The Impact of Financial Inclusion on Economic Growth in Algeria

DOI:

https://doi.org/10.35945/gb.2024.18.001საკვანძო სიტყვები:

Financial Inclusion, Economic Growth, Bootstrapped coefficient estimates, Algeriaანოტაცია

This research explores the impact of financial inclusion on economic growth in Algeria during the period 2004–2021. To achieve this objective, the researcher utilized the Bootstrapped coefficient estimates method, recognized for its accuracy in analyzing relationships within economic data. The study establishes a significant and noticeable relationship between financial inclusion and economic growth, highlighting the critical role of inclusive financial services in fostering economic development. Specifically, the findings emphasize that borrowing from commercial banks and the availability of ATMs have a positive and meaningful effect on economic expansion. These elements facilitate access to credit and enhance financial accessibility, which are crucial drivers of growth. On the other hand, the study identifies a surprising negative influence of the total number of bank branches on economic growth. This could point to inefficiencies or structural challenges within the banking system that warrant further investigation. The findings underline the need for tailored financial policies.

Keywords: Financial Inclusion, Economic Growth, Bootstrapped coefficient estimates, Algeria.

Introduction

Global financial inclusion history demonstrates that achieving universal access to basic financial services has been a protracted and constantly changing process. Many organizations started to transition from providing only microcredit services to providing basic availability of financial facilities like insurance and savings starting in the late 1990s and early 2000s.[1]

Financial inclusion became one of the major issues that surfaced on the global scene following the 2008 global financial crisis, highlighting its significance. Low-income households were among those whose financial well-being was significantly impacted by the crisis. The 2009 G20 Pittsburgh Summit recommended pre-financial inclusion to widely open the doors for financial subsidy to unprivileged groups, with recommendations for the improvement of financial inclusion concluded at the 2010 G20 Toronto Summit.[2]

The pandemic of COVID-19 has demonstrated the essentiality of financial inclusion, as governments paced to offer monetary funds to unprivileged groups, providing opportunities for expanding financial inclusion amid social distancing.[3]

In light of the economic significance of financial inclusion, the paper targets exploring the influence of financial inclusion on economic growth by scrutinizing the following question: To what extent could financial inclusion affect the Algerian economic boom significantly? The research timespan co-occurred with a series of econometrics from 2004 to 2021.

The study combines the following divisions: Section 2 comprises a review of previous studies in this discipline, section three manifests the relationship between financial inclusion and economic boom, section four highlights the research methodology, and section five contains a discussion and the salient conclusions.

Literature Review

According to (Shahid Manzoor & Amjad, (2023)), Financial inclusion is a frequently debated subject among scholars, governmental officials, and financial experts.[4] International financial institutions, such as the IMF, Alliance for Financial Inclusion (AFI), and World Bank (WB), along with central banks, are actively seeking to promote financial inclusion domestically.

Financial inclusion, according to the Reserve Bank of India (RBI) definition, involves providing financially threatened and vulnerable groups with suitable access to satisfactory monetary commodities and services fairly by dominant institutional agents.[5] According to (G20, (2021)), financial inclusion implies guaranteeing individuals and businesses can access basic financial services like credit, transactions, savings, payments, and insurance that satisfy their essentials in a sustainable promoted way.[6]

In words of (Ozili, (2018)), financial inclusion is viewed as the potential of people to reach governmental financial facilities primarily by having formal bank accounts.[7] Governmental officials responsible for policies and scholars have shown noticeable concern in financial inclusion for four distinct justifications. They have shown a significant interest in Financial inclusion for four key reasons. Financial inclusion is seen as a significant approach to reaching sustainable development objectives, as it enhances social inclusion, decreases poverty, and provides various socio-economic advantages.[8]

According to (Hannig & Jansen, (2010)), financial inclusion can be assessed using various factors, such as:[9]

Access: The capability to utilize financial facilities and products provided by official institutions. Comprehending degrees of access may necessitate understanding and evaluating possible hindrances to opening and utilizing a bank account for any justification, like expenses and proximity of bank service locations (such as branches and ATMs). A simple way to measure access is by tallying open accounts at different financial institutions and evaluating the percentage of the population.

Quality: It refers to how well a financial service or product meets the client’s bases. Quality is reflected in the way clients perceive and feel about the products that are accessible to them. The quality measurement determines the level of the financial service provider’s relationship with the clients.

Usage: The emphasis is on long-lasting effects and the utilization of the product. To gauge usage, it is necessary to have information on the consistency, frequency, and length of usage throughout a period of time.

Impact: it evaluates how clients’ lives have changed due to using a financial product or service.

The Correlation Between Financial Inclusion and Economic Development

These perspectives are evident in the results of the current studies. For example, it was demonstrated (Bayar & Gavriletea, (2018)) that economic boost is boosted by financial inclusion due to improved availability to monetary agencies and markets.[10] This implies that financial inclusion will provide individuals with increased opportunities to access commodities, services, and privacies provided by official financial agencies and in monetary markets. Individuals have the opportunity to utilize these financial commodities to either establish financial work or participate in economic endeavors that support economic development.[11] (Hussain, Rehman, Ullah, Waheed, & Hassan, (2024)) investigated how financial inclusion is linked to economic growth using data from 21 Asian states between 2004 and 2019. Moreover, they addressed the minor samples by separating the total samples into first-world and third-world nations. Financial inclusion in Asia has a salient influence on economic growth in the future, according to their findings. Additionally, the research found that the impact of financial inclusion on economic growth is stronger in first-world nations as opposed to third-world nations. In addition, these results offer valuable policy ideas for policymakers to create significant and inclusive financial policies to consolidate sustainable economic boom fairly.[12] In the same vein, (Chuka, et al., (2022)) analyzed how financial inclusion determines the economic growth of Sub-Saharan African states from 2012 to 2018 through Panel data. This study employed the Generalized Method of Moments (GMM). By utilizing a combination index of financial inclusion along with specific financial inclusion measures, it was found that the accessibility aspect, reach aspect, and overall access to financial services have a noteworthy effect on economic prosperity, whereas the utilization aspect of access to financial services enhances economic boom but not noticeably. Furthermore, the presence of bank branches and ATMs has a notable effect on economic advancement. Deposit accounts and loans contribute to economic growth, but their impact is not as substantial. On the other hand, high levels of eminent deposits harm economic development. Furthermore, research on moveable money indexes between 2012 and 2018 demonstrated that the presence of mobile money agents inhibits economic growth, whereas the existence of moveable money accounts and transactions adds to economic growth, albeit not noticeably. That is, it is salient to implement financial education policies in Africa to assist Africans have a better grasp of the advantages of using banking services.[13] (christopher & Eunice , (2024)) aims to explore how financial inclusion influences the enlarging of the economy in sub-Saharan Africa. The research was conducted in 47 African countries between 2010 and 2020. The research revealed a significant connection between financial inclusion and economic prosperity.[14] (Biswas, (2023)) investigated to what extent financial inclusion contributes to an economic boom in (4) South Asian states by focusing on its positive impact on human capital. Utilizing panel data and various indicators of financial inclusion to uncover the link between increased access to financial services leading to growth in the economy. The research shows that financial inclusion has a beneficial effect on the economic boom in these nations, indicating that it aids in the development of a state’s monetary infrastructure, ultimately boosting economic concerns and generating job opportunities.[15]

(Siddiki & Bala-Keffi, (2024)) Retackles the connection between economic boom and financial inclusion by analyzing information obtained from 153 states. Their examination shows that the connection displays positive but fluctuating impacts at different levels of financial development. Therefore, there is a consistent connection between economic growth and financial inclusion, although the strength and effects of this link differ across countries with varying levels of financial improvement, underscoring the need to customize financial inclusion strategies in light of the particular stage of the monetary industry’s development.[16]

(Van Dinh & Linh , (2019)) Assesses the consequences of indicators of financial inclusion on economic boost. The finding manifests that relationships are found between the many bank branches, ATMs, domestic credit in the private sector, and the aggregated rate of prosperity at the economic level. Citizens will attain a luxurious lifestyle resulting from this improvement.[17]

Data & Methodology

This part presents the data, approach, and methodology employed to evaluate the link between financial access to services and economic boost in Algeria.

Data, Source, and Description

The paper exploits per annum information for Algeria Country from 2004 to 2021. The choice of the state and sample time range depended upon the access to data on financial inclusion. The study variables are financial inclusion- the independent variable- which can be evaluated by a group of indexes, the sum of (ATMs) amounts to 100,000 for every grown-up adult employed to assess account ownership among individuals or businesses in formal financial institutions, sum of branches of bank which equals 100,000 for adults (NBB) has been used as an alternative indicator to signify to spread of financial institutions, borrowers from commercial banks per 1,000 adults (BOR) have been used as an alternative indicator for credit. The dependent variable is (GDP) assimilating the economic boom.

All data were gathered by the World Bank. Depending on recent literature on financial inclusion (Morgan & Pontines, (2014)),[18] (Park & Mercado, Jr, (2015)),[19] (Sarma, (2008)).[20]

Model

A Bootstrap model was utilized to elucidate the connection between economic boom and access to financial services in Algeria.

〖LNGDP〗_t= α_0+α_1 〖LNATM〗_(t-1)+α_2 〖LNNBB〗_(t-1)+α_3 〖LNBOR〗_(t-1)+ε_t

LNGDP is the dependent variable representing the logarithm of gross domestic product. LNATM, LNNBB, and LNBOR denote the logarithmic forms of the quantities of automated teller machines, bank branches, and loaners from capital banks. serves as the intercept while are parameters for estimation, representing the error term. In conclusion, stands for temporal relations.

Data Analysis

It is significant to elucidate thoroughly the fixedness of the variables before estimating the model to validate correct application. For the end of this goal, unit root measures such as the Augmented Dickey-Fuller (1981) and Phillips-Perron (PP) test (1988) were utilized.

Table 1. The result of the unit root measure

|

|

At the level |

At first difference |

||

|

Variables |

ADF |

PP |

ADF |

PP |

|

LNGDP |

-2.283243 (0.4198) |

-2.254232 (0.4336) |

-4.408726 (0.0157) |

-6.961824 (0.0002) |

|

LNATM |

-5.044651 (0.0010) |

-12.50823 (0.0000) |

-2.483070 (0.1384) |

-1.668647 (0.4271) |

|

LNNBB |

-4.736690 (0.0028) |

-6.844436 (0.0000) |

-3.168009 (0.0428) |

-3.390251 (0.0274) |

|

LNBOR |

-1.086911 (0.6955) |

-1.086911 (0.6955) |

-4.485694 (0.0034) |

-4.459014 (0.0036) |

Source: Eviews 13 program outputs.

The findings of the ADF test and PP test (Table 1) indicate that all the variables fixedness at the first difference I (1). Except for two variables (LNATM, LNNBB), their stationarity was confirmed at the level I (0).

Model Estimation

Table 2. Model Estimation Results

Dependent variable: LNGDP

strategy: Least Squares

Sample: 2004/2021

Included reviews: 18

Bootstrapped coefficient values and standard errors (10000 repetitions)

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob |

|

LNNBB |

-1.728851 |

3.676974 |

-0.470183 |

0.6455 |

|

LNBOR |

0.615002 |

0.270753 |

2.271453 |

0.0394 |

|

LNATM |

0.457639 |

0.200055 |

2.287565 |

0.0382 |

|

C |

30.08081 |

5.680555 |

5.295400 |

0.0001 |

|

R-squared |

0.929392 |

Mean dependent var |

30.25266 |

|

|

Adjusted R-squared |

0.914261 |

S.D. dependent var |

0.383215 |

|

|

S.E of regression |

0.112210 |

Akaike info criterion |

-1.343762 |

|

|

Sum squared resid |

0.176275 |

Schwarz criterion |

-1.145901 |

|

|

Log-likelihood |

16.09386 |

Hannan-Quinn criteria |

-1.316480 |

|

|

F-statistic |

61.42566 |

Durbin-Watson stat |

1.658549 |

|

|

Prob (F-statistic) |

0.00000 |

|

|

|

Source: Eviews 13 program outputs.

- The totality of branches of the bank is 100,000 per adult, which has a negative impact of -1.728851 on GDP, but this impact is not noticeably significant at a 5% level. This implies an inverse link between the total sum of branches of the bank and GDP, where an accretion in bank divisions brings a decrease in GDP. This outcome does not align with the earlier study (Wibowo, Mardani, & Iqbal, (2023)) that identified a direct correlation between the number of bank branches and economic advancement.[21]

- A significant (0.615002) effect of the people who borrow from commercial banks was proven to be 1,000 per adult (BRO) on GDP, and this effect is significant at a 5% level, which means there is a direct relationship between the people who borrow from business banks and GDP. In other words, the more increase in the percentage of the borrowers from commercial banks, the greater the degree of GDP. This finding is consistent with previous work (Arab & Allai, (2023)).[22]

- There is a positive effect (457639) of ATMs per 100,000 adults on GDP, and this effect is significant at 5%, that is, there is an immediate link between ATMs and GDP, which is consistent with economic theory.That is, as long as the total sum of ATMs increases, the GDP will increase in turn. This finding is consistent with previous work (Van Dinh & Linh , (2019)).[23]

In conclusion, the R-squared coefficient measures 0.929392. This percentage indicates how well the model explains the changes in (GDP) by examining the impact of independent variables and their contribution to understanding these changes. In simpler terms, the model’s variables account for 92.93% of the changes observed, with the remaining 7% attributed to variables not part of the model.

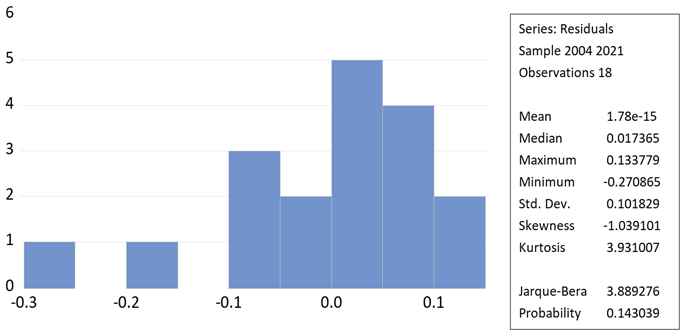

The Jarque-Bera test is utilized to assess if the residuals adhere to a normal distribution. The outcomes of this test are displayed in the following diagram:

Figure 1. Result of Jarque-Bera test

Source: Eviews 13 program outputs.

From Fig.1, it is noted that the rest of the parts of the graph take a normal standard of differentiation since the Jarque-Bera value is 3.88, which is smaller than the tabulated Chi-square value of 5.99. Additionally, the p-value is 0.143. It is larger than 5%.

Serial Correlation Test: The Breusch-Godfrey Serial Correlation LM Test is utilized to examine the values of autocorrelation. The test value (Obs*R-squared) is 0.297623 and has a p-value of 0.8617, exceeding 5% (P-value = 0.8617 > 0.05). This shows agreement with the null hypothesis, which posits that there is no autocorrelation in the residuals of the estimated model. The Following Table 3.

Table 3. Breusch-Godfrey LM test for autocorrelation

Breusch-Godfrey Correlation LM Test

Null hypothesis: No serial correlation at up to 2 lags

|

F-statistic |

0.100876 |

Prob. F (2,12) |

0.9048 |

|

Obs*R- Squared |

0.297623 |

Prob. Chi-Square (2) |

0.8617 |

Source: Eviews 13 program outputs.

Test of Heteroscedasticity: There are several tests to determine heteroskedasticity in time series econometric, namely the Breusch-Pagan Godfrey.

The result of Table 4 showed that the test value was (Obs*R-squared = 0.919528) with a probability greater than 5% (P-value = 0.8207> 0.05). Such findings consolidated the truth of the null hypothesis and highlighted that the variation of the error evaluations is similar.

Table 4. Test of Heteroskedasticity

Heteroskedasticity Test Breusch-Pagan-Godfrey

Null hypothesis: Homoskedasticity

|

F-statistic |

0.251230 |

Probability. F (3,14) |

0.8591 |

|

Obs*R-squared |

0.919528 |

Probability. Chi-square (3) |

0.8207 |

|

Scaled explained SS |

0.815198 |

Prob. Chi-square (3) |

0.8458 |

Source: Eviews 13 program outputs.

Conclusion

This work highlighted the ties between increased access to financial services leading to growth in the economy in Algeria. Hence, the paper concluded the following:

- There is an inverse link between the total sum of branches of banks and economic boom, indicating a negative deviation. According to Cameron, this means that the level of bank proliferation is insufficient, in addition to the low-scaled access of banking facilities to all social sectors.

- A noticeable relationship between ATMs and the economic boom in Algeria was concluded. This means that ATMs increase in number results in easy reach of the citizens to governmental financial sources. Thus, recognition of financial facilities will be aggregated, making people more knowledgeable about the different financial products offered.

- There is a significant link between borrowers from commercial banks and economic growth. This result can be interpreted as a large segment of individuals using formal borrowing channels.

Recommendations:

- Banking institutions must adopt savings products for marginalized and poor segments of society.

- The state must open opportunities for the youth, they represent a large percentage of the Algerian society because they suffer from obstacles such as not benefiting from financial facilities.

- The government should work on decreasing the differences between the higher and lower classes- from a financial point of view- by expanding social protection programs, supporting marginalized groups, and meeting their needs for goods and necessities for daily life.

Bibliography:

1. Arab, F., & Allai, F. (2023). Measuring the impact of financial inclusion and digital financial services on the level of economic activity in Algeria in light of the Corona pandemic. Journal of Economic Growth and Entrepreneurship (JEGE), 6(4);

2. Bayar, Y., Gavriletea, M. (2018, June). Financial inclusion and economic growth: Evidence from transition economies of the European Union. Journal of International Finance and Economics, 18(2). <https://doi.org/10.18374/JIFE-18-2.9>;

3. Biswas, G. (2023, July). Financial inclusion and its impact on economic growth: Empirical evidence from South Asian countries. European Journal of Business and Management Research, 8(4). <https://doi.org/10.24018/ejbmr.2023.8.4.20>;

4. Christopher, B., Eunice, A.-D. (2024). The effect of financial inclusion on economic growth: The role of human capital development. Cogent Social Sciences, 10(1). <https://doi.org/10.1080/23311886.2024.2346118>;

5. Chuka, I., Kenechukwu, O., Eze, F., Samuel, M., Anthony, E., Godwin, I., & Onwumere, J. (2022, April 16). Financial inclusion and its impact on economic growth: Empirical evidence from sub-Saharan Africa. Cogent Economics & Finance, 1-28. <https://doi.org/10.1080/23322039.2022.2060551>;

6. (2021). The impact of COVID-19 on digital financial inclusion;

7. Hannig, A., Jansen, S. (2010, December). Financial inclusion and financial stability: Current policy issues. ADBI Working Paper Series (No. 259);

8. Hussain, S., Rehman, A., Ullah, S., Waheed, A., Hassan, S. (2024). Financial inclusion and economic growth: Comparative panel evidence from developed and developing Asian countries. SAGE Open, 14(1). <https://doi.org/10.1177/21582440241232585>;

9. Morgan, P., Pontines, V. (2014, July). Financial stability and financial inclusion. ADBI Working Paper Series (No. 488);

10. National Financial Educators Council. (2024, March 26). <https://www.financialeducatorscouncil.org/history-of-financial-inclusion/> [Last Access 25.07.2024];

11. Ozili, P. (2018, March 17). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340. <https://doi.org/10.1016/j.bir.2017.12.003>;

12. Ozili, P. K. (2020, July). Financial inclusion research around the world: A review. Forum for Social Economics, 1-23. <https://doi.org/10.1080/07360932.2020.1715238>;

13. Pant Josh, D. (2011, June 28). Financial inclusion & financial literacy. BI OECD seminar roundtable on the updates on financial education and inclusion programmes in India. <https://www.oecd.org/finance/financial-education/48303408.pdf> [Last Access 26.07.2024];

14. Park, C.-Y., Mercado, R., Jr. (2015, January). Financial inclusion, poverty, and income inequality in developing Asia. ADB Economics Working Paper (No. 426);

15. Sahay, R., Allmen, U., Lahreche, A., Purva, K., Ogawa, S., Bazarbash, M., Beaton, K. (2020). The promise of fintech: Financial inclusion in the post-COVID-19 era. International Monetary Fund (No. 20/09);

16. Sarma, M. (2008, June). Index of financial inclusion. Working Paper (No. 215);

17. Shahid Manzoor, S., Amjad, A. (2023, January). Macro dimensions of financial inclusion index and its status in developing countries. MPRA Paper, No. 118036. <Retrieved from https://mpra.ub.uni-muenchen.de/118036/> [Last Access 28.07.2024];

18. Siddiki, J., Bala-Keffi, L. (2024, March). Revisiting the relation between financial inclusion and economic growth: A global analysis using panel threshold regression. Economic Modelling. <https://doi.org/10.1016/j.econmod.2024.106707>;

19. Van Dinh, T., Linh, N. (2019). The impacts of financial inclusion on economic development: Cases in Asian-Pacific countries. Comparative Economic Research, 22(1);

20. Wibowo, D., Mardani, Y., Iqbal, M. (2023). Impact of financial inclusion on economic growth and unemployment: Evidence from Southeast Asian countries. International Journal of Finance & Banking Studies, 12(2);

Footnotes

[1] National Financial Educators Council. (2024). <https://www.financialeducatorscouncil.org/history-of-financial-inclusion/> [Last Access 25.07.2024].

[2] Wibowo, D., Mardani, Y., Iqbal, M. (2023). Impact of financial inclusion on economic growth and unemployment: Evidence from Southeast Asian countries. International Journal of Finance & Banking Studies, 12(2), pp. 55-66.

[3] Sahay, R., Allmen, U., Lahreche, A., Purva, K., Ogawa, S., Bazarbash, M., Beaton, K. (2020). The promise of fintech: Financial inclusion in the post-COVID-19 era. International Monetary Fund (No. 20/09).

[4] Shahid Manzoor, S., Amjad, A. (2023). Macro dimensions of financial inclusion index and its status in Developing Countries. MPRA Paper. No. 118036. pp. 1-20. <https://mpra.ub.uni-muenchen.de/118036/> [Last Access 25.07.2024].

[5] Pant, J. D. (2011). Financial inclusion & financial literacy. BI OECD Seminar-Roundtable on the Updates on Financial Education and Inclusion Programmes in India. <https://www.oecd.org/finance/financial-education/48303408.pdf> [Last Access 26.07.2024].

[6] G20. (2021). The impact of COVID-19 on digital financial inclusion.

[7] Ozili, P. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), pp. 329-340. <https://doi.org/10.1016/j.bir.2017.12.003>.

[8]Ozili, P. K. (2020). Financial inclusion research around the world: A review. Forum for Social Economics. pp. 1-23. <https://doi.org/10.1080/07360932.2020.1715238>.

[9] Hannig, A., Jansen, S. (2010). Financial inclusion and financial stability: current policy issues. ADBI Working paper series (No. 259).

[10] Bayar, Y., Gavriletea, M. (2018). Financial inclusion and economic growth: evidence from transition economies of European Union. Journal of International Finance and Economics. 18(2). <https://doi.org/10.18374/JIFE-18-2.9>.

[11] Ozili, P., Ademiju, A., Rachid, S. (2023). Impact of financial inclusion on economic growth: review of existing literature and directions for future research. Munich Personal RePEc Archive (MPRA) (No. 118788). <https://mpra.ub.uni-muenchen.de/118788/> [Last Access 28.07.2024].

[12] Hussain, S., Rehman, A., Ullah, S., Waheed, A., Hassan, S. (2024). Financial Inclusion and Economic Growth: Comparative Panel Evidence from Developed and Developing Asian Countries. SAGE Open. 14 (1), pp. 1-15. <https://doi.org/10.1177/21582440241232585>.

[13] Chuka, I., Kenechukwu, O., Eze, F., Samuel, M., Anthony , E., Godwin, I., Onwumere, J. (2022). Financial inclusion and its impact on economic growth: Empirical evidence from sub-Saharan Africa. Cogent Economics & Finance. pp. 1-28. <https://doi.org/10.1080/23322039.2022.2060551>.

[14] Christopher, B., Eunice, A.-D. (2024). The effect of financial inclusion on economic growth: the role of human capital development. Cogent Social Sciences. 10 (1). <https://doi.org/10.1080/23311886.2024.2346118>.

[15] Biswas, G. (2023). Financial Inclusion and Its Impact on Economic Growth: An Empirical Evidence from South Asian Countries. European Journal of Business and Management Research. 8 (4). <http://dx.doi.org/10.24018/ejbmr.2023.8.4.20>.

[16] Siddiki, J., Bala-Keffi, L. (2024). Revisiting the relation between financial inclusion and economic growth: a global analysis using panel threshold regression. Economic Modelling. <https://doi.org/10.1016/j.econmod.2024.106707>.

[17] Van Dinh, T., Linh, N. (2019). The impacts of financial inclusion on economic development cases in Asian-Pacific Countries. Comparative Economic Research. 22 (1), pp. 7-16.

[18] Morgen, P., Pontines, V. (2014). Financial stability and financial inclusion. ADBI Working Paper Series (No. 488).

[19] Park, C.-Y., Mercado, Jr, R. (2015). Financial inclusion, poverty, and income inequality in Developing Asia. ADB Economics Working Paper (No. 426).

[20] Sarma, M. (2008). Index of financial inclusion. Working Paper (No. 215).

[21] Wibowo, D., Mardani, Y., & Iqbal, M. (2023). Impact of financial inclusion on economic growth and unemployment: Evidence from Southeast Asian countries. International Journal of Finance & Banking Studies, 12(2), 55-66.

[22] Arab, F., & Allai, F. (2023). Measuring The Impact of Financial Inclusion And Digital Financial Srvices on The Level of Economic Activity in Algeria In Light of the Corona Pandemic. Journal of Economic Growth and Entrepreneurship JEGE. 6 (4).

[23] Van Dinh , T., & Linh , N. (2019). The impacts of financial inclusion on economic development cases in Asian-Pacific Countries. Comparative Economic Research. 22 (1), 7-16.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

საავტორო უფლებები (c) 2024 Hafsa Dib (Author)

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .