Digital Finance in Algeria: Analyzing the Impact of COVID-19 on E-Banking Adoption

DOI:

https://doi.org/10.35945/gb.2024.18.004საკვანძო სიტყვები:

COVID-19, Electronic banking, Algeria, Digital transformation, Challenges and opportunitiesანოტაცია

This study aims to analyze the impact of the COVID-19 pandemic on the development of electronic banking in Algeria, focusing on how the health crisis has accelerated the digital transformation of the banking sector and identify the challenges and opportunities associated with this transition in a specific Algerian context. The study uses a descriptive and analytical approach. It is based on statistical data to illustrate the evolution of electronic banking in Algeria. The analysis focuses on public policies, bank initiatives, and consumer behavior.

The study reveals that the COVID-19 pandemic has significantly impacted the development of e-banking in Algeria. There has been a sharp increase in digital transactions, including bank transfers, electronic payments, and ATM withdrawals. Electronic banking has played a crucial role in ensuring the continuity of financial services during the lockdown periods. However, challenges persist in terms of security, financial inclusion, and the development of digital infrastructure.

Keywords: COVID-19, Electronic banking, Algeria, Digital transformation, Challenges and opportunities.

- Introduction

The world is currently living in the era of the digital revolution, in which information technologies prevail. Advances in information and communication technologies (ICT) have revolutionized business management methods. Technology serves as an essential link between the information and business processes. ICT has had a significant influence in almost every sector,[1] and banks, like other business entities, have been leveraging ICT for many years. The health crisis with the emergence of the COVID-19 pandemic at the end of 2019 and its rapid spread worldwide threatened the collapse of the global economy, banking sector, and various vital sectors in countries. Algeria is one of the countries where this pandemic appeared, which required preventive measures to prevent the spread of COVID-19 among the population; this is the process of closing borders and all public institutions, schools, and universities and freezing various economic, financial, and banking activities to preserve the security of citizens. To ensure the continuity of the banking sector in Algeria, it was necessary to support continuous developments in the field of technology by relying on digitization through the promotion and use of information and communication technologies.

Where the State has sought to redouble its efforts to meet the needs of customers and achieve digital transformation because of its various positive effects on the national economy and the banking sector, by supporting and stimulating the use of digital means and electronic processes in payment, where the general framework for the transition to a non-monetary payment system has been developed, in accordance with recognized international standards, taking into account local variables, as came after the precautionary measures imposed by the health crisis and urged by the Ministry of Health, and the National Corona Virus Monitoring and Tracking Committee, by providing the most appropriate climate for the exercise of these online operations through remote work due to the activation of social distancing, the process adopted by the banking sector, which is considered an intermediary between customers, where electronic banking or online banking services have enabled the customer to manage online transactions.

Internet and technological advances have transformed the way financial services are offered and used.[2] E-banking has transformed the banking sector by providing clients with the ease of doing financial transactions at any time and from any location. Furthermore, e-banking has enhanced the effectiveness of banking procedures and reduced the cost of providing services.[3]

Banks and various financial institutions offer innovative and alternative electronic channels to maintain competitive advantage and meet customer expectations, and banking institutions offer various types of electronic banking services. These include ATMs, e-wallets, debit cards with chips, electronic payment terminals (EDCs), mobile banking, and online banking.[4] Customers are increasingly using their mobile devices and desktops to make payments for products and services through online banking.[5]

Global e-banking played a pivotal role during the COVID-19 pandemic by operating entirely electronically without exchanging tangible goods to protect people and maintain social distance so that people feel completely safe and easily accessible in online transactions (such as payments for essential items (food and medicine), billing, top-up, money transfer, receipt of payments, etc.) Online banking is now an essential e-commerce application adopted by financial institutions to satisfy the growing demands of their customers and remain at the forefront of technological advances.[6]

This study helps us understand how the COVID-19 pandemic accelerated the digital transformation of the banking sector in Algeria. As digitalization becomes essential worldwide, it is crucial to see how a country like Algeria has responded and adapted its banking services to this new reality. It also highlights the Algerian banking sector’s challenges, including security, financial inclusion, and digital infrastructure. At the same time, it explores the opportunities created by this digital transition, such as the potential to improve access to financial services for a more significant portion of the population. This study aims to review the evolution of electronic banking services in Algeria, focusing on recent developments related to the COVID-19 pandemic.

The subsequent sections of this document are organized as follows: Section two provides a literature review. Section three outlines the conceptual framework. Section four discusses the role of the pandemic in accelerating the digitalization of the banking sector in Algeria. Section five examines the contribution of digital financial services to economic recovery. Finally, section six summarizes the progress in implementing electronic banking services in Algeria and suggests avenues for future research.

- Literature Review

The rapid advancement of information and communication technologies has revolutionized the banking sector, leading to the widespread adoption of electronic banking.[7] E-Banking is an innovative tool that is rapidly becoming a necessity and a strategic asset for banks to remain profitable in a competitive market.[8] The Covid-19 pandemic accelerated this transformation, with lockdowns and social distancing measures requiring the use of digital channels.

Several key factors influencing customer satisfaction with electronic banking services in Libyan banks. These factors include perceived usefulness, ease of use, credibility, and customer attitudes[9]. This study reveals that customer attitude is the most important factor, followed by ease of use, credibility, and perceived usefulness. These findings suggest that banks need to focus on these aspects to improve customer satisfaction. The adoption of electronic banking by Algerian customers is analyzed through factors such as technological acceptance, ease of use, and transaction security[10]. This study highlights that key barriers to adoption include security concerns and a lack of awareness of the benefits of e-banking. Suggested strategies to improve adoption include strengthening security measures and increasing awareness of the benefits of e-banking. In addition, another study also explores the relationship between the quality of electronic banking services and customer satisfaction with financial services, identifying key factors such as reliability, efficiency, and security[11]. This study provides empirical evidence of the importance of these factors in improving customer satisfaction and proposes strategies for banks to improve their e-banking services. The use of digital financial services has increased significantly, especially in developing economies where access to traditional banking services is limited.[12]

During the COVID-19 pandemic, e-banking has highlighted its role in operating entirely electronically without exchanging tangible goods to protect people and maintain social distancing. People feel completely safe and easily accessible in online transactions (e.g., payments for essential items (food and medicine), billing, top-up, investment, money transfer, and receiving payments).[13] Digital financial services have enabled governments to disburse money to those who need it quickly and efficiently and have enabled many households and businesses to quickly access payments and financing online. Risks to stability and integrity may exist, which could be exacerbated if the use of digital financial services is rapidly expanded in times of crisis without appropriate regulations and safeguards.[14]

Electronic financial services, developed during the 2008 financial crisis, played a crucial role in addressing the challenges posed by the COVID-19 pandemic[15]. The use of modern financial technology positively affects the work and policies of banks and financial institutions.[16] The pandemic has accelerated the digitization of banking services by several years, forcing banks to modernize their infrastructure and improve their online user experience.[17] The use of electronic payment methods in the Corona era accelerated and facilitated financial transactions and provided security.[18] The impact of COVID-19 on digital banking, noting a significant acceleration of digital transformation in the banking sector. Customers prefer these channels to traditional methods because of their convenience and security.[19] The pandemic has pushed banks to modernize their legacy systems to meet growing customer expectations.[20]

To examine the impact of the COVID-19 pandemic on the adoption of online banking services in Indonesia, comparing the effects on Islamic and conventional banks, the study shows that the pandemic has significantly boosted the use of these services. Factors such as perceived usefulness, ease of use, and trust have proven to be crucial in this process[21]. This demonstrates the importance of meeting customer needs and preferences to drive the adoption of digital services. Traditional banks face several challenges when adapting to the digital age. These challenges include the need to update legacy systems, ensure the security of digital transactions, and address customer concerns about privacy and trust[22]. To overcome these challenges, banks should prioritize improving the perceived usefulness, ease of use, and credibility of their e-banking services. In addition, targeted marketing campaigns and incentives can help improve customer attitudes towards digital banking. The COVID-19 pandemic has catalyzed the development and adoption of e-banking across the globe, with banks investing heavily in technology to facilitate remote transactions and ensure the continuity of services during lockdowns.[23] Digital banking has played an important role in improving financial inclusion.[24]

Fintech solutions play a crucial role in the banking industry’s digital transformation.[25] Fintech companies have introduced innovative financial services that are profitable, efficient, and convenient, thereby improving their financial inclusion. For example, digital wallets and peer-to-peer lending have enabled individuals and SMEs to access financial services without going through the strict processes of traditional banks.[26]

- Concept of Electronic Banking Services

Electronic banking is defined as the conduct of banking operations using modern information and communication technologies, whether for withdrawal, payment credit,[27] transfer, securities trading, or other banking activities. It is also defined as the provision of banking services using information and communication technologies through the Internet, automated vending machines, private networks, mobile phones, and fixed and personal accounts. Banking service is available after and within 24 hours, every day of the week, at high speed, at a lower cost, and without a meeting place between the customer and the bank.[28] There are several types of electronic banking services, which are services that depend on the use of the Internet and rely on highly skilled human frameworks[29] and community trust in financial institutions, and the development of e-commerce in this environment.

- The Role of the COVID-19 Pandemic in Accelerating the Digitization of the Banking Sector in Algeria

The Coronavirus has contributed to the acceleration of digitization in the banking sector in Algeria, where account-to-account transfers have reached a recovery, registering more than 2.9 billion dinars in 2020, an increase of 137% compared to 2019. Electronic payment has also been upgraded, and the number of transactions related to electronic payment services via the golden card has increased significantly, with more than 6.6 million cards with 3.8 million renewed cards issued in 2020. The Golden Card also recorded nearly 4 million transactions in 2020 compared to 2019 (about 670,000), an increase of 487% in one year.

The new self-payment service launched by Algeria Post via the Postal Mob application (which allows Gold cardholders to schedule the transfer of funds from a current postal account to other postal accounts) increased by 557% in transfers in one year (991,991 transactions in 2020 compared to 150,992 transactions in 2019). The same goes for payments via the electronic payment terminal (EPT), which increased by 773%, in addition to ATM withdrawals, which amounted to DZD 956 billion, an increase of 15% compared to 2019.[30]

The spread of the Coronavirus has forced the government to look for ways to develop electronic programs used in virtual transactions using the Internet between the customer and the banking and banking institution through virtual marketing, improving the quality of remote banking services and their expansion in Algeria, facilitating the adoption of receiving funds and allowing the receipt of hard currency funds, even partially, on “Western Union” in addition to establishing clear mechanisms for the process of sending money abroad that are distributed to all banks, and the establishment of bureau de change to ease the control of parallel markets.

The state was able to reach the neediest groups through social transfers and other financial aid through digital financial services. In the era of the Corona pandemic, it is crucial to prioritize the augmentation of transfer money allocated to beneficiaries and promote the use of digital operations. Amidst the current circumstances, digital financial services aid companies in resolving pressing liquidity issues. They facilitate seamless communication with financial service providers, expedite the withdrawal of funds from existing credit lines, and provide alternative financing options to offset the scarcity of liquidity in conventional financial operations.

- How Can Digital Financial Services Pave the Way for Economic Recovery in Algeria?

Algeria and the MENA area have experienced economic shocks worsened by the coronavirus epidemic, leading to decreased oil prices. The most recent estimates from the Economic Observatory indicate that the Algerian economy had a substantial decline in real GDP for 2020. Algeria’s pursuit of digital transformation, a prominent development objective before the epidemic, has become crucial in the country’s recovery efforts. Access to cheap financial services is crucial for reducing poverty, promoting economic development, and building resilience. It also facilitates financial inclusion, particularly for women. In Algeria, a significant portion of the population currently needs access to basic transaction accounts, with 57% of adults and 71% of women unable to safely and effectively make and receive payments.

Consequently, they needed to provide access to more extensive financial services such as savings, insurance, and credit. In conjunction with conventional financial service providers, financial technology can decrease expenses, enhance efficiency, ensure safety and transparency, and provide more secure financial services. Expanding the availability of digital payment options would serve as an entry point for Algerians who need to be more knowledgeable about the financial industry to utilize digital financial services. The expansion of mobile phones in many developing nations has been used by mobile financial services to initiate the “first wave” of digital financial services. Despite having better access to mobile broadband networks than the MENA average, the adoption of digital financial services in Algeria still needs to grow. Only 16% of Algerian adults and 11% of women utilize digital payments, whereas the regional average is 23% for adults and 18% for women. In comparison, emerging and developing countries have a significantly higher adoption rate, with 36% of adults and 32% of women using digital payments.

While many countries have begun to address the underlying enablers of digital financial services and digital payments management, they need vital enablers, enabling legal and regulatory frameworks, financial and digital infrastructure, and ancillary government support systems. To address these three areas, policymakers need to consider a wide range of critical issues, ranging from basic digital connectivity and mobile penetration, access to national payment infrastructure and e-money, non-banking services or the deployment of digital and biometric identity systems, enabling access to government data platforms and ensuring competition for digital financial services.[31] The benefits of financial services for the poor are well documented; however, they carry risks for users and the broader financial system: issues related to data privacy, unequal access to technology and the “digital divide”, cyber security and operational risks, financial integrity, and challenges for competition authorities. This requires high regulation, control, and supervision by the competent authorities.

- The Development of Certain Electronic Banking Services in Algeria

Digital financial services provide governments with expedient and secure means to assist those in need via social transfers and other financial help, particularly when mobility is risky or restricted. Prior to the onset of the coronavirus crisis, it was evident that two specific applications of digital financial services, excluding mobile money transfers, money transfers, and government-to-person payments, were especially advantageous for impoverished individuals. Based on the World Bank’s Global Remittance Prices Database data, the average overall cost of sending funds is 6.8%; however, digital transactions will reduce the cost to 3.3%. According to Findex statistics, many Algerians own a bank account, although they continue using services outside their bank accounts for domestic transactions. Hence, augmenting the financial resources allocated to remittance beneficiaries and promoting digital platforms is crucial. Implementing digital payment systems may enhance the transparency and oversight of governments that provide emergency cash to individuals and enterprises by facilitating the monitoring of financial disbursements and actions. Digital financial services provide solutions for companies facing liquidity issues, allowing them to engage with financial service providers, access credit quickly and seamlessly, and secure alternative financing options. These services are helpful not only for addressing liquidity gaps in traditional financial channels but also for supporting innovative business models that cater to underserved populations. Significant e-commerce platforms are becoming more critical as Jumia expands its operations into Algeria to join existing local platforms like OuedKnis, Batolis, and IdealForme. Telecommunications operators have used the capabilities of digital financial services to streamline payments and provide pay-as-you-go options for solar energy, insurance, and loan services.

Although Algeria has made strides in supporting fintech technologies and advancing digital financial services, there is still room for improvement in increasing awareness of their advantages and fostering their expansion. Algeria aims to promote economic activity and improve the lives of its residents by increasing the availability of digital financial services. This will enable individuals to grow their wealth, make productive investments, and, most importantly.

Electronic banking services in Algeria have made good progress in recent years. Most Algerian banks have set up mobile applications and online banking services through which customers can carry out banking transactions such as checking their balance, transferring funds, paying bills, etc. The advent of electronic debit cards (CIB, Visa, and MasterCard) has also facilitated access to online banking services.

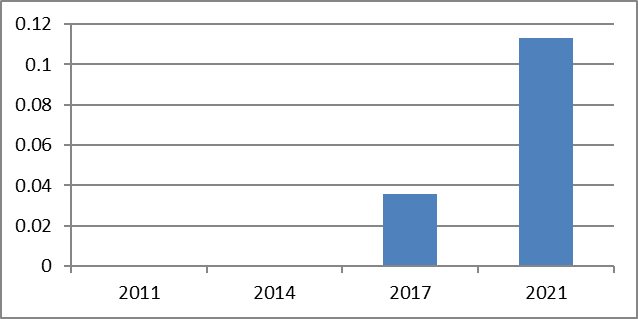

Fig.1. Check of balance by phone or Internet in Algeria (+15%)

Source: Prepared by researcher based on World Bank data

<https://www.worldbank.org/en/publication/globalfindex/Data>

This chart effectively communicates the steady growth in digital banking adoption in Algeria, mainly using mobile and Internet technologies for essential banking functions such as checking account balances. The graph shows a gradual increase in the use of mobile phones or the Internet to check the balance of accounts from 2011 to 2021. In 2011, usage was minimal; there was a slight increase in 2014, with a notable increase in 2017. The most significant growth in 2021 indicates a significant adoption of numerical account balance verification. This increase could be influenced by increased Internet penetration, the development of online banking, and increased public awareness and confidence in digital banking in Algeria. This period also coincides with global trends in digital transformation and the impact of the COVID-19 pandemic, which has accelerated the adoption of digital services across the globe.

This rise is fuelled by several factors, such as the proliferation of mobile devices, improved internet access, emerging online banking services, and increasing public awareness and confidence in Algeria’s electronic banking environment. It is also an era of global digital transformation, boosted by the COVID-19 pandemic, which has led to the rapid implementation of digital service proposals worldwide.

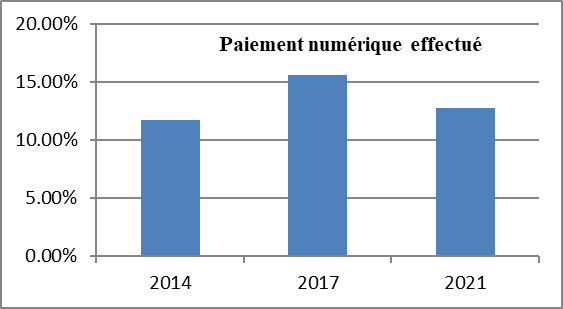

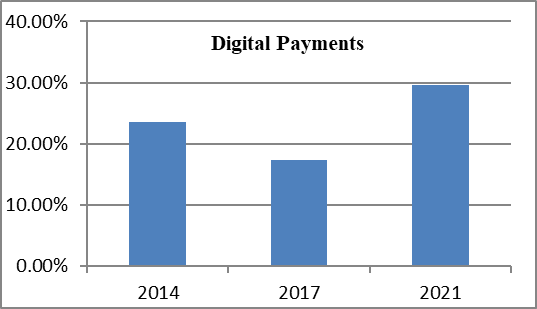

Fig.2. Digital payment in Algeria (% aged 15 +)

Source: Prepared by researcher based on World Bank data

https://www.worldbank.org/en/publication/globalfindex/Data

Both graphs show that there has been a general increase in digital payment activities in Algeria between 2014 and 2021. However, the growth rate differs between those who make payments and those who receive them. Approximately 10% of people aged 15 and older have made a digital payment. This percentage increased to around 12%, showing modest growth in digital payments adoption over three years. The percentage continues to increase to around 15%. This suggests an increasing trend in the use of digital means of payment among the Algerian population, probably due to the expansion of digital infrastructure and a better familiarity with digital transactions.

This concerns the Digital Payments received (% aged 15 and over) in Algeria. In 2014, approximately 20% of people received digital payments. In 2017, the percentage decreased slightly to around 15%, showing a decline in the receipt of digital payments during this period. The percentage rebounded significantly in 2021 to around 25%, indicating strong growth in the receipt of digital payments. The sharp increase in digital payments received between 2017 and 2021 may reflect broader economic or social changes, such as increased trust in digital payment systems, increased e-commerce, government initiatives to promote digital financial inclusion, the effects of the COVID-19 pandemic, which may have accelerated the shift to digital transactions.

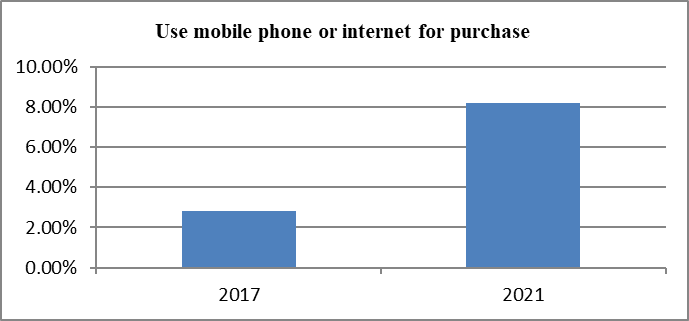

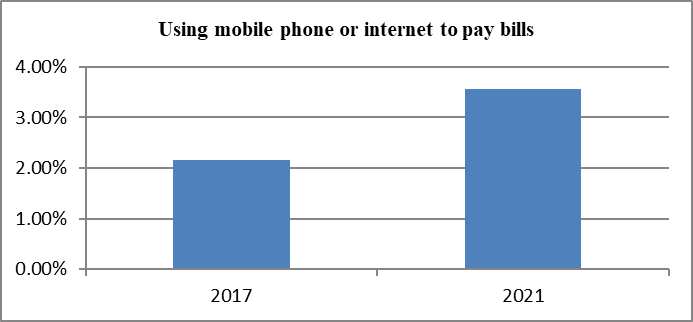

Fig. 3. The adoption of online services (purchases and bill payments) in Algeria

Source: Prepared by researcher based on World Bank data

<https://www.worldbank.org/en/publication/globalfindex/Data>

In 2017, less than 5% of people aged 15 and over made online purchases; in 2021, this percentage reached about 8%, indicating a growing trend towards online shopping. In 2017, around 2% of the population aged 15 and over used online services to pay their bills; in 2021, this doubled to around 4%, reflecting a growing adoption of digital payment methods.

Both graphs show an upward trend in adopting online services (purchases and bill payments) between 2017 and 2021 among Algerians aged 15 and over. This can be attributed to increased internet penetration, better smartphone access, and a shift to digital platforms, potentially accelerated by the COVID-19 pandemic.

The data suggests that Algerians are increasingly embracing digital platforms for shopping and paying bills, reflecting a broader trend toward digital transformation in the country. Increased digital engagement could provide businesses and decision-makers opportunities to develop e-commerce and digital payments infrastructure further.

Conclusion

This study has highlighted the significant acceleration of the digital transformation of the banking sector in Algeria, largely due to the COVID-19 pandemic. As the world turned to digital solutions to overcome the restrictions imposed by the health crisis, Algeria also embraced this trend, adopting digital technologies to maintain the continuity of financial services.

The findings show that despite progress, the Algerian banking sector still needs to overcome several challenges to capitalize on this transformation fully. Issues of security, limited financial inclusion, and still underdeveloped digital infrastructures still need to be addressed. However, the post-pandemic period offers unique opportunities to overcome these challenges, with the rise of digital financial services and the possibility of further innovation to meet the growing needs of consumers.

Ultimately, the ability of the Algerian banking sector to continue evolving and adapting to this new digital era will determine its resilience and future success. Concerted efforts by regulators, financial institutions, and the government must be made to ensure an inclusive, secure, and sustainable digital transition, thereby ensuring that all segments of society can benefit from this transformation.

Authorship of the Work

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflicts of Interest

The authors declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding Information

This research has not been funded.

Bibliography:

1. Agency, A. P. (2022). Electronic payment “evolved” due to the COVID-19 pandemic in Algeria. Retrieved on April 2, 2024. (in Arabic);

2. Allada, V., Dubey, R., Agarwal, S. (2014). Exploring antecedents of online banking customers and empirical validation. International Journal of Productivity and Quality Management, 14. <https://doi.org/10.1504/IJPQM.2014.065559>’

3. Almansour, B., Elkrghli, S. (2023). Factors influencing customer satisfaction on e-banking services: A study of Libyan banks. International Journal on Technology, Innovation, and Management (IJTIM), 3(1). <https://doi.org/10.54489/ijtim.v3i1.211>;

4. Arner, D. W., Barberis, J., Walker, J., Buckley, R. P., Dahdal, A., Zetzsche, D. A. (2020). Digital finance & The COVID-19 crisis. SSRN Electronic Journal. <https://doi.org/10.2139/ssrn.3558889>;

5. Bank, W. (2022). COVID-19 drives global surge in use of digital payments. <https://www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge-in-use-of-digital-payments>;

6. Bellahcene, M., Latreche, H. (2023). E-banking adoption by Algerian bank customers: Towards an integrated model. International Journal of E-Services and Mobile Applications, 15(1). <https://doi.org/10.4018/IJESMA.317943>;

7. Bousrih, J. (2023). The impact of digitalization on the banking sector: Evidence from fintech countries. Asian Economic and Financial Review, 13(4). <https://doi.org/10.55493/5002.v13i4.4769>;

8. Campanella, F., Serino, L., Crisci, A. (2023). Governing fintech for sustainable development: Evidence from the Italian banking system. Qualitative Research in Financial Markets, 15(4). <https://doi.org/10.1108/QRFM-01-2022-0009>;

9. Carranza, R., Díaz, E., Sánchez‐Camacho, C., Martín‐Consuegra, D. (2021). E-banking adoption: An opportunity for customer value co-creation. Frontiers in Psychology, 11. <https://doi.org/10.3389/fpsyg.2020.621248>;

10. Ceyla, P., al. (April 2020). Digital financial services. The World Bank Group. <https://www.worldbank.org/en/topic/financialsector/publication/digital-financial-services>;

11. DiCaprio, A., Bischof, D., Edwards, S., Facter, S., Goulandris, A., Meynell, D., Vrontamitis, M. (2020). Digital rapid response measures taken by banks under COVID-19. International Chamber of Commerce. <https://iccmex.mx/comision/posturas-herramientas/icc-covid-response-banks-best-digital-practice-2020pdf.pdf>;

12. Ene, E., Abba, G., Fatokun, G. (2019). The impact of electronic banking on financial inclusion in Nigeria. American Journal of Industrial and Business Management, 9. <https://doi.org/10.4236/ajibm.2019.96092>;

13. Hammoud, J., Bizri, R., El Baba, I. (2018). The impact of e-banking service quality on customer satisfaction: Evidence from the Lebanese banking sector. SAGE Open, 8. <https://doi.org/10.1177/2158244018790633>;

14. Hussein, R., Miaraj, H. (2004). Electronic banking as an approach to modernizing Algerian banks. Proceedings of the National Symposium on the Algerian Banking System and Economic Transformations – Realities and Challenges. University of Chlef, Algeria. (In Arabic);

15. Imran, A., Jaail, D. (2020). Modern financial technologies and their effects on banks and financial institutions. Al-Aseel Journal of Economic and Administrative Research. <https://www.asjp.cerist.dz/en/downArticle/462/4/1/118777>. (In Arabic).

16. Indrasari, A., Nadjmie, N., Endri, E. (2022). Determinants of satisfaction and loyalty of e-banking users during the COVID-19 pandemic. International Journal of Data and Network Science, 6(2). <https://doi.org/10.5267/j.ijdns.2021.12.004>;

17. Lapina, E. N., Orazaliev, A. A., Kalnaya, A., Oseledko, I. V. (2021). Increasing the availability of financial services as a factor in ensuring socio-economic stability in the region. The Challenge of Sustainability in Agricultural Systems. <https://doi.org/10.1007/978-3-030-72110-7_78>;

18. Malaquias, R. F., Hwang, Y. (2019). Mobile banking use: A comparative study with Brazilian and U.S. participants. International Journal of Information Management, 44. <https://doi.org/10.1016/j.ijinfomgt.2018.10.004>;

19. Mansour, R., Tahraoui, M. (2024). Factors affecting the use of e-banking: A qualitative study. Globalization and Business, 9(17). <https://doi.org/10.35945/gb.2024.17.006>;

20. McKinsey & Company. (2020). The COVID-19 recovery will be digital: A plan for the first 90 days. McKinsey Digital. <https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-covid-19-recovery-will-be-digital-a-plan-for-the-first-90-days>;

21. Nourine, B., Kandouz, A. (2007). Electronic banking in banking institutions as an approach to building the digital economy in Algeria. Afak Journal, 04. (In Arabic);

22. O’Reilly, M. (2020). Deloitte insights. <https://www2.deloitte.com/us/en/insights/economy/covid-19/banking-and-capital-markets-impact-covid-19.html>;

23. Razmat, K., Munad, S. (2022). The importance of electronic payment methods in the time of Corona. Journal of Ijtihad for Legal and Economic Studies;

24. Rehabi, S., Trad Khoja, H. (2021). The impact of providing electronic banking services during crises on increasing the competitiveness of banks: The case of the COVID-19 pandemic. Al-Asil Journal of Economic and Administrative Research;

25. Report, W. B. (2015). Aspects of payment by the Committee on Payments and Market Infrastructures;

26. Tala, L. (2020). Electronic administration and modernization of public service: A strategic technological choice for administrative reform. Al-Asil Journal of Economic and Administrative Research. <https://www.asjp.cerist.dz/en/downArticle/462/4/2/140040>. (In Arabic);

27. Vilhena, S., Navas, R. (2023). The impact of COVID-19 on digital banking. Journal of Entrepreneurial Researchers, 1(1). <https://doi.org/10.29073/jer.v1i1.11>;

28. Vruti, C. (2021). Effectiveness of e-banking during the COVID-19 pandemic. International Journal of Advanced Research in Computer and Communication Engineering, 10(10). <https://doi.org/10.17148/IJARCCE.2021.101001>;

29. Yi, L., Thomas, H. (2007). A review of research on the environmental impact of e-business and ICT. Environment International, 33(6). <https://doi.org/10.1016/j.envint.2007.03.015>;

30. Zhang, T. L., Kizildag, M. (2018). Banking “on-the-go”: Examining customer’s adoption of mobile banking services. International Journal of Quality and Service Sciences, 10, 279–295. <https://doi.org/10.1108/ijqss-07-2017-0067>.

[1] Yi, L., & Thomas, H. (2007). A review of research on the environmental impact of e-business and ICT. Environment International, 33(6), 842. <https://doi.org/10.1016/j.envint.2007.03.015>.

[2] Malaquias, R. F., Hwang, Y. (2019). Mobile banking use: A comparative study with Brazilian and U.S. participants. International Journal of Information Management, 44, 134. <https://doi.org/10.1016/j.ijinfomgt.2018.10.004>.

[3] Allada, V., Dubey, R., Agarwal, S. (2014). Exploring antecedents of online banking customers and empirical validation. International Journal Productivity and Quality Management, 14, 475. <https://doi.org/10.1504/IJPQM.2014.065559>.

[4] Indrasari, A., Nadjmie, N., & Endri, E, Op. cit., 498.

[5] Zhang, T. L., Kizildag, M. (2018). Banking “on-the-go”: Examining customer’s adoption of mobile banking services. Int.J. Qual. Serv. Sci, 10, 283. <https://doi.org/10.1108/ijqss-07-2017-0067>.

[6] Hammoud, J., Bizri, R., El Baba, I. (2018). The Impact of E-Banking Service Quality on Customer Satisfaction: Evidence from the Lebanese Banking Sector. SAGE Open, 8, 54. <https://doi.org/10.1177/2158244018790633>.

[7] Rehabi, S., Trad Khoja, H. (2021). The impact of providing electronic banking services during crises on increasing the competitiveness of banks - The case of the COVID-19 pandemic. Al-Asil Journal of Economic and Administrative Research, 270.

[8] Ceyla, P., & al. (April 2020). Digital financial services. The World Bank Group. <https://www.worldbank.org/en/topic/financialsector/publication/digital-financial-services> [Last Access 30.09.2024].

[9] Almansour, B., Elkrghli, S. (2023). Factors Influencing Customer Satisfaction on E-Banking Services: A study of Libyan banks. International Journal on Technology, Innovation, and Management (IJTIM) 3(1), 37. <https://doi.org/10.54489/ijtim.v3i1.211>.

[10] Bellahcene, M., Latreche, H. (2023). E-Banking Adoption by Algerian Bank Customers: Towards an Integrated Model. International Journal of E-Services and Mobile Applications, 15 (1), 5. <10.4018/IJESMA.317943>.

[11] Vilhena, S., Navas, R. (2023). The impact of COVID-19 on digital banking. Journal of entrepreneurial researchers, 1 (1), 24. <https://doi.org/10.29073/jer.v1i1.11>.

[12] Bank, W. (2022). COVID-19 Drives Global Surge in Use of Digital Payments. <https://www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge-in-use-of-digital-payments>. [Last Access 30.09.2024].

[13] Vruti, C. (2021). Effectiveness of E-banking during the COVID-19 Pandemic. International Journal of Advanced Research in Computer and Communication Engineering, 10(10), 3. <10.17148/IJARCCE.2021.101001>.

[14] DiCaprio, A., Bischof, D., Edwards, S., Facter, S., Goulandris, A., Meynell, D., Vrontamitis, M. (2020). Digital rapid response measures taken by banks under COVID-19. International Chamber Of Commerce, 6. <https://iccmex.mx/comision/posturas-herramientas/icc-covid-response-banks-best-digital-practice-2020pdf.pdf> [Last Access 30.09.2024].

[15] Arner, D. W., Barberis, J., Walker, J., Buckley, R. P., Dahdal, A., Zetzsche, D. A. (2020). Digital finance & The COVID-19 crisis. SSRN Electronic Journal. <https://doi.org/10.2139/ssrn.3558889>.

[16] Imran, A., Jaail, D. (2020). Modern Financial Technologies and Their Effects on Banks and Financial Institutions. Al-Aseel Journal of Economic and Administrative Research, 117. <https://www.asjp.cerist.dz/en/downArticle/462/4/1/118777>. (in Arabic). [Last Access 30.09.2024].

[17] McKinsey & Company. (2020). The COVID-19 recovery will be digital: A plan for the first 90 days. Retrieved from McKinsey Digital <https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-covid-19-recovery-will-be-digital-a-plan-for-the-first-90-days> [Last Access 30.09.2024].

[18] Razmat, K., Munad, S. (2022). The Importance of Electronic Payment Methods in the Time of Corona. Journal of Ijtihad for Legal and Economic Studies, 650.

[19] Mansour, R., Tahraoui, M, Op.cit., 80.

[20] Vilhena, S., Navas, R., Op.cit., 26.

[21] Indrasari, A., Nadjmie, N., Endri, E. Op.cit., 500.

[22] Carranza, R., Díaz, E., Sánchez‐Camacho, C., Martín‐Consuegra, D. (2021). E-banking adoption: an opportunity for customer value co-creation. Frontiers in Psychology, 11, 3. <https://doi.org/10.3389/fpsyg.2020.621248>.

[23] O’Reilly, M. (2020). Deloitte Insights. <https://www2.deloitte.com/us/en/insights/economy/covid-19/banking-and-capital-markets-impact-covid-19.html> [Last Access 30.09.2024].

[24] Ene, E., Abba, G., Fatokun, G. (2019). The Impact of Electronic Banking on Financial Inclusion in Nigeria. American Journal of Industrial and Business Management, 9, 1411. <https://doi.org/10.4236/ajibm.2019.96092>.

[25] Campanella, F., Serino, L., Crisci, A. (2023). Governing Fintech for sustainable development: evidence from the Italian banking system. Qualitative Research in Financial Markets, 15(4), 560. <https://doi.org/10.1108/QRFM-01-2022-0009>.

[26] Bousrih, J. (2023). The impact of digitalization on the banking sector: Evidence from fintech countries. Asian Economic and Financial Review, 13(4), 271. <https://doi.org/10.55493/5002.v13i4.4769>.

[27] Hussein, R., Miaraj, H. (2004). Electronic Banking as an Approach to Modernizing Algerian Banks. Proceedings of the National Symposium on the Algerian Banking System and Economic Transformations - Realities and Challenges - University of Chlef, Algeria, 98. (In Arabic).

[28] Nourine, B., Kandouz, A. (2007). Electronic Banking in Banking Institutions as an Approach to Building the Digital Economy in Algeria. Afak Journal, 04, 21. (in Arabic).

[29] Tala, L. (2020). Electronic Administration and Modernization of Public Service: A Strategic Technological Choice for Administrative Reform. Al-Asil Journal of Economic and Administrative Research, 42. (in Arabic).

[30] Agency, A. P. (2022). Electronic payment “evolved” due to the COVID-19 pandemic in Algeria. Retrieved April O2, 2024. (in Arabic).

[31] Report, W. B. (2015). Aspects of Payment by the Committee on Payments and Market Infrastructures.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .