Factors affecting the use of e-banking services among customers of Algerian banks: A qualitative study

DOI:

https://doi.org/10.35945/gb.2024.17.006საკვანძო სიტყვები:

e-Babking use, Algeria, TAM, eWOMანოტაცია

This study aims to identify the factors influencing the use of e-banking services among clients of Algerian banks. To this end, a theoretical model was proposed based on the technology acceptance model (TAM) and the concept of electronic word of mouth (eWOM). To validate the variables of the proposed model in the Algerian context, we conducted a qualitative study using semi-structured interviews, which were carried out with 17 clients from various cities across Algeria, including those in the east, west, north, and south of the country. The data collected were subjected to thematic content analysis using a constructivist research approach. The results revealed significant effects of perceived usefulness, perceived ease of use, perceived trust, and electronic word-of-mouth (eWOM) on the use of e-banking services among clients of Algerian banks. The results also uncovered other variables that are expected to have a significant effect on e-banking use in Algeria, namely perceived costs and perceived service quality.

Keywords: e-Babking use, Algeria, TAM, eWOM

1. Introduction:

The use of technology in modern banking services, known as e-banking systems, enhances banking performance, impacts productivity, and reinforces the intention to use these technologies in the digital age (Fatonah et al., 2018, p. 13) [1]. Designated by other terms, such as internet banking, electronic banking, tele-banking, mobile banking, etc. (Hasan et al., 2010, p. 3) [2]. The evolution of e-banking has put an end to endless queues in front of different bank counters, as the internet now allows for multiple banking transactions from anywhere and at any time (Ataya & Ali, 2019, p. 6) [3]. Moreover, in developed countries, many financial transactions are conducted through electronic money (Anouze & Alamro, 2020, p. 11) [4]. Like other developing countries, the Algerian banking sector has made colossal efforts over the past two decades (Bellahcen & Latrech, 2020, p. 6) [5]. These efforts have yielded results since 2023 with the circulation of 10.712.133 interbank cards, of which 70% were active, and the establishment of 3.030 ATMs and 38.144 POS machines for merchants (GIE-Monétique, 2023) [6]. Despite the progress made by the banking sector to keep up with the rapid pace of innovation and ICT worldwide, the use of e-banking in Algeria is still in its early stages compared to the density of the national economic fabric (Bellahcene & Mehdi KHEDIM, 2016, p. 4) [7]. This has been proven by the numbers provided by the Economic Interest Group, where only 2.204.836.081,42 DZD of transactions per bank card were carried out in 2023. This is a very small number considering a population of 44.6 million inhabitants and a GDP per capita of around 2,568 dollars in 2023, according to the IMF (2023).

In contrast to this situation, it would be crucial to investigate with clients of Algerian banks the factors likely to influence their use of electronic banking services, namely, Algeria has made a remarkable leap in the development of electronic banking systems during the past two decades. A wide range of research studies worldwide have been interested in this subject, aiming to demonstrate the effect of different determinants influencing clients’ use of e-banking.

Previous research concerning the adoption of e-banking has utilized prominent innovation adoption theories, such as the technology acceptance model (TAM) (Salloum & Al-Emran, 2018) [8], with its two pivotal variables. We note that perceived ease of use was identified as a key factor in the study by Sarkam et al., (2021), p. 6 [9], and perceived usefulness in the study by Kurnia et al., (2010). p. 11 [10]. Likewise, in Algeria, the studies by (Bellahcen & Latrech, 2020, p. 9) [11] confirmed the effect of perceived ease of use and perceived usefulness on the adoption of e-banking, as well as the Theory of Planned Behavior (TPB) (Hanafizadeh et al., 2014, p. 2) [12] in which behavioural intention is a significant determinant of the use of information systems. While their findings identify various factors responsible for the limited adoption of e-banking, a consensus has yet to be reached on the specific variables that influence e-banking adoption, and results vary depending on the location, context, and timeframe (Bellahcene & Latreche, 2023, p. 6) [13]. Moreover, the issue has not been extensively explored in the broader context of developing countries and, more specifically, in the case of Algeria.

Henceforth, the aim of this research is to examine the principal factors that influence the use and adoption of electronic banking services among Algerian bank customers. More precisely, this study puts forth, tests and validates an all-encompassing theoretical framework for customer adoption of e-banking by incorporating both, the Technology Acceptance Model (TAM) and the theory of planned behaviour (TPB).

The subsequent sections of this paper are organized as follows: Section two provides a literature review. Section three puts forward the conceptual framework. Section four elucidates the research methodology employed in this study. Section five presents the findings. Lastly, section six concludes the work and suggests avenues for future research.

2. Literature review:

Electronic banking services have been defined by (Daniel, 1999, p. 4) [14], as providing banking services to customers via the Internet. The same researcher has defined them as an information service where banks provide certain banking services via the Internet (Sheikh & Rahman, 2020, p. 9) [15], describes e-banking as all banking activities that can reduce customers’ different expenses when they can access their accounts without visiting bank branches. At this stage, the researchers have directed their attention to technology adoption, drawing upon several theories, among which the most well-known is the theory of reasoned action (TRA) (Fishbein & Ajzen, 1975, p. 19) [16]. The technology acceptance model (TAM) (Davis et al., 1989, p. 7) [17]. The theory of planned behaviour (TPB) (Ajzen, 1991, p. 3) [18], and the unified theory of acceptance and use of technology (UTAUT) (Viswanath Venkatesh et al., 2003, p. 6) [19].

In recent times, there has been significant academic interest in adopting electronic banking, with many researchers, such as Roy et al., (2017), p. 9 [20], integrating the technology acceptance model. The analysis indicates that the level of acceptance of internet banking among customers is influenced by two critical factors - perceived ease of use and external risk. On their part, Gharaibeh et al., (2018), p. 11 [21] employed a mixed-method approach to the Unified Theory of Acceptance and Use of Technology (UTAUT 2) to demonstrate that the acceptance of mobile banking services is significantly and positively influenced by factors such as mass media, trust, effort expectancy, performance expectancy, facilitating conditions, and social influence. However, it was observed that there was no significant relationship between hedonic motivation and the adoption of mobile banking services in the Malaysian context. Similarly, Martins et al., (2014) [22] used the UTAUT model to understand the main determinants of internet banking adoption in the Portuguese context. The findings provide support for certain relationships posited by the UTAUT model, including performance expectancy, effort expectancy, and social influence, as well as the significance of risk as a stronger predictor of intention. Furthermore, Ahmad et al., (2020), p. 9 [23] examined the current usage of e-banking through the Technology Acceptance Model (TAM). The study’s findings demonstrate that e-service quality has a positive impact on perceived usefulness, perceived ease of use, and intention to use e-banking, while perceived usefulness has a positive effect on attitude towards using e-banking and behavioural intentions to use e-banking. Alalwan et al., (2015) [24] employed an extended TAM model by including two external variables, namely perceived risk and self-efficacy, to investigate customers of the Jordanian bank. The findings indicate that perceived usefulness, perceived ease of use, and perceived risk significantly influence behavioural intention. On the other hand, Anouze & Alamro, (2020), p. 10 [25] introduced confusion between the TAM and TPB models in testing the intention to use electronic banking services. The data analysis shows that several key factors, such as perceived ease of use, perceived usefulness, security, and reasonable pricing, emerge as barriers to the intention to use e-banking services in Jordan. To explore the intention to use m-banking, Thanh D. Nguyen et al., (2019), p. 5 [26] integrated electronic Word of Mouth (e-WOM) into the TAM model. Based on the research findings, it can be inferred that e-WOM holds a predominant position within the structural model of the intention to adopt mobile banking. On the other hand, in the United Arab Emirates, Salloum & Al-Emran, (2018), p. 8 [27], expanded the Technology Acceptance Model (TAM) by incorporating the trust factor to study the use of electronic payment services among students. The findings from the empirical study indicate that trust plays a significant role in predicting perceived usefulness, perceived ease of use, and adoption of e-payment. Moreover, perceived ease of use is a crucial factor influencing perceived usefulness and adoption of e-payment. Employing the modified Technology Acceptance Model (TAM) in an under-researched Zambian context, Mwiya et al., (2017), p. 3 [28] explored how the perceived usefulness, perceived ease of use, and trust (in terms of safety and credibility) of e-banking technology impact its adoption. The results indicate that the perceived usefulness, ease of use, and trust each have a significant positive influence on the attitude towards electronic banking. In Algeria, Mansour et al., (2022), p. 6 [29] incorporated socio-demographic factors into the TAM model to predict the factors influencing the adoption of e-banking among clients of Algerian banks. The results revealed that gender moderates the influence of perceived usefulness and perceived trust on e-banking adoption and that profession moderates the relationship between perceived ease of use and e-banking adoption.

There is a low level of internet user penetration in developing countries, as a result, many individuals prefer traditional methods (such as personal contact) for obtaining financial services when conducting business, which could account for the low adoption rate of online banking (Anouze & Alamro, 2020, p. 9) [30]. In Algeria, the use of e-banking still remains in the embryonic stage (Bellahcene & Mehdi KHEDIM, 2016, p. 4) [31].

3. Proposed model

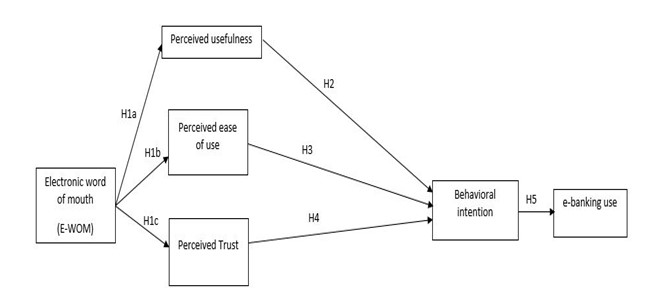

To identify the factors likely to influence the use of e-banking services among Algerian bank customers, an integrated model combining the Technology Acceptance Model (TAM) and the Theory of Planned Behavior (TPB) was constructed.

Based on previous studies, TAM, originally proposed by Davis (1986), p. 6 [32], aims to provide verification and explanation of the determinants of acceptance and use of information technologies. Over the past two decades, the Technology Acceptance Model (TAM) has been the most commonly employed framework among researchers in the field of information systems and has amassed substantial empirical evidence (Bellahcene & Latreche, 2023, p. 11) [33]. Therefore, the conceptual model proposed in this study includes all factors adopted by TAM. Then, and in addition to the TAM, our model was based on TPB.

The theory of planned behaviour (TPB) (Ajzen, 1991, p. 13) [34] represents an expansion of the Theory of Reasoned Action (TRA) developed by Lai, (2017), p. 8) [35], which was deemed necessary due to the TRA’s limitations in accounting for behaviours that are not completely under individuals’ voluntary control. In the theory of planned behaviour, similar to the original theory of reasoned action, the individual’s intention to perform a particular behaviour is a central factor (Ajzen, 1991, p. 6) [36]. Building upon this, we have augmented our proposed model by including the behavioural intention factor to predict the adoption of electronic banking services. In addition, our proposed model incorporates e-WOM and perceived trust, in addition to the TAM and TPB. Accordingly, the research model contains five main factors affecting e-banking use, figure (1).

Electronic Word-of-Mouth (e-WOM): as defined by Thanh D. Nguyen et al., (2019), p. 9 [37] represents the dynamic and continuous process of exchanging information among potential, actual, or past consumers regarding a product, service, brand, or company, which is available to a multitude of people and institutions via the internet. e-WOM is also an extraordinary tool for free communication about services or products and has become an interesting research topic for managers on social media (Nguyen et al., 2019, p. 11) [38].

This variable has been discussed in several studies, such as the study by (Augusto & Torres, 2018, p. 7) [39], which focuses on e-WOM in the banking industry context, as well as the study by(Petrović et al., 2021, p. 8) [40], which examines the influence of electronic word-of-mouth on the use of m-banking. From there, we propose the following hypotheses:

H1a: eWOM will affect the perceived usefulness of behavioural intention to use e-banking among clients of Algerian banks.

H1b: eWOM will affect the perceived ease of use of the behavioural intention to use e-banking among Algerian banks’ clients.

H1c: eWOM will affect the perceived trust in the behavioural intention to use e-banking among Algerian banks’ clients.

As previously stated, the original TAM is based on two main variables:

Perceived usefulness: Defined by (Davis, 1989, p. 4) [41] as a measure in which a person believes that the use of a technology should increase work performance. This arises from the definition of the term “useful”: “capable of being used advantageously”. (Farrell & Petersen, 1982, p. 8) [42]. The IS community has also conducted extensive research providing evidence of the significant impact of perceived usefulness on usage intention (Mansour et al., 2022, p. 4) [43]. Thus, we have tested the following hypothesis:

H2: Perceived usefulness will have a positive effect on the behavioural intention to use e-banking among clients of Algerian banks.

Perceived ease of use: Defined as the measure in which a person believes technology can be used without significant effort (Viswanath Venkatesh et al., 2003, p. 9) [44]. Previous research on the adoption of e-banking has established that consumers’ attitudes towards e-banking adoption are significantly influenced by their perception of ease of use (Sarkam et al., 2021, p. 8) [45]. Consequently, we propose the following hypothesis:

H3: Perceived ease of use will have a positive effect on the behavioural intention to use e-banking among clients of Algerian banks.

According to the TAM, these two variables determine the intention to use, which determines the behaviour of using technology. Over the past two decades, numerous studies have tested the TAM, demonstrating the positive influence of perceived usefulness and perceived ease of use on the adoption of information technologies in general and e-banking in particular (Bellahcene & Latreche, 2023, p. 11) [46].

The research model introduced a third independent variable: perceived trust. Gefen et al., (2003), p. 2 [47] defined trust as the affection reflecting a sense of security towards another party. Doney & Cannon, (1997), p. 6 [48] suggested that perceived trust is a complex concept in marketing and social psychology. Moreover, several studies using the TAM have emphasized the importance of the trust concept in using ICT. Therefore, the fourth hypothesis of this model was formulated as follows:

H4: Perceived trust will have a positive effect on the behavioral intention to use mobile banking among clients of Algerian banks.

Behavioural intention: The Theory of Planned Behavior (TPB), posit that adoption behaviour is driven by behavioural intentions which are a function of an individual’s attitude and the influence of external factors (Hanafizadeh et al., 2014, p. 8) [49]. Behavioural intention measures the strength of one’s willingness to exert effort while performing certain behaviours (Lee, 2009) [50]. TAM suggests that two specific beliefs perceived ease of use and perceived usefulness, determine one’s behavioural intention to use a technology, which has been linked to subsequent behaviour (Viswanath Venkatesh, 2000, p. 6) [51].

H5: Behavioral intention positively influences the use of e-banking among clients of Algerian banks.

Figure (1): The proposed model

Source: (Viswanath Venkatesh & Davis, 1996, p. 7)

4. Research Methodology:

According to relativists, people who belong to different social classes and ethnic groups experience the same reality differently. This is why we chose a constructivist research approach that acknowledges a subjective epistemology and relativist ontology.

To validate the proposed variables in the Algerian context and identify any potential new variables, an exploratory qualitative survey was conducted with bank customers, randomly selected from several cities across Algeria, namely the provinces of Tlemcen, Ain-Temouchent, Sidi-Bel-Abbès, Oran, Algiers, El-Bayad, M’sila, and Khenchla.

The construction of the Interview Guide, also known as a grid or framework, the interview guide represents “the inventory of themes to be addressed during the interview and data that, at some point in the exchange, will be the subject of intervention by the investigator if the interviewee does not address them spontaneously (Marie et al., 2016, p. 13) [52].

An interview guide was developed based on previous research on “The use of electronic banking services”. During this process, measurement tools - including the reliability of coding used in previous studies - were used to evaluate the proposed conceptual model.

To avoid biased information that may result from a misunderstanding of the questions by respondents, the interview guide was tested on a small sample of two (2) respondents who were interviewed face-to-face. This allowed us to modify our question framework appropriately, avoid poorly worded questions, and address them accordingly. It should also be noted that the appellations of some constructs adopted in our model were modified in our interview guide, using synonyms to facilitate perception by the interviewees.

5. Data Analysis Technique:

To address the research question, the collected data was subjected to the following techniques:

- Descriptive analysis using Nvivo 10 to highlight the characteristics of the sample;

- Thematic content analysis, also on Nvivo 10, involves frequency coding of words to identify repetitive and similar words referencing the variables in our proposed conceptual model. Additionally, a description of coding words was used to link expressions with keywords to obtain reliable support for confirming our proposed model.

- Sample Characteristics and Description:

Initial contact with the respondents was made through various methods, such as phone, email, or Facebook, to explain the purpose of the interview the project goal, obtaining prior agreement to record the interviews, scheduling appointments, and agreeing on the location of the interview. The constructed interview guide covered seventeen (17) interviewees from all over Algeria, including the East, West, North, and South regions. The only requirement was that interviewees be users of e-banking services, regardless of the degree of their usage.

As shown in Table 02, the age of the respondents ranged from 24 to 48 years old. The majority of the respondents (6 persons) were managers in the public sector, while the rest consisted of two (4 persons) PhD students, two (2 persons) branch managers, three (3 persons) managers in insurance, one (1 person) retired and one (1 person) unemployed. With regards to their domiciliary banks, we observed that the interviewees had no preference between public banks such as BEA, CPA, BDL, BNA, BEA, CNEP, or Algérie poste, and multinational banks such as AGB, TRUST BANK, and SGA. The seventeen interviewees used at least one bank. Regarding the number of e-banking services used, we noticed that there is only one interviewee who uses a single electronic banking service, while the others use between two and five services. Regarding their city of residence, we found that four (4) respondents lived in Tlemcen, while the remaining respondents were dispersed, with only one respondent residing in each of the following cities: Ain-Temouchent, Sidi-Belabess, Oran, Alger, M’sila, El-bayadh, or Khenchla.

Table 1 : Sample Characteristics

|

Interviews |

Sex |

Age |

Professional situation |

Domiciliary banks |

e-banking services used |

Town of residence |

|

Interviewee 1 |

Male |

44 |

Manager in insurance |

BEA, TRUST BANK |

1 |

Tlemcen |

|

Interviewee 2 |

Male |

27 |

PhD Student |

AGB, Algérie Poste |

4 |

Tlemcen |

|

Interviewee 3 |

Male |

37 |

Branch Manager |

CPA |

2 |

El bayadh |

|

Interviewee 4 |

Male |

38 |

Branch Manager |

CPA, BNA, BEA |

4 |

Tlemcen |

|

Interviewee 5 |

Male |

36 |

Manager in the public sector. |

CPA, Algérie poste |

5 |

Tlemcen |

|

Interviewee 6 |

Male |

33 |

Manager in insurance |

BEA, AGB, CNEP |

3 |

Oran |

|

interviewee 7 |

Male |

48 |

Retired |

SGA, Algérie Poste |

2 |

Sidi Belabes |

|

Interviewee 8 |

Male |

36 |

Manager in insurance |

CPA, Algérie poste |

4 |

Tlemcen |

|

Interviewee 9 |

Male |

26 |

Manager in the public sector. |

CPA |

3 |

M’sila |

|

Interviewee 10 |

Male |

43 |

PhD Student |

BDL, Algérie Poste |

3 |

Khenchla |

|

Interviewee 11 |

Male |

28 |

Manager in the public sector. |

BNA, Algérie Poste |

3 |

Alger |

|

Interviewee 12 |

Male |

29 |

Manager in the public sector. |

TRUST BANK, Algéria Poste office |

5 |

Ain Temouchent |

|

Interviewee 13 |

Female |

26 |

PhD Student |

Paysera bank |

5 |

Tlemcen |

|

Interviewee 14 |

Female |

32 |

Manager in the public sector |

Trust bank |

3 |

Oran |

|

Interviewee 15 |

Female |

28 |

Manager in the public sector |

Algéria Poste office |

3 |

Alger |

|

Interviewee 16 |

Female |

24 |

Unemployed |

Algéria Poste office |

2 |

Alger |

|

Interviewee 17 |

Female |

25 |

PhD Student |

BEA |

4 |

Tlemcen |

Source: By researchers based on Nvivo10 outputs

However, we observed an average interview duration of thirty-eight (38) minutes, conducted in various locations and recorded by several means and in different modes, either face-to-face or online, as shown in Table 2 below.

Table 2: Characteristics of the interviews

|

Interviews |

Recording equipment |

Duration of the interview |

Location of the interview |

Mode of the interview |

|

Interviewee 1 |

- Smartphone OPPO F11 - Audacity |

26,44 mins |

Tlemcen |

Face to face |

|

Interviewee 2 |

- Smartphone OPPO F11 - Audacity |

41,57 mins |

Tlemcen |

Face to face |

|

Interviewee 3 |

- Smartphone OPPO F11 - Audacity |

42,06 mins |

Tlemcen |

Online |

|

Interviewee 4 |

- Smartphone OPPO F11 - Audacity |

40 mins |

Tlemcen |

Face to face |

|

Interviewee 5 |

- Smartphone OPPO F11 - Audacity |

44,06 mins |

Tlemcen |

Face to face |

|

Interviewee 6 |

- Smartphone OPPO F11 - Audacity |

39,58 mins |

Oran |

Face to face |

|

Interviewee 7 |

- Smartphone OPPO F11 - Audacity |

31,34 mins |

Sidi Belabes |

Face to face |

|

Interviewee 8 |

- Smartphone OPPO F11 - Audacity |

33,03 mins |

Tlemcen |

Face to face |

|

Interviewee 9 |

- Smartphone OPPO F11 - Audacity |

35,11 mins |

Tlemcen |

Online |

|

Interviewee 10 |

- Smartphone OPPO F11 - Audacity |

34,10 mins |

Tlemcen |

Face to face |

|

Interviewee 11 |

- Smartphone OPPO F11 - Audacity |

46,28 mins |

Tlemcen |

Online |

|

Interviewee 12 |

- Smartphone OPPO F11 - Audacity |

44,18 mins |

Ain Temouchent |

Face to face |

|

Interviewee 13 |

- Smartphone OPPO F11 - Audacity |

41,22 mins |

Tlemcen |

Online |

|

Interviewee 14 |

- Smartphone OPPO F11 - Audacity |

39,58 mins |

Tlemcen |

Online |

|

Interviewee 15 |

- Smartphone OPPO F11 - Audacity |

34,20 mins |

Tlemcen |

Online |

|

Interviewee 16 |

- Smartphone OPPO F11 - Audacity |

31,06 mins |

Tlemcen |

Online |

|

Interviewee 17 |

- Smartphone OPPO F11 - Audacity |

40,04 mins |

Tlemcen |

Face to face |

Source: By researchers based on Nvivo10 outputs

6. Results:

6.1 Trustworthiness of qualitative findings:

The trustworthiness or rigour of a study is determined by the level of confidence in the data, interpretation, and methods used to ensure its quality. For a study to be considered credible by readers, researchers must establish the necessary protocols and procedures for each study (Connelly, 2022, p. 11) [53]. To do so, we conducted a coding reliability test as follows”.

- Coding Reliability Test:

We performed a data coding operation during this stage by categorizing them into significant words or phrases related to the research question. In a qualitative study, coding reliability refers to the stability of the coding, and it helps to verify if the coding rules are unambiguous (Allard-Poesi, 2003, p. 16) [54]. This coding reliability test was implemented through the steps proposed by (Allard-Poesi, 2003, p. 17) [55].

Coding stability or intra-evaluator reliability: when the same coder codes the data repeatedly. To do this, we performed several coding operations several times, with consistent results, which confirmed the accuracy and reliability of the coding.

Coding reproducibility (or inter-coder reliability ICR): The extent to which the coding produces the same results when different people code the same data. A high level of ICR demonstrates that the coding is both reliable and replicable, which therefore strengthens evidence that the results of a qualitative study are scientifically valid (MacPhail et al., 2016, p. 8) [56]. To pass this test, we handed our data to another researcher, “PhD student”, who performed an independent coding. A similarity test was then conducted using the Nvivo 10 software, which allowed us to assess the reliability of our data coding, with a similarity exceeding 85%.

6.2 Thematic analysis approach:

This study employed a qualitative approach to thematic analysis. Thematic content analysis is centred around identifying recurring patterns or themes across the entire dataset and is a widely utilized technique for qualitative data analysis (Braun & Clarke, 2006, p. 3) [57]. The first step of analysis involved open coding, an important process of breaking down the data into units (Jin & Hurd, 2018, p. 7) [58]. Therefore, we opted for two coding approaches to clarify our content analysis.

6.2.1 Coding by word frequency:

Each coding process begins with the preparation of the corpus. This preparation involves working on the corpus and its indexing (Gavard-Perret et al., 2008, p. 11) [59]. Following Quivy and Van Campenhoudt (1995), p. 12 [60], we first coded the relevant data for the research during the data collection phase. The first form of coding involved selecting all sources from the corpus, including all interviews and attributes, and searching for repetitive keywords with unlimited word count and a maximum word length of four (04) letters. The goal of this step is to avoid overwhelming the researcher with the richness of information presented in the analysis corpus.

Table 3 : Codes

|

Interviews |

e-banking |

Trust |

Ease |

Use |

e-WOM or Social Medias |

Advantage or Usefulness |

Costs, fees |

Quality |

|

Interviewee 1 |

5 |

2 |

0 |

1 |

2 |

0 |

1 |

2 |

|

Interviewee 2 |

6 |

7 |

1 |

2 |

2 |

4 |

1 |

1 |

|

Interviewee 3 |

8 |

4 |

1 |

7 |

2 |

1 |

1 |

1 |

|

Interviewee 4 |

14 |

3 |

0 |

0 |

1 |

0 |

1 |

1 |

|

Interviewee 5 |

11 |

2 |

0 |

4 |

3 |

2 |

1 |

3 |

|

Interviewee 6 |

5 |

4 |

0 |

3 |

3 |

0 |

1 |

2 |

|

Interviewee 7 |

1 |

1 |

1 |

2 |

4 |

0 |

2 |

1 |

|

Interviewee 8 |

5 |

2 |

0 |

2 |

3 |

1 |

1 |

0 |

|

Interviewee 9 |

10 |

2 |

1 |

4 |

4 |

0 |

1 |

1 |

|

Interviewee 10 |

1 |

2 |

0 |

4 |

3 |

0 |

1 |

2 |

|

Interviewee 11 |

2 |

2 |

1 |

2 |

3 |

1 |

1 |

2 |

|

Interviewee 12 |

6 |

3 |

1 |

1 |

2 |

3 |

1 |

1 |

|

Interviewee 13 |

9 |

2 |

1 |

2 |

1 |

2 |

1 |

1 |

|

Interviewee 14 |

5 |

1 |

0 |

4 |

5 |

2 |

1 |

2 |

|

Interviewee 15 |

3 |

2 |

2 |

2 |

3 |

1 |

1 |

1 |

|

Interviewee 16 |

6 |

3 |

2 |

1 |

1 |

2 |

3 |

1 |

|

Interviewee 17 |

8 |

2 |

3 |

1 |

0 |

1 |

2 |

1 |

|

Total |

104 |

44 |

14 |

42 |

42 |

20 |

21 |

23 |

Source: Resulting from Nvivo10’s word frequency coding

Emerging from the first coding, we unveiled a significant list of keywords (Table 3), which can serve as the basis of our content analysis and confirm our research model. These words were shared either multiple times within a single interview or across all interviews, confirming the shared similar ideas among the interviewees regarding the different factors discussed, which can influence the use of online banking services.

It is essential to note that some constructs, as cited in the literature and theories, were replaced in our interview guide based on their understanding by the interviewees. As observed by (Frédiric, 1996, p. 8) [61], “even with rigorous coding procedures, the researcher intervenes in the actor’s own language by transforming the discourse’s form”. Hence, it was necessary for us to integrate similar names for our variables to facilitate maximum understanding among the interviewees.

6.2.2 Coding by text frequency (Categorization):

BARDIN (1977) [62] defined the unit of analysis, which can be a word, the meaning of a word or group of words, a whole sentence, sentence fragments such as “subject/verb/object,” one or several paragraphs, or an entire text. To better illustrate the frequency coding of words, we deemed it necessary to move to a phrase-based coding method in relation to all the codes demonstrated in Table 3 above. This method aims to highlight and identify expressions related to codes to have broader and more indicative confirmation support to validate our proposed research model. Table 4 below shows a description of the codes

Table 4: The description of the codes

|

Codes |

The sentences encoded in relation to the keyword |

|

E-banking |

· There are interesting and functional e-banking services available in Algeria. · Let’s be logical, e-banking services play a huge role in everyday life. · For me, e-banking is very necessary, I can withdraw money through ATMs whenever I need to. |

|

Trust |

· E-banking services are not always trustworthy. · Trust is relative, I cannot fully trust online banking services. · It is a great advantage that we can trust a machine (ATM). |

|

Ease |

· Yes, they play an important role in my life as they make daily tasks easier. · E-banking is important for making life easier. · The first advantage is the facilitation of daily financial transactions. |

|

Use |

· Personally, I am very limited in the use of these services in my daily life. · Undoubtedly, we will reach a more advanced stage in the use of electronic banking systems. · There is no reason to stop using electronic banking services. |

|

Social Medias (eWOM) |

· Certainly, social media can be a means of negative or positive influence on the use of electronic banking services. · Social media have a very high degree of influence on internet users. · I think that social media have a noticeable impact and can influence e-banking users in both positive and negative ways. |

|

Advantage or Usefulness |

· I can check my account at any time, either through ATMs or my smartphone or computer, which is a real advantage. · A major advantage is that it saves on travel, time, effort, and even expenses. · In my opinion, these applications are of great usefulness, representing a significant advantage for me. |

|

Costs or fees |

· Transaction fees are never verified, and they can be inflated without us being able to realize it. · Other banks offer better services in terms of costs compared to my bank. · I would have liked them to stop generating fees for current accounts like mine. |

|

Services’ quality |

· It is good to avoid human contact through the use of e-banking, but the quality of the services still needs improvement. · The quality of e-banking services in Algeria still needs to be improved. · I compare the electronic services offered by my bank, with those of others banks, and I see that they offer better services in terms of quality compared to my bank |

Source : By researchers, based on Nvivo10 outputs.

Referring to Table 4 above, sentence encoding has provided a significant analytical framework for each of the keywords listed above. To extract salient points, randomly selected sentences from the corpus were used.

Main theme 1: e-banking use

Regarding the concept of e-banking, all interviewees repeatedly mentioned that electronic banking services are of immense importance and necessary for daily life. For example, one respondent stated, “I think it is now obligatory to use e-banking services given all the advantages they can provide”.

It was also discovered that the concept of usage is significant for all interviewees, which was mentioned 42 times. Almost all of the sentences referred to usage, particularly regular usage, sometimes even intense usage, and only a few times limited usage by electronic bank customers. Moreover, one of the interviewees noted that is good to avoid human contact through the use of e-banking, but the quality of the services still needs improvement”.

Main theme 2: Technology acceptance

Regarding the concept of usefulness or advantage as evoked by the interviewees, all respondents admit that electronic banking services are indispensable for the user’s daily life, which is why they listed many advantages regarding electronic banking services, each according to their degree of usage and integrity in information systems. Example: I can check my account and credit at any time, either from ATMs or from my smartphone or computer, and it is a real advantage.

Ease of use of electronic banking services was mentioned by half of the interviewees, noting that this factor can contribute to users’ intention to adopt e-banking, especially since respondents have varying degrees of IT proficiency. Therefore, it is justifiable that not everyone finds ease of use important when using e-banking services. For example, one respondent said, “I find banking applications on my mobile very useful for daily life. It makes payment for products and services easier”.

The concept of Trust was found to be very influential, as it was present in all randomly selected sentences and was mentioned by all interviewees. Some customers trust electronic banking services completely, while others prefer to be more cautious and have relative trust instead of complete trust. For example, one respondent stated, “Trust for me is relative, I cannot completely trust electronic banking services”.

Main theme 3: Electronic word of mouth (e-WOM)

Called upon by “social media” in the interview guide to facilitate its perception, electronic word-of-mouth (e-WOM) was very significant for this study. Sometimes negative, sometimes positive, but most of the time, playing a mixed role, having both a positive and negative influence on electronic banking clients, and it varies depending on the personality or social orientation of the internet user. Example: They have a very significant effect, whether positive or negative, I think that social media can influence e-banking users through all the stories we hear about on the internet regarding this kind of technology.

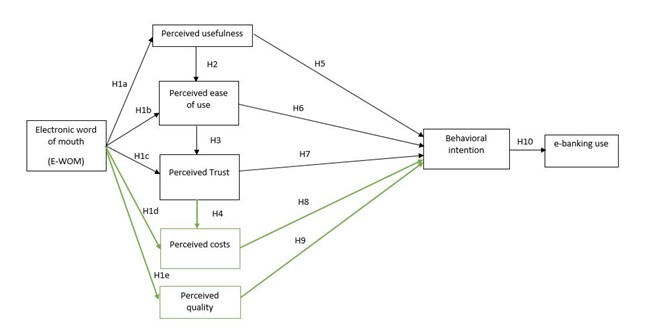

However, besides the variables proposed in the theoretical model, we have identified other variables influencing customers to use electronic banking services in Algeria.

Costs and fees were very significant in our study. This variable was defined by (Nguyen et al., 2019, p. 11) [63] as the level to which an individual believes that using e-banking will incur costs. Constantinides (2002), p. 8 [64] as the possible expenses associated with using ICT, namely equipment costs, access costs, and transaction fees. All interviewees mentioned bank charges (commissions, costs, fees, etc.) at least once. All respondents complained about the fees, sometimes called exorbitant, especially when the bank does not clearly communicate these fees and are automatically deducted during banking operations (transfer, withdrawal, etc.). In fact, one interviewee told us that he cancelled his bank account because of unclear commissions deducted from his account. Example: I submitted a request to cancel my account because it generated many fees without being able to have a clear picture of these deductions. These results are consistent with several studies in e-banking, such as Thanh D. Nguyen et al., (2019), p. 7 [65] study, in which perceived costs significantly affected the use of m-Banking. Also, in the study by Anouze & Alamro, (2020), p. 9 [66], reasonable prices, stand out as the barrier to intention to use e-banking services in Jordan.

On the other hand, the qualitative analysis has highlighted the determinant of “Quality”, which is a significant factor in the use of online banking services in Algeria. Example: The quality of e-banking services in Algeria still needs to be improved. It was defined by Venkatesh; Viaswanath & Davis; Fred D., (2000), p. 10 [67] as the degree to which an individual believes the system performs its tasks effectively. In Yaseen & El Qirem’s (2018), p. 6 [68] study, perceived quality has a vital impact on the behaviour intention in an electronic context, which is adequate with our results. Similarly, Naik et al., (2010), p. 8 [69] found that dominant dimensions of service quality directly influence behaviour intention and consumer satisfaction.

Figure 2: Structural model

Source: By researchers, based on content analysis.

7. Discussion and implications:

7.1 Discussion:

This qualitative study attempted to confirm the factors listed in the Technology Acceptance Model of Davis, (1989), and possibly discover other factors influencing the adoption of electronic banking services among Algerian bank customers. Like other researchers, such as Thanh D. Nguyen et al., (2019), p. 9 [70] we confirm in our proposed model the influence of electronic word-of-mouth, perceived usefulness, perceived trust, and perceived costs on the use of electronic banking services by Algerian bank customers. However, perceived ease of use was found to be less influential among Algerian bank customers, unlike Salimon et al., (2017), p. 4 [71] study, which classified ease of use as crucial for use and considered banking services to be easy to use if the user expends little physical and mental effort compared to other proposed factors. Furthermore, our results were aligned with the findings of Salloum & Al-Emran, (2018), p. 11 [72], who were able to confirm the significant influence of perceived usefulness and perceived trust among electronic payment users. The results also support Kurnia et al., (2010), p. 7 [73] study conducted in China, which confirmed that customers’ lack of trust seriously impedes the growth of e-banking.

Similarly, our results were in agreement with those of Petrović et al., (2021), p. 4 [74], who confirmed the influence of electronic word-of-mouth (eWOM) on the intention to use mobile banking. The results of Luarn & Lin, (2005), p. 8 [75] like ours, also confirmed the influence of perceived costs on the intention to use e-banking. Based on an inductive qualitative survey conducted throughout Algeria, the results showed that using e-banking is determined by several factors. Such as the perceived ease of use adopted in the model, perceived usefulness adopted in the original TAM model by Davis et al., (1989), as well as perceived trust taken into account in several studies, such as Garín-Muñoz et al., (2019) p. 9 [76] study.

7.2 Academic implications:

This study provides significant academic contributions to the literature on technology adoption and acceptance. Firstly, our study proposes an extended theoretical model that integrates a fusion of the Technology Acceptance Model and Theory of Planned Behaviour with the extension of two variables that we deemed potential: namely, e-WOM and perceived trust. All of these variables were tested on a sample of customers in the Algerian context as a developing country. Secondly, this study aimed not only to validate the proposed variables but also to open the field of appearance to other variables that may be significant for Algerian bank customers, such as perceived trust and perceived costs. Thirdly and finally, our qualitative study adopted a thematic content analysis, which is a crucial tool for addressing many scientific questions in the field of ICT that may have been taboo for statistical analysis on the one hand and, on the other hand, to form a platform for a possible quantitative study in the same context.

7.3 Managerial Implications:

On the managerial side, the findings will provide researchers with a broader view of factors that may influence the use of electronic services provided by Algerian banks. Important insights from this qualitative study have emerged, forming an ideal platform for future, more precise quantitative studies. Firstly, the perceived ease of use and perceived usefulness factors extracted from Davis’ (1989) original TAM model were confirmed in this study for clients operating in a developing banking sector. These factors have a crucial impact on Algerian e-banking users. Perceived trust and perceived costs modified in the technology acceptance model have also proven their impact on the use of electronic banking services by Algerian clients. On the other hand, the electronic word-of-mouth (eWOM) factor was also deemed significant for e-banking users in Algeria. For IT managers, the results suggest studying the ergonomics of all available e-banking channels in the country and ensuring they are easy to use and useful for users. This can be achieved by launching demonstration campaigns through videos on banks’ official websites, on social media, as well as in bank waiting rooms, and by investing in advertising in this sense. Secondly, Algerian clients will adopt e-banking services only if they believe they are equipped with all security measures. The lack of a reliable and robust system for managing financial transactions can affect clients’ trust in this system. On the other hand, the Algerian banking sector must pay attention to the costs demanded from clients to benefit from the system, as this is a young society that is very careful about understanding and using IT. Finally, Algerian banks must take their interaction with clients on social media and all electronic platforms seriously, as the influence of electronic word-of-mouth can be fatal for potential or prospective clients. Therefore, it would be clear to involve bank managers to salvage the image of the banks (GBADEBO, 2016, p. 3) [77].

8. Limitations and Conclusion:

Despite the interesting contributions this study provides, it is not without limitations. On the one hand, using qualitative survey data on a restricted number of respondents does not provide definitive evidence. Therefore, quantitative and longitudinal studies, which establish causality through the temporal precedence of constructs, are needed to justify the validity of the proposed model and the relationships among the constructs. On the other hand, the sample size of the qualitative study is relatively small; thus, a quantitative study is strongly recommended to boost the statistical power of the results (Champely & Verdot, 2007, p. 14) [78]. Finally, the data were collected in Algeria, and the generalizability of the results to other developing countries may be limited.

This study examined the factors that influence customers’ use of electronic banking services in Algeria, namely ease of use, perceived usefulness, perceived trust, perceived costs, behavioural intention, and electronic word-of-mouth (eWOM). This paper proposes a modified model of the Technology Acceptance Model (TAM). The results and contribution open an interesting avenue for future research, particularly quantitative studies in Algeria and developing countries in general.

REFERENCES:

- Fatonah, S., Yulandari, A., & Wibowo, F. W. (2018). A Review of E-Payment System in E-Commerce. Journal of Physics: Conference Series, 1140(1). https://doi.org/10.1088/1742-6596/1140/1/012033

- Hasan, M. S., Baten, A. H., Azizul, Kamil, M., Abdulbasah, Sanjida, A., & Parveen. (2010). Adoption of e-banking in Bangladesh: An exploratory study. African Journal of Business Management, 4(13), 2718–2727. http://www.academicjournals.org/AJBM

- Ataya, M. A. M., & Ali, M. A. M. (2019). Acceptance of Website Security on E-banking. A-Review. ICSGRC 2019 - 2019 IEEE 10th Control and System Graduate Research Colloquium, Proceeding, August, 201–206. https://doi.org/10.1109/ICSGRC.2019.8837070

- Anouze, A. L. M., & Alamro, A. S. (2020). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38(1), 86–112. https://doi.org/10.1108/IJBM-10-2018-0271

- Bellahcen, M., & Latrech, H. (2020). Factors influencing e-banking use by Algerian banks customers; Empirical study. Review of Knowledge Aggregates, N°6, 10, 290-306

- GIE-Monétique. (2023). Paiement électronique: le nombre des TPE a évolué de 30% au 1er trimestre 2021. https://www.aps.dz/economie/121720-paiement-electronique-le-nombre-des-tpe-a evolue-de-30-au-1er-trimestre-2021 [Last Access : 16.12.23].

- Bellahcene, M., & Mehdi KHEDIM, M. (2016). Les facteurs influençant l’adoption de l’e-banking par les clients des banques algériennes. Economie & Société N°, 12, 71–85.

- Salloum, S. A., & Al-Emran, M. (2018). Factors affecting the adoption of e-payment systems by university students: Extending the tam with trust. International Journal of Electronic Business, 14(4), 371–389. https://doi.org/10.1504/ijeb.2018.098130

- Sarkam, N. A., Faezah, N., Razi, M., & Jamil, N. I. (2021). Factors Influencing Consumers ‘ Intention to Use E-Payment System : a Study Among E-Payment Users in Malaysia. EasyChair Preprint, 5473, 12.

- Kurnia, S., Peng, F., & Liu, Y. R. (2010). Understanding the adoption of electronic banking in China. Proceedings of the Annual Hawaii International Conference on System Sciences, 1–10. https://doi.org/10.1109/HICSS.2010.421

- Bellahcen, M., & Latrech, H. (2020). Factors influencing e-banking use by Algerian banks customers; Empirical study. Review of Knowledge Aggregates, N°6, 10, 290-306.

- Hanafizadeh, P., Keating, B. W., & Khedmatgozar, H. R. (2014). A systematic review of Internet banking adoption. Telematics and Informatics, 31(3), 492–510. https://doi.org/10.1016/j.tele.2013.04.003

- Bellahcene, M., & Latreche, H. (2023). E-Banking Adoption by Algerian Bank Customers : Towards an Integrated Model. International Journal of E-Services and Mobile Applications, 15(1), 1–20. https://doi.org/10.4018/IJESMA.317943

- Daniel, E. (1999). Provision of electronic banking in the UK and the Republic of Ireland. International Journal of Bank Marketing, 17(2), 72–83. https://doi.org/10.1108/02652329910258934

- Sheikh, B., & Rahman, M. (2020). Satisfaction of E-Banking Transaction towards International Buyers of Garment Products in Bangladesh: A Qualitative Study. 340436128(April).

- Fishbein, M. A., & Ajzen, I. (1975). Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. (2nd ed., Vol. 10). Penn State University Press.

- Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterl, 13(3), 319–340. https://doi.org/10.5962/bhl.title.33621

- Ajzen, I. (1991). The Theory of Planned Behavior. University of Massachusetts at Amherst Research, 50(1), 179–211. https://doi.org/10.47985/dcidj.475

- Venkatesh, Viswanath, Michael, G. M., Gordon, B. D., & Fred, D. D. (2003). USER ACCEPTANCE OF INFORMATION TECHNOLOGY: TOWARD A UNIFIED VIEW1. Inorganic Chemistry Communications, 27(3), 425–478. https://doi.org/10.1016/j.inoche.2016.03.015

- Roy, S. K., Balaji, M. S., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking adoption in India: a perceived risk perspective. Journal of Strategic Marketing, 25(5–6), 418–438. https://doi.org/10.1080/0965254X.2016.1148771

- Gharaibeh, M. K., Arshad, M. R. M., & Gharaibh, N. K. (2018). Using the UTAUT2 model to determine factors affecting adoption of mobile banking services: A qualitative approach. International Journal of Interactive Mobile Technologies, 12(4), 123–134. https://doi.org/10.3991/ijim.v12i4.8525

- Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management, 34(1), 1–13. https://doi.org/10.1016/j.ijinfomgt.2013.06.002

- Ahmad, S., Bhatti, S. H., & Hwang, Y. (2020). E-service quality and actual use of e-banking: Explanation through the Technology Acceptance Model. Information Development, 36(4), 503–519. https://doi.org/10.1177/0266666919871611

- Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., Lal, B., & Williams, M. D. (2015). Consumer adoption of Internet banking in Jordan: Examining the role of hedonic motivation, habit, self-efficacy and trust. Journal of Financial Services Marketing, 20(2), 145–157. https://doi.org/10.1057/fsm.2015.5

- Anouze, A. L. M., & Alamro, A. S. (2020). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38(1), 86–112. https://doi.org/10.1108/IJBM-10-2018-0271

- Thanh Nguyen, T. D., Nguyen, T. Q. L., Nguyen, T. V., & Tran, T. D. (2019). Intention to Use M–Banking: The Role of E–WOM. Springer Nature Switzerland, 1(March), 215–229. https://doi.org/10.1007/978-3-030-16657-1_20

- Salloum, S. A., & Al-Emran, M. (2018). Factors affecting the adoption of e-payment systems by university students: Extending the tam with trust. International Journal of Electronic Business, 14(4), 371–389. https://doi.org/10.1504/ijeb.2018.098130

- Mwiya, B., Chikumbi, F., Shikaputo, C., Kabala, E., Kaulung’ombe, B., & Siachinji, B. (2017). Examining Factors Influencing E-Banking Adoption: Evidence from Bank Customers in Zambia. American Journal of Industrial and Business Management, 07(06), 741–759. https://doi.org/10.4236/ajibm.2017.76053

- Mansour, R., KHEDIM, M. M., LATRECHE, H., & BELLAHCENE, M. (2022). Les déterminants de l’utilisation des systèmes d’e-banking par les clients des banques Algérienne: Etude quantitative. Revue Etudes Economique, 16(3), 764–779.

- Anouze, A. L. M., & Alamro, A. S. (2020). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38(1), 86–112. https://doi.org/10.1108/IJBM-10-2018-0271

- Bellahcene, M., & Mehdi KHEDIM, M. (2016). Les facteurs influençant l’adoption de l’e-banking par les clients des banques algériennes. Economie & Société N°, 12, 71–85.

- Davis, F. D. (1986). A TECHNOLOGY ACCEPTANCE MODEL FOR EMPIRICALLY TESTING NEW END-USER INFORMATION SYSTEMS: THEORY AND RESULTS [Sloan School of Management,]. In SLOAN SCHOOL OF MANAGEMENT. https://doi.org/10.1126/science.146.3652.1648

- Bellahcene, M., & Latreche, H. (2023). E-Banking Adoption by Algerian Bank Customers : Towards an Integrated Model. International Journal of E-Services and Mobile Applications, 15(1), 1–20. https://doi.org/10.4018/IJESMA.317943

- Ajzen, I. (1991). The Theory of Planned Behavior. University of Massachusetts at Amherst Research, 50(1), 179–211. https://doi.org/10.47985/dcidj.475

- Lai, P. (2017). the Literature Review of Technology Adoption Models and Theories for the Novelty Technology. Journal of Information Systems and Technology Management, 14(1), 21–38. https://doi.org/10.4301/s1807-17752017000100002

- Ajzen, I. (1991). The Theory of Planned Behavior. University of Massachusetts at Amherst Research, 50(1), 179–211. https://doi.org/10.47985/dcidj.475

- Thanh Nguyen, T. D., Nguyen, T. Q. L., Nguyen, T. V., & Tran, T. D. (2019). Intention to Use M–Banking: The Role of E–WOM. Springer Nature Switzerland, 1(March), 215–229. https://doi.org/10.1007/978-3-030-16657-1_20

- Nguyen, T. D., Nguyen, T. Q. L., Nguyen, T. V., & Tran, T. D. (2019). Intention to Use M–Banking: The Role of E–WOM. Springer Nature Switzerland, 1(March), 215–229. https://doi.org/10.1007/978-3-030-16657-1_20

- Augusto, M., & Torres, P. (2018). Effects of brand attitude and eWOM on consumers’ willingness to pay in the banking industry: Mediating role of consumer-brand identification and brand equity. Journal of Retailing and Consumer Services, 42(October 2017), 1–10. https://doi.org/10.1016/j.jretconser.2018.01.005

- Petrović, M., Rajin, D., Milenković, D., & Marić, D. (2021). The influence of eWOM on the use of mobile banking. Ekonomika Preduzeca, 69(3–4), 95–104. https://doi.org/10.5937/ekopre2102095p

- Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterl, 13(3), 319–340. https://doi.org/10.5962/bhl.title.33621

- Farrell, D., & Petersen, J. C. (1982). Patterns of Political Behavior in Organizations. The Academy of Management Review, 7(3), 403. https://doi.org/10.2307/257332

- Mansour, R., KHEDIM, M. M., LATRECHE, H., & BELLAHCENE, M. (2022). Les déterminants de l’utilisation des systèmes d’e-banking par les clients des banques Algérienne: Etude quantitative. Revue Etudes Economique, 16(3), 764–779.

- Venkatesh, Viswanath, Michael, G. M., Gordon, B. D., & Fred, D. D. (2003). USER ACCEPTANCE OF INFORMATION TECHNOLOGY: TOWARD A UNIFIED VIEW1. Inorganic Chemistry Communications, 27(3), 425–478. https://doi.org/10.1016/j.inoche.2016.03.015

- Sarkam, N. A., Faezah, N., Razi, M., & Jamil, N. I. (2021). Factors Influencing Consumers ‘ Intention to Use E-Payment System : a Study Among E-Payment Users in Malaysia. EasyChair Preprint, 5473, 12.

- Bellahcene, M., & Latreche, H. (2023). E-Banking Adoption by Algerian Bank Customers : Towards an Integrated Model. International Journal of E-Services and Mobile Applications, 15(1), 1–20. https://doi.org/10.4018/IJESMA.317943

- Gefen, D., Karahanna, E., & Straub, D. W. (2003). TRUST AND TAM IN ONLINE SHOPPING: AN INTEGRATED MODEL. MIS Quarterly: Management Information Systems, 27(1), 51–90.

- Doney, P. M., & Cannon, J. P. (1997). An Examination of the Nature of Trust in Buyer–Seller Relationships. Journal of Marketing, 61(2), 35–51. https://doi.org/10.1177/002224299706100203

- Hanafizadeh, P., Keating, B. W., & Khedmatgozar, H. R. (2014). A systematic review of Internet banking adoption. Telematics and Informatics, 31(3), 492–510. https://doi.org/10.1016/j.tele.2013.04.003

- Lee, M. C. (2009). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130–141. https://doi.org/10.1016/j.elerap.2008.11.006

- Venkatesh, Viswanath. (2000). Determinants of perceived ease of use : integrating control , intrinsic motivation , acceptance model. Inorganic Chemistry Communications, 11(3), 319–340.

- Marie, L., Gevard, P., Gotteland, H., & Alain, J. (2016). methodologie de la recherche en sciences de gestion (Pearso (ed.); 2ème).

- Connelly, L. M. (2022). Trustworthiness in Qualitative Research. Journal of Human Lactation, 38(4), 598–602. https://doi.org/10.1177/08903344221116620

- Allard-Poesi, F. (2003). Coder les données. Conduire Un Projet de Recherche, Une Perspective Qualitative, April, 28.

- Allard-Poesi, F. (2003). Coder les données. Conduire Un Projet de Recherche, Une Perspective Qualitative, April, 28.

- MacPhail, C., Khoza, N., Abler, L., & Ranganathan, M. (2016). Process guidelines for establishing Intercoder Reliability in qualitative studies. Qualitative Research, 16(2), 198–212. https://doi.org/10.1177/1468794115577012

- Braun, V., & Clarke, V. (2006). Qualitative Research in Psychology Using thematic analysis in psychology Using thematic analysis in psychology. Qualitative Research in Psychology, 3(2), 77–101.

- Jin, H., & Hurd, F. (2018). Exploring the Impact of Digital Platforms on SME Internationalization: New Zealand SMEs Use of the Alibaba Platform for Chinese Market Entry. Journal of Asia-Pacific Business, 19(2), 72–95. https://doi.org/10.1080/10599231.2018.1453743

- Gavard-Perret, M.-L., Gotteland, D., Haon, C., & Jolibert, A. (2008). Méthodologie de la recherche : Réussir son mémoire ou sa thèse en sciences de gestion. Post-Print. https://ideas.repec.org/p/hal/journl/halshs-00355220.html [Last Access 10.03.24]

- Quivy, R. et Van Campenhoudt, L. (1995), « Manuel de recherche en sciences sociales », Editions Dunod, Paris.

- Frédiric, W. (1996). Méthodes qualitatives et recherche en gestion de Frédéric Wacheux - Livre - Decitre. https://www.decitre.fr/livres/methodes-qualitatives-et-recherche-en-gestion-9782717830538.html [Last Access 03.03.24]

- BARDIN, L. (1977). L’Analyse du contenu, de L. Bardin - Persée. https://www.persee.fr/doc/colan_0336-1500_1977_num_35_1_4449 [Last Access 22.03.24]

- Nguyen, T. D., Nguyen, T. Q. L., Nguyen, T. V., & Tran, T. D. (2019). Intention to Use M–Banking: The Role of E–WOM. Springer Nature Switzerland, 1(March), 215–229. https://doi.org/10.1007/978-3-030-16657-1_20

- Constantinides, E. (2002). The 4S web-marketing mix model. Electronic Commerce Research and Applications, 1(1), 57–76. https://doi.org/10.1016/S1567-4223(02)00006-6

- Thanh Nguyen, T. D., Nguyen, T. Q. L., Nguyen, T. V., & Tran, T. D. (2019). Intention to Use M–Banking: The Role of E–WOM. Springer Nature Switzerland, 1(March), 215–229. https://doi.org/10.1007/978-3-030-16657-1_20

- Anouze, A. L. M., & Alamro, A. S. (2020). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38(1), 86–112. https://doi.org/10.1108/IJBM-10-2018-0271

- Venkatesh, Viaswanath, & Davis, F. D. (2000). A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Management Science, 46(2), 186–204.

- Yaseen, S. G., & El Qirem, I. A. (2018). Intention to use e-banking services in the Jordanian commercial banks. International Journal of Bank Marketing, 36(3), 557–571. https://doi.org/10.1108/IJBM-05-2017-0082

- Naik, C. N. K., Gantasala, S. B., & Prabhakar, G. V. (2010). SERVQUAL, customer satisfaction and behavioural intentions in retailing. European Journal of Social Sciences, 17(2), 200–213.

- Thanh Nguyen, T. D., Nguyen, T. Q. L., Nguyen, T. V., & Tran, T. D. (2019). Intention to Use M–Banking: The Role of E–WOM. Springer Nature Switzerland, 1(March), 215–229. https://doi.org/10.1007/978-3-030-16657-1_20

- Salimon, M. G., Yusoff, R. Z. Bin, & Mohd Mokhtar, S. S. (2017). The mediating role of hedonic motivation on the relationship between adoption of e-banking and its determinants. International Journal of Bank Marketing, 35(4), 558–582. https://doi.org/10.1108/IJBM-05-2016-0060

- Salloum, S. A., & Al-Emran, M. (2018). Factors affecting the adoption of e-payment systems by university students: Extending the tam with trust. International Journal of Electronic Business, 14(4), 371–389. https://doi.org/10.1504/ijeb.2018.098130

- Kurnia, S., Peng, F., & Liu, Y. R. (2010). Understanding the adoption of electronic banking in China. Proceedings of the Annual Hawaii International Conference on System Sciences, 1–10. https://doi.org/10.1109/HICSS.2010.421

- Petrović, M., Rajin, D., Milenković, D., & Marić, D. (2021). The influence of eWOM on the use of mobile banking. Ekonomika Preduzeca, 69(3–4), 95–104. https://doi.org/10.5937/ekopre2102095p

- Luarn, P., & Lin, H. H. (2005). Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior, 21(6), 873–891. https://doi.org/10.1016/j.chb.2004.03.003

- Garín-Muñoz, T., López, R., Pérez-Amaral, T., Herguera, I., & Valarezo, A. (2019). Models for individual adoption of eCommerce, eBanking and eGovernment in Spain. Telecommunications Policy, 43(1), 100–111. https://doi.org/10.1016/j.telpol.2018.01.002

- Gbadebo, s. m. (2016). the influences of e-satisfaction, e-trust and hedonic motivation on the relationship between e-banking adoption and its determinants in nigeria. universiti utara malaysia. Mediterranean Journal of Social Sciences, n°7/1/ 53-63 https://doi: 10.5901/mjss.2016.v7n1p54

- Champely, S., & Verdot, C. (2007). L’apport de la taille d’effet et de la puissance statistique. Staps, 77, 49–61.

Downloads

ჩამოტვირთვები

გამოქვეყნებული

გამოცემა

სექცია

ლიცენზია

საავტორო უფლებები (c) 2024 Rachid Mansour, Mokhtar Tahraoui (Author)

ეს ნამუშევარი ლიცენზირებულია Creative Commons Attribution-ShareAlike 4.0 საერთაშორისო ლიცენზიით .