Asymmetric Effect of Monetary and Fiscal Policy Uncertainty on the Energy Transition: Evidence from the United States

DOI:

https://doi.org/10.35945/gb.2025.19.002Keywords:

Monetary policy, fiscal policy, energy transition, renewable energy, quantileAbstract

This research attempts to investigate how uncertainty in fiscal policy (FPU) and monetary policy (MPU) affects the US energy transition. While previous literature took the total renewable energy consumption (REC) as an indicator for the energy transition, this study uses different renewable energies across different sources, including solar, hydropower, wind, and biomass. Then, the novel multivariate quantile on quantile regression (MQQR) approach and time-varying nonparametric quantile causality (TVNQC) methods were applied in the period from 2000 to 2023. The MQOQ findings demonstrate a robust asymmetry between MPU, FPU, and all renewable energy sources, where MPU has the biggest impact, meanwhile, biomass energy has the strongest relationship. This was affirmed by TVNQC, which reveals a significant time-varying causation impact of MPU and FPU on various renewable energy sources; however, the causality becomes weaker during periods of global economic uncertainty, such as the COVID-19 pandemic and the Russia-Ukraine war. These findings provide a new insight for policymakers for addressing the energy transition and sustainability challenges.

Keywords: Monetary policy, fiscal policy, energy transition, renewable energy, quantile.

Introduction

Energy consumption served a crucial role in the expansion of different types of industries and the fast rise in the world economy ever since the start of the Industrial Revolution.[1] The bulk of this energy usage comes from polluting and non-renewable sources, it consequently caused an unheard-of increase in environmental degradation such as natural disasters, extreme weather events and greenhouse gases emissions,[2] With Carbon dioxide (CO2) represent the most significant component of greenhouse gases, making up the biggest proportion of their entire amount, where, the primary cause of the high CO2 emissions is the production and consumption of human’s activities.[3] Due to climate change and pollution consequences, the shift to renewable energy sources is rapidly gaining importance, whereas transitioning from one or a group of dominating energy resources to a different type is referred to as an “energy transition”. Historical instances include the use of coal instead of wood during the Industrial Revolution and the use of kerosene instead of whale oil in the late 1800s.[4] Meanwhile, the current energy transition is the move toward substituting fossil fuels, which have higher carbon footprints, with cleaner alternatives, notably wind, solar, and biomass energies. Nevertheless, it is uncommon to entirely replace a main source of energy transition by an alternate all at once, instead, this transition typically occurs progressively, beginning with a small percentage and increasing to attain a major portion of the energy consumption’s composition.[5]

In recent years, the world began to take significant steps towards energy transition, especially after the Paris Climate Change Agreement, with a massive investment push in the renewable energy generation sector, yet not as fast as anticipated, despite the proven advantages of renewable energy.[6] Besides of relatively low cost of fossil fuels, there are a number of challenges that impede the advancement of renewable energy. As an instance, the high expense of installation, maintenance, and policy uncertainty.[7] In light of policy uncertainty, policymakers may shift their attention away from environmental sustainability toward other pressing challenges, which negatively affect the environmental restrictions. Furthermore, it’s reasonable for firms to anticipate laxer environmental regulations in an environment where a high degree of political uncertainty leads to a greater emphasis on economic goals.[8] One of the most significant policy uncertainties that the energy transition may encounter is economic policy uncertainty (EPU), which is defined as the degree of ambiguity around the government policies, especially those pertaining to monetary and fiscal policies, that could significantly affect the business environment.[9] Moreover, many research, proved that EPU have significant impacts on energy generation (e.g.; Shafiullah et al.;[10] Yi et al.;[11] Aslan et al.[12]), through price swings and a high reliance on foreign countries, additionally, the renewable energy generation and consumption proportions in a given economy could be influenced by government policies, such as subsidies and direct investment, which aim to improve the macroeconomic climate for energy supply, as both proportions increase due to the increased in energy sector investments. However, EPU has the potential to hinder renewable energy generation through price shocks and fossil fuel shortages.

In contrast to other energy sources, the consumption of renewable energy is directly impacted by governmental policies, particularly monetary policy through its impacts on financial investments. Monetary policy can make it more difficult for investors to get financing and raise the initial cost of investing, as well as the bank lending channel, which rises in response to an increase in the money supply and consequently boosts investments. Given that investing in renewable energy is more expensive and riskier than conventional energy sources, it is extremely susceptible to changes in monetary policies.[13] Fiscal policy, on the other hand, is predicated on altering the level of the country’s tax base. Tight fiscal policies have the potential to deter investors, and capital provision would continue to be a barrier by increasing the investors’ access to capital costs. However, the renewable energy industry stands to benefit from the lax policies, which present a favorable investment opportunity.[14] Overall, monetary and fiscal policies are both directly and indirectly related to environmental quality, through their significant role in the mitigation of CO2 emissions and financing the world’s energy transition.[15] Furthermore, the renewable energy sector comprises the various categories of the energy sources, in each of which has its properties or behavior to policy measures, where recent studies have highlighted significant heterogeneities within these energy sectors (e.g. Jurasz et al.;[16] Liu et al.;[17] Sinha et al.[18]). Hence, it is important to recognize the heterogeneous nature of renewable energy sources when formulating policies, where understanding how policy uncertainties differentially impact various renewable energy sectors is critical for both policymakers and investors aiming to foster sustainable energy development. Additionally, tailored policy interventions that account for the distinct characteristics of each energy source can enhance the effectiveness of renewable energy policies and promote a more efficient transition to sustainable energy systems.

Despite the growing literature on the nexus between policy uncertainty and renewable energy consumption, most existing studies tend to aggregate overall renewable energy consumption (REC) data, potentially overlooking the distinct dynamics present within individual energy sources. The research fills an important knowledge gap through separate analysis of renewable energy’s main consumption areas, including solar and hydropower and wind power, and biomass. Moreover, the complex interplay between monetary policy uncertainty (MPU) and fiscal policy uncertainty (FPU) and their effects on energy transition indicators has received limited academic attention. Most of the prior research focused on how policy uncertainty affected overall renewable energy consumption (REC), with limited attention to the asymmetric impact on various policies and how they affect energy transition. Hence, the current research looks at the effects of MPU and FPU on different types of renewable energy. The United States was selected for examination in this study, due to it is both the biggest economy and the second-highest carbon emitter in the world. Additionally, it ranks among the top countries in the world for the REC (Syed & Bouri, 2022), as it has come a long way in its energy transition, due to its significant development in the renewable energy sector. Yet, the REC makes around only 11.3% of total energy consumption. Additionally, the study also makes use of the novel multivariate quantile on quantile regression (MQQR) and time-varying nonparametric quantile causality (TVNQC) approaches. With these methodologies, the impact of MPU and FPU on each of the renewable energy segments is examined with a high degree of detail. These approaches offer more robust evidence on the heterogeneity of the impacts of monetary and fiscal uncertainties across the different sectors of energy by considering disaggregate renewable energy data and using quantile regression models, which goes much deeper into the nature of the energy transition, and reveals the unequal exposure and associated different vulnerabilities and resilience of those sectors dependent on solar, hydropower, wind and biomass consumption. Meanwhile, the time-varying analysis allows for the uncovering of the dynamic nature of these causal relationships, which can reveal how the strength and direction of policy impacts can shift significantly over different periods.

Here is the structured overview of this paper: Section 2, summarizes the relevant literature on the subject. Section 3, details the study’s methodology and dataset, Section 4 contains the empirical results and associated discussions, and the final section offers some concluding comments and implications for policies.

- Literature Review

The global energy transition has recently received more attention from researchers considering the urgent need to address climate change and promote sustainable development (e.g. Tian et al.;[19] Elshkaki;[20] Hassan et al.[21]). In the context of the U.S energy transition, the literature researchers have examined this subject from various perspectives over the years. Solomon & Krishna[22] compared the United States with France and Brazil in terms of sustainable energy transition. Unlike the success of France and Brazil in shifting from an oil-based transportation system to more sustainable alternatives, the U.S. was unable to transition from imported oil to a combination of locally produced energy sources. O’Connor & Cleveland[23] studied the U.S. energy transition by analyzing the patterns of the consumption of different energy sources. They reveal that, when traditional energy is taken into account, energy intensity in the United States from 1820 to 2010 shows a downward tendency, as opposed to the inverse U-shaped nexus observed when just commercial energy is taken into account. Stokes & Breetz[24] analyzed the impact of the politics of U.S. state and federal policy on energy transition, using a variety of renewable energy sectors. The finding shows that Similar trends can be observed in various industries: emerging technology is misappreciated or misinterpreted, high-energy costs present windows of opportunity for legislation, Policies are gradually expanded once they are enacted, and growing political intrigue is a result of established technology’s danger to the status quo. The study of Mayer[25] investigated whether community economic identity, elite political affiliation, and ideological cues raise the support for energy transition in multiple U.S. states. Study findings indicate that local policymakers who see fossil fuels as relevant to their area are more likely to back the energy transition, although community economic identities centered around renewable energy sources might not increase endorsement. Surprisingly, elite partisan cues did not affect opinions of the energy transition, while party membership was a strong predictor. Karapin[26] analyzed several eras of renewable energy policymaking at the federal and state levels. A detrimental impact of federalism was found on national policies pertaining to the U.S energy transition, given the way its federalist institutions combine with polarization within the parties and a robust fossil fuel sector domestically. Similarly, Roemer & Haggerty[27] evaluated how state and federal policy in the United States West’s rural coal communities facilitate or impede transition planning. It is discovered that Coal areas are shown to be more unpredictable due to the absence of a national energy transition program, leading to the emergence of two separate and divergent policy pathways at the state level. Hammond & Brady[28] analyzed how critical minerals affect the U.S. energy transition using greenhouse gas emissions. They found that the availability of critical minerals will not allow for the green energy transition, and that the price of these commodities will drive up the cost of green energy; moreover, the U.S. government will persist in obstructing any agreement on a clear strategy to promote domestic mineral production. Hincapie-Ossa et al[29] assessed the county-level economic vulnerability to U.S. energy transition, using a machine learning method. The results show that counties with a high concentration of coal mining have a notably lower capacity to handle economic hardship. Using a multivariate quantile on quantile regression, Usman et al[30] examined how residential energy use affects U.S energy transition policies. The findings show that the clean electricity transition across quantiles is positively impacted by household energy-related efficiency.

Despite the existence of literature that covered the effect of EPU on U.S. energy transition (e.g., Nakhli et al.;[31] Ayhan et al.;[32] Husain et al.;[33]). The literature is still limited in terms of monetary and fiscal policies on REC. Sohail et al[34] investigated asymmetry between MPU and both REC and non-REC, using a nonlinear-ARDL model. The findings show that whereas reduced MPU has a considerable positive impact on U.S. REC, yet, MPU’s measurement has negligible effects over the short and long terms. While it has short- and long-term negative effects on non-REC, when there is increasing U.S. monetary policy uncertainty. Jamil et al[35] used the ARDL approach to analyze the effect of MPU, FPU, and trade policy uncertainty on the U.S. energy transition. They found that whereas FPU increases the generation of renewable energy, MPU decreases it both in the short and long terms. Furthermore, the production of renewable energy is unaffected by trade policy uncertainties. Hashmi et al[36] studied the relationships between U.S monetary policy and REC. The results show that expansionary monetary policy encourages REC in both the long- and short-term and vice versa. Additionally, monetary policy has a rather large impact in the short term. By applying the STIRPAT approach, Sun et al.[37] examined how monetary and fiscal policy affected the G7 nations’ REC. The empirical findings indicate that the increased fiscal policy contributes significantly to REC. Where Bildirici et al[38] analyzed the U.S. monetary and fiscal policy causal impact on CO2 emissions as an indicator of U.S. energy transition using a nonlinear bootstrapping ARDL to generalize the nonlinear bootstrapping Granger causality test. The results reveal that monetary and fiscal policy exhibit an asymmetrical impact in both the short and long run. While the contractionary or expansionary effects of fiscal measures raise CO2 emissions, the expansion of monetary policies drives down CO2 emissions.

In general, the prior research regarding the effects of MPU and FPU on REC that we highlight in this paper has provided mixed findings, where REC has often been considered a single variety. Meanwhile, looking at the evolution of renewables specifically, the market for renewable energy sources is quite diverse, which means that the market for one source may react differently to changes in policy compared to another source. On the other hand, while some studies have begun to address these issues, there is a clear need for further research employing advanced econometric techniques such as multivariate quantile on quantile regression and time-varying nonparametric quantile causality, that can capture both the asymmetric and dynamic nature of policies impacts across various quantiles of different sources of REC. Addressing this gap would provide a more granular understanding of how distinct facets of policy uncertainty shape the energy transition practically in the U.S., ultimately offering more precise insights for policymakers and investors.

- Methodology

2.1. Data

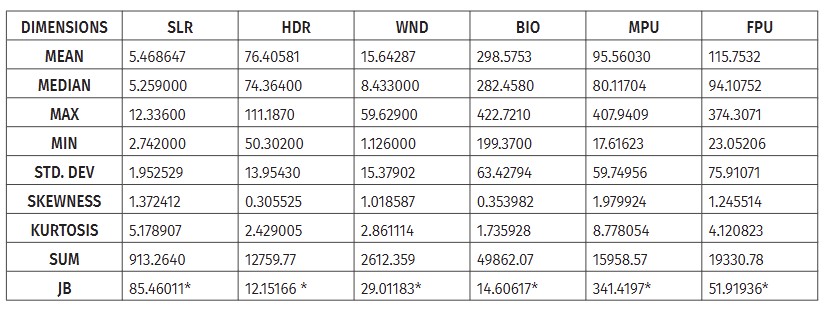

Table 1: Descriptive statistics

Note: * stands for P<0.01.

Source: Author’s research in R-studio.

The research dataset contains different renewable energy consumption of the four main sources, obtained from U.S. Energy Information Administration, namely, solar (SLR), hydropower (HDR), wind (WND), and biomass (BIO), all measured in Trillion BTU. In addition to the Monetary Policy Uncertainty index (MPU) and Fiscal Policy Uncertainty index (FPU), collected from Federal Reserve Economic Data. Monthly data was used for all variables within the U.S., in the period from January 2000 to November 2023, with 287 Observations, as displayed in Table 10.

2.2. Empirical methods

2.2.1. MQOQ method

The study analyzed the asymmetric effect of MPU and FPU on REC as a proxy for energy transition by applying the MQQR approach, which was employed in many recent studies about renewable energy (e.g., Sinha et al;[39] Abbas et al;[40] Usman et al.[41]). This approach is considered an extension of Sim & Zhou’s[42] quantile on quantile regression (QQR), which functions in a bivariate frame and provides a combination of nonparametric estimation and quantile regression. Nevertheless, there’s a possibility that this approach will suffer from omitted series bias. Meanwhile, MQOQ approach enables to examination of the standalone impact of each variable after controlling for confounding factors, by evaluating the dependent and independent variables’ quantiles.

With Y as the dependent variable and X1, X2 ... Xn as the independent variables, the MQQR model for the Y and X relationship across different quantiles (0,05-0,95) can be described as follows:

Where: represent the quantiles of X1, X2 ... Xn respectively, indicates the quantile of Y, and is the error with a zero –quantile. Since the QQR method relies on the bandwidth size being appropriately picked, we will next set it to 0.05 for our MQQR models.

2.2.2. TVNQC method

Following Adebayo,[43] this study uses the time-varying nonparametric quantile causality (TVNQC) method presented by Olasehinde-Williams et al. (2023), which uses the time-varying nonparametric quantile causality (NQC) approach of Balcilar et al. (2016) in rolling sub-sample windows to analyze the study’s dependent and independent variables’ dynamic causal relationship. This method offers a more comprehensive view of the causal quantile effect among the study variables and exhibits greater robustness against errors of misspecification (Mouffok & Mouffok[44]).

- Results and Discussion

3.1. Unit root and nonlinear tests

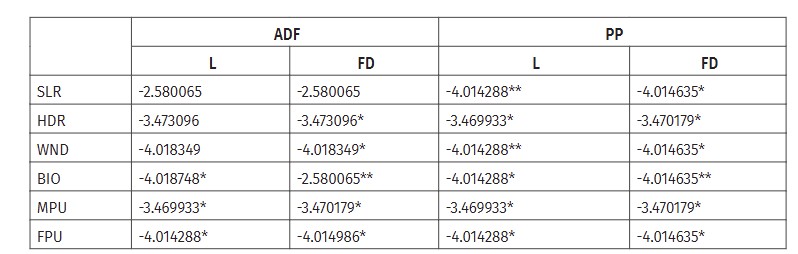

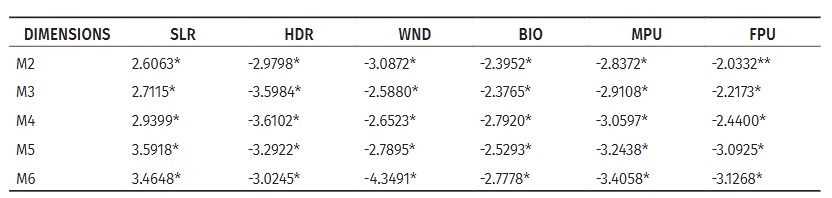

Firstly, we ascertain the variables’ levels of stationarity using Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) as two distinct unit root tests in order to obtaining accurate results. According to the findings of the tests listed in Table 2, the null hypothesis can be rejected in the level series at the 1% level of significance, except for SLR and WND, where their stationarity can be confirmed at the 5% level of significance.

Table 2: Unit root tests

Note: L, FD, * and ** stand for level, first difference, P<0.01, and P<0.05, respectively.

Source: Author’s research in R-studio

Brock et al.[45] BDS test is employed to assess nonlinearity of the study variables. Based on the results of Table 3, the null hypothesis of linearity for all the variables is rejected, as such, there is a nonlinear tendency in SLR, HDR, WND, BIO, MPU and FPU.

Table 3: BDS tests

Note: * stands for P<0.01.

Source: Author’s research in R-studio

3.2. MQQR results

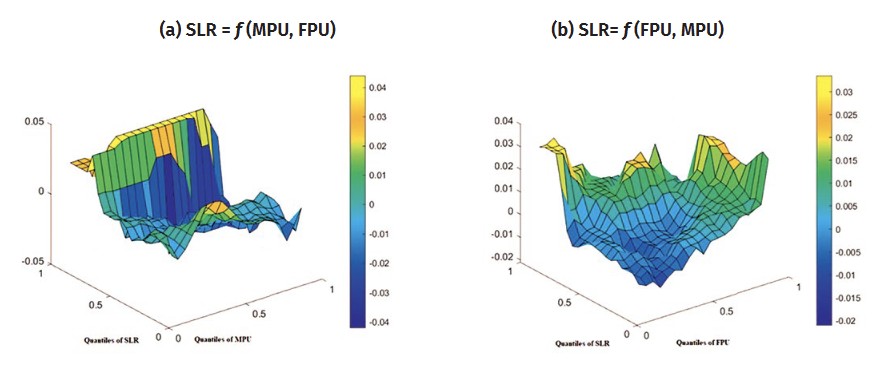

Figure 1: MQQR plots of the impact of MPU and FPU on SLR

Source: Author’s research in MATLAB

Figure 1 presents the slope coefficient estimates of the impact of the τth quantile of MPU in the presence of FPU and of FPU in the presence of MPU on the quantile of SLR at various values of δ and τ. According to Figure 2 (a), MPU has a positive impact on SLR at the low quantiles of MPU (0.23 to 0.43) and the high quantiles of SLR (0.66 to 0.90). This finding suggests that when the level of MPU is relatively low, any increase in uncertainty may actually coincide with or even promote higher levels of solar energy consumption, perhaps reflecting a scenario where low uncertainty encourages investment in renewable energy projects at times when the solar sector is already performing strongly. Conversely, when the analysis shifts to the higher MPU, it has a negative impact on SLR at the high quantiles of MPU (0.80 to 0.90) and the medium and high quantiles of SLR (0.66 to 0.90). This inversion could indicate that when monetary policy uncertainty is elevated, it dampens solar energy investments or adoption, especially in segments of the market that are otherwise robust, possibly due to risk aversion or tighter credit conditions affecting capital-intensive renewable projects. In addition. Figure 2 (b) shows that at the low and medium quantiles of FPU (0.05 to 0.50), the impact of FPU on SLR is negative at low and medium quantiles of SLR (0.05 to 0.52) and positive at the high quantiles of SLR (0.57 to 0.90). This pattern might suggest that, under relatively stable fiscal conditions, increases in uncertainty can have a dual character, suppressing solar energy consumption when the sector is underperforming but stimulating it when the sector is already in a high-consumption phase, potentially due to strategic adjustments by market participants who perceive uncertainty as a signal to capitalize on favorable conditions. While at the high quantiles of FPU (0.71 to 0.90), the impact of FPU on SLR is positive at the low and medium quantiles of SLR (0.05 to 0.61) and negative at the high quantiles of SLR (0.76 to 0.90). This reversal could imply that under conditions of high fiscal uncertainty, lower-performing segments of the solar energy market might experience a boost, possibly due to government interventions or reallocation of resources—while the sectors already enjoying high levels of solar consumption become adversely affected, perhaps due to market saturation or increased competition for limited fiscal support. The findings confirm the previous studies (e.g., Sohail et al.;[46] Khan & Su;[47] Liu et al.[48]).

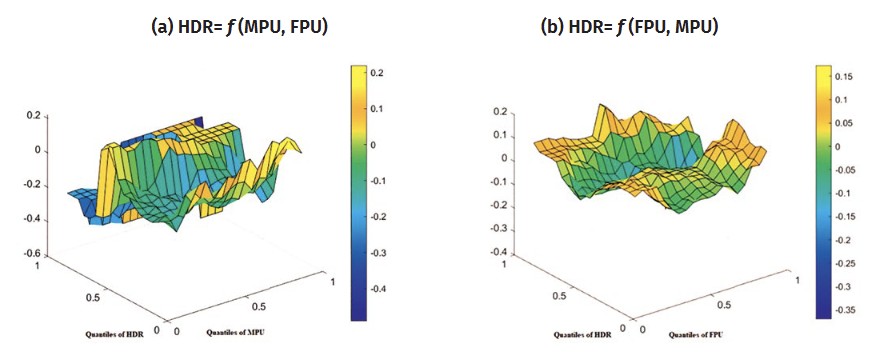

Figure 2: MQQR plots of the impact of MPU and FPU on HDR

Source: Author’s research in MATLAB

Figure 2 shows the slope coefficient estimates of the impact of the τth quantile of MPU in the presence of FPU and of FPU in the presence of MPU on the quantile of HDR at various values of δ and τ. From Figure 3 (a), we note that the HDR was positively impacted by MPU at all quantile levels of MPU (0.19 to 0.90) and the medium quantiles of HDR (0.47 to 0.71). This suggests that during periods of medium hydropower consumption, increases in MPU are associated with enhanced HDR activity. One interpretation of this finding is that, under moderate levels of hydropower usage, monetary uncertainty might encourage a reallocation of capital towards renewable energy investments, thereby bolstering hydropower initiatives. Also, it was negatively impacted by MPU at the low and high quantiles of HDR (0.14 to 0.42; 0.76 to 0.90). This could be indicative of scenarios where either a low base level of hydropower consumption or an already saturated market becomes more vulnerable to the destabilizing effects of monetary uncertainty. In low-consumption settings, even modest uncertainty might deter further investment, while in high-consumption scenarios, the added uncertainty might constrain additional expansion by heightening risk perceptions among investors. In Figure 3 (b), MPU has a positive impact on HDR at the low and high quantiles of MPU (0.05 to 0.33, 0.61 to 0.90) and the low and high quantiles of HDR (0.05 to 0.42, 0.76 to 0.90). This positive relationship may imply that in conditions of relatively low or very high fiscal uncertainty, perhaps hydropower consumption benefits through targeted policy measures or compensatory investments that offset uncertainty. Meanwhile, it has a negative impact on HDR at the medium quantiles of MPU (0.38 to 0.71) and SLR (0.47 to 0.71). This negative impact at moderate levels might signal that during periods of middling fiscal uncertainty, the market experiences conflicting signals that lead to hesitancy or misallocation of resources, thereby stifling hydropower development. These results are consistent with prior studies (e.g., Xue et al.;[49] Yi et al.;[50] Dai et al. 2025[51]).

Figure 3: MQQR plots of the impact of MPU and FPU on WND

Source: Author’s research in MATLAB

Figure 3 presents the slope coefficient estimates of the impact of the τth quantile of MPU in the presence of FPU and of FPU in the presence of MPU on the quantile of WND at various values of δ and τ. Figure 4 (a) shows that at the medium quantiles of WND (0.51 to 0.57), the impact of MPU on WND is positive. This suggests that under moderate levels of WND, an increase in MPU might spur investment or operational activity in wind energy. This could be interpreted as market participants perceiving moderate uncertainty as a precursor to potential corrective actions or policy adjustments that might benefit the wind energy sector. Yet, the impact becomes negative at the low quantiles of WND (0.05 to 0.41) and at the medium and high quantiles of MPU (0.47 to 0.90), indicating that when wind energy consumption is already at a subdued level or medium to high level of MPU, any increase in monetary uncertainty may exacerbate investor hesitancy or reduce the flow of capital necessary for growth in the sector. Meanwhile, the impact of FPU on WND at the all-quantiles levels of FPU and WND is positive, with the highest and most significant impact at the high quantiles of FPU (0.80 to 0.90) and the low quantiles of WND (0.05 to 0.19), as shown in Figure 4 (b). the consistently positive impact across all quantiles suggests that fiscal policy uncertainty may catalyze enhancing wind energy consumption, potentially by fostering a reallocation of resources towards more sustainable and economically viable energy alternatives in times of fiscal unpredictability, which minimize the shifting to non-renewable alternatives and support the investment in wind energy than other renewable sources (Johnston & Yang;[52] Chen[53]).

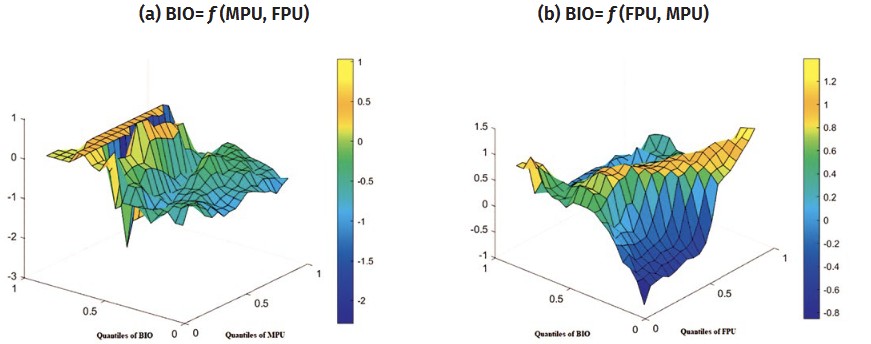

Figure 4: MQQR plots of the impact of MPU and FPU on BIO

Source: Author’s research in MATLAB

Figure 4 demonstrates the slope coefficient estimates of the impact of the τth quantile of MPU in the presence of FPU and of FPU in the presence of MPU on the quantile of BIO at various values of δ and τ. Figure 5 (a) outcomes show that MPU has a negative impact on BIO at the all quantiles levels of MPU (0.05 to 0.90) and the low and high quantiles of BIO (0.05 to 0.47; 0.61 to 0.71) This suggests that when biomass consumption is either relatively low or within a specific high range, increased monetary uncertainty tends to depress investment or operational activities in the biomass sector. It is conceivable that in these segments, heightened MPU exacerbates risk aversion among investors or signals tighter credit conditions, thus leading to reduced capital flows into biomass projects. While the relationship reverses at the medium and high quantiles of BIO (0.66 to 0.71, 0.76 to 0.90). This implies that when the biomass consumption is high, increased monetary uncertainty might spur a reallocation of resources or foster a competitive environment that benefits the biomass sector. This positive effect could be interpreted as market participants perceiving uncertainty as an opportunity to shift investments towards biomass, possibly due to its relative resilience or because of supportive measures that come into play during periods of heightened monetary instability. Figure 5 (b) affirms that at the low quantiles of FPU (0.05 to 0.41), suggesting that even in relatively stable fiscal environments, the increases in FPU can have a dampening effect on biomass consumption when the sector is already underperforming. The impact of FPU on BIO is positive at medium and high quantiles of BIO (0.42 to 0.90) and it’s negative at the low quantiles of BIO (0.05 to 0.42). This hints that when biomass consumption is more robust, the increases in fiscal uncertainty may be associated with proactive adjustments, while in more uncertain fiscal settings, even the lower-performing BIO might benefit from targeted fiscal interventions or a rebalancing of resource allocation. For the low medium and high quantiles of FPU (0.41 to 0.90), the impact of FPU on BIO is positive at low quantiles of BIO (0.05 to 0.42) and it’s negative at the medium and high quantiles of BIO (0.42 to 0.90), which implies that for the periods that already exhibiting higher levels of biomass consumption, increased fiscal uncertainty may hinder further growth, possibly due to market saturation or the adverse effects of broader economic instability. These outcomes are in line with past studies (e.g., Zhang & Razzaq;[54] Qamruzzaman et al.[55]).

Overall, the MPU and FPU have an asymmetric relationship with different U.S REC sources at the majority of combinations of quantiles. In particular, MPU exerts the most pronounced and multifaceted influence on the U.S. energy transition, where MPU tends to have substantial positive or negative impacts on REC depending on the prevailing market conditions. Meanwhile, FPU also affects these energy sources, yet its effects are generally less dramatic than those of MPU. Moreover, biomass energy consistently shows the strongest relationship with both MPU and FPU.

3.3. TVNQC results

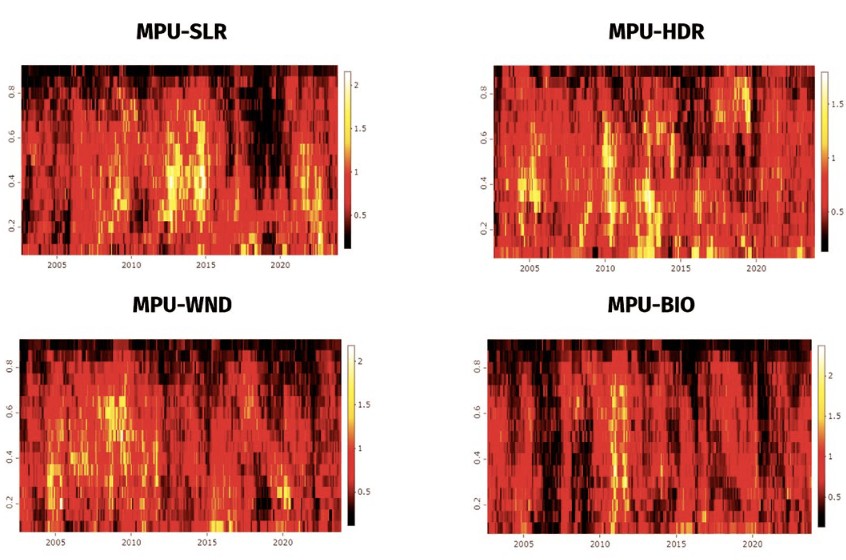

The study applies the time-varying nonparametric quantile causality (TVNQC) to determine the causal influence of MPU and FPU on SLR, HDR, WND, and BIO in the US, using a rolling window size of 3 years. Figure 5 presents the time-varying causal impact of MPU on SLR, HDR, WND, and BIO. We note that the time-varying causality between MPU and renewable energies consumption is concentrated at the all-quantiles levels (0.10 to 0.90). This wide distribution indicates that the effect of MPU permeates nearly all levels of renewable energy consumption, reflecting the pervasive nature of monetary uncertainty across different market conditions. Notably, the causality exhibits significant temporal variation, with marked intensification during the 2005-2009 and 2011-2015 periods. These intervals likely coincide with episodes of heightened macroeconomic turbulence, such as the global financial crisis and subsequent recovery phases, when fluctuations in monetary policy were more pronounced and, as a result, had a stronger spillover effect on investment decisions and operational activities within the renewable energy sector. Conversely, the period from 2020 to 2023 shows a weakened causal relationship, suggesting that recent developments, including shifts in the global economic environment, changes in policy frameworks, or evolving market conditions, have mitigated the influence of monetary policy uncertainty on renewable energy investments. Furthermore, SLR emerges as the most sensitive to MPU fluctuations, displaying the highest level of causality. This pronounced sensitivity could be attributed to the capital-intensive nature of solar projects and the sector’s reliance on rapidly evolving technological and financial conditions, which make it more reactive to shifts in monetary policy. On the other hand, HDR shows the lowest causality with MPU, suggesting a relative insensitivity that might stem from the mature, long-term infrastructure characteristic of hydropower projects, which are typically less vulnerable to short-term monetary fluctuations. This confirms the prior research (e.g., Lu et al.;[56] Li et al.;[57] Wang et al.[58]).

Figure 5: TVNQC plots of causal impact of MPU on SLR, HDR, WND, and BIO.

Source: Author’s research in R-studio

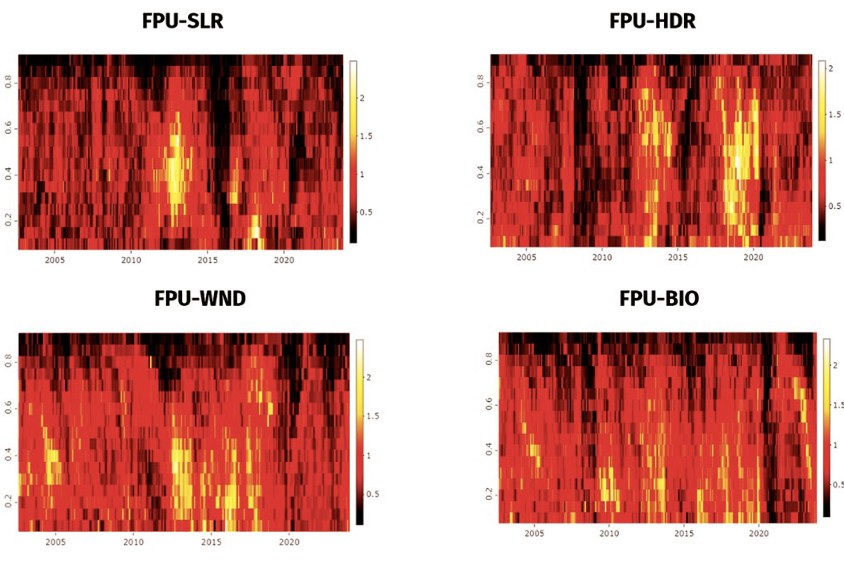

Figure 6 shows the time-varying causal impact of FPU on SLR, HDR, WND, and BIO. The results display that the time-varying causality between FPU and renewable energies consumption is appearing at the low, medium, and high quantiles (0.15 to 0.80). This broad range implies that fiscal policy uncertainty does not solely affect extremely low or high consumption levels; rather, its impact is distributed across the entire consumption spectrum. However, the causality is not static over time. Instead, it exhibits clear temporal fluctuations, with pronounced periods of stronger causality during 2011–2015 and again in 2017–2019. These intervals may correspond to periods when fiscal policy was undergoing significant shifts or when macroeconomic conditions heightened fiscal risks, thereby exerting more substantial influence on investment decisions and consumption patterns within the renewable energy sectors. Meanwhile, the period from 2020 to 2023 is characterized by a relatively weaker causal linkage, possibly reflecting the sensitivity of the causal nexus between FPU and REC to the changes in policy responses, market destabilization, global economic crisis, and rising geopolitical risks. Among the four energy types, BIO exhibits the strongest causal relationship with FPU, suggesting that fluctuations in fiscal uncertainty are most keenly felt in the biomass sector. This heightened sensitivity may be due to the capital-intensive and policy-dependent nature of biomass investments, where fiscal signals play a critical role in driving financing decisions and operational adjustments. In contrast, SLR shows the weakest causal connection with FPU, indicating that the solar sector might be less vulnerable to fiscal uncertainty, potentially due to more diversified financing structures, technological advancements, or stronger policy support that cushions against fiscal fluctuations. These findings coincide with past studies research (e.g., Su et al.;[59] Wang et al.;[60] Zhao et al.[61])

Figure 6: TVNQC plots of the impact of FPU on SLR, HDR, WND, and BIO.

Source: Author’s research in R-studio

Conclusion

The present research delves into the asymmetric impact of monetary and fiscal policy uncertainty on energy transition in the United States, using U.S renewable energy consumption from solar, hydropower, wind and biomass as proxy US energy transition, with monthly data spanning from January 2000 to November 2023, by applying the multivariate quantile on quantile approach (MQOQ) and time-varying nonparametric quantile causality (TVNQC) approaches. The MQOQ results show that U.S. monetary and fiscal policy uncertainty indexes have a significant asymmetric impact on different renewable energy consumption, where the monetary policy uncertainty index has the bigger impact, while renewable energy consumption from biomass has the strongest relationship with monetary and fiscal policy uncertainty indexes than the author’s sources. The TVNQC outcomes reveals a strong time-varying causality of U.S. monetary and fiscal policy uncertainty indexes with all renewable energies consumption sources, except for the period of covid-19 and Russia-Ukraine war (2020-2023), whereas biomass source shows a stronger causality with US monetary and fiscal policy uncertainty indexes respectively than the author renewable energies sources.

The implications of this result are crucial for policymakers and investors involved in shaping transformation plans in the U.S. energy sector. First, policymakers should design tailored incentives for each sector. For example, targeted subsidies or tax credits could be implemented for solar projects during periods of high monetary uncertainty, while biomass sectors might benefit more from direct fiscal support, as well as adopting frameworks that can adjust monetary and fiscal measures in real time based on market conditions. Additionally, the dynamic causal nexus between policy uncertainty and renewable energy consumption can help authorities design policies that are more resilient during economic stress and capitalize on periods of stability. Moreover, by tailoring interventions to both the sector and the prevailing economic conditions, policymakers can better support long-term investments in renewable energy. Second, investors should diversify their investments across different renewable energy sectors can help to mitigate risks associated with policy fluctuations, also adjust their strategies in anticipation of future turbulent periods by increasing hedging measures or reallocating assets to more resilient sectors. Furthermore, by implementing flexible and dynamic strategies, investors can take advantage of both uncertain and certain periods to invest in renewable energy and capitalize on the entire energy transition.

Even though the current study advances the understanding of how monetary and fiscal policy uncertainty affects the US energy transition, some limitations need to be acknowledged. For example, the analysis is focused mainly on the United States and a specific set of renewable energy sources. Future research could extend the analysis by generalizing the findings a cross-country framework or using sector-specific renewable energy consumption. Additionally, although the MQOQ and TVNQC approaches are powerful in uncovering nonlinear and asymmetric effects, they are limited in terms of dynamic impact analysis. Researchers can employ alternative methods, such as wavelet analysis or other dynamic quantile approaches. Lastly, the study does not account for other macroeconomic factors (e.g., technological innovations, global energy prices, international policy spillovers), which can be done by future studies to add more clarification to the impact of monetary and fiscal policy uncertainty on the U.S energy transition.

Bibliography:

- Abbas, S., Saha, T., Sinha, A. (2024). Price response of top-five renewable energy firms to Russia-Ukraine conflict: An advanced quantile analysis to achieve net-zero in United States of America. Journal of Cleaner Production;

- Adebayo, T. S. (2024). Do uncertainties moderate the influence of renewable energy consumption on electric power CO2 emissions? A new policy insight. International Journal of Sustainable Development & World Ecology, 31(3);

- Adedoyin, F. F., Zakari, A. (2020). Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Science of the Total Environment, 738;

- Aslan, A., Ilhan, O., Usama, A. M., Savranlar, B., Polat, M. A., Metawa, N., Raboshuk, A. (2024). Effect of economic policy uncertainty on CO2 with the discrimination of renewable and non renewable energy consumption. Energy, 291;

- Ayhan, F., Kartal, M. T., Kılıç Depren, S., Depren, Ö. (2023). Asymmetric effect of economic policy uncertainty, political stability, energy consumption, and economic growth on CO2 emissions: evidence from G-7 countries. Environmental Science and Pollution Research, 30(16);

- Bildirici, M., Çırpıcı, Y. A., & Ersin, Ö. Ö. (2023). Effects of Technology, Energy, Monetary, and Fiscal Policies on the Relationship between Renewable and Fossil Fuel Energies and Environmental Pollution: Novel NBARDL and Causality Analyses. Sustainability, 15(20);

- Broock, W. A., Scheinkman, J. A., Dechert, W. D., LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric reviews, 15(3);

- Carley, S., Konisky, D. M. (2020). The justice and equity implications of the clean energy transition. Nature Energy, 5(8);

- Chen, L. (2024). The Dynamic Efficiency of Policy Uncertainty: Evidence from the Wind Industry. Working Paper;

- Chen, P. Y., Chen, S. T., Hsu, C. S., Chen, C. C. (2016). Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renewable and Sustainable Energy Reviews, 65;

- Chu, L. K., Le, N. T. M. (2022). Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: the case of G7 countries. Environmental Science and Pollution Research, 29(2);

- Dai, J., Farooq, U., Alam, M. M. (2025). Navigating energy policy uncertainty: Effects on fossil fuel and renewable energy consumption in G7 economies. International Journal of Green Energy, 22(2), 239-252;

- Elshkaki, A. (2023). The implications of material and energy efficiencies for the climate change mitigation potential of global energy transition scenarios. Energy, 267;

- Fouquet, R. (2016). Historical energy transitions: Speed, prices and system transformation. Energy research & social science, 22;

- Fu, H., Guo, W., Sun, Z., Xia, T. (2023). Asymmetric impact of natural resources rent, monetary and fiscal policies on environmental sustainability in BRICS countries. Resources Policy, 82;

- Hammond, D. R., & Brady, T. F. (2022). Critical minerals for green energy transition: a United States perspective. International Journal of Mining, Reclamation and Environment, 36(9);

- Hashmi, S. M., Bhowmik, R., Inglesi-Lotz, R., Syed, Q. R. (2022). Investigating the Environmental Kuznets Curve hypothesis amidst geopolitical risk: Global evidence using bootstrap ARDL approach. Environmental Science and Pollution Research, 29(16);

- Hashmi, S. M., Syed, Q. R., Inglesi-Lotz, R. (2022). Monetary and energy policy interlinkages: The case of renewable energy in the US. Renewable Energy, 201;

- Hassan, Q., Viktor, P., Al-Musawi, T. J., Ali, B. M., Algburi, S., Alzoubi, H. M., et al. (2024). The renewable energy role in the global energy Transformations. Renewable Energy Focus, 48;

- Hincapie-Ossa, D., Frey, N., Gingerich, D. B. (2023). Assessing county-level vulnerability to the energy transition in the United States using machine learning. Energy Research & Social Science, 100;

- Husain, S., Sohag, K., Wu, Y. (2024). The responsiveness of renewable energy production to geopolitical risks, oil market instability and economic policy uncertainty: Evidence from United States. Journal of Environmental Management, 350;

- Jamil, M., Ahmed, F., Debnath, G. C., Bojnec, Š. (2022). Transition to renewable energy production in the United States: The role of monetary, fiscal, and trade policy uncertainty. Energies, 15(13);

- Johnston, S., Yang, C. (2019). Policy uncertainty and investment in wind energy. Working Paper;

- Jurasz, J., Canales, F. A., Kies, A., Guezgouz, M., Beluco, A. (2020). A review on the complementarity of renewable energy sources: Concept, metrics, application and future research directions. Solar Energy, 195;

- Karapin, R. (2020). Federalism as a double-edged sword: the slow energy transition in the United States. The Journal of Environment & Development, 29(1);

- Kartal, M. T. (2023). Production-based disaggregated analysis of energy consumption and CO2 emission nexus: evidence from the USA by novel dynamic ARDL simulation approach. Environmental Science and Pollution Research, 30(3);

- Khan, K., Su, C. W. (2022). Does policy uncertainty threaten renewable energy? Evidence from G7 countries. Environmental Science and Pollution Research, 29(23);

- Lahiani, A., Mefteh-Wali, S., Shahbaz, M., Vo, X. V. (2021). Does financial development influence renewable energy consumption to achieve carbon neutrality in the USA?. Energy Policy, 158;

- Li, Z. Z., Su, C. W., Moldovan, N. C., Umar, M. (2023). Energy consumption within policy uncertainty: Considering the climate and economic factors. Renewable Energy, 208;

- Liu, K., Luo, J., Faridi, M. Z., Nazar, R., Ali, S. (2025). Green shoots in uncertain times: Decoding the asymmetric nexus between monetary policy uncertainty and renewable energy. Energy & Environment;

- Liu, R., He, L., Liang, X., Yang, X., Xia, Y. (2020). Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy enterprises? A comparative study based on regulatory effects. Journal of Cleaner Production, 255;

- Lu, Z., Zhu, L., Lau, C. K. M., Isah, A. B., Zhu, X. (2021). The role of economic policy uncertainty in renewable energy-growth nexus: evidence from the Rossi-Wang causality test. Frontiers in Energy Research, 9;

- Mayer, A. (2019). National energy transition, local partisanship? Elite cues, community identity, and support for clean power in the United States. Energy Research & Social Science, 50;

- Mohsin, M., Taghizadeh-Hesary, F., Iqbal, N., Saydaliev, H. B. (2022). The role of technological progress and renewable energy deployment in green economic growth. Renewable Energy, 190;

- Mouffok, M. A., Mouffok, O. (2025). Wavelet-quantile analysis of the nexus between economic policy uncertainty and sustainable markets: An ESG context. Journal of Cleaner Production;

- Nakhli, M. S., Shahbaz, M., Jebli, M. B., Wang, S. (2022). Nexus between economic policy uncertainty, renewable & non-renewable energy and carbon emissions: contextual evidence in carbon neutrality dream of USA. Renewable Energy, 185;

- O’Connor, P. A., Cleveland, C. J. (2014). US energy transitions 1780–2010. Energies, 7(12);

- Qamruzzaman, M., Karim, S., Jahan, I. (2022). Nexus between economic policy uncertainty, foreign direct investment, government debt and renewable energy consumption in 13 top oil importing nations: Evidence from the symmetric and asymmetric investigation. Renewable Energy, 195;

- Razmi, S. F., Moghadam, M. H., Behname, M. (2021). Time-varying effects of monetary policy on Iranian renewable energy generation. Renewable Energy, 177;

- Roemer, K. F., Haggerty, J. H. (2021). Coal communities and the US energy transition: A policy corridors assessment. Energy Policy, 151;

- Shafiullah, M., Miah, M. D., Alam, M. S., Atif, M. (2021). Does economic policy uncertainty affect renewable energy consumption?. Renewable Energy, 179;

- Sim, N., Zhou, H. (2015). Oil prices, US stock return, and the dependence between their quantiles. Journal of Banking & Finance, 55;

- Sinha, A., Ghosh, V., Hussain, N., Nguyen, D. K., Das, N. (2023). Green financing of renewable energy generation: Capturing the role of exogenous moderation for ensuring sustainable development. Energy Economics, 126;

- Sinha, A., Murshed, M., Das, N., Saha, T. (2025). Modeling renewable energy market performance under climate policy uncertainty: A novel multivariate quantile causality analysis. Risk Analysis. Available at: <https://doi.org/10.1111/risa.17714>;

- Sohail, M. T., Xiuyuan, Y., Usman, A., Majeed, M. T., Ullah, S. (2021). Renewable energy and non-renewable energy consumption: assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environmental Science and Pollution Research, 28;

- Solomon, B. D., Krishna, K. (2011). The coming sustainable energy transition: History, strategies, and outlook. Energy policy, 39(11);

- Su, C. W., Khan, K., Umar, M., Zhang, W. (2021). Does renewable energy redefine geopolitical risks? Energy Policy, 158;

- Sun, C., Khan, A., Liu, Y., & Lei, N. (2022). An analysis of the impact of fiscal and monetary policy fluctuations on the disaggregated level renewable energy generation in the G7 countries. Renewable Energy, 189;

- Stokes, L. C., Breetz, H. L. (2018). Politics in the US energy transition: Case studies of solar, wind, biofuels and electric vehicles policy. Energy Policy, 113;

- Tian, J., Yu, L., Xue, R., Zhuang, S., Shan, Y. (2022). Global low-carbon energy transition in the post-COVID-19 era. Applied energy, 307;

- Usman, O., Iorember, P. T., Ozkan, O., Alola, A. A. (2024). Dampening energy security-related uncertainties in the United States: The role of green energy-technology investment and operation of transnational corporations. Energy, 289;

- Wang, K. H., Wen, C. P., Liu, H. W., Liu, L. (2023). Promotion or hindrance? Exploring the bidirectional causality between geopolitical risk and green bonds from an energy perspective. Resources Policy, 85;

- Wang, X., Li, J., Ren, X. (2022). Asymmetric causality of economic policy uncertainty and oil volatility index on time-varying nexus of the clean energy, carbon and green bond. International Review of Financial Analysis, 83;

- Xue, C., Shahbaz, M., Ahmed, Z., Ahmad, M., Sinha, A. (2022). Clean energy consumption, economic growth, and environmental sustainability: what is the role of economic policy uncertainty? Renewable Energy, 184;

- Yi, S., Raghutla, C., Chittedi, K. R., Fareed, Z. (2023). How economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renewable Energy, 202;

- Zhang, R. J., Razzaq, A. (2022). Influence of economic policy uncertainty and financial development on renewable energy consumption in the BRICST region. Renewable Energy, 201;

- Zhao, Z., Gozgor, G., Lau, M. C. K., Mahalik, M. K., Patel, G., Khalfaoui, R. (2023). The impact of geopolitical risks on renewable energy demand in OECD countries. Energy Economics, 122.

Footnotes

[1] Chen, P. Y., Chen, S. T., Hsu, C. S., Chen, C. C. (2016). Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renewable and Sustainable Energy Reviews, 65, 420-431.

[2] Hashmi, S. M., Bhowmik, R., Inglesi-Lotz, R., Syed, Q. R. (2022). Investigating the Environmental Kuznets Curve hypothesis amidst geopolitical risk: Global evidence using bootstrap ARDL approach. Environmental Science and Pollution Research, 29(16), 24049-24062.

[3] Kartal, M. T. (2023). Production-based disaggregated analysis of energy consumption and CO2 emission nexus: evidence from the USA by novel dynamic ARDL simulation approach. Environmental Science and Pollution Research, 30(3), 6864-6874.

[4] Carley, S., Konisky, D. M. (2020). The justice and equity implications of the clean energy transition. Nature Energy, 5(8), 569-577.

[5] Fouquet, R. (2016). Historical energy transitions: Speed, prices and system transformation. Energy research & social science, 22, 7-12.

[6] Mohsin, M., Taghizadeh-Hesary, F., Iqbal, N., Saydaliev, H. B. (2022). The role of technological progress and renewable energy deployment in green economic growth. Renewable Energy, 190, 777-787.

[7] Lahiani, A., Mefteh-Wali, S., Shahbaz, M., Vo, X. V. (2021). Does financial development influence renewable energy consumption to achieve carbon neutrality in the USA? Energy Policy, 158, 112524.

[8] Xue, C., Shahbaz, M., Ahmed, Z., Ahmad, M., Sinha, A. (2022). Clean energy consumption, economic growth, and environmental sustainability: what is the role of economic policy uncertainty? Renewable Energy, 184, 899-907.

[9] Adedoyin, F. F., Zakari, A. (2020). Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Science of the Total Environment, 738, 140014.

[10] Shafiullah, M., Miah, M. D., Alam, M. S., Atif, M. (2021). Does economic policy uncertainty affect renewable energy consumption? Renewable Energy, 179, 1500-1521.

[11] Yi, S., Raghutla, C., Chittedi, K. R., Fareed, Z. (2023). How economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renewable Energy, 202, 1357-1367.

[12] Aslan, A., Ilhan, O., Usama, A. M., Savranlar, B., Polat, M. A., Metawa, N., Raboshuk, A. (2024). Effect of economic policy uncertainty on CO2 with the discrimination of renewable and non renewable energy consumption. Energy, 291, 130382.

[13] Razmi, S. F., Moghadam, M. H., Behname, M. (2021). Time-varying effects of monetary policy on Iranian renewable energy generation. Renewable Energy, 177, 1161-1169.

[14] Chu, L. K., Le, N. T. M. (2022). Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: the case of G7 countries. Environmental Science and Pollution Research, 29(2), 2866-2882.

[15] Fu, H., Guo, W., Sun, Z., Xia, T. (2023). Asymmetric impact of natural resources rent, monetary and fiscal policies on environmental sustainability in BRICS countries. Resources Policy, 82, 103444.

[16] Jurasz, J., Canales, F. A., Kies, A., Guezgouz, M., Beluco, A. (2020). A review on the complementarity of renewable energy sources: Concept, metrics, application and future research directions. Solar Energy, 195, 703-724.

[17] Liu, R., He, L., Liang, X., Yang, X., Xia, Y. (2020). Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy enterprises? A comparative study based on regulatory effects. Journal of Cleaner Production, 255, 120102.

[18] Sinha, A., Murshed, M., Das, N., Saha, T. (2025). Modeling renewable energy market performance under climate policy uncertainty: A novel multivariate quantile causality analysis. Risk Analysis. Available at: <https://doi.org/10.1111/risa.17714>.

[19] Tian, J., Yu, L., Xue, R., Zhuang, S., Shan, Y. (2022). Global low-carbon energy transition in the post-COVID-19 era. Applied energy, 307, 118205.

[20] Elshkaki, A. (2023). The implications of material and energy efficiencies for the climate change mitigation potential of global energy transition scenarios. Energy, 267, 126596.

[21] Hassan, Q., Viktor, P., Al-Musawi, T. J., Ali, B. M., Algburi, S., Alzoubi, H. M., et al. (2024). The renewable energy role in the global energy Transformations. Renewable Energy Focus, 48, 100545.

[22] Solomon, B. D., Krishna, K. (2011). The coming sustainable energy transition: History, strategies, and outlook. Energy policy, 39(11), 7422-7431.

[23] O’Connor, P. A., Cleveland, C. J. (2014). US energy transitions 1780–2010. Energies, 7(12), 7955-7993.

[24] Stokes, L. C., Breetz, H. L. (2018). Politics in the US energy transition: Case studies of solar, wind, biofuels and electric vehicles policy. Energy Policy, 113, 76-86.

[25] Mayer, A. (2019). National energy transition, local partisanship? Elite cues, community identity, and support for clean power in the United States. Energy Research & Social Science, 50, 143-150.

[26] Karapin, R. (2020). Federalism as a double-edged sword: the slow energy transition in the United States. The Journal of Environment & Development, 29(1), 26-50.

[27] Roemer, K. F., Haggerty, J. H. (2021). Coal communities and the US energy transition: A policy corridors assessment. Energy Policy, 151, 112112.

[28] Hammond, D. R., Brady, T. F. (2022). Critical minerals for green energy transition: a United States perspective. International Journal of Mining, Reclamation and Environment, 36(9), 624-641.

[29] Hincapie-Ossa, D., Frey, N., Gingerich, D. B. (2023). Assessing county-level vulnerability to the energy transition in the United States using machine learning. Energy Research & Social Science, 100, 103099.

[30] Usman, O., Iorember, P. T., Ozkan, O., Alola, A. A. (2024). Dampening energy security-related uncertainties in the United States: The role of green energy-technology investment and operation of transnational corporations. Energy, 289, 130006.

[31] Nakhli, M. S., Shahbaz, M., Jebli, M. B., Wang, S. (2022). Nexus between economic policy uncertainty, renewable & non-renewable energy and carbon emissions: contextual evidence in carbon neutrality dream of USA. Renewable Energy, 185, 75-85.

[32] Ayhan, F., Kartal, M. T., Kılıç Depren, S., Depren, Ö. (2023). Asymmetric effect of economic policy uncertainty, political stability, energy consumption, and economic growth on CO2 emissions: evidence from G-7 countries. Environmental Science and Pollution Research, 30(16), 47422-47437.

[33] Husain, S., Sohag, K., Wu, Y. (2024). The responsiveness of renewable energy production to geopolitical risks, oil market instability and economic policy uncertainty: Evidence from United States. Journal of Environmental Management, 350, 119647.

[34] Sohail, M. T., Xiuyuan, Y., Usman, A., Majeed, M. T., Ullah, S. (2021). Renewable energy and non-renewable energy consumption: assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environmental Science and Pollution Research, 28, 31575-31584.

[35] Jamil, M., Ahmed, F., Debnath, G. C., Bojnec, Š. (2022). Transition to renewable energy production in the United States: The role of monetary, fiscal, and trade policy uncertainty. Energies, 15(13), 4527.

[36] Hashmi, S. M., Syed, Q. R., Inglesi-Lotz, R. (2022). Monetary and energy policy interlinkages: The case of renewable energy in the US. Renewable Energy, 201, 141-147.

[37] Sun, C., Khan, A., Liu, Y., Lei, N. (2022). An analysis of the impact of fiscal and monetary policy fluctuations on the disaggregated level renewable energy generation in the G7 countries. Renewable Energy, 189, 1154-1165.

[38] Bildirici, M., Çırpıcı, Y. A., Ersin, Ö. Ö. (2023). Effects of Technology, Energy, Monetary, and Fiscal Policies on the Relationship between Renewable and Fossil Fuel Energies and Environmental Pollution: Novel NBARDL and Causality Analyses. Sustainability, 15(20), 14887.

[39] Sinha, A., Ghosh, V., Hussain, N., Nguyen, D. K., Das, N. (2023). Green financing of renewable energy generation: Capturing the role of exogenous moderation for ensuring sustainable development. Energy Economics, 126, 107021.

[40] Abbas, S., Saha, T., Sinha, A. (2024). Price response of top-five renewable energy firms to Russia-Ukraine conflict: An advanced quantile analysis to achieve net-zero in United States of America. Journal of Cleaner Production, 141153.

[41] Usman, O., Iorember, P. T., Ozkan, O., Alola, A. A. (2024). Dampening energy security-related uncertainties in the United States: The role of green energy-technology investment and operation of transnational corporations. Energy, 289, 130006.

[42] Sim, N., Zhou, H. (2015). Oil prices, US stock return, and the dependence between their quantiles. Journal of Banking & Finance, 55, 1-8.

[43] Adebayo, T. S. (2024). Do uncertainties moderate the influence of renewable energy consumption on electric power CO2 emissions? A new policy insight. International Journal of Sustainable Development & World Ecology, 31(3), 314-329.

[44] Mouffok, M. A., Mouffok, O. (2025). Wavelet-quantile analysis of the nexus between economic policy uncertainty and sustainable markets: An ESG context. Journal of Cleaner Production, 145574.

[45] Broock, W. A., Scheinkman, J. A., Dechert, W. D., LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric reviews, 15(3), 197-23.

[46] Sohail, M. T., Xiuyuan, Y., Usman, A., Majeed, M. T., Ullah, S. (2021). Renewable energy and non-renewable energy consumption: assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environmental Science and Pollution Research, 28, 31575-31584.

[47] Khan, K., Su, C. W. (2022). Does policy uncertainty threaten renewable energy? Evidence from G7 countries. Environmental Science and Pollution Research, 29(23), 34813-34829.

[48] Liu, K., Luo, J., Faridi, M. Z., Nazar, R., Ali, S. (2025). Green shoots in uncertain times: Decoding the asymmetric nexus between monetary policy uncertainty and renewable energy. Energy & Environment.

[49] Xue, C., Shahbaz, M., Ahmed, Z., Ahmad, M., Sinha, A. (2022). Clean energy consumption, economic growth, and environmental sustainability: what is the role of economic policy uncertainty? Renewable Energy, 184, 899-907.

[50] Yi, S., Raghutla, C., Chittedi, K. R., Fareed, Z. (2023). How economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renewable Energy, 202, 1357-1367.

[51] Dai, J., Farooq, U., Alam, M. M. (2025). Navigating energy policy uncertainty: Effects on fossil fuel and renewable energy consumption in G7 economies. International Journal of Green Energy, 22(2), 239-252.

[52] Johnston, S., Yang, C. (2019). Policy uncertainty and investment in wind energy. Working Paper.

[53] Chen, L. (2024). The Dynamic Efficiency of Policy Uncertainty: Evidence from the Wind Industry. Working Paper.

[54] Zhang, R. J., Razzaq, A. (2022). Influence of economic policy uncertainty and financial development on renewable energy consumption in the BRICST region. Renewable Energy, 201, 526-533.

[55] Qamruzzaman, M., Karim, S., Jahan, I. (2022). Nexus between economic policy uncertainty, foreign direct investment, government debt and renewable energy consumption in 13 top oil importing nations: Evidence from the symmetric and asymmetric investigation. Renewable Energy, 195, 121-136.

[56] Lu, Z., Zhu, L., Lau, C. K. M., Isah, A. B., Zhu, X. (2021). The role of economic policy uncertainty in renewable energy-growth nexus: evidence from the Rossi-Wang causality test. Frontiers in Energy Research, 9, 750652.

[57] Li, Z. Z., Su, C. W., Moldovan, N. C., Umar, M. (2023). Energy consumption within policy uncertainty: Considering the climate and economic factors. Renewable Energy, 208, 567-576.

[58] Wang, K. H., Wen, C. P., Liu, H. W., Liu, L. (2023). Promotion or hindrance? Exploring the bidirectional causality between geopolitical risk and green bonds from an energy perspective. Resources Policy, 85, 103966.

[59] Su, C. W., Khan, K., Umar, M., Zhang, W. (2021). Does renewable energy redefine geopolitical risks?. Energy Policy, 158, 112566.

[60] Wang, X., Li, J., Ren, X. (2022). Asymmetric causality of economic policy uncertainty and oil volatility index on time-varying nexus of the clean energy, carbon and green bond. International Review of Financial Analysis, 83, 102306.

[61] Zhao, Z., Gozgor, G., Lau, M. C. K., Mahalik, M. K., Patel, G., Khalfaoui, R. (2023). The impact of geopolitical risks on renewable energy demand in OECD countries. Energy Economics, 122, 106700.

Downloads

Downloads

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.