, Reporting and Auditing, (2016). Available at: <https://saras.gov.ge/Content/files/bugaltruli-agricxvis-angarishgebis-da-auditis-shesaxeb-kanoni.pdf>.

[10] World Bank. (2021). Georgia Corporate Governance Report on the Observance of Standards and Codes. Available at: <https://openknowledge.worldbank.org/server/api/core/bitstreams/100d9e33-fbd4-5086-a6c5-8c7d600ab360/content>.

[11] Russo, M. V., Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of management Journal, 40(3), pp. 534-559.

[12] Gray, R., Kouhy, R., Lavers, S. (1995). Corporate social and environmental reporting. Accounting, Auditing & Accountability Journal, 8(8), pp. 47-77.

[13] Jensen, M. C., Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), pp. 305-360.

[14] Freeman, R. E., Harrison, J. S., Wicks, A. C., Parmar, B. L., De Colle, S. (2010). Stakeholder theory: The state of the art. Cambridge University Press.

[15] Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), pp. 355-374. Available at: <https://www.jstor.org/stable/1882010>.

[16] Verrecchia, R. E. (2001). Essays on disclosure. Journal of accounting and economics, 32(1-3), pp. 97-180.

[17] Fernando, S., Lawrence, S. (2014). A theoretical framework for CSR practices: Integrating legitimacy theory, stakeholder theory and institutional theory. Journal of Theoretical Accounting Research, 10(1), pp. 149-178.

[18] Cormier, D., Ledoux, M. J., Magnan, M. (2011). The informational contribution of social and environmental disclosures for investors. Management Decision, 49(8), pp. 1276-1304.

[19] Desai, R. (2022). Determinants of corporate carbon disclosure: A step towards sustainability reporting. Borsa Istanbul Review, 22(5), pp. 886-896.

[20] Kumar, P., Firoz, M. (2018). Impact of carbon emissions on cost of debt-evidence from India. Managerial Finance, 44(12), pp. 1401-1417.

[21] Healy, P. M., Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of accounting and economics, 31(1-3), pp. 405-440.

[22] Brammer, S., Pavelin, S. (2008). Factors influencing the quality of corporate environmental disclosure. Business Strategy and the Environment, 17(2), pp. 120-136.

[23] Ben-Amar, W., Chang, M., McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. Journal of business ethics, 142(2), pp. 369-383.

[24] Ali, W., Frynas, J. G., Mahmood, Z. (2017). Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Corporate social responsibility and environmental management, 24(4), pp. 273-294.

[25] Pirveli, E. (2020). Earnings persistence and predictability within the emerging economy of Georgia. Journal of Financial Reporting and Accounting, 18(3), pp. 563-589.

[26] Foundation, E. (2021). Georgia Media Landscape Assessment. Available at: <https://epfound.ge/static/file/202206134459-media-good-governance.-09.06.22.pdf>.

[27] Pirveli, E., Thompson, P. (2022). ESG Indicators of Sustainability Reporting in Emerging Georgia: Application Levels, Determinants and the Impact. 5th International Conference on Applied Research in Management, Economics and Accounting, Barcelona, Spain.

[28] Pirveli, E. (2024). Corporate disclosure timing under IFRS: the case of emerging Georgia. Journal of Financial Reporting and Accounting, 22(5), pp. 1253-1283.

[29] World Bank. (2021). Georgia Corporate Governance Report on the Observance of Standards and Codes. Available at: <https://openknowledge.worldbank.org/server/api/core/bitstreams/100d9e33-fbd4-5086-a6c5-8c7d600ab360/content>.

[30] Ibid.

[31] Pirveli, E. (2014). Accounting quality in Georgia: Theoretical overview and development of predictions. International Journal of Business and Social Science (USA), 5(3), pp. 283-293.

[32] Pirveli, E. (2020). Earnings persistence and predictability within the emerging economy of Georgia. Journal of Financial Reporting and Accounting, 18(3), pp. 563-589.

[33] Ruhnke, K., Gabriel, A. (2013). Determinants of voluntary assurance on sustainability reports: an empirical analysis. Journal of Business Economics, 83(9), pp. 1063-1091.

[34] Cormier, D., Magnan, M. (1999). Corporate environmental disclosure strategies: determinants, costs and benefits. Journal of Accounting, Auditing & Finance, 14(4), pp. 429-451.

[35] Haniffa, R. M., Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), pp. 391-430.

[36] Chan, M. C., Watson, J., & Woodliff, D. (2014). Corporate governance quality and CSR disclosures. Journal of Business Ethics, 125(September), pp. 59-73.

[37] De Villiers, C., Naiker, V., Van Staden, C. J. (2011). The effect of board characteristics on firm environmental performance. Journal of Management, 37(6), pp. 1636-1663.

[38] Fama, E. F., Jensen, M. C. (1983). Separation of ownership and control. The journal of law and Economics, 26(2), pp. 301-325.

[39] Cheng, E. C., Courtenay, S. M. (2006). Board composition, regulatory regime and voluntary disclosure. The international journal of accounting, 41(3), pp. 262-289.

[40] Orazalin, N., Mahmood, M. (2020). Determinants of GRI-based sustainability reporting: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 10(1), pp. 140-164.

[41] Pirveli, E., Thompson, P. (2022). ESG Indicators of Sustainability Reporting in Emerging Georgia: Application Levels, Determinants and the Impact. 5th International Conference on Applied Research in Management, Economics and Accounting, Barcelona, Spain.

[42] Stacchezzini, R., Melloni, G., Lai, A. (2016). Sustainability management and reporting: the role of integrated reporting for communicating corporate sustainability management. Journal of Cleaner Production, 136(November), pp. 102-110.

[43] Kolsi, M. C., Attayah, O. F. (2018). Environmental policy disclosures and sustainable development: Determinants, measure and impact on firm value for ADX listed companies. Corporate social responsibility and environmental management, 25(5), pp. 807-818.

[44] Hassan, A., Elamer, A. A., Fletcher, M., Sobhan, N. (2020). Voluntary assurance of sustainability reporting: Evidence from an emerging economy. Accounting Research Journal, 33(2), pp. 391-410.

[45] Faisal, F., Situmorang, L. S., Achmad, T., Prastiwi, A. (2020). The role of government regulations in enhancing corporate social responsibility disclosure and firm value. The Journal of Asian Finance, Economics and Business (JAFEB), 7(8), pp. 509-518.

[46] Hamad, S., Draz, M. U., Lai, F.-W. (2020). The impact of corporate governance and sustainability reporting on integrated reporting: A conceptual framework. Sage Open, 10(2), pp. 1-15.

[47] Faisal, F., Situmorang, L. S., Achmad, T., Prastiwi, A. (2020). The role of government regulations in enhancing corporate social responsibility disclosure and firm value. The Journal of Asian Finance, Economics and Business (JAFEB), 7(8), pp. 509-518.

[48] Matuszak, Ł., Różańska, E. (2020). Online corporate social responsibility (CSR) disclosure in the banking industry: evidence from Poland. Social Responsibility Journal, 16(8), pp. 1191-1214.

[49] Li, D., Huang, M., Ren, S., Chen, X., Ning, L. (2018). Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. Journal of business ethics, 150, pp. 1089-1104.

[50] Masoud, N., Vij, A. (2021). The effect of mandatory CSR disclosure on firms: empirical evidence from UAE. International Journal of Sustainable Engineering, 14(3), pp. 378-389.

[51] Orazalin, N., Mahmood, M. (2020). Determinants of GRI-based sustainability reporting: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 10(1), pp. 140-164.

[52] Gatti, L., Seele, P. (2014). Evidence for the prevalence of the sustainability concept in European corporate responsibility reporting. Sustainability Science, 9(May), pp. 89-102.

[53] Desai, R. (2022). Determinants of corporate carbon disclosure: A step towards sustainability reporting. Borsa Istanbul Review, 22(5), 886-896.

[54] Gatti, L., Seele, P. (2014). Evidence for the prevalence of the sustainability concept in European corporate responsibility reporting. Sustainability Science, 9(May), pp. 89-102.

[55] Ching, H. Y., Gerab, F., Toste, T. H. (2017). The quality of sustainability reports and corporate financial performance: Evidence from Brazilian listed companies. Sage Open, 7(2), 2158244017712027.

[56] Belal, A. R., Cooper, S. M., Khan, N. A. (2015). Corporate environmental responsibility and accountability: what chance in vulnerable Bangladesh? Critical Perspectives on Accounting, 33(December), pp. 44-58.

[57] Bhatia, A., Tuli, S. (2017). Corporate attributes affecting sustainability reporting: an Indian perspective. International Journal of Law and Management, 59(3), pp. 322-340.

[58] Matuszak, Ł., Różańska, E. (2020). Online corporate social responsibility (CSR) disclosure in the banking industry: evidence from Poland. Social Responsibility Journal, 16(8), pp. 1191-1214.

[59] Lassoued, N., Khanchel, I. (2023). Voluntary CSR disclosure and CEO narcissism: the moderating role of CEO duality and board gender diversity. Review of Managerial Science, 17(3), pp. 1075-1123.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .