Is Winemaking Central to Georgia’s Economy?

DOI:

https://doi.org/10.35945/gb.2024.18.006Keywords:

Georgia, Wine Economy, Tourism, SubsidyAbstract

Based on the primary data and review of secondary sources, this paper argues that wine is more than a symbol of Georgia; it is a foundation of the country’s economy and social life. The article also looks beyond the direct current statistics of the formal economy and considers the indirect economic impact, trends, and potential, an assessment of winemaking and wine-related tourism points to these sectors as a business priority for Georgia and an important economic and social development vehicle. The study also highlights the potential risks associated with climate change, including increased heat stress, drought, altered growing seasons, and other relatively minor obstacles. The paper identifies specific grapevine cultivars that may be particularly vulnerable to these challenges and explores adaptation strategies to mitigate their negative effects. The results of this study offer valuable insights for Georgian winemakers and policymakers to ensure the sustainability of the country’s wine industry in the face of a changing climate.

Keywords: Georgia, Wine Economy, Tourism, Subsidy.

Introduction

The Centrality of Winemaking in Georgia’s History and Culture

Georgia’s history and culture are inseparable from winemaking. The 8,000-year-old Qvevri method of using terra cotta urns buried in the ground for fermenting crushed grapes is evidence of Georgia’s uniqueness as the birthplace of winemaking. Having originated in 6000 BC, winemaking spread from the Caucasus west to the eastern Mediterranean from 2500 BC and to the north into much of Europe by 400 AD. Regarding the language, the Georgian word ghvino (wine) was probably the origin of the Latin term vino, considering that Georgia was allied with the Latin Roman Empire from the 1st century BC to the 4th century AD.

On an even deeper level, viticulture and winemaking are integral to the Georgian Orthodox religion, whose major symbol is the “Grapevine Cross”. The 6th-century Jvari Monastery in Mtskheta – the continuous religious center of Georgia – has a painting of the Virgin Mary holding grapes for Christ as a child. The country’s church architecture and paintings use the vine leaf as one of the most distinctive motives.

Reinforcing the centrality of winemaking in Georgia’s customs, through centuries, wine has had a special meaning as a unifier of people and a source of social cohesion. The traditional supra feast has bonded people via collective experiences of toasting, singing, and dancing, while hospitality is part of the national character.[1] Despite the greater profitability of other agriproducts (for instance, watermelons), Georgia favors winemaking.

The social, cultural, and religious prominence of winemaking begs the question of whether it is equally central to Georgia’s economy. If winemaking is vital for the economy, to what extent is it important for its current condition and further development?

Wine Exports and Georgia’s Gross Domestic Product (GDP)

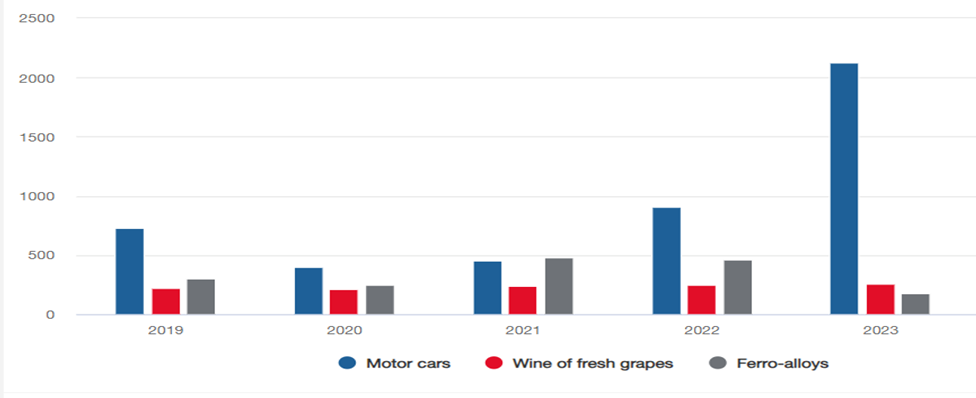

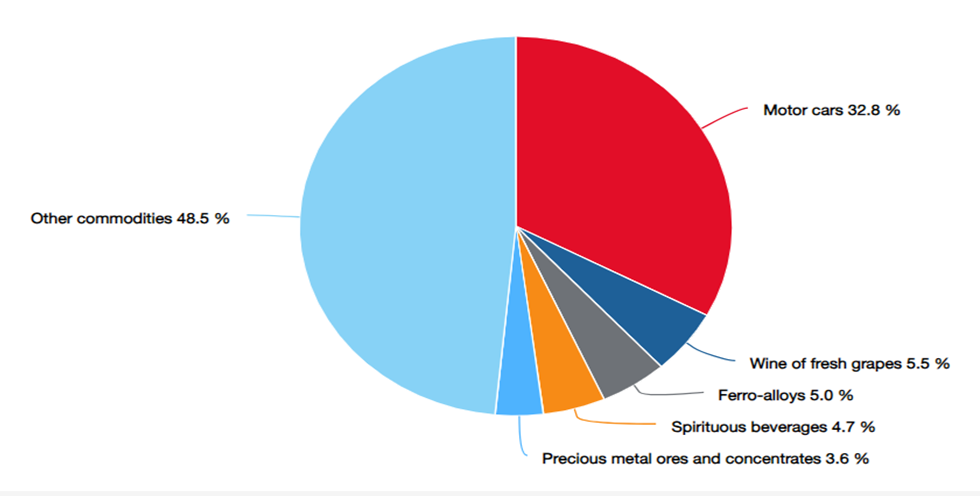

The value of Georgian wine exports was $259 million in 2023, making the industry the second-largest export generator for the country (Graph 1). Adding other alcoholic beverages to “wine of fresh grapes” brought 2023 exports in this combined category to $457 million.[2] In January-June 2024, “wine of fresh grapes” comprised 5.5% of the country’s total exports and was the second most exported commodity after motor cars, which accounted for 32.8% of (re)exports. Together with the category of “spirituous beverages”, wine and other alcoholic exports amounted to 10.2% of the country’s total exports[3] (see Graph 2).

Graph 1. Major commodity positions by exports, million USD

Source: National Statistics Office of Georgia.[4]

Graph 2. Share of major commodity positions by exports in January-June 2024*

* Revised data will be published on November 15, 2024

Source: National Statistics Office of Georgia.[5]

The high rank of wine in Georgia’s exports implies its importance, but it is largely due to the country’s lack of promising export options and low export diversification. More than 50% of the total exports are made up of only five commodity positions: motor cars, wine of fresh grapes, ferroalloys, spirituous beverages, and precious metal ores and concentrates.

In the first six months of 2024, Georgia exported 54.5 million liters of wine worth $156.7 million to 61 countries. The exports figure meant a 26% increase over the same period of 2023, while revenues increased by 24%.[6]

In Russia’s wine imports, Georgian wine amounted in 2022 to 19% in US dollar terms, while its share in top wine importer countries was negligible.[7] The 2024 remarkable upswing in Georgia’s wine exports was especially notable in exports to Russia, which increased 74% in the first quarter of the year compared to the same period of 2023, accounting for $65 million in value.[8] Despite serious efforts to diversify exports of wine, Russia remains the main destination of Georgian wine, reaching 65% of the overall 2023 exports in this sector, the highest figure since 2005.[9] Russia ranked second among Georgia’s commercial partners in the first quarter of 2024, while Turkey ranked first.[10]

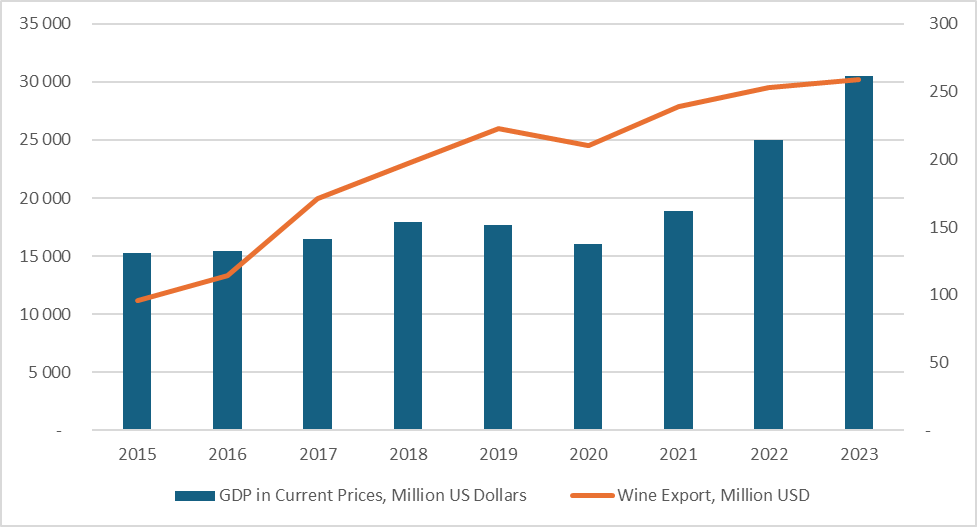

As shown in Graph 3, the share of wine exports in Georgia’s GDP has been growing along with the GDP growth in 2015-2021.[11] The country’s GDP has continued to increase since 2021. It showed an 11% growth in 2022 and a 7.5% growth in 2023 and reached 80.2 billion GEL (or $30.5 billion) in 2023 (Graph 3). The share of wine exports in the GDP in 2023 equaled 0.85% and was more than 1.50% if spirituous beverages were considered.* Compared to 0.64% in 2015,[12] these figures signal a significant increase over the 8 years.

Graph 3. Wine exports and GDP, 2015-2023

Source: Forbes.[13]

Wine is the main source of income for several regions in Georgia. It also enhances the economic and social welfare of local communities. In Kakheti, winemaking is the dominant sector and a crucial source of employment. In 2013, around 65–70% of all vineyards in Georgia were concentrated in the Kakheti region, which has many family-run wine cellars representing small and mid-sized wineries.[14] While 16.4% of the labor force was unemployed in 2023 at the national level, this figure was lower – 12% – in Kakheti.[15]

There are also wineries in many other areas, including Racha, Shida Kartli, Kvemo Kartli, Imereti, Samegrelo, Guria, Samtskhe-Javakheti, and Ajara. Georgia’s rugged and mountainous landscape limits the availability of arable acreage, and the overwhelming majority of households own less than two hectares of agricultural land. Only 4.8% of households own two to five hectares of land, and 1.5% own more than five hectares. As over 40% of Georgia’s population lives in rural areas, agriculture, including the cultivation of grapevines, offers an important safety net through small-scale village-type farming.[16]

Georgia’s formal wine production sector attracted, on average, 0.8% of directly employed people (approximately 5,000 people) from 2011-2019. As for total employment in the sector, it is estimated to be around 100 thousand people. The latter estimate includes self-employed people and those working in the broader winemaking cluster on distribution, sales, trade, mechanization, chemical treatment of vines, transportation, and other auxiliary tasks.

The average monthly remuneration of employees in the winemaking sector amounted to 1,046 GEL (or 371 dollars) in 2019, having increased by about 11.5% annually between 2011 and 2019. It constituted 93% of the country’s average salary in 2019.[17] Given Georgia’s unemployment rate of 16.4% in 2023,[18] informal or complementary employment in winemaking makes a difference in rural areas. The size of Georgia’s informal economy is estimated to be 46.5% of GDP,[19] which represents $40.4 billion at the GDP (PPP) level. While the nominal 2023 GDP of Georgia in current prices was $30.5 billion, it was more than double, $86.8 billion, accounting for purchasing power parity (PPP), which makes this indicator comparable across countries.[20]

State Promotion and Subsidies of Winemaking

The National Wine Agency (NWA) of Georgia implements an extensive program to promote Georgia’s winemaking. The state budget of this program in 2024 was set at 16 million GEL (or almost $6 million), which is 2 million GEL ($740 thousand) higher than the figure for 2023.[21] The NWA does not promote wine exports to Russia, which are already extensive. It prioritizes marketing Georgian wine in the USA, Great Britain, Germany, Poland, the Baltic states, China, South Korea, and Japan. In these countries, the contractor companies of the NWA hold a variety of events to increase the export potential of Georgian wine. Wine exhibitions, festivals, and other events are also held throughout Georgia to raise the potential of the wine industry and wine-related tourism in the domestic and international markets.

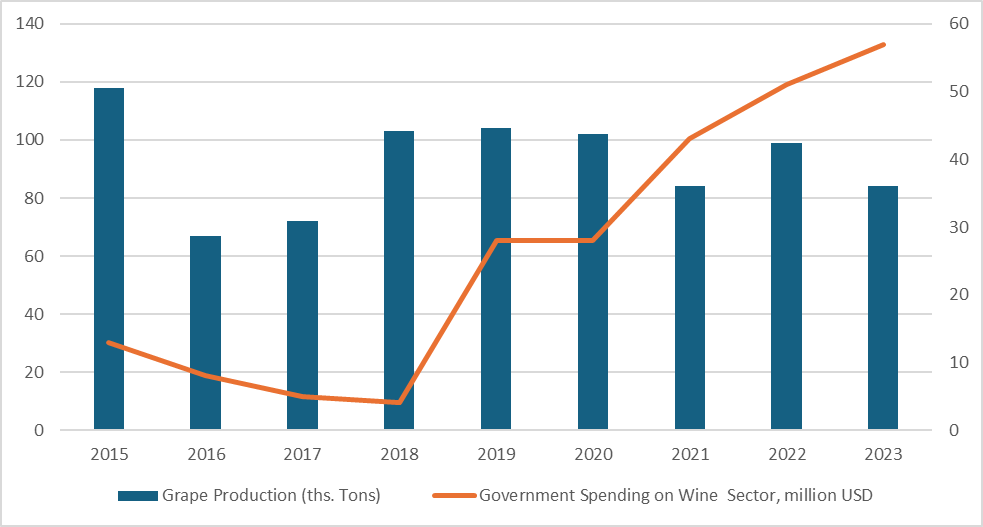

Furthermore, the Government of Georgia supports national winemaking through two types of subsidies. Direct subsidies entail cash payments to producers per kilogram of grapes. As for indirect subsidies, they encourage state-owned companies to purchase grapes from farmers. After a temporary decline of the subsidiary scheme in 2017-2019, spending on the wine sector resumed with a new force in 2020 (Graph 4). In 2021, the government’s spending on the wine sector increased by 44%, compared to 2020, with the largest share (90%) going to grape subsidies.[22] In 2022, the government continued to subsidize the grape harvest, allocating about 150 million GEL ($54.2 million) for this purpose and emphasizing the purchase and processing of specific grape varieties from the Kakheti region.[23]

Graph 4. Grape Production and Government Spending on the Wine Sector

Source: Free Network.[24]

Some analysts question the effectiveness of direct subsidies to producers of grapes. The significance of the promotion of Georgian wine exports suggests the need to prioritize subsidizing the marketing of wine in foreign markets to help winemakers enter international trade networks, especially in European and other strategic countries.[25] Other proposals for useful government interventions include ensuring producers’ adherence to food safety standards to improve the quality of grapes and wine and providing high-quality extension services, including advice and technical support, to benefit the sustainable, long-term growth of the wine sector.[26]

Food and Wine Tourism

Wine-related tourism is not a modern phenomenon. There is evidence of wine tourism in ancient Egypt, Greece, and China going back to the Tang dynasty (618-907 AD) (This Day in Wine History, 2022).[27] The modern wine tourism industry is believed to have been born in California in the 1970s. Mondavi Winery was one of the first wineries to welcome guests for tastings, launching the popularity of winery tours in the USA. In the 1980s, wine tourism spread outside the Americas to become common in Italy, France, South Africa, and other countries

The United Nations World Tourism Organization (UNWTO) held its 1st Global Conference on Wine Tourism in Kakheti, Georgia, in September 2016. This inaugural event attracted more than 200 participants from almost 50 countries.[28] The latest, 7th UNWTO Global Conference on Wine Tourism took place in November 2023 in Spain’s winemaking region La Rioja under the theme of “Inclusive, sustainable and digital wine tourism: Building stronger territorial cohesion”. The conference aimed to identify ways to make wine tourism an enabler of a more sustainable, inclusive, and resilient future for communities.[29]

The section on wine and food of the 2018 strategy of the Georgian National Tourism Administration blended the themes of the country’s cultural heritage and unique wine and cuisine. It called for the promotion of Georgia as “the Cradle of Wine”, identification of wine routes/trails in the Kakheti and Imereti regions, and the development of wine- and food-related services and festivities. To differentiate Georgia from competitor destinations, the strategy proposed aspiring for an “emotional connection” with the country’s visitors/tourists around authentic, engaging, and unique experiences.[30]

Following the inevitable decline of Georgia’s tourism industry as well as the entire economy during the COVID-19 pandemic,[31] also known as the coronomic crisis,[32] the years 2022 and 2023 saw an impressive recovery. In 2023, revenues from international tourism exceeded the 2019 level by 26.2% or $856.7 million and the 2022 data by 17.3% or $608.7 million. In 2023, 7.1 million international travelers visited Georgia, which amounted to a 75.6% recovery in numbers from the pre-pandemic period. As a result, the country received a record $4.1 billion in tourism revenue.[33]

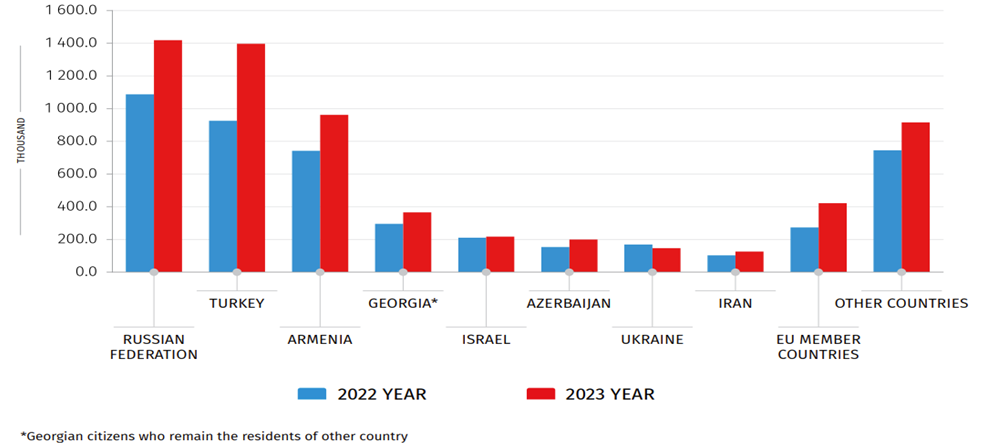

The largest number of visitors (1.2 million) in 2023 was from Russia, amounting to 23.2% of the total number of visitors, followed by Turkey (21.4%) and Armenia (13.5%). Correspondingly, the citizens of Russia, Turkey, and Armenia made the most visits (Graph 5).[34]

Graph 5. Distribution of the number of visits made by inbound visitors by the country of citizenship

Source: National Statistics Office of Georgia.[35]

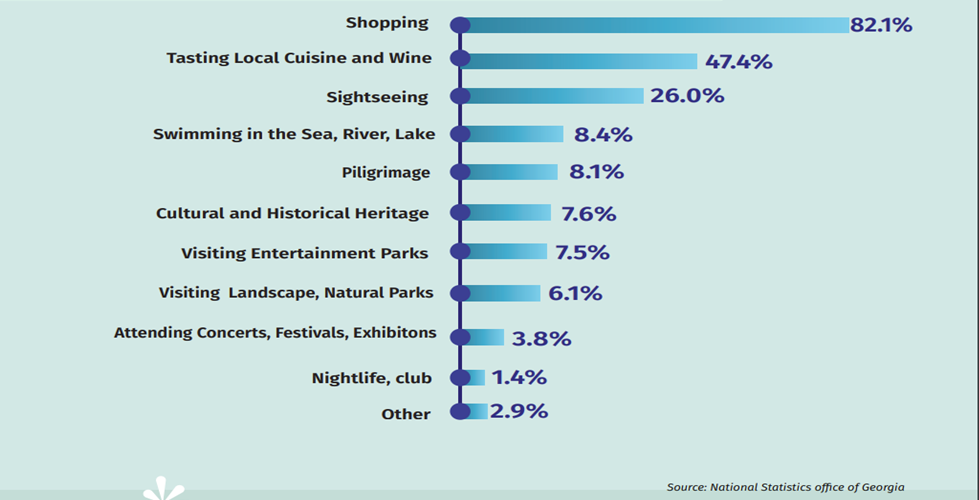

The expenditures during the 2023 visits were 20.5% higher compared to the previous year’s record.[36] For this paper, it is important to highlight the share of food and drinks in the overall expenditures. In 2022, the largest share of visitors’ expenditures was registered on served food and drinks (33.2% of total expenses) and accommodation (31% of total expenses).[37] “Tasting local cuisine and wine” was one of the most popular tourist activities – the second only after shopping – in 2022 (Graph 6). In 2023, the share of food and drinks decreased to 21.6%, while accommodation and shopping were the main expenditure categories (Graph 7).

Graph 6. Popular tourist activities

Source: Georgian National Tourism Administration.[38]

Graph 7. Distribution of the expenditure spent by inbound visitors by expenditure categories in 2023*

|

|

Expenditure (Million USD) |

% |

Average Expenditure Per Visit (USD) |

|

Accommodation |

1793 |

36.4 |

291 |

|

Shopping |

1152 |

23.4 |

186 |

|

Foods and Drinks |

1065 |

21.3 |

172 |

|

Holiday, Leisure, Recreation, Culture and Sporting Activities |

495 |

10 |

80 |

|

Local Transport |

359 |

7.3 |

58 |

|

Other Expenditures |

62 |

1.3 |

10 |

|

Total Expenditure |

4945 |

100 |

797 |

Source: National Statistics Office of Georgia.[39]

*Official average exchange rate for 2023 was taken at 1$ = 2.6279 GEL

How important is the tourism sector for the economy? Worldwide, in 2022, the Travel and Tourism sector contributed 7.6% to global GDP, constituting an increase of 22% from 2021, though 23% below the 2019 pre-pandemic level.[40] In the same year in Georgia, the added value of tourism-related industries as a share of GDP increased from 6.7% to 7.2%. More than 20% of this value was driven by food and beverage services.[41] In 2023, the world’s Travel and Tourism sector contributed 9.1% to the global GDP and added 27 million new jobs.[42]

Wine-related tourism is essential for the development of winemaking regions of Georgia to support well-established and also startup companies as well as households. In 2023, the visits to the wine-making regions of Kakheti, Imereti, Samtske-Javakheti, and Kvemo Kartli comprised 20% of the total visits to Georgia.[43] The ability to sell wine directly to consumers in wineries plays a critical role in the growth and development of Georgia’s beverage industry as well as the advancement of local communities. Many rural producers in Georgia do not have distribution contracts enabling them to retail their wine. Therefore, the openness of their establishments for visitation, which typically includes tours, tastings, and opportunities to purchase beverages, is indispensable.[44]

Given a dramatic increase in the number of wineries registering for commercial production – from 80 in 2006 to an estimated 2,400 in 2023[45] – these wineries can serve as the lifeblood of regional tourism and the rural economy. Close to one-half of the Georgian population is still employed in agriculture, while this sector accounted for 7-8% of GDP in 2014-2023,[46] and 98% of farm workers are considered self-employed practicing subsistence agriculture.[47] Since human capital in the rural economy remains largely untapped, it can be mobilized to participate in both winemaking and wine and food tourism offerings.

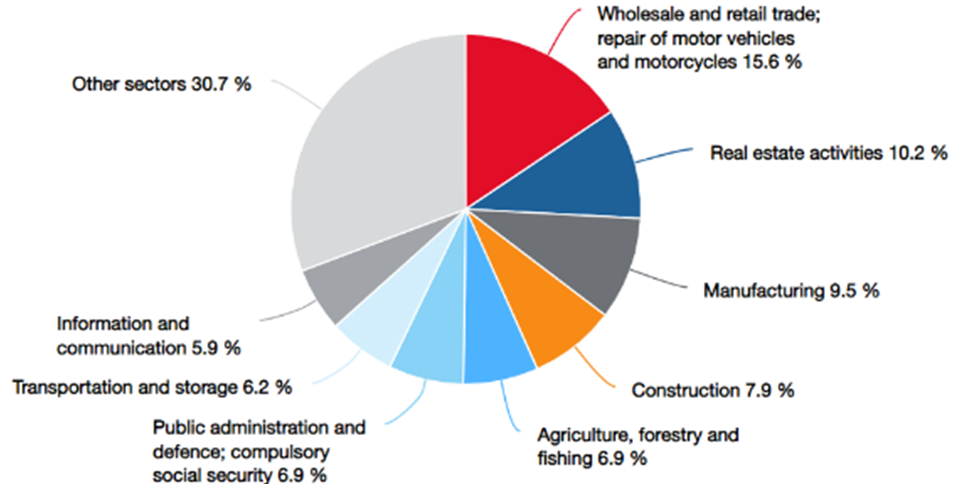

Overall Impact of Winemaking and Wine Tourism

If we consider only direct statistics on Georgia’s winemaking, the impact of this sector appears moderate, if not small. Because mountains occupy 65% of Georgia’s territory,[48] opportunities for large-scale agriculture are limited, and small-scale village-type farming and winemaking are predominant. Even though wine exports in Georgia have been growing, they comprised only 5.5% of the country’s total exports in January–June 2024.[49] They also do not contribute much to the country’s GDP: 0.85% or about 1.50%, if considering spirituous beverages, according to the 2023 statistics.** “Agriculture, forestry, and fishing” – a category that includes vine-growing – added only 6.9% to the GDP (Graph 8), and winemaking is subsidized by the government.

Graph 8. GDP structure 2023, %

Source: National Statistics Office of Georgia.[50]

However, it is important to look beyond current data about the formal economy and focus on trends and potential, also with the help of modern financial technologies.[51], [52] Wine was the second most exported commodity in Georgia in both 2023 and the first half of 2024.[53] The rank of wine in Georgia’s exports had increased compared to 2018 when the wine industry was the fifth-largest export generator for the country.[54] The share of wine exports in Georgia’s GDP has been growing along with the GDP growth,[55] and it is increasingly important for regional development in terms of both economic growth and employment. It is also notable that detailed statistics on GDP reflect the formal economy, whereas data on the informal economy is scarce, thus underrepresenting trends in village-type winemaking.

Compared to other major commodity positions, such as “motor cars” and “ferroalloys”, winemaking has greater potential. Georgia does not produce cars but rather reexports them,[56] the country’s mining industry has been in decline since Georgia’s independence from the Soviet Union, and the ferroalloys market has experienced a crisis.[57] Wine is a more promising export option than the alternatives, considering the country’s climate, terrain, and soil; culture and long history of winemaking; and economic performance and prospects. Moreover, past manufacturing and mining showed negative environmental impacts that would contradict interest in marketing Georgia as a beautiful place and a “Cradle of Wine”.

Learning from the world’s top winemaking regions, the wine industry not only contributes significantly to the export and GDP but also provides a multiplier effect on the economy. This point can be proven by the example of California, which is known as “the world’s great wine state”, accounts for 87% of US wine production and, if it were an independent nation, would be the world’s fourth wine-producing country behind Italy, France, and Spain.[58] California’s wine industry generates close to $88.12 billion in total economic activity that embraces farming, banking, accounting, manufacturing, packaging, transportation, printing, and advertising. It directly employs as many as 256 thousand people; creates an additional 116 thousand jobs in supplier and ancillary industries; and produces $8.45 billion in tax revenues on the local, state, and national levels (Exhibit 1).[59]

Exhibit 1. What’s Wine Worth? 2022 California Economic Impact Study

|

Wine Producers |

Jobs |

Annual Wages (Bln $) |

Tourism Visits |

Tourist Expenditures (Bln $) |

Total Taxes (Bln $) |

Federal Taxes (Bln $) |

State and Local Taxes (Bln $) |

|

4 795 |

513 738 |

32.05 |

25 215 863 |

8.56 |

8.45 |

5.42 |

3.03 |

|

Total Impact – 88.12 billion USD |

|||||||

Source: The National Association of American Wineries.[60]

The 2022 economic impact study of California’s wine industry also corroborates a strong linkage between winemaking and tourism. California’s “wine country” generates more than 25 million tourist visits and $8.56 billion in annual tourism expenditures, benefiting local economies and tax bases.[61] This evidence brings us to a brief discussion of the overall impact of Georgia’s tourism sector.

As noted above, in 2022, Georgia received $3.5 billion from incoming tourism, and the share of tourism in Georgia’s GDP was 7.2% – almost on par with the worldwide 7.6% contribution of the Travel and Tourism sector to the global GDP.[62] In 2023, revenue from tourism increased to $4.1 billion,[63] which amounted to 13.4% of the $30.5 billion GDP.[64] The 13.4% figure was higher than the 9.1% contribution of the world’s Travel and Tourism sector to the global GDP in 2023.[65] Before the COVID-19 pandemic in 2019, the Georgian travel and tourism industry represented 25% of the total GDP, and this industry supported 482 thousand jobs (equivalent to more than one in every four jobs).[66] The comparison of the 2023 and 2019 data suggests that Georgia’s tourism has not yet fully recovered from the economic crisis caused by a health emergency and that the upward trend in the advancement of this sector is likely to continue.

Considering 7.1 million visitors to Georgia in 2023,[67], the average country’s revenue per visitor in the same year was $577.[68] For comparison, in France, the country with the highest number of international tourist arrivals worldwide, the average revenue per visitor in 2023[69] – the year that saw a record number of arrivals at 100 million[70] and a record revenue of €69 billion or $75 billion – was $750.*** Thus, even though Georgia is a much less known tourist destination than France, the country’s capacity to generate revenue from tourism is substantial in relative terms.

While the added value of Georgia’s tourism as a share of GDP increased in 2022 compared to 2021, more than 20% of this value was driven by food and beverage services.[71] Although the share of food and drinks decreased to third place in the visitors’ expenditures in 2023, compared to 2022, when this share occupied the top position, “tasting local cuisine and wine” remains one of the most popular tourist activities. This reveals the cross-fertilization of winemaking and food and wine tourism, which especially benefits winemaking regions of Georgia, increases awareness of the country across the world and boosts its economic and social development.

In the international context, as well as in Georgia, winemaking can generate secondary economic activity. Winemaking is closely linked with major sectors of the economy: agriculture (grape growing), wine production (grape processing into wine and other alcoholic drinks), transportation (of grapes and wine), marketing of wine, and businesses associated with wine and food tourism (hotels, restaurants, events planning, supermarkets, and shops). Reversely, tourism affects and bolsters other sectors of the economy. In 2018, before the COVID-19 pandemic, 31.3% of Georgia’s GDP depended on the travel and tourism industry, including parks and transportation.[72]

Investment in winemaking and food and wine tourism can thus stimulate most of the Georgian economy – both urban and rural. As labor-intensive sectors, these sectors generate jobs, revenue, and taxes directly, as well as through ancillary industries and services. Georgia’s strong economic performance in 2021 and 2022, which the International Monetary Fund attributed to tourism revenues and a surge in war-related immigration and financial inflows, suggests sound business and investment conditions, favorably comparing the country to its regional peers Georgia’s investment attractiveness,[73] the high rank of wine in exports, and the closeness of tourism-related indicators to global averages reinforce the centrality of winemaking and wine tourism in the country’s economy.

Given Georgia’s 8,000-year history of winemaking, the existence of more than 500 varieties of indigenous grapes, and distinctive traditional methods of wine production, the potential of the country’s wine industry is above the global average. Similarly, the potential of Georgia’s wine tourism is way above average. Wine tasting can be effectively combined with learning about the unique Georgian culture of hospitality and enjoying a rich and diverse natural landscape, as the country is blessed with majestic mountains, exceptional valleys, and a remarkable seaside.

Furthermore, there are indications that winemaking can be more profitable in Georgia relative to other sectors of the economy and international competitors. A TBC Capital survey of large- to medium-size Georgian wineries revealed high financial returns—about twice the average for Georgian businesses in general.[74] According to EBIT Group, a financial consulting company, both net profit margin and return on equity are significantly higher for Georgian wine-producing companies compared to US winemakers.[75] Highlighting the reality and the potential of winemaking in Georgia, these assessments suggest its business priority for the country and its role as the engine of economic growth.

The ancient Georgian deity of wine, Aguna, is the god of vineyard fertility and crop prosperity.[76] Amplified by a quintessentially Georgian attitude that “every guest is a gift from God”, a blend of winemaking and wine tourism offers the country a promise of economic prosperity, even though much is still to be done to gain Georgia’s recognition as a producer of the world’s best wines and a top tourist destination.

Conclusion

Winemaking is central to Georgia’s cultural identity and social life, but its direct economic contribution appears moderate: wine exports account for a small percentage of GDP, and the formal wine industry employs a relatively small portion of the workforce. However, considering indirect impacts and future potential, wine is a significant driver of the national economy and regional development:

- Importance beyond statistics: wine production is crucial for rural communities, offering employment and income security; the informal wine economy is substantial.

- Growth potential: wine exports are increasing, and Georgia has a competitive advantage due to its unique grape varieties, climate, and winemaking traditions.

- Multiplier effect: winemaking is linked to other sectors like agriculture, tourism, and transportation, stimulating overall economic activity.

- Tourism synergy: wine tourism is a major driver for regional economies, attracting visitors and boosting revenue from food and beverage services.

Georgia’s future economic development can significantly benefit from investing in and promoting both winemaking and wine tourism. By leveraging its unique heritage and fostering a thriving wine industry, Georgia can attract investment, create jobs, and enhance its reputation as a global tourist destination, similar to the case of US wine industry centers.

Bibliography:

1. Agenda.ge. (2024). Georgian wine exports to the US, Europe have significantly increased, National Wine Agency says. <https://agenda.ge/en/news/2024/39895#gsc.tab=0> [Last Access 10.10.2024].

2. Charaia, V., Lashkhi, M. (2022). Foreign direct investments during the coronomic crisis and armed conflict in the neighbourhood, Case of Georgia. Globalization and Business, 7(13). <https://eugb.ge/index.php/111/article/view/17> [Last Access 10.10.2024].

3. Charaia, V., Chochia, A., Lashkhi, M. (2020). The impact of FDI on economic development: The case of Georgia. TalTech Journal of European Studies, 10(2). <https://intapi.sciendo.com/pdf/10.1515/bjes-2020-0017> [Last Access 10.10.2024].

4. Deisadze, S., Gelashvili, S., Katsia, I. (2020). To subsidize or not to subsidize Georgia’s wine sector? ISET Economist Blog. <https://iset-pi.ge> [Last Access 10.10.2024].

5. Dinello, N. (2022). Centrality of winemaking in Georgia: From prehistoric age to present-day globalization. Journal of Wine Research. <https://www.tandfonline.com/doi/abs/10.1080/09571264.2022.2110050> [Last Access 10.10.2024].

6. (2024). Georgia at a glance. FAO in Georgia, Food and Agriculture Organization of the United Nations. <https://www.fao.org/georgia/programmes-and-projects/georgia-at-a-glance/en/> [Last Access 10.10.2024].

7. Gabritchidze, N. (2023). Georgian miners strike as company cites global market crisis. <https://eurasianet.org/georgian-miners-strike-as-company-cites-global-market-crisis> [Last Access 10.10.2024].

8. Gelashvili, S., Deisadze, S., Seturidze, E. (2022). An overview of the Georgian wine sector: Policy brief. Free Network. <https://freepolicybriefs.org/2022/11/21/overview-georgia-wine-sector/> [Last Access 10.10.2024].

9. Georgia National Tourism Administration. (2024). Record $4.1 billion in tourism revenue and 7.1 million international travelers - 2023 statistics. <https://gnta.ge/ge/2023-statistics-info/?fbclid=IwAR3xD0boFcMaTR_L3jKrhwz_WQOGN_Eb4zOBaB0gQ6wMdePxx648hU2GFa4> [Last Access 10.10.2024].

10. Georgia Today. (2021). Wine production sector in Georgia. <https://georgiatoday.ge/wine-production-sector-in-georgia/#:~:text=The%20wine%20production%20sector%20in,CAGR%20of%2012.1%25%20was%20reported> [Last Access 10.10.2024].

11. Georgia.to. (2024). Government policy in the Georgian wine sector. <https://georgia.to/government-policy-in-georgian-wine-sector/> [Last Access 10.10.2024].

12. Georgian National Tourism Administration. (2023). Georgian tourism in figures: Structure and industry data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

13. GIZ. (2013). Kakheti regional development strategy 2014-2021 (pp. 12-13). Tbilisi. <https://faolex.fao.org/docs/pdf/geo200876.pdf> [Last Access 10.10.2024].

14. Hellibrand GORI. (2024). California - Vineyard of the Americas. Explore the world’s top wine regions. <https://about-california.com/wines.htm#:~:text=California%20%2D%20Vineyard%20of%20the%20Americas,87%25%20of%20US%20wine%20production> [Last Access 10.10.2024].

15. International Monetary Fund. (2024). World Economic Outlook Database. <https://www.imf.org/en/Publications/WEO/weo-database/2024/April/weo-report?c=915,&s=NGDP_RPCH,NGDPD,PPPGDP,NGDPDPC,PPPPC,PCPIPCH,&sy=2022&ey=2029&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.> [Last Access 10.10.2024].

16. International Trade Administration. (2023). Agricultural sector. Georgia – Country commercial guide. <https://www.trade.gov/country-commercial-guides/georgia-agricultural-sector> [Last Access 10.10.2024].

17. Jmukhadze, N. (2022). The role and influence of wine export on the economic growth of Georgia. Forbes. <https://forbes.ge/en/ghvinis-eqsportis-roli-da-gavlena-saqarthvelos-ekonomikur-zrdaze/> [Last Access 10.10.2024].

18. Kvakhadze, I., Surmava, M., Beroshvili, T. (2022). Georgian wine industry overview: August 2022 sector report. TBC Capital. <https://tbccapital.ge/static/file/202208124343-georgian-wine-industry-overview-12.08.2022-tbccapital.pdf> [Last Access 10.10.2024].

19. Lashkhi, M., Charaia, V., Boyarchuk, A., Ebralidze, L. (2022). The impact of fintech on financial institutions: The case of Georgia. TalTech Journal of European Studies, 12(2). <https://intapi.sciendo.com/pdf/10.2478/bjes-2022-0010> [Last Access 10.10.2024].

20. Lashkhi, M., Ogbaidze, S., Lashkhi, M., Charaia, V. (2022). Startup access to finance in Georgia and international experience. <https://ekonomisti.tsu.ge/?cat=nomer&leng=eng&adgi=692> [Last Access 10.10.2024].

21. Mamardashvili, G. (2022). Georgia, the cradle of wine. Georgian Folklore Magazine, Journal No. 1. <https://geofolk.ge/en/article/saqartvelo--ghvinis-akvani/57#:~:text=The%20ancient%20Georgian%20deity%20of,Guria%20and%20Lechkhumi)%20until%20recently> [Last Access 10.10.2024].

22. Market Entry Georgia. (2024). Automotive - Market research. Tbilisi. <https://www.marketentry.ge/automotive#:~:text=In%20Georgia%20cars%20are%20mostly,is%20not%20producing%20cars%20itself> [Last Access 10.10.2024].

23. Municipal Development Fund of Georgia. (2018). Marketing, branding and promotional strategy for Georgia, Part II – Strategy. RFP No.: IBRD/IDA/RDPII/CS/QCBS/03-2017.

24. National Statistics Office of Georgia. (2024a). Exports by commodity groups (HS 2-digit level) in 2015-2024, e <https://www.geostat.ge/en/modules/categories/637/export> [Last Access 10.10.2024].

25. National Statistics Office of Georgia. (2024b). Unemployment, percentage and labor force indicators by regions. Employment and Unemployment. <https://www.geostat.ge/en/modules/categories/683/Employment-Unemployment> [Last Access 10.10.2024].

26. National Statistics Office of Georgia. (2024c). Inbound tourism statistics in Georgia. <https://www.geostat.ge/media/59934/Inbound-Tourism-Statistics---%282023-year%29.pdf> [Last Access 10.10.2024].

27. National Statistics Office of Georgia. (2024d). GDP at current prices, billion GEL. Gross Domestic Product (GDP). <https://www.geostat.ge/en/modules/categories/23/gross-domestic-product-gdp> [Last Access 10.10.2024].

28. National Wine Agency. (2024). Promotion of Georgian wine on international markets will become more active in 2024. <https://wine.gov.ge/En/News/37081> [Last Access 10.10.2024].

29. Papava, V., Charaia, V. (2020). The coronomic crisis and some challenges for the Georgian economy. GFSIS, Expert Opinion, (136). <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3572124> [Last Access 10.10.2024].

30. Quinn, C. (2020). The tourism industry is in trouble. These countries will suffer the most. Foreign Policy. <https://foreignpolicy.com/2020/04/01/coronavirus-tourism-industry-worst-hit-countries-infographic/> [Last Access 10.10.2024].

31. Statista. (2024). Number of international tourist arrivals in France from 2010 to 2023. <https://www.statista.com/statistics/436543/number-of-inbound-overnight-visits-france/#:~:text=The%20number%20of%20international%20tourist,by%20the%20destination%20to%20date> [Last Access 10.10.2024].

32. TASS. (2024). Georgian wine exports to Russia rise by 74% in Q1 2024. <https://tass.com/economy/1777963> [Last Access 10.10.2024].

33. The National Association of American Wineries. (2023). California economic impact study 2022. <https://wineamerica.org/economic-impact-study/california-wine-industry/#:~:text=2022,the%20American%20economy%20in%202022> [Last Access 10.10.2024].

34. This Day in Wine History. (2022). History of wine tourism in the ancient world. <https://thisdayinwinehistory.com/history-of-wine-tourism-in-the-ancient-world/> [Last Access 10.10.2024].

35. Tourism Economics. (2021). Data and digital platforms: Driving the tourism recovery in Georgia, an Oxford Economics Company. <https://s3.amazonaws.com/tourism-economics/craft/Google_Georgia_Final.pdf> [Last Access 10.10.2024].

36. Transparency International Georgia. (2024). Georgia’s economic dependence on Russia: Summary of 2023. <https://transparency.ge/en/blog/georgias-economic-dependence-russia-summary-2023> [Last Access 10.10.2024].

37. Tsereteli, M. (2024). Georgian wine and its narrative drive development: The Central Asia – Uncorking Georgia’s wine boom: A statistical deep dive and exploring key regions. 8Wines. <https://www.cacianalyst.org/publications/analytical-articles/item/13548-georgian-wine-and-> [Last Access 10.10.2024].

38. S. Department of State. (2023). Investment climate statements: Georgia (2023). <https://www.state.gov/reports/2023-investment-climate-statements/georgia/#:~:text=Growth%20and%20inflation%20are%20expected,favorably%20compares%20to%20regional%20peers> [Last Access 10.10.2024].

39. UN Tourism. (2016). 1st UNWTO Global Conference on Wine Tourism. <https://www.unwto.org/archive/global/event/1st-unwto-global-conference-wine-tourism> [Last Access 10.10.2024].

40. UN Tourism. (2023). 7th UNWTO Global Conference on Wine Tourism. <https://www.unwto.org/7-UNWTO-Global-Conference-Wine-Tourism> [Last Access 10.10.2024].

41. UN Tourism. (2024). World tourism barometer. <https://pre-webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2024-06/Barom_PPT_May_2024.pdf?VersionId=U7O62HatlG4eNAj.wcmuQG1PMCjK.Yss> [Last Access 10.10.2024].

42. UN. (2020). Building the resilience of mountain communities in the face of crisis: United Nations, Georgia. <https://georgia.un.org/en/104787-building-resilience-mountain-communities-face-crisis> [Last Access 10.10.2024].

43. University of Georgia Extension. (2024). Georgia’s alcoholic beverage industry 2024 outlook. <https://extension.uga.edu/publications/detail.html?number=AP130-2-15&title=georgias-alcoholic-beverage-industry-2024-outlook> [Last Access 10.10.2024].

44. Veseth, M. (2020). Anatomy of Georgia’s wine export surge. The Wine Economist. <https://wineeconomist.com/2020/12/08/ghvino/> [Last Access 10.10.2024].

45. Wine History Tours. (2023). A historical timeline of wine tourism. <https://winehistorytours.com/a-historical-timeline-of-wine-tourism/#:~:text=THE%20BIRTH%20OF%20WINE%20TOURISM&text=In%20California%2C%20in%20the%201970s,opening%20their%20doors%20to%20guests> [Last Access 10.10.2024].

46. World Economics. (2024). Georgia’s informal economy size. <https://www.worldeconomics.com/Informal-Economy/Georgia.aspx> [Last Access 10.10.2024].

47. World Travel and Tourism Council. (2023). Global travel & tourism catapults into 2023 says WTTC, economic impact research. <https://wttc.org/news-article/global-travel-and-tourism-catapults-into-2023-says-wttc#:~:text=A%20look%20back%20on%20last%20year&text=This%20recovery%20represented%207.6%25%20of,GDP%20contribution%20of%20%247.7TN> [Last Access 10.10.2024].

48. World Travel and Tourism Council. (2024). World economic impact report. <https://researchhub.wttc.org/product/world-economic-impact-report> [Last Access 10.10.2024].

Footnotes

[1] Dinello, N. (2022). Centrality of winemaking in Georgia: From prehistoric age to present-day globalization. Journal of Wine Research. <https://doi.org/10.1080/09571264.2022.2110050>.

[2] National Statistics Office of Georgia. (2024a). Exports by commodity groups (HS 2-digit level) in 2015-2024, export. <https://www.geostat.ge/en/modules/categories/637/export> [Last Access 10.10.2024].

[3] Ibid.

[4] Ibid.

[5] National Statistics Office of Georgia. (2024a). Exports by commodity groups (HS 2 digit level) in 2015-2024, export. <https://www.geostat.ge/en/modules/categories/637/export> [Last Access 10.10.2024].

[6] Agenda.ge. (2024). Georgian wine exports to the US, Europe have significantly increased, National Wine Agency says. <https://agenda.ge/en/news/2024/39895#gsc.tab=0> [Last Access 10.10.2024].

[7] Kvakhadze, I., Surmava M., Beroshvili T. (2022). Georgian Wine Industry Overview: August 2022 Sector Report, TBC Capital. <https://tbccapital.ge/static/file/202208124343-georgian-wine-industry-overview-12.08.2022-tbccapital.pdf> [Last Access 10.10.2024].

[8] TASS. (2024). Georgian wine exports to Russia rise by 74% in Q1 2024. <https://tass.com/economy/1777963> [Last Access 10.10.2024].

[9] Transparency International Georgia. (2024). Georgia’s Economic Dependence on Russia: Summary of 2023. <https://transparency.ge/en/blog/georgias-economic-dependence-russia-summary-2023> [Last Access 10.10.2024].

[10] TASS. (2024). Georgian wine exports to Russia rise by 74% in Q1 2024. <https://tass.com/economy/1777963> [Last Access 10.10.2024].

[11] Jmukhadze, N. (2022). The Role and Influence of Wine Export on the Economic Growth of Georgia. Forbes. <https://forbes.ge/en/ghvinis-eqsportis-roli-da-gavlena-saqarthvelos-ekonomikur-zrdaze/> [Last Access 10.10.2024].

[12] Jmukhadze, N. (2022). The Role and Influence of Wine Export on the Economic Growth of Georgia. Forbes. <https://forbes.ge/en/ghvinis-eqsportis-roli-da-gavlena-saqarthvelos-ekonomikur-zrdaze/> [Last Access 10.10.2024].

* Calculated by authors from the data of the National Statistics Office of Georgia.

[13] Jmukhadze, N. (2022). The Role and Influence of Wine Export on the Economic Growth of Georgia. Forbes. <https://forbes.ge/en/ghvinis-eqsportis-roli-da-gavlena-saqarthvelos-ekonomikur-zrdaze/> [Last Access 10.10.2024].

[14] GIZ. (2013). Kakheti Regional Development Strategy 2014-2021 (pp. 12-13). Tbilisi. <https://faolex.fao.org/docs/pdf/geo200876.pdf> [Last Access 10.10.2024].

[15] National Statistics Office of Georgia. (2024b). Unemployment, percentage and Labor Force Indicators by Regions. Employment and Unemployment. <https://www.geostat.ge/en/modules/categories/683/Employment-Unemployment> [Last Access 10.10.2024].

[16] International Trade Administration. (2023). Agricultural Sector. Georgia – Country Commercial Guide. <https://www.trade.gov/country-commercial-guides/georgia-agricultural-sector> [Last Access 10.10.2024].

[17] Georgia Today. (2021). Wine Production Sector in Georgia. <https://georgiatoday.ge/wine-production-sector-in-georgia/#:~:text=The%20wine%20production%20sector%20in,CAGR%20of%2012.1%25%20was%20reported> [Last Access 10.10.2024].

[18] National Statistics Office of Georgia. (2024b). Unemployment, percentage and Labor Force Indicators by Regions. Employment and Unemployment. <https://www.geostat.ge/en/modules/categories/683/Employment-Unemployment> [Last Access 10.10.2024].

[19] World Economics. (2024). Georgia’s Informal Economy Size. <https://www.worldeconomics.com/Informal-Economy/Georgia.aspx> [Last Access 10.10.2024].

[20] International Monetary Fund. (2024). Georgia. World Economic Outlook Database. <https://www.imf.org/en/Publications/WEO/weo-database/2024/April/weo-report?c=915,&s=NGDP_RPCH,NGDPD,PPPGDP,NGDPDPC,PPPPC,PCPIPCH,&sy=2022&ey=2029&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1> [Last Access 10.10.2024].

[21] National Wine Agency. (2024). Promotion of Georgian wine on international markets will become more active in 2024. News. <https://wine.gov.ge/En/News/37081> [Last Access 10.10.2024].

[22] Gelashvili, S., Deisadze S., Seturidze E. (2022). An Overview of the Georgian Wine Sector: Policy Brief, Free Network. <https://freepolicybriefs.org/2022/11/21/overview-georgia-wine-sector/> [Last Access 10.10.2024].

[23] Georgia.to. (2024). Government Policy in the Georgian Wine Sector. <https://georgia.to/government-policy-in-georgian-wine-sector/> [Last Access 10.10.2024].

[24] Gelashvili, S., Deisadze S., Seturidze E. (2022). An Overview of the Georgian Wine Sector: Policy Brief, Free Network. <https://freepolicybriefs.org/2022/11/21/overview-georgia-wine-sector/> [Last Access 10.10.2024].

[25] Jmukhadze, N. (2022). The Role and Influence of Wine Export on the Economic Growth of Georgia. Forbes. <https://forbes.ge/en/ghvinis-eqsportis-roli-da-gavlena-saqarthvelos-ekonomikur-zrdaze/> [Last Access 10.10.2024].

[26] Deisadze, S., Gelashvili S., Katsia I. (2020). To Subsidize or Not to Subsidize Georgia’s Wine Sector? ISET Economist Blog. To Subsidize or Not to Subsidize Georgia’s Wine Sector? (iset-pi.ge) [Last Access 10.10.2024].

[27] This Day in Wine History. (2022). History of Wine Tourism in the Ancient World. <https://thisdayinwinehistory.com/history-of-wine-tourism-in-the-ancient-world/> [Last Access 10.10.2024].

[28] UN Tourism. (2016). 1st UNWTO Global Conference on Wine Tourism. <https://www.unwto.org/archive/global/event/1st-unwto-global-conference-wine-tourism> [Last Access 10.10.2024].

[29] UN Tourism. (2023). 7th UNWTO Global Conference on Wine Tourism. <https://www.unwto.org/7-UNWTO-Global-Conference-Wine-Tourism> [Last Access 10.10.2024].

[30] Municipal Development Fund of Georgia. (2018). Marketing, branding, and promotional strategy for Georgia, Part II – Strategy (pp. 31-72). RFP No.: IBRD/IDA/RDPII/CS/QCBS/03-2017.

[31] Charaia, V., Lashkhi, M. (2022). Foreign direct investments during the coronomic crisis and armed conflict in the neighbourhood, Case of Georgia. Globalization and Business, 7(13), pp. 51-56. <https://eugb.ge/index.php/111/article/view/17> [Last Access 10.10.2024].

[32] Papava, V., Charaia, V. (2020). The coronomic crisis and some challenges for the Georgian economy. GFSIS, Expert Opinion, (136). <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3572124> [Last Access 10.10.2024].

[33] Georgia National Tourism Administration. (2024). Record $4.1 billion in tourism revenue and 7.1 million international travelers - 2023 statistics. <https://gnta.ge/ge/2023-statistics-info/?fbclid=IwAR3xD0boFcMaTR_L3jKrhwz_WQOGN_Eb4zOBaB0gQ6wMdePxx648hU2GFa4> [Last Access 10.10.2024].

[34] National Statistics Office of Georgia. (2024c). Inbound Tourism Statistics in Georgia (pp. 4-9). <https://www.geostat.ge/media/59934/Inbound-Tourism-Statistics---%282023-year%29.pdf> [Last Access 10.10.2024].

[35] National Statistics Office of Georgia. (2024c). Inbound Tourism Statistics in Georgia (pp. 4-9). <https://www.geostat.ge/media/59934/Inbound-Tourism-Statistics---%282023-year%29.pdf> [Last Access 10.10.2024].

[36] Ibid.

[37] Georgian National Tourism Administration. (2023). Georgian Tourism in Figures: Structure and Industry Data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

[38] Georgian National Tourism Administration. (2023). Georgian Tourism in Figures: Structure and Industry Data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

[39] National Statistics Office of Georgia. (2024c). Inbound Tourism Statistics in Georgia (pp. 4-9). <https://www.geostat.ge/media/59934/Inbound-Tourism-Statistics---%282023-year%29.pdf> [Last Access 10.10.2024].

[40] World Travel and Tourism Council. (2023). Global Travel & Tourism Catapults into 2023 Says WTTC, Economic Impact Research. <https://wttc.org/news-article/global-travel-and-tourism-catapults-into-2023-says-wttc#:~:text=A%20look%20back%20on%20last%20year&text=This%20recovery%20represented%207.6%25%20of,GDP%20contribution%20of%20%247.7TN> [Last Access 10.10.2024].

[41] Georgian National Tourism Administration. (2023). Georgian Tourism in Figures: Structure and Industry Data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

[42] World Travel and Tourism Council. (2023). Global Travel & Tourism Catapults into 2023 Says WTTC, Economic Impact Research. <https://wttc.org/news-article/global-travel-and-tourism-catapults-into-2023-says-wttc#:~:text=A%20look%20back%20on%20last%20year&text=This%20recovery%20represented%207.6%25%20of,GDP%20contribution%20of%20%247.7TN> [Last Access 10.10.2024].

[43] National Statistics Office of Georgia. (2024c). Inbound Tourism Statistics in Georgia (pp. 4-9). <https://www.geostat.ge/media/59934/Inbound-Tourism-Statistics---%282023-year%29.pdf> [Last Access 10.10.2024].

[44] University of Georgia Extension. (2024). Georgia’s Alcoholic Beverage Industry 2024 Outlook. <https://extension.uga.edu/publications/detail.html?number=AP130-2-15&title=georgias-alcoholic-beverage-industry-2024-outlook> [Last Access 10.10.2024].

[45] Tsereteli, M. (2024). Georgian Wine and its Narrative Drive Development. The Central Asia – Uncorking Georgia’s Wine Boom: A Statistical Deep Dive and Exploring Key Regions. 8Wines. <https://www.cacianalyst.org/publications/analytical-articles/item/13548-georgian-wine-and-> [Last Access 10.10.2024].

[46] International Trade Administration. (2023). Agricultural Sector. Georgia – Country Commercial Guide. <https://www.trade.gov/country-commercial-guides/georgia-agricultural-sector> [Last Access 10.10.2024].

[47] FAO. (2024). Georgia at a Glance. FAO in Georgia, Food and Agriculture Organization of the United Nations. <https://www.fao.org/georgia/programmes-and-projects/georgia-at-a-glance/en/> [Last Access 10.10.2024].

[48] UN. (2020). Building the resilience of mountain communities in the face of crisis. United Nations: Georgia. <https://georgia.un.org/en/104787-building-resilience-mountain-communities-face-crisis> [Last Access 10.10.2024].

[49] National Statistics Office of Georgia. (2024a). Exports by commodity groups (HS 2 digit level) in 2015-2024, export. <https://www.geostat.ge/en/modules/categories/637/export> [Last Access 10.10.2024].

[50] National Statistics Office of Georgia. (2024d). GDP at current prices, billion GEL. Gross Domestic Product (GDP). <https://www.geostat.ge/en/modules/categories/23/gross-domestic-product-gdp> [Last Access 10.10.2024].

[51] Lashkhi, M., Charaia, V., Boyarchuk, A., Ebralidze, L. (2022). The Impact of Fintech on Financial Institutions: The Case of Georgia. TalTech Journal of European Studies, 12(2), pp. 20-42. <https://intapi.sciendo.com/pdf/10.2478/bjes-2022-0010> [Last Access 10.10.2024].

[52] Lashkhi, M., Ogbaidze, S., Lashkhi, M., Charaia, V. (2022). Startup access to finance in Georgia and international experience. <https://ekonomisti.tsu.ge/?cat=nomer&leng=eng&adgi=692> [Last Access 10.10.2024].

[53] National Statistics Office of Georgia. (2024a). Exports by commodity groups (HS 2 digit level) in 2015-2024, Export. <https://www.geostat.ge/en/modules/categories/637/export> [Last Access 10.10.2024].

** Calculated by authors from the data of the National Statistics Office of Georgia.

[54] Tsereteli, M. (2024). Georgian Wine and its Narrative Drive Development. The Central Asia – Uncorking Georgia’s Wine Boom: A Statistical Deep Dive and Exploring Key Regions. 8Wines.

<https://www.cacianalyst.org/publications/analytical-articles/item/13548-georgian-wine-and-> [Last Access 10.10.2024].

[55] Jmukhadze, N. (2022). The Role and Influence of Wine Export on the Economic Growth of Georgia. Forbes. <https://forbes.ge/en/ghvinis-eqsportis-roli-da-gavlena-saqarthvelos-ekonomikur-zrdaze/> [Last Access 10.10.2024].

[56] Market Entry Georgia. (2024). Automotive - Market Research. Tbilisi. <https://www.marketentry.ge/automotive#:~:text=In%20Georgia%20cars%20are%20mostly,is%20not%20producing%20cars%20itself> [Last Access 10.10.2024].

[57] Gabritchidze, N. (2023). Georgian miners strike as company cites global market crisis. Eurasianet. <https://eurasianet.org/georgian-miners-strike-as-company-cites-global-market-crisis> [Last Access 10.10.2024].

[58] Hellibrand GORI. (2024). California - Vineyard of the Americas. About-California.com, Explore the World’s Top Wine Regions. <https://about-california.com/wines.htm#:~:text=California%20%2D%20Vineyard%20of%20the%20Americas,87%25%20of%20US%20wine%20production> [Last Access 10.10.2024].

[59] The National Association of American Wineries. (2023). California Economic Impact Study 2022. <https://wineamerica.org/economic-impact-study/california-wine-industry/#:~:text=2022,the%20American%20economy%20in%202022> [Last Access 10.10.2024].

[60] Ibid.

[61] Ibid.

[62] Georgian National Tourism Administration. (2023). Georgian Tourism in Figures: Structure and Industry Data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

[63] Georgian National Tourism Administration. (2023). Georgian Tourism in Figures: Structure and Industry Data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

[64] National Statistics Office of Georgia. (2024d). GDP at current prices, billion GEL. Gross Domestic Product (GDP). <https://www.geostat.ge/en/modules/categories/23/gross-domestic-product-gdp> [Last Access 10.10.2024].

[65] World Travel and Tourism Council. (2024). World Economic Impact Report. <https://researchhub.wttc.org/product/world-economic-impact-report> [Last Access 10.10.2024].

[66] Tourism Economics. (2021). Data and Digital Platforms: Driving the Tourism Recovery in Georgia, an Oxford Economics Company. <https://s3.amazonaws.com/tourism-economics/craft/Google_Georgia_Final.pdf> [Last Access 10.10.2024].

[67] Georgia National Tourism Administration. (2024). Record $4.1 billion in tourism revenue and 7.1 million international travelers - 2023 statistics. <https://gnta.ge/ge/2023-statistics-info/?fbclid=IwAR3xD0boFcMaTR_L3jKrhwz_WQOGN_Eb4zOBaB0gQ6wMdePxx648hU2GFa4> [Last Access 10.10.2024].

[68] Ibid.

[69] Statista. (2024). Number of international tourist arrivals in France from 2010 to 2023. <https://www.statista.com/statistics/436543/number-of-inbound-overnight-visits-france/#:~:text=The%20number%20of%20international%20tourist,by%20the%20destination%20to%20date> [Last Access 10.10.2024].

[70] UN Tourism. (2024). World Tourism Barometer. <https://pre-webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2024-06/Barom_PPT_May_2024.pdf?VersionId=U7O62HatlG4eNAj.wcmuQG1PMCjK.Yss> [Last Access 10.10.2024].

***Calculated by authors using the average exchange rate in 2023 of Euro to USD of 1.0824 USD. ExchangeRates.org.UK. Euro to US Dollar Spot Exchange Rates for 2023 [Last Access 26.07.2024].

[71] Georgian National Tourism Administration. (2023). Georgian Tourism in Figures: Structure and Industry Data 2022 (pp. 8-23). <https://gnta.ge/wp-content/uploads/2023/09/2022-eng-1.pdf> [Last Access 10.10.2024].

[72] Quinn, C. (2020). The Tourism Industry Is in Trouble. These Countries Will Suffer the Most. Foreign Policy. <https://foreignpolicy.com/2020/04/01/coronavirus-tourism-industry-worst-hit-countries-infographic/> [Last Access 10.10.2024].

[73] Charaia, V., Chochia, A., & Lashkhi, M. (2020). The impact of FDI on economic development: The Case of Georgia. TalTech Journal of European Studies, 10(2), pp. 96-116. <https://intapi.sciendo.com/pdf/10.1515/bjes-2020-0017> [Last Access 10.10.2024].

[74] Veseth, M. (2020). Anatomy of Georgia’s Wine Export Surge. The Wine Economist. <https://wineeconomist.com/2020/12/08/ghvino/> [Last Access 10.10.2024].

[75] Georgia Today. (2021). Wine Production Sector in Georgia. <https://georgiatoday.ge/wine-production-sector-in-georgia/#:~:text=The%20wine%20production%20sector%20in,CAGR%20of%2012.1%25%20was%20reported> [Last Access 10.10.2024].

[76] Mamardashvili, G. (2022). Georgia, the Cradle of Wine. Georgian Folklore Magazine, Journal No.1. <https://geofolk.ge/en/article/saqartvelo--ghvinis-akvani/57#:~:text=The%20ancient%20Georgian%20deity%20of,Guria%20and%20Lechkhumi)%20until%20recently> [Last Access 10.10.2024].

Downloads

Downloads

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.