Bayesian Networks for Migration, International Remittances, Trade, Foreign Direct Investments, Inflation, Real Interest Rate and Employment in Georgia

DOI:

https://doi.org/10.35945/gb.2024.18.009საკვანძო სიტყვები:

Emigration, Immigration, Bayesian Networks, Machin Learning, Remittancesანოტაცია

Migration has long been a topic of interest in Georgia, given its small economy, population, and unique history and culture. The main objective of this study is to examine the factors affecting emigration and immigration in Georgia and identify the dependencies among various macroeconomic variables, such as international remittances, trade, foreign direct investment (FDI), inflation, real interest rates, and employment. Using data spanning from 2002 to 2023, the study applies a machine learning technique, specifically Bayesian Networks, to analyze these relationships. The findings are discussed, and conclusions are drawn, along with recommendations for both the government and researchers for further exploration. To our knowledge, this is the first study to apply the Bayesian Network algorithm to investigate these dynamics in Georgia, filling an important research gap.

The results indicate that both immigration and emigration are affected by remittances paid, with emigration also being dependent on employment. It was found that remittances received and exports are directly influenced by remittances paid, while imports are affected by both exports and employment. Additionally, remittances received are directly dependent on imports, and the real interest rate is influenced by both imports and inflation (CPI). FDI is shown to be dependent on inflation, imports, and remittances received. Furthermore, both emigration and immigration are dependent on exports, imports, and remittances received, with immigration also exhibiting a dependency on FDI.

Keywords: Emigration, Immigration, Bayesian Networks, Machin Learning, Remittances.

- Introduction

Migration has been a long-standing topic for Georgia. As a small country with a limited population and economy, the country faces challenges due to emigration, particularly the brain drain - the loss of skilled workers and professionals - which hinders its development. On the other hand, immigration, particularly of skilled workers, is beneficial for the country and, therefore, also a subject of interest.

Machine learning is evolving quickly and has become a crucial component in diverse fields such as economics, medicine, and business. Virtually every sector now depends on data, and harnessing it effectively holds the potential to address a wide range of challenges across these domains. However, research applying data science techniques in economics and business remains limited for Georgia.

Importantly, no studies currently employ machine learning techniques, such as Bayesian Networks, to examine the potential causes of migration and explore the relationships between macroeconomic variables like FDI, international trade, remittances, inflation, interest rates, and employment in Georgia. Therefore, another central aim of this research is to create a base for future research for Georgia and inspire others to apply various data science techniques in investigating different economic topics.

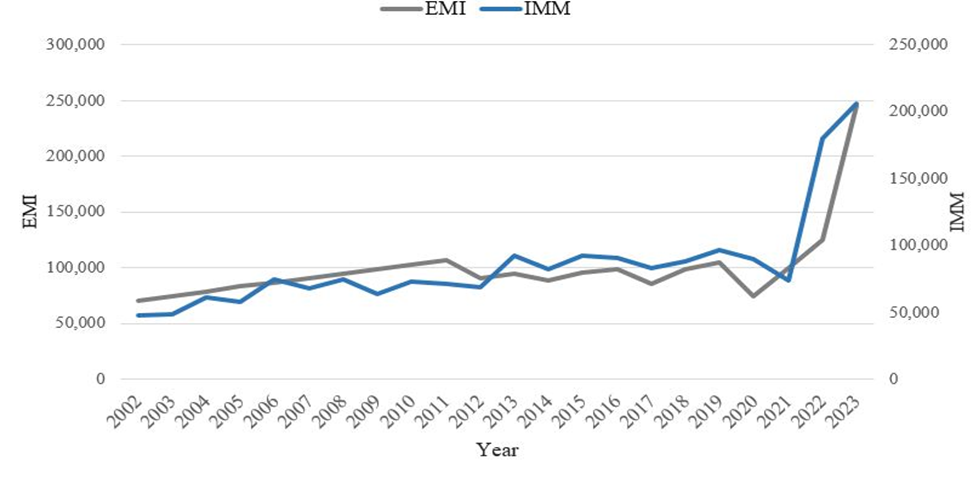

Georgia is a developing country with a GDP per capita (PPP) of $22,247 and a population of 3.7 million as of 2023.[1] Given its relatively small population compared to many other countries, migration has long been a topic of interest in Georgia. As shown in Graph 1, both emigration (the number of people leaving the country) and immigration (the number of people arriving in Georgia) have had an increasing trend since 2002, with a notable increase in both trends in 2022. In 2023, the number of emigrants comprised 245,064, while the number of immigrants was 205,857.

Graph 1. Emigration (EMI) and Immigration (IMM) in Georgia (2002-2023)

Source: The National Statistics Office of Georgia <www.geostat.ge>

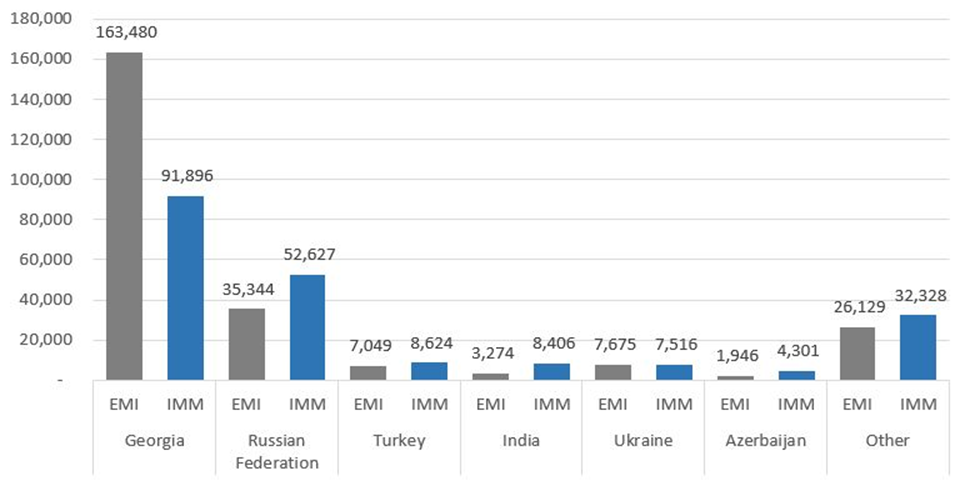

Analyzing migration by citizenship is also a valuable approach. As shown in Graph 2, the majority of migrants are Georgian citizens, followed by individuals from Russia, Turkey, Ukraine, India, and Azerbaijan.

The largest group of migrants falls within the age range of 15-64, followed by those in the 0-14 and 65+ age groups.[2] Thus, the largest group of migrants is the working-age population.

Graph 2. Emigrants (EMI) and Immigrants (IMM) by Citizenship (2023)

Source: The National Statistics Office of Georgia <www.geostat.ge>

As previously noted, Georgia is a developing country with relatively low productivity, making the size of its workforce and the level of economic activity crucial factors for growth.

This research aims to identify the potential causes of migration and explore the relationships among various macroeconomic variables. Specifically, the objective of this study is to examine the dependence between migration and other macroeconomic factors, including international remittances, trade, foreign direct investment (FDI), inflation, real interest rates, and employment, as well as to investigate the interdependencies among these variables. To achieve this, the study applies the machine learning algorithm, specifically Bayesian Networks, which are probabilistic graphical models, to detect complex relationships between the variables.

The first task was to select relevant variables, followed by building appropriate models and ultimately analyzing and interpreting the results.

The structure of the study includes a literature review, an overview of the data, methodology, and a presentation of the results for emigration and immigration separately. The study concludes with a discussion of the findings and provides recommendations for both the government and future researchers. The research is done in R programming language.

- Literature Review

While numerous studies have examined migration in Georgia, most focus on emigration, with only a few exploring the underlying causes of migration. Even fewer studies have utilized statistical analysis, and almost none have employed machine learning approaches.

Kharaishvili, E. et al. (2017) investigated the causes of labor and educational migration, as well as challenges related to youth unemployment by age and gender, particularly in Georgia’s agricultural sector. The study identified high poverty levels, underdeveloped infrastructure, and limited access to healthcare and other public services as the primary drivers of migration. It suggested that the government should develop policies to create employment opportunities for youth, especially in rural areas.[3]

Zangurashvili, M. (2020) explored the causes of youth emigration from Georgia, concluding that the key factors affecting it were distrust of state institutions, the lack of an employment policy for new job seekers, an unpromising labor market, nepotism, and low wages in an unfair work environment.[4]

Mihi-Ramirez, A. et al. (2020) examined the relationship between emigration, immigration, foreign direct investment (FDI), international remittances, and trade in Spain, using a Mixed Linear Model (MLM) for the period from 1998 to 2016. Their findings revealed that the effects of imports, exports, and FDI on migration were significant. They also found that remittances sent had a significant effect on immigration, while both remittances sent and received impacted emigration.[5]

Tchanidze, K. et al. (2021) analyzed the impact of migration on Georgia’s labor market. Their findings indicated that young people often emigrate in search of better living conditions. Many from rural areas leave the country illegally, bypassing efforts to settle in urban centers. To address this, the study recommended that the government should create job opportunities for both highly educated individuals and those without higher education.[6]

Karkashadze, N. et al. (2021) examined migration causes in Georgia and concluded that limited employment opportunities and low wages were the main reasons for emigration. The study also highlighted that many people emigrate abroad to pursue education. Additionally, the COVID-19 pandemic significantly affected migration patterns, with many leaving the country afterward. The study suggested that to reduce emigration, the government should increase investment, enhance public spending to create jobs, and ensure that social insurance programs are effectively integrated into the labor market.[7]

- Data Overview

The data presented in this study are 10 macroeconomic variables for Georgia for 22 years between 2002-2023. The data doesn’t have missing values, and the sources of the data are the National Statistics Office of Georgia and The World Bank’s Data - The World’s Development Indicators. Detailed information about the data is presented in Table 1.

Table 1: Macroeconomic Variables Included in the Model

|

IMM |

Immigration to Georgia. Source: The National Statistics Office of Georgia |

|

EMI |

Emigration from Georgia. Source: The National Statistics Office of Georgia |

|

FDI |

Foreign Direct Investment net inflow current (current US$)- BOP. Source: The World Bank |

|

REMR |

Personal remittances, received (current US$). Source: The World Bank |

|

REMP |

Personal remittances, paid (current US$). Source: The World Bank |

|

IMP |

Imports of goods and services (current US$). Source: The World Bank |

|

EXP |

Exports of goods and services (current US$). Source: The World Bank |

|

CPI |

Inflation, consumer prices (annual %). Source: The World Bank |

|

EMPL |

Employment to population ratio, 15+, total (%) (modeled ILO estimate). Source: The World Bank |

|

RIR |

Real interest rate (%). Source: The World Bank |

Source: The National Statistics Office of Georgia <www.geostat.ge>

The World Bank <https://data.worldbank.org/>

Over the past 22 years, Georgia has experienced several significant economic and political events. These include the Rose Revolution in 2003 when the “National Movement” came to power; the Russian-Georgian war in 2008; a change in government in 2012, when the “Georgian Dream” party assumed office; the Russian economic crisis in 2015, which also impacted Georgia’s economy; the onset of the COVID-19 pandemic in 2020; and the Russia-Ukraine war which started in 2022.

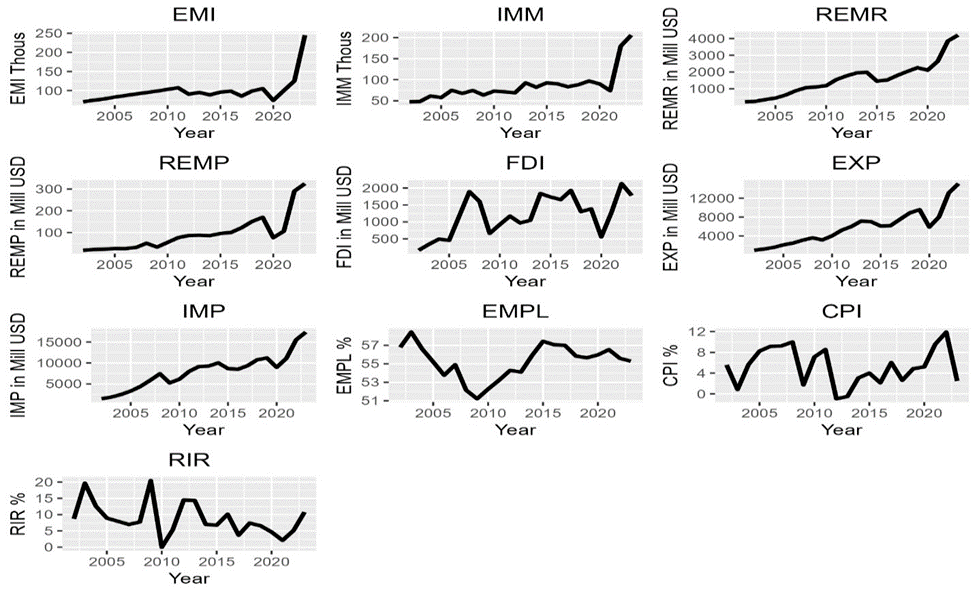

Graph 3 presents the time series of Georgia’s macroeconomic variables from 2002 to 2023. The trends in emigration (EMI) and immigration (IMM) were relatively stable over the years. However, both variables saw a significant surge in 2022, with even greater increases observed in 2023.

Graph 3. Time Series of the Variables (2002-2023)

Source: The National Statistics Office of Georgia <www.geostat.ge>

The World Bank <https://data.worldbank.org/>

Remittances received (REMR) experienced a significant decline in 2015, primarily due to the economic crisis in Russia at that time. Since the majority of remittances to Georgia originated from Russia, the downturn in Russia’s economic activity had a direct impact on remittances received in Georgia (Blouchoutzi, A. et al., 2023).[8]

Remittances paid (REMP) followed an upward trend over the years but saw a notable decrease in 2009, following the Russia-Georgia war, and again in 2020 during the COVID-19 pandemic.

Foreign Direct Investment (FDI) showed some fluctuations over the years but generally followed an upward trajectory. Exports (EXP) and imports (IMP) also exhibited an increasing trend, though both experienced a sharp decline in 2009 after the Russia-Georgia war, in 2015-2016 during Russia’s economic crisis, and in 2022 when the Russia-Ukraine war began.

The employment-to-population ratio (EMPL) fluctuated over the years, with a significant decline in 2009 following the Russia-Georgia conflict.

Inflation (CPI) and the real interest rate (RIR) both exhibited fluctuations throughout the period. While CPI had a constant trend across the years, RIR showed a downward trend.

- Methodology

- The Bayesian Networks

Bayesian networks are graphical models that represent the joint probability distribution of a set of variables and detect dependence between them. In the networks, nodes correspond to the variables, while arrows indicate probabilistic dependencies between them. The structure of the network is a directed acyclic graph (DAG), meaning there are no cycles or circular dependencies between variables. The DAG facilitates the factorization of the global probability distribution into local distributions through the Markov property (Scutari, M. 2009).[9]

More specifically:

- For discrete variables:

![]()

- For continuous variables:

![]()

The term refers to the parents of the random variable - , which depends on their respective parents. Bayesian networks utilize a two-step process: first, the algorithm learns the structure of the DAG, and then it estimates the local distributions of the random variables, conditioned on their parent variables (Scutari, M. 2009). There are three main types of Bayesian networks: Discrete, where all variables are discrete; Continuous, where all variables are continuous; and Mixed, which involves both continuous and discrete variables.

4.2 The Structure Learning Algorithms, Blacklist and Whitelist

When the structure of a Directed Acyclic Graph (DAG) is unknown, it can be determined using two main types of algorithms: constraint-based and score-based algorithms.

- Constraint-based algorithms use conditional independence tests to evaluate the probabilistic relationships between variables and construct the DAG. These algorithms detect conditional dependencies among variables, are more effective with large datasets, and are computationally more efficient. Some common functions within constraint-based algorithms include Grow-Shrink (GS), Incremental Association (IAMB), Fast Incremental Association (Fast.IAMB), Interleaved Incremental Association (Inter.IAMB), and Max-Min Parents and Children (MMPC). Each of these methods employs slightly different techniques to identify conditional dependencies between variables (Scutari, M. 2009).

- Score-based algorithms, on the other hand, assess the fit of the DAG by assigning a score to each network structure and optimizing it using algorithms such as hill-climbing or tabu search. (Scutari, M. 2009). By maximizing the score, these algorithms aim to identify the best network structure. While score-based methods can perform better with smaller datasets, they tend to be more computationally expensive due to the large search space.

Given that the dataset in this study is relatively small, first, a score-based algorithm, specifically hill-climbing (HC), was applied. However, the Bayesian networks did not fully capture the dependencies among several variables. To address this, the conditional independence test was used to assess the conditional dependencies of these variables, particularly using the ci.test function. When the data is categorical, in the ci.test, the mutual information test is applied for ordered factors, the Jonckheere-Terpstra test, and for continuous variables, the linear correlation. Since the data in this study is continuous, in the ci.test, the linear correlation test was applied. In the context of the ci.test, the null hypothesis ( ) asserts that the variables are conditionally independent. If the p-value is less than the significance level, the null hypothesis is rejected in favor of the alternative hypothesis ( , which states that there is conditional dependence between the variables.

If there is prior knowledge regarding relationships between variables, this can be incorporated into the Bayesian Network through whitelist or blacklist arguments. Relationships that are whitelisted will be included in the model, while relationships marked as blacklisted will be excluded. If a relationship is both whitelisted and blacklisted, it will be treated as whitelisted and will not be counted as blacklisted (Scutari, M. 2009). This study only blacklisted the arc and did not whitelist it to avoid excessive intervention and artificial results.

- Results

- Emigration and All Other Macroeconomic Variables

In the first scenario, the primary objective was to identify the variables that influence emigration and, after that, the relationships among all other variables, such as remittances, trade, interest rate, inflation, FDI, and employment. Since emigration is the key variable, the arc from emigration to trade, employment, interest rate, inflation, FDI, and remittances was blacklisted to prevent any direct arrows from emigration to these variables.

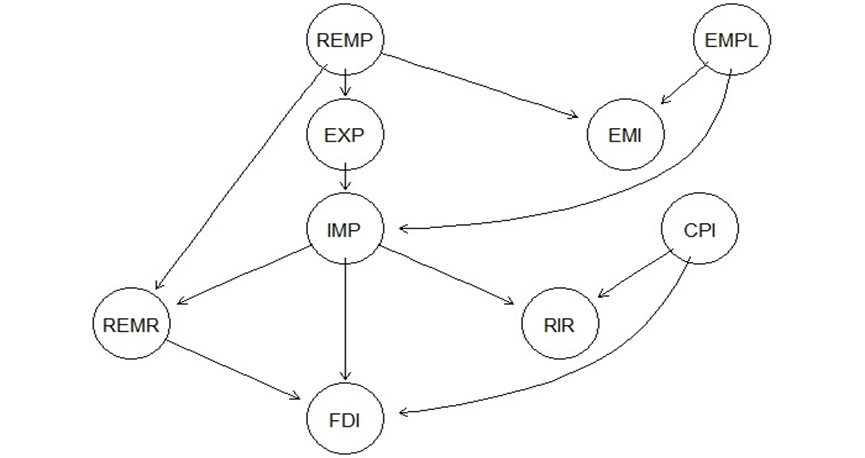

Graph 4 illustrates the results from the Directed Acyclic Graph (DAG), highlighting the relationships among the macroeconomic variables. As shown in Graph 6, remittances received are directly influenced by remittances paid. Emigration is affected by both remittances paid and employment. Exports are directly dependent on remittances paid, while imports are influenced by exports. FDI depends on remittances received, imports, and inflation (CPI). Additionally, FDI indirectly depends on remittances paid and exports through imports. Finally, the real interest rate is influenced by both imports and inflation (CPI).

Graph 4. DAG for Emigration and All Other Macroeconomic Variables

Source: Author’s research in R-studio

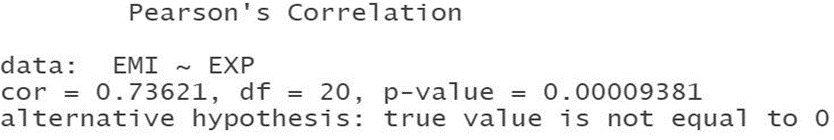

The DAG did not capture the dependency between emigration and other macroeconomic variables, apart from remittances paid and employment. Therefore, the missing relationships were examined using the conditional independence (CI) test. As shown in Table 2, emigration and imports are dependent, as the p-value is less than 0.05 at the 95% significance level.

Table 2. CI Test for Emigration and Import

Source: Author’s research in R-studio

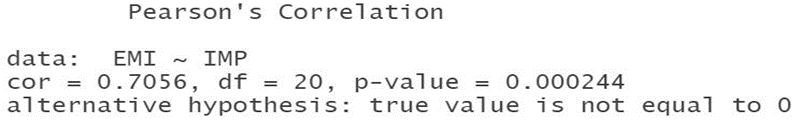

Table 3 presents the results of the conditional independence test for emigration and exports. The findings indicate that emigration and exports are dependent, as the p-value is less than 0.05.

Table 3. CI Test for Emigration and Export

Source: Author’s research in R-studio

The test results also revealed that emigration and remittances received are dependent, with a p-value of 0.0001. The was not rejected for the other variables. The p-values for emigration and variables such as FDI, CPI, and RIR ranged between 0.05 and 0.9, indicating that no significant relationships were detected between them.

- 5.2 Immigration and All Other Macroeconomic Variables

In the second scenario, the primary variable is immigration, and the objective is to identify the factors that influence immigration and explore how other macroeconomic variables, such as remittances, trade, interest rates, inflation, FDI, and employment, interact with each other. As in the first scenario, the arc from immigration to the other variables was excluded to prevent any direct arrows from immigration to these variables since the focus is on the variables that affect immigration.

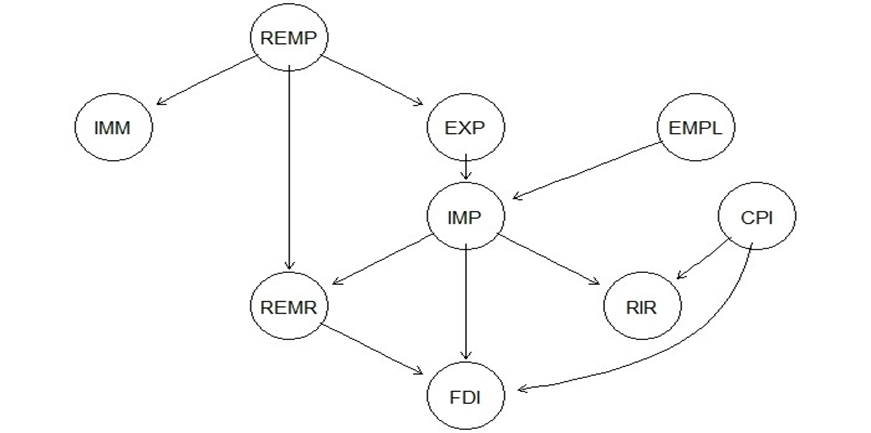

Graph 5 illustrates the Directed Acyclic Graph (DAG), which shows the dependencies between the variables. As depicted in Graph 5, immigration directly depends on remittances paid, which is the only variable in the DAG influencing immigration. The relationships between the other variables in this scenario are consistent with those in the first scenario. Specifically, remittances received and exports are directly dependent on remittances paid. Imports depend on exports and employment, while remittances received are directly dependent on imports. Finally, FDI is influenced by remittances received, imports, and inflation (CPI), and the real interest rate is dependent on both imports and inflation (CPI).

Graph 5. DAG for Immigration and All Other Macroeconomic Variables

Source: Author’s research results in R-studio

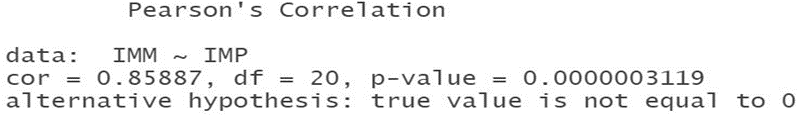

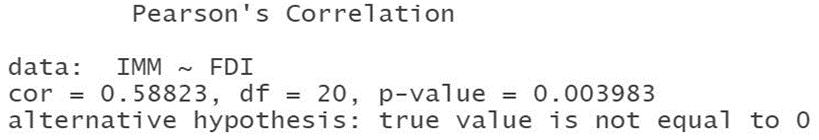

Similar to the first scenario, the DAG did not capture the dependency between immigration and all other macroeconomic variables, except for remittances paid. Therefore, the missing relationships were examined using the conditional independence (CI) test. As shown in Table 4, immigration and imports are dependent, as the p-value is less than the significance level of 0.05.

Table 4. CI Test for Immigration and Import

Source: Author’s research results in R-studio

Table 5 presents the results of the conditional independence test for immigration and FDI. The findings show that immigration and FDI are dependent, as the p-value is below the significance level of 0.05.

Table 5. CI Test for Immigration and FDI

Source: Author’s research results in R-studio

The test results also indicated that immigration and exports, as well as immigration and remittances received, are dependent, with p-values of 2.55E-08 and 0.0039, respectively. The hypothesis was not rejected for the other variables. Specifically, the p-values for immigration and other variables, such as CPI and RIR, ranged from 0.5 to 0.8, indicating that no significant relationships were identified between them.

- Discussion of Results

Bayesian networks show the dependencies between variables but do not necessarily indicate causation. Identifying cause-and-effect relationships requires further investigation; however, this section will still discuss the associations and potential cause-and-effect relationships that may exist between these variables.

Both immigration and emigration are dependent on remittances paid. Remittances paid can affect immigration by providing financial incentives in the recipient country. If remittances paid from a particular country are high, it may make that country more attractive to foreigners, encouraging them to migrate there. The relationship between remittances paid and emigration should be more indirect. A decline in remittances sent abroad could be a result of an economic downturn, which, in turn, may push people to leave the country in search of better opportunities elsewhere.

Emigration is closely linked to employment in Georgia, where limited employment opportunities are one of the primary reasons for emigration to another country.

For both scenarios, the relationships between the macroeconomic variables are largely consistent. In both cases, remittances received are directly dependent on remittances paid. During an economic downturn, people may reduce the amount they remit while simultaneously asking for financial support from abroad, which can lead to an increase in remittances received.

Exports are directly dependent on remittances paid. This relationship is more complex, as an increase in remittances paid can stimulate the economy in the recipient country, boosting consumption. This, in turn, can lead to higher demand for imports, thereby increasing exports from the sending country.

Imports are directly related to exports, as the revenue generated from exports typically funds the imports. Imports are also directly dependent on employment since higher employment can lead to greater income and consumption, which usually increases imports.

Remittances received are directly dependent on imports, though the relationship can be more indirect and complex. Imports can affect economic conditions, employment, consumption patterns, and inflation, all of which can influence the need for financial support from abroad. If imports cause higher living costs, they may indirectly lead to an increase in remittances received. This relationship is complex and can be shaped by factors such as wage disparities, economic policies, and migration patterns.

FDI and remittances received are dependent, as remittances can help stimulate the economy in the recipient country, making it a more attractive destination for foreign direct investment.

The real interest rate and imports are also dependent, albeit indirectly. Imports can affect the real interest rate through various channels, such as inflation, economic growth, and exchange rates. If an increase in imports leads to higher inflation, the central bank may raise nominal interest rates, which in turn would raise the real interest rate.

The real interest rate and CPI (consumer price index) are also directly dependent, as inflation is a key factor in determining real interest rates. Since real interest rates are calculated by subtracting inflation from nominal interest rates, the relationship is clear.

Finally, FDI directly depends on inflation. High inflation can create uncertainty in the economy, discouraging foreign investment. Generally, there is a negative relationship between FDI and CPI, as higher inflation tends to deter investment.

Conclusion

This study explored the relationships among migration, international remittances, trade, foreign direct investment (FDI), inflation, interest rates, and employment by employing the machine learning technique of Bayesian Networks. The primary focus was on emigration and immigration and the factors influencing these phenomena. The Bayesian Network models were constructed with emigration and immigration as the key variables of interest, starting with emigration as the primary variable and then addressing immigration.

The results indicated that both immigration and emigration are dependent on remittances paid, with emigration also being dependent on employment. Remittances received were found to be directly influenced by remittances paid, exports were dependent on remittances paid, and imports were influenced by both exports and employment. Additionally, remittances received were found to be directly dependent on imports, while the real interest rate was influenced by both imports and inflation (CPI). FDI was found to be dependent on inflation (CPI). Moreover, both emigration and immigration were dependent on exports, imports, and remittances received, with immigration also showing a dependency on FDI.

These findings align with previous research on the relationships between migration, imports, exports, FDI, and remittances. Additionally, they support the notion that employment-related issues are a significant driver of emigration, as highlighted by numerous studies. Georgia’s small economy and limited labor market diversity contribute to the lack of job opportunities, especially for younger workers. Furthermore, low remuneration in nearly all sectors exacerbates the problem. To address these issues, the government should focus on attracting more international companies and FDI in the country, improving the education system, and enhancing skills development to meet labor market demands. Employment is a multifaceted issue influenced by factors such as economic growth, political stability, and overall economic stability - areas that require significant improvement in Georgia.

While this study tried to explore the associations and potential cause-and-effect relationships between the variables, Bayesian Networks primarily highlight dependencies but not necessarily causal links. Therefore, further research is needed to clarify causation. Specifically, the interesting findings from this study - such as the dependencies between remittances received and imports, FDI and remittances received, and the real interest rate and imports—warrant further investigation. Additionally, the relationship between migration, exports, imports, and FDI should be explored further to better understand cause-and-effect relationships and provide more comprehensive explanations.

Bibliography:

- Blouchoutzi, A., Pedi, R. (2023). In-betweenness and Migration Interdependence: Lessons from Georgia, Moldova, and Ukraine. Studia Europejskie-Studies in European Affairs, 27(1);

- Karkashadze, N., Ukleba, S. (2021). Unemployment and migration in Georgia at the modern stage. FBIM Transactions, 9(2);

- Kharaishvili, E., Chavleishvili, M., Lobzhanidze, M., Damenia, N., Sagareishvili, N. (2017). Problems of youth employment in agricultural sector of Georgia and causes of migration. International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 11(10);

- Mihi-Ramirez, A., Sobieraj, J., Garcia-Rodriguez, Y. (2020). Interaction of foreign direct investment, international trade, and remittances with emigration and immigration. Transformations in Business & Economics, 19(2A);

- Scutari, M. (2009). Learning Bayesian networks with the bnlearn R package. arXiv preprint arXiv:0908.3817;

- Tchanidze, K., Katsadze, I. (2021). The Study of Migration Influence on the Labor Market Structure and Employment in Georgia. Georgian Maritime Scientific Journal, 1(1);

- The National Statistics Office of Georgia www.geostat.ge [Last Access: 11.29.2024];

- The World Bank. <https://data.worldbank.org/> [Last Access: 11.29.2024];

- Zangurashvili, M. (2020). The main reasons for migration of young educated people from Georgia (Doctoral dissertation, Masarykova Univerzita).

Footnotes

[1] The World Bank. <https://data.worldbank.org/> [Last Access: 11.29.2024].

[2] The National Statistics Office of Georgia. <www.geostat.ge> [Last Access: 11.29.2024].

[3] Kharaishvili, E., Chavleishvili, M., Lobzhanidze, M., Damenia, N., Sagareishvili, N. (2017). Problems of youth employment in agricultural sector of Georgia and causes of migration. International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 11(10), 2116-2121.

[4] Zangurashvili, M. (2020). The main reasons for migration of young educated people from Georgia (Doctoral dissertation, Masarykova Univerzita).

[5] Mihi-Ramirez, A., Sobieraj, J., Garcia-Rodriguez, Y. (2020). Interaction of Foreign Direct Investment, International Trade and Remittances with Emigration and Immigration. Transformations in Business & Economics, 19(2A), 42-59.

[6] Tchanidze, K., Katsadze, I. (2021). The Study of Migration Influence on the Labor Market Structure and Employment in Georgia. Georgian Maritime Scientific Journal, 1(1), 87-96.

[7] Karkashadze, N., Ukleba, S. (2021). Unemployment and Migration in Georgia at the Modern Stage. FBIM Transactions, 9(2).

[8] Blouchoutzi, A., Pedi, R. (2023). In-betweenness and Migration Interdependence: Lessons from Georgia, Moldova, and Ukraine. Studia Europejskie-Studies in European Affairs, 27(1), 127-148.

[9] Scutari, M. (2009). Learning Bayesian networks with the bnlearn R package. arXiv preprint arXiv:0908.3817.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .