Studying the relationship between some macroeconomic variables and economic growth in Algeria using the ARDL model

DOI:

https://doi.org/10.35945/gb.2025.20.009Keywords:

Exchange rate, inflation rate, oil price, ARDL model, economic growthAbstract

This study investigates the impact of exchange rate fluctuations, inflation, and oil prices on Algeria's economic growth from 1990 to 2022. Employing the Autoregressive Distributed Lag (ARDL) model and analyzed using EViews 12, the research evaluates both short- and long-term dynamics among these variables. The findings reveal a significant inverse relationship between exchange rate depreciation and economic growth, suggesting that currency instability adversely affects Algeria’s economic performance. Similarly, inflation exhibits a negative long-term association with growth, highlighting the detrimental effects of rising price levels on the economy. Conversely, oil prices demonstrate a positive long-term relationship with growth, underscoring Algeria’s reliance on hydrocarbon revenues as a key driver of economic expansion. The model’s estimation results indicate that these independent variables collectively explain 91% of the variations in economic growth, confirming their substantial influence. These insights underscore the need for policymakers to stabilize exchange rates, control inflation, and diversify the economy to mitigate overdependence on oil. The study contributes to the empirical literature on macroeconomic determinants of growth in resource-dependent economies.

Keywords: Exchange rate, inflation rate, oil price, ARDL model, economic growth.

Introduction

Economic growth is a key objective for all countries, whether developed or developing, due to its critical role in measuring development and societal progress. It reflects the total output of goods and services within an economy and is widely regarded as a fundamental indicator of economic performance. From a theoretical standpoint, economic growth remains one of the most significant topics in economic development, attracting the attention of prominent economists such as Adam Smith, David Ricardo, and Schumpeter, who sought to identify its key determinants.

Over time, economic realities have evolved, leading to shifts in the frameworks and theories used to explain growth. Today, economic growth is understood as the result of multiple and diverse factors, necessitating a thorough examination of all influencing variables—particularly economic ones. Among the most important macroeconomic variables affecting growth are the exchange rate, inflation, and oil prices. Against this backdrop, the study addresses the following research question: How do the exchange rate, inflation rate, and oil price influence economic growth in Algeria from 1990 to 2022?

This study aims to analyze the relationship between these macroeconomic variables and economic growth in Algeria, specifically assessing the impact of exchange rates, inflation, and oil prices.

To address the research question and achieve the study’s objectives, a mixed-method approach is employed. The first part adopts a descriptive approach, reviewing prior studies and theoretical frameworks related to the variables under examination. The second part utilizes a quantitative analytical approach, applying the ARDL model to empirically assess the impact of selected macroeconomic variables on Algeria’s economic growth from 1990 to 2022. The analysis is conducted using the EViews 12 software.

1. Literature review

Chowdhury (2019) investigated the impact of macroeconomic variables—inflation (INF), real interest rate (INT), exchange rate (EXR), and household consumption expenditure growth (HCE)—on GDP growth in Bangladesh (1987–2015). Using correlation and multiple regression analysis, the study found a positive relationship between GDP and all variables except inflation.[1] The independent variables explained 75.60% of GDP variance, confirming their significant influence on economic growth.

Alam et al. (2022) examined the long-term relationship between investment, exports, imports, and government spending components (health, education, and other expenditures) on Saudi Arabia’s GDP (1985–2018). Applying the ARDL cointegration and error correction model,[2] the study revealed a positive long-run relationship between GDP, investment, exports, and government education spending, while imports, health expenditures, and other government spending had a negative impact.

Akhtar and Nisa (2023) explored the combined effect of macroeconomic variables on Pakistan’s economic growth (1970–2022) within the environmental Kuznets curve framework. The results indicated that energy use significantly increases carbon emissions, whereas manufacturing, exports, and financial development reduce them. Financial development, energy consumption, carbon emissions, and manufacturing positively influenced growth, while exports had a negative effect.[3]

Sulaiman (2023) employed the ARDL model to analyze the relationship between GDP growth and key variables (inflation, government spending, oil prices, and population growth) in Iraq (2003–2019). The findings confirmed a long-term equilibrium relationship, with oil prices being the most influential factor—consistent with Iraq’s status as an oil-dependent economy.[4]

2. Theoretical framework for study variables

2.1 Economic growth

Achieving positive economic growth rates is a key priority for governments, particularly in developing and underdeveloped countries striving for economic development, poverty reduction, and overcoming socioeconomic challenges. Economic growth is a quantitative concept representing the annual increase in an economy’s gross domestic product (GDP) (Fraj Muhammad Al-Qahtani& Khaled Zaki Al-Deeb, 2022). It refers to the rise in real net output over a specific period, typically a year or successive intervals. Additionally, economic growth entails an increase in real per capita income that outpaces population growth.[5]

According to Titoush Suhaila (2018), economic growth implies:

- An increase in real per capita income, not just GDP;[6]

- A real (not monetary) rise in national income, where per capita income growth exceeds inflation;

- A sustained, long-term increase rather than a temporary one.

Modern economic development is influenced by several key factors:

Capital Accumulation: Capital accumulation is a fundamental driver of economic growth, enhancing a nation’s productive capacity.[7] Its rate depends on three factors:[8]

- The level of real savings, determined by the willingness and ability to save;

- The presence of financial institutions that mobilize savings for investment;

- The allocation of savings toward capital goods.

Human Capital: Investment in human capital expands individual capabilities, improves education and skills, and fosters innovation.[9]

Trade Openness: A more open economy, characterized by greater trade volumes, correlates with higher growth rates.[10]

Rate of Technical Progress: Technological advancement enhances both physical and human capital, boosting production and living standards. Its impact spans education, management, marketing, and production.[11]

2.2 Exchange rate

The exchange rate connects domestic and global economies, influencing resource allocation, export competitiveness, and import costs. It ties local prices to global market prices[12] and reflects the units of foreign goods needed to purchase one unit of domestic goods.[13]

2.3 Oil price

Oil pricing has evolved from well-based and port-based systems to monopolistic and later competitive pricing shaped by supply and demand.[14] It represents the monetary value of a petroleum commodity, denominated in USD and subject to market fluctuations.[15] The volatile nature of the oil market leads to constant price changes.[16] Crude oil prices reflect the USD value per barrel over the industry’s development.[17]

2.4 Inflation

Inflation is a complex phenomenon with varying definitions. It denotes an abnormal price surge, described by Enelegame as a self-reinforcing price increase due to excess demand.[18] Friedman attributes it to excessive money supply growth.[19] Inflation measures the rate of price increases, either broadly (e.g., overall price levels or cost of living) or for specific goods/services.[20]

3. An econometric study of the impact of the exchange rate, oil price, and inflation on economic growth in Algeria

To analyze the impact of key macroeconomic variables on Algeria’s economic growth from 1990 to 2022, this study employs annual data sourced from the World Bank. The autoregressive distributed lag (ARDL) model, developed by Pesaran and Shin (2001),[21] is used due to its flexibility in handling variables with different integration orders—whether stationary at level (I(0)), first difference (I(1)), or a mix of both.

The study variables are defined as follows:

Dependent variable: Economic growth (GDP).

Independent variables: Real exchange rate (EX), inflation rate (INF), and oil price.

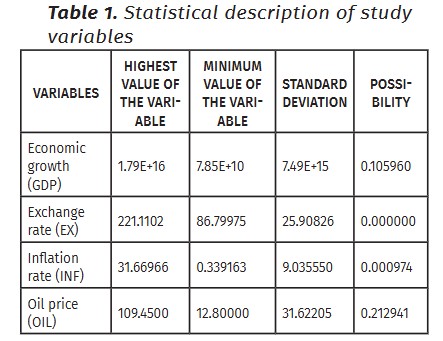

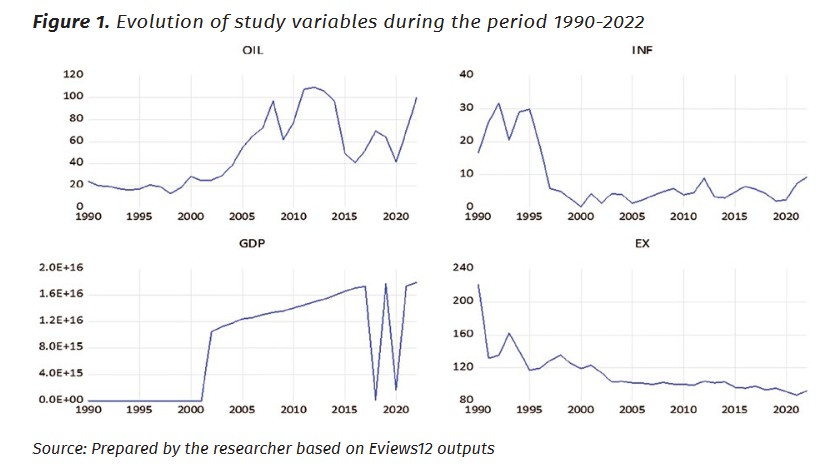

3.1 Description of the study variables

3.2 Testing time series stationarity

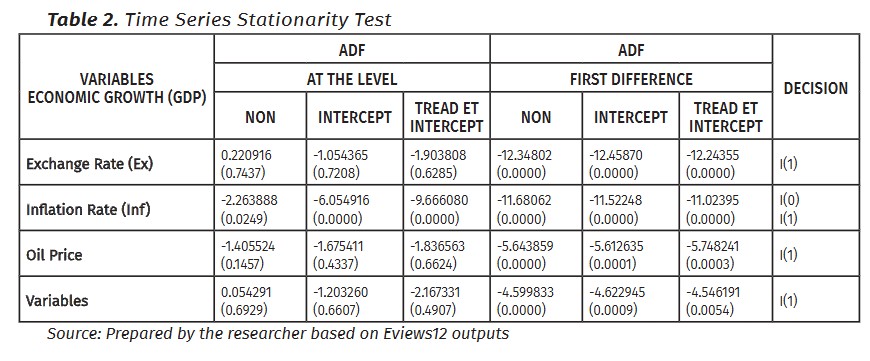

Economic literature mandates testing time series stationarity before estimating relationships. Many economic series exhibit non-stationarity due to a unit root, where the mean, variance, and covariance become time dependent. To address this issue, we employ the Augmented Dickey-Fuller (ADF) unit root test. The subsequent table presents our test results.

Table 2 reveals that the economic growth, inflation rate, and oil price series achieve stationarity at first difference, as confirmed by their 5% significance levels. The exchange rate series demonstrates stationarity at both the level and first difference.

Table 2 reveals that the economic growth, inflation rate, and oil price series achieve stationarity at first difference, as confirmed by their 5% significance levels. The exchange rate series demonstrates stationarity at both the level and first difference.

3.3 ARDL model estimation results

The ARDL model estimation results presented in Table 3 indicate statistical validity, supported by the significant Fisher statistic. Optimal lag lengths were determined as follows: 4 lags for economic growth, 4 for the exchange rate, 2 for the inflation rate, and 4 for the oil price. Consequently, the ARDL (4,4,2,4) specification emerges as the optimal model based on the Akaike Information Criterion (AIC).

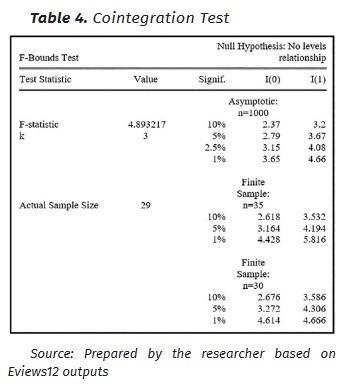

3.4 Cointegration test

This test relies on the possibility of a long-term equilibrium relationship between the study variables by using the bounds test, as shown in the following table:

The boundary test results (F-statistic = 4.89) exceed the upper critical values at all significance levels, as shown in Table 4. This leads us to reject the null hypothesis in favor of the alternative hypothesis, confirming a long-term cointegrating relationship among the study variables.

3.5 Diagnostic testing procedures

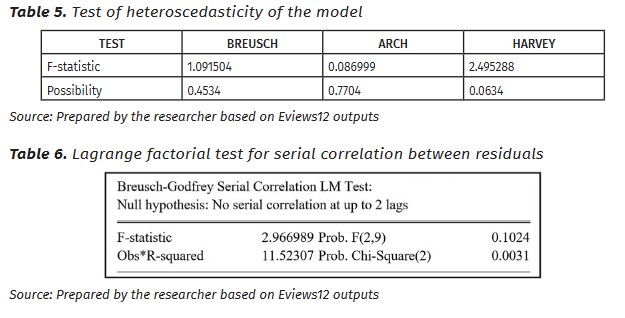

3.5.1 Heteroskedasticity testing

The Fisher probability statistics presented in Table 5 demonstrate statistical insignificance (p > 0.05) across all three test specifications, confirming the presence of homoskedasticity in the model residuals.

3.5.2 Serial correlation testing via the lagrange multiplier

We employ the Breusch-Godfrey test to examine residual autocorrelation, with the null hypothesis positing no serial correlation. The test utilizes Fisher’s statistic to evaluate this hypothesis.

The Fisher probability statistic (0.1024) exceeds the 5% significance threshold, leading us to accept the null hypothesis of no autocorrelation in the model residuals.

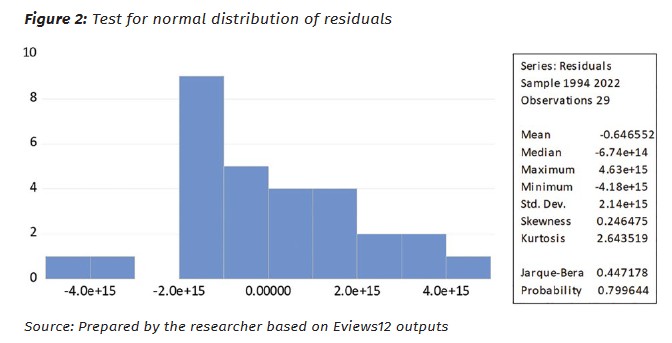

3.5.3 Test for normal distribution of residuals

The Jarque-Bera test statistic (0.799) exceeds the 5% significance level, leading to an acceptance of the null hypothesis and rejection of the alternative hypothesis regarding the non-normal distribution of model residuals. This indicates the residuals follow a normal distribution.

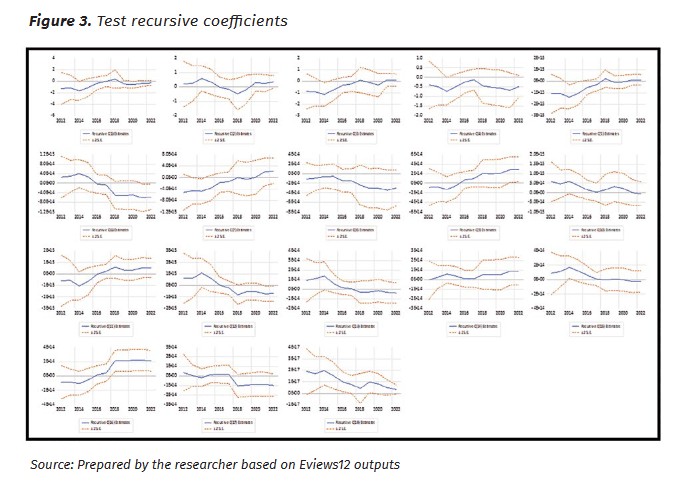

3.6 Structural stability test of parameters

The figure demonstrates that the model’s estimated coefficients maintain structural stability throughout the study period. This conclusion is supported by the test statistics remaining within the 5% significance critical bounds across all observations.

The figure demonstrates that the model’s estimated coefficients maintain structural stability throughout the study period. This conclusion is supported by the test statistics remaining within the 5% significance critical bounds across all observations.

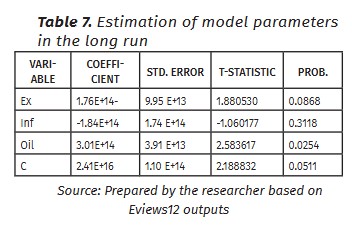

3.7 Estimation of long-term parameters

The results presented in Table 7 demonstrate significant long-run relationships between macroeconomic variables and economic growth in Algeria. Specifically, a 1% depreciation of the exchange rate leads to a 1.76% increase in economic growth, indicating an inverse relationship. Conversely, a 1% rise in oil prices corresponds with a 3.01% expansion of economic growth, showing a direct positive effect. The analysis also reveals that a 1% increase in the inflation rate results in a 1.84% contraction of economic growth, confirming an inverse relationship. These empirical findings are consistent with established economic theory and are supported by most econometric studies in this field.

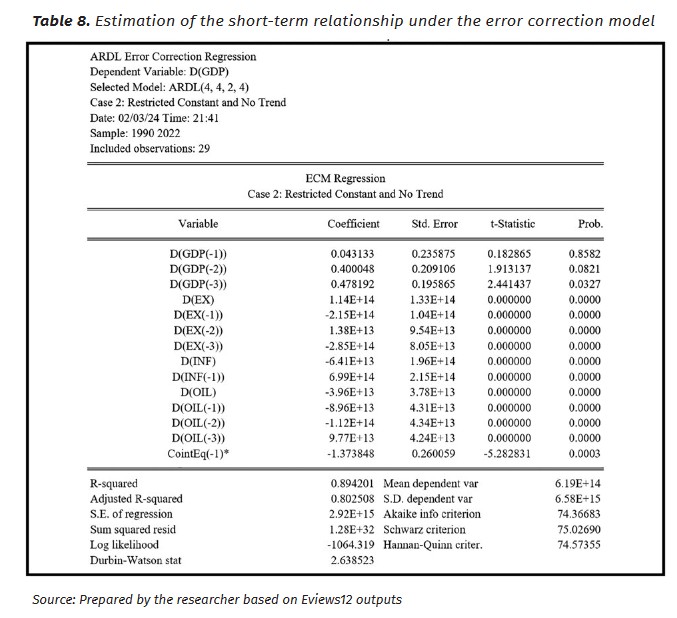

3.8 Estimating the Short-term Relationship within the Error Correction Model

The estimation results of the error correction model demonstrate a statistically significant (p-value = 0.0003) negative coefficient (-1.373848) for the error correction term (cointEq-1), indicating a robust short-run adjustment mechanism toward long-run equilibrium. The magnitude of the coefficient suggests that approximately 137% of short-run disequilibrium is corrected annually, implying an overshooting adjustment process. This finding confirms both the existence of a stable long-run relationship among the variables and a strong short-run dynamic interaction, as evidenced by the rapid and complete correction of deviations from equilibrium within a single period. The results are consistent with theoretical expectations regarding error correction mechanisms in cointegrated systems.

Conclusion

This study investigated the impact of exchange rates, inflation, and oil prices on Algeria's economic growth from 1990 to 2022 using the Autoregressive Distributed Lag (ARDL) model and EViews 12 software. The empirical findings reveal several key relationships:

First, the results confirm an inverse relationship between the exchange rate and economic growth. A depreciation of the Algerian dinar enhances export competitiveness and stimulates domestic production, thereby supporting economic expansion. Second, inflation exhibits a negative long-run impact on growth, as rising prices erode consumer purchasing power, suppress demand, and discourage investment. Conversely, oil prices demonstrate a positive relationship with economic growth, reflecting Algeria’s heavy dependence on hydrocarbon exports. Higher oil revenues enable increased government spending on development projects, fostering economic activity.

The econometric analysis yields the following specific findings:

- The bounds test confirms cointegration among the variables, indicating a stable long-run relationship;

- Inflation and exchange rates negatively affect economic growth in the long run;

- Oil prices positively influence economic growth in the long run;

- The model explains 91% of the variation in economic growth (R² = 0.91);

- The error correction term (-1.37) indicates rapid adjustment, with 137% of short-run disequilibria corrected annually;

- To promote sustainable growth, policymakers should consider;

- Implementing a flexible exchange rate regime to mitigate oil price volatility;

- Pursuing price-stability-oriented monetary policy;

- Accelerating economic diversification efforts;

- Improving the investment climate through governance reforms;

- Enhancing human capital through education and vocational training;

- These measures could help reduce Algeria’s vulnerability to external shocks while fostering more balanced and resilient economic development.

References:

Akhtar, H., Nisa, T. U. (2023). Impact of macroeconomic variables on economic growth: A mediation-moderation model evidence from Pakistan. Energy Research Letters, 4(1). Available at: <https://doi.org/10.46557/001c.67890>;

Al-Assar, R., Al-Sharif, A. (2000). Foreign trade. Dar Al-Masirah for Publishing and Distribution;

Al-Sharfat, A. J. (2010). Economic development in the Arab world (Reality, obstacles, and ways to advance). Dar Jaleelizzaman;

Alam, F. et al. (2022). Economic growth in Saudi Arabia through sectoral reallocation of government expenditures. SAGE Open, 12(4). Available at: <https://doi.org/10.1177/21582440221132129>;

Baba, Q. M. M. S. (2021). The Relationship Between the Inflation Rate, Exchange Rate Changes, and the Trade Balance in Sudan for the Period 1999–2017. Journal of Quantitative and Qualitative Research in Economic and Administrative Sciences, 03(02);

Bouzaher, S. (2018). The impact of hydrocarbon revenues on economic growth and governance [PhD thesis, University of Tlemcen];

Chowdhury, A. H. M. Y. (2019). Impact of macroeconomic variables on economic growth: Bangladesh perspective. Journal of Business and Economics, 2(2);

Dardouri, R., Sararma, A. W. (2021). The impact of oil prices on economic growth in Algeria for the period (1970-2020): An econometric study using the autoregressive distributed lag (ARDL) model. Journal of Economic and Financial Studies, 14(1);

Ghazzazi, I. (2020). Modeling Brent oil price volatility using autoregressive models conditioned on non-variance consistency for the period (January 1990-July 2019). Journal of Strategy and Development, 10(1);

Hawas, A. (2016). Economic openness to international trade and its impact on economic growth: The case of China [Ph.D. thesis, University of Tlemcen];

Kardosi, N. A. (2022). The effects of fiscal policy on economic growth in Algeria [Unpublished Ph.D. thesis, University of Maghnia-Tlemcen];

Kryeziu, A. (2016). The impact of macroeconomic factors on economic growth. European Scientific Journal, 12(7);

Lakhdari, I., Ghazazi, I. (2022). Econometric modeling of the impact of global oil price fluctuations on foreign exchange reserves in Algeria during the period (1990-2019). Journal of Contemporary Economic Research, 5(1);

Mjahdi, K., Elzaar, H. B. (2023). Measuring the Impact of Inflation on Economic Growth During the Period (1980–2020). Al-Academia Journal of Social and Human Studies, 15;

Mustafa, G., El-Nasser, H. M. (2019). The impact of monetary policy on economic growth in Algeria (An econometric study for the period 1990-2017). Journal of Finance and Markets, 5(10);

Naimi, A., Sheikhawi, A. A. (2022). The impact of oil price volatility on long-term economic growth in Algeria (1990-2020): An econometric study using the autoregressive distributed lag (ARDL) model. Journal of Economic Development, 7(1);

Nawali, S. (2018). The effects of dollar and euro fluctuations on foreign trade in Algeria, Morocco, and Tunisia [PhD thesis, University of Tlemcen];

Pesaran, M. H., Shin, Y. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3). Available at: <https://doi.org/10.1002/jae.616>;

Sulaiman, W. S. (2023). The impact of some macroeconomic variables on economic growth in Iraq for the period 2003-2019. AL-Anbar University Journal of Economic and Administrative Sciences, 15(1);

Tlemsani, H. (2018). The impact of the real exchange rate on economic growth in Algeria [Ph.D. thesis, University of Tlemcen];

Younes, T. B., Ahmed, S. (2021). The impact of monetary and fiscal policies on inflation rates amid oil price volatility: A case study of Algeria for the period 1990–2016. Journal of Strategy and Development, 11(01).

Footnotes

[1] Chowdhury, A. H. M. Y. (2019). Impact of macroeconomic variables on economic growth: Bangladesh perspective. Journal of Business and Economics, 2(2), pp. 19-22.

[2] Alam, F. et al. (2022). Economic growth in Saudi Arabia through sectoral reallocation of government expenditures. SAGE Open, 12(4), pp. 1-13. Available at: <https://doi.org/10.1177/21582440221132129>.

[3] Akhtar, H., Nisa, T. U. (2023). Impact of macroeconomic variables on economic growth: Mediation-moderation model evidence from Pakistan. Energy Research Letters, 4(1). Available at: <https://doi.org/10.46557/001c.67890>.

[4] Sulaiman, W. S. (2023). The impact of some macroeconomic variables on economic growth in Iraq for the period 2003-2019. AL-Anbar University Journal of Economic and Administrative Sciences, 15(1), pp. 32-44.

[5] Mustafa, G., El-Nasser, H. M. (2019). The impact of monetary policy on economic growth in Algeria (An econometric study for the period 1990-2017). Journal of Finance and Markets, 5(10), pp. 435-457.

[6] Kryeziu, A. (2016). The impact of macroeconomic factors on economic growth. European Scientific Journal, 12(7), pp. 331-345.

[7] Kardosi, N. A. (2022). The effects of fiscal policy on economic growth in Algeria [Unpublished Ph.D. thesis, University of Maghnia-Tlemcen].

[8] Tlemsani, H. (2018). The impact of the real exchange rate on economic growth in Algeria [Ph.D. thesis, University of Tlemcen].

[9] Hawas, A. (2016). Economic openness to international trade and its impact on economic growth: The case of China [Ph.D. thesis, University of Tlemcen].

[10] Al-Assar, R., Al-Sharif, A. (2000). Foreign trade. Dar Al-Masirah for Publishing and Distribution.

[11] Al-Sharfat, A. J. (2010). Economic development in the Arab world (Reality, obstacles, and ways to advance). Dar Jaleelizzaman.

[12] Nawali, S. (2018). The effects of dollar and euro fluctuations on foreign trade in Algeria, Morocco, and Tunisia [PhD thesis, University of Tlemcen].

[13] Bouzaher, S. (2018). The impact of hydrocarbon revenues on economic growth and governance [PhD thesis, University of Tlemcen].

[14] Naimi, A., Sheikhawi, A. A. (2022). The impact of oil price volatility on long-term economic growth in Algeria (1990-2020): An econometric study using the autoregressive distributed lag (ARDL) model. Journal of Economic Development, 7(1), p. 38.

[15] Dardouri, R., Sararma, A. W. (2021). The impact of oil prices on economic growth in Algeria for the period (1970-2020): An econometric study using the autoregressive distributed lag (ARDL) model. Journal of Economic and Financial Studies, 14(1), p. 413.

[16] Lakhdari, I., Ghazazi, I. (2022). Econometric modeling of the impact of global oil price fluctuations on foreign exchange reserves in Algeria during the period (1990-2019). Journal of Contemporary Economic Research, 5(1), p. 468.

[17] Ghazzazi, I. (2020). Modeling Brent oil price volatility using autoregressive models conditioned on non-variance consistency for the period (January 1990-July 2019). Journal of Strategy and Development, 10(1), pp. 91-111.

[18] Mjahdi, K., Elzaar, H. B. (2023). Measuring the Impact of Inflation on Economic Growth During the Period (1980–2020). Al-Academia Journal of Social and Human Studies, 15, 720–727.

[19] Baba, Q. M. M. S. (2021). The Relationship Between the Inflation Rate, Exchange Rate Changes, and the Trade Balance in Sudan for the Period 1999–2017. Journal of Quantitative and Qualitative Research in Economic and Administrative Sciences, 03(02), 93-120.

[20] Younes, T. B., Ahmed, S. (2021). The impact of monetary and fiscal policies on inflation rates amid oil price volatility: A case study of Algeria for the period 1990–2016. Journal of Strategy and Development, 11(01), 426–446.

[21] Pesaran, M. H., Shin, Y. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), pp. 289-326. Available at: <https://doi.org/10.1002/jae.616>.

Downloads

Downloads

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.