FDI, FDI’s Impact on Economic Growth and the Investment Environment in Georgia

DOI:

https://doi.org/10.35945/gb.2023.16.004Keywords:

Foreign Direct Investment, Economic Growth, Sovereign Credit RatingAbstract

Georgia, with its open policy towards foreign investment flows, was one of the first countries in the Post-Soviet space. From the day of gaining independence, FDI has become the most important indicator of the country, and the assessment of the volume of foreign investment flows carried out in the country, statically or dynamically, has not lost its relevance to this day. Present article explores the volume of foreign direct investments made in Georgia, in dynamic; From the total indicators, in terms of geography, the largest investor countries are identified; In the period 2013-2022, the structure of FDI is expanded according to components and the percentage distribution of share capital, reinvestments and debt obligations from the total indicators is highlighted; The impact of FDI on economic growth indicators has been determined using correlation-regression analysis. The article also provides global figures for foreign direct investment, including countries receiving the largest FDI flows; In order to assess the investment environment, in dynamics, the sovereign credit ratings of Georgia evaluated by the leading rating companies are presented. Statistical observation, collection-grouping and analysis techniques and methods are used in the research process.

Keywords: Foreign Direct Investment, Economic Growth, Sovereign Credit Rating

Introduction

In recent decades, globalization trends have significantly increased the mobility of investment capital worldwide. Therefore, foreign direct investment (FDI) flows have increased, and their impact on economic growth indicators has become complex. From the different evidence, the connection between FDI and economic growth is mixed. Some empirical investigations confirm the positive productivity effect. However, others find a negative or no productivity effect. It should be mentioned that for the developed countries, there are positive and significant spillover effects. For the developing countries, results are more mixed (Pharjiani, Sh. 2015). [1]

Policymakers in both emerging and advanced economies agree that FDI is a critical component of a successful development strategy. The European Commission, for example, states that Foreign Direct Investment is a driver of competitiveness and economic development. Similarly, during the COVID-19 pandemic, the World Bank regarded FDI as critical to crisis recovery. The enthusiasm of policymakers stands in stark contrast to academic literature. A Google Scholar search for publications with titles that include the phrases FDI, and economic growth or Foreign Direct Investment and growth finds almost 5000 papers. Many of these have received tens of thousands of citations. While there are a few papers that find a positive link between FDI and economic growth, there is now a consensus that FDI flows alone are not enough. That complementary inputs such as human capital (Borensztein et al. 1998) [2] and financial depth (Alfaro et al. 2004 and Alfaro et al. 2010) [3-4] play a central role in the link between FDI and economic growth (Benetrix, A., Pallan, H., Panizza, U., 2022). [5]

With its open policy towards investment flows, Georgia was one of the first countries in the post-Soviet space. From the day of gaining independence, against the background of investment hunger characteristic of a country undergoing systemic transformation, it has become the most important indicator of the country, and the assessment of the volume of foreign investment flows carried out in the country, statically or dynamically, has not lost its relevance to this day.

Foreign direct investments are a category of the country's international investment activity and an important component of the balance of payments statistical report reflecting foreign economic relations. Foreign direct investment (FDI) refers to the ownership of a share in an enterprise located in the territory of another country by a resident of one country and conducting various economic operations related to this enterprise. The direct investment includes the initial capital investment operation and every subsequent operation between the direct investor and the direct investment enterprise. An investor who owns at least 10% of the shares of an enterprise or the equivalent of such participation is a direct investor. Individuals, corporate or non-corporate, private, and state organizations can act as direct investors (BPM6). [6]

The receiving country's investment environment is important in attracting foreign direct investments and subsequently effectively managing them, which, considering a number of factors, is unique in the case of each country. As a country with a developing economy, Georgia has experienced difficult and important changes in the economic and political direction during the last decades. The country's success is reflected in the country's leading positions in various international rankings. However, there are still problematic areas that require drastic and effective reforms.

Foreign Direct Investments and its impact on Economic Growth

According to the statistical data from the United Nations Conference on Trade and Development (UNCDAT), the global flows of foreign direct investments from 1990 to 2021 totalled $33.5 trillion. (World Investment Report) [7]. Among them, 62% was received by countries with developed economies and 38% by countries with developing economies. In the considered period, the countries receiving the largest investment flows were the USA ($5.9 trillion), China ($2.6 trillion), United Kingdom ($2.1 trillion), Hong Kong ($1.8 trillion), Singapore ($1.2 trillion), Germany ($1.1 trillion), Brazil ($1.1 trillion), Canada ($1 trillion), Ireland ($0.9 trillion), Netherlands ($0.8 trillion), Spain ($0.8 trillion), Mexico ($0.7 trillion), India ($0.7 trillion). In 2022, compared to 2021, Global FDI decreased by 12%, to $1.295 trillion. Investment flows mainly increased in developing countries by 4%, to $916 billion, while decreasing in developed economies by 37%, to $378 billion.

Georgia is among the countries with a developing economy, which, according to the data of the mentioned source (UNCDAT), during the years 1990-2022, received up to $25 billion of foreign direct investment, less than 0.1% of the total figure.

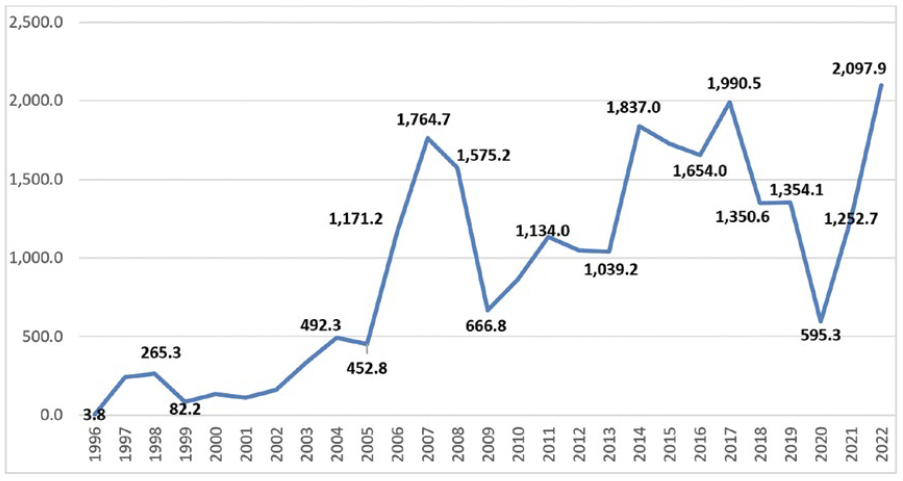

From the second half of the 90s of the 20th century, foreign direct investments have become one of the key indicators of the Georgian economy. According to the data of the National Statistical Service of Georgia (Geostat, Foreign Direct Investments) [8], from 1996 to 2022, the indicator of the FDI implemented in the country amounted to almost 25.4 billion US dollars. At the initial stage, significant transnational capital flows were determined by the investments made in the pipeline projects passing through Georgia, particularly the Baku-Sufsa oil pipeline and the works carried out at the Sufsa terminal. Since 2005, a number of reforms have been implemented in Georgia to remove barriers to entry into the tax, customs, financial fields and investment market. The process of privatization of state-owned enterprises was activated. Accordingly, high flows of foreign investments were recorded in 2007, which is explained more by the change of the owner than by the sustainable improvement of production processes. The events of the August 2008 war and the world economic crisis reduced investment flows to a minimum. In 2009-2011, foreign investments in Georgia grew steadily. A decrease in election years characterizes the dynamics of FDI; for example, we can cite the data of 2012, 2016 and 2020, the main factors of which are the expectations of the election year and post-election uncertainty. In 2019-2020, we also have to mention the pandemic and the economic stagnation related to it as the main factor for decreasing FDI flows. It should be noted here that in recent years, the inflows of foreign direct investments in Georgia were negatively affected by the disputes related to constructing the deep-water port of Anaklia. However, the state asset's future use is currently under active consideration (Diagram №1).

The highest FDI rate since 1996 (adjusted by Geostat) was recorded in 2022 ($2.1 billion; 8.27% of the total), followed by 2017 (7.87%) and 2007 (6.93%).

Diagram №1

Source: National Statistics Office of Georgia.

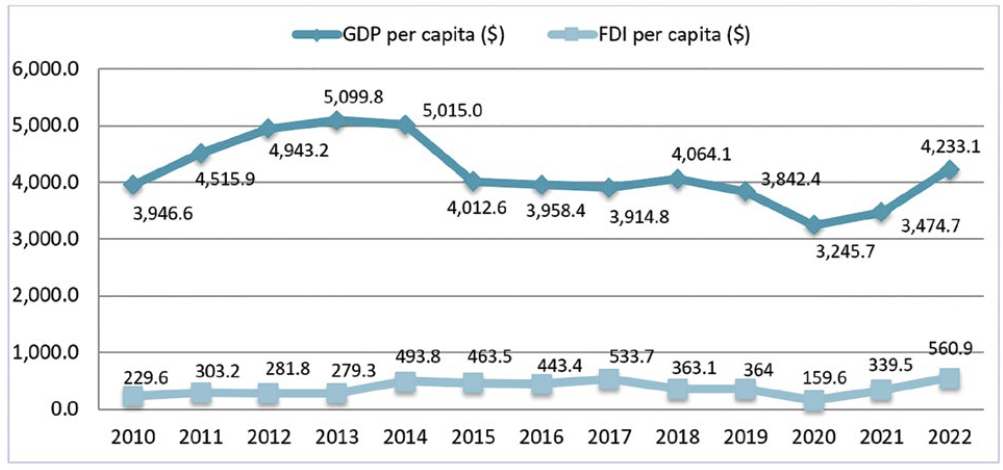

We can compare FDI per capita and GDP per capita (we used GDP at 2015 prices) in dynamics, from 2010 to 2022, and notice that the main trends match only from 2020 to 2022 (Diagram №2). There are many crucial factors, which impact on these measures, between them are changes in demographical picture and currency exchange rate of Georgia.

Source: National Statistics Office of Georgia.

If we group the current indicators of FDI carried out in the years 1996-2022 according to investor countries and look at the geography of investment flows, the United Kingdom leads the largest investor countries with an investment of 3.7 billion US dollars (14.74% of the total). According to the total data, including 2019, the largest investor country was Azerbaijan; however, against reduced commitments[1] in 2020 and 2022, Azerbaijan occupies the third position after the United Kingdom and the Netherlands.

In the period 1996-2022, 31.5% (7.97 billion US dollars) of foreign direct investments made in Georgia came from EU countries, 17.3% was held by the group of countries included in the Commonwealth of Independent States (CIS) (4.38 billion US dollars), and the total amount from other countries was realized 49.7% of the FDI (12.6 billion US dollars), the weight of international organizations is 1.4%, and in the case of 0.06% of total investments, the country is unknown.

The offshore zone was also included in the list of the largest investor countries. Considering the legal framework adapted to the foreign investor, Georgian citizens often used offshore for reinvestment. Some of the large Georgian companies are registered in the territory of the European Union, therefore, part of their turnover is perceived as foreign investments.

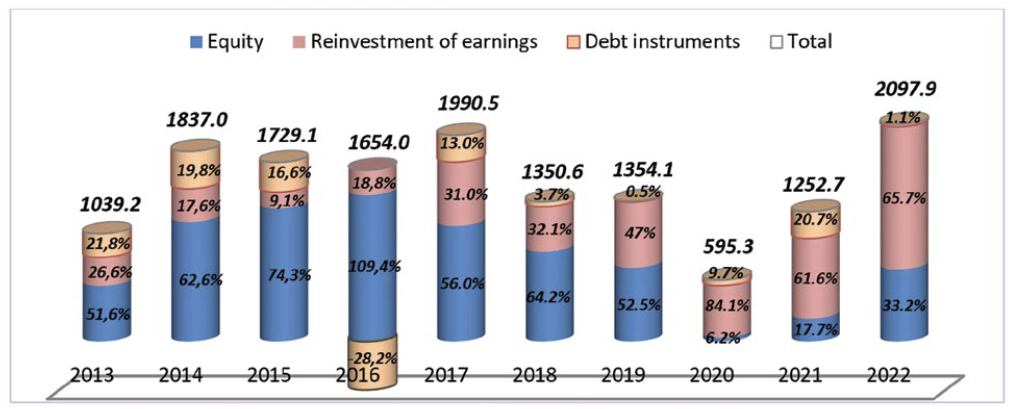

If we look at the components of foreign direct investments made in Georgia in the dynamics of the last 10 years, we can see that the rate of share capital (liabilities to the direct investor) was the highest in 2016 and amounted to 1.81 billion US dollars (109.4% of the annual FDI), although the index of debt instruments in the same year was negative, -466.2 million US dollars, which accordingly reduced the index of the annual FDI (Diagram №3).

The rate of reinvested earnings, which refers to the difference between profit and loss and dividends, was the highest in dynamics according to the preliminary data of 2022 and amounted to USD 1.3 billion in absolute terms (64.5% of the annual FDI).

Diagram №3

Source: National Statistics Office of Georgia.

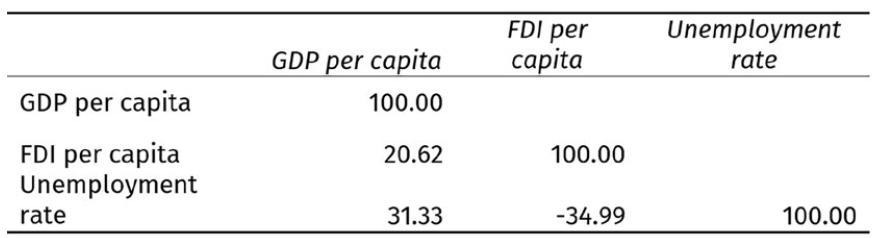

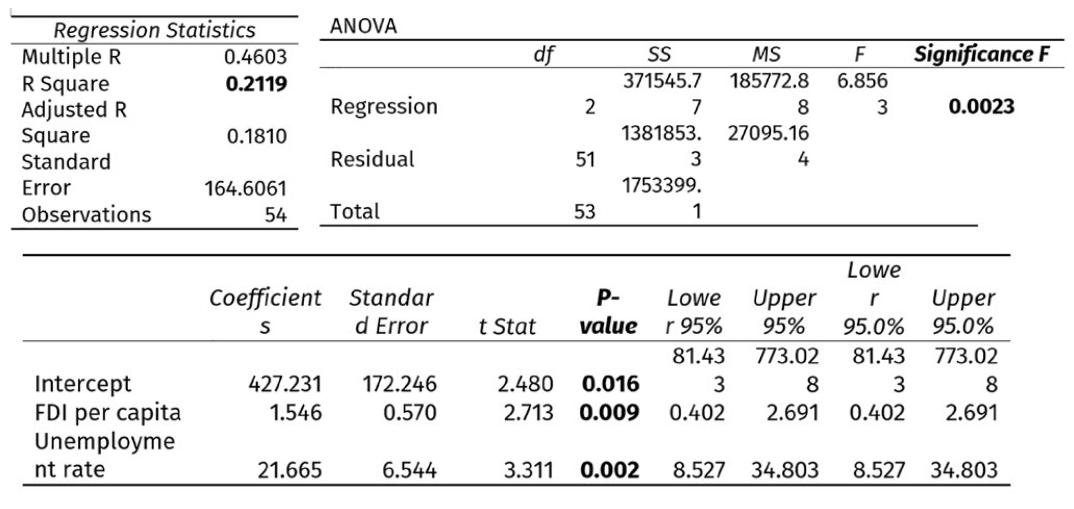

To determine the relationship between FDI flows and economic growth indicators in Georgia, we used correlation-regression analysis on 54 quarters of data (2010-I - 2023-II). For the regression model, GDP per capita was defined as a dependent variable, whereas FDI per capita and unemployment rate - independent variables.

The correlation matrix (Table №1) shows that in the reporting period, the link between GDP per capita and FDI per capita was almost insignificant (21%), while the correlation between FDI per capita and the unemployment rate was noted as inversely proportional and relatively significant (-35%).

Table №1

Correlation Matrix

According to the linear regression analysis, the ANOVA test shows that the significance of the F-test and T-test is reliable; it means that the chosen regression model is acceptable, but the determination coefficient demonstrates that the independent variables influence just 21.2% of the dependent variable (Table №2).

Table №2

Sovereign Credit Ratings of Georgia

International credit ratings significantly determine the country's investment environment. A country's sovereign credit rating is a kind of message to investors and other interested parties about the risk associated with investing in the respective country. Rating companies assess the country's economic and political environment to determine the appropriate risk level and the country's ability as a borrower to meet its obligations to creditors. Accordingly, great importance is attached to the evaluations of the rating companies because the deterioration of the specific ratings may significantly complicate the attraction of foreign investments in the country and borrowing in the international credit market.

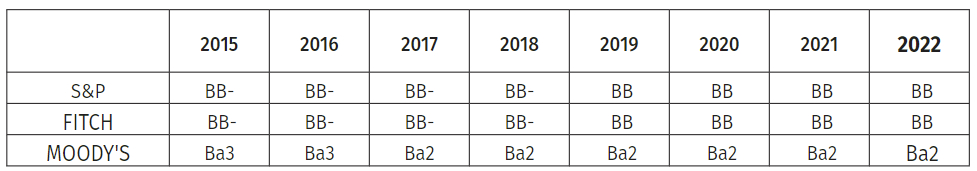

Rating companies evaluate countries every year. According to the symbols used in the assessment, the level "A" corresponds to the degree of low risk, "B" is an average score and indicates credit risk, and if "C" is used, it is very high credit risk and probability of default. "+" and "-" are also added to the rating score for quality ranking in the case of Standard & Poor's (S&P Global) [9] and Fitch (FitchRatings) [10] and ranks 1 to 3 in the case of Moody's (Moody’s) [11]. However, 'BBB', 'Baa' and above are investment grade and 'BB', 'Ba' and below is non-investment grade.

The sovereign credit ratings of Georgia determined by the three largest rating companies - "Big Three" ("S&P Global", "Fitch" and "Moody's") are characterized by a positive trend in dynamics (Table №3). According to the data of 2022, two rating steps separate Georgia from the "risky" category to the "investment" category.

Table №3

Sovereign Credit Ratings of Georgia

Source: National Bank of Georgia [12]

The practice of assigning ratings to Georgia begins in 2005. In 2004-2007, against the backdrop of improved economic indicators, Standard & Poor's assigned a "B+" credit rating to Georgian government securities with positive expectations, followed by a "BB-" rating from Fitch, which at the time was a positive signal for the economy about the rapid improvement. The advancement in international ratings at that time contributed to the issuance of the first Eurobonds (worth 500 million USD) by the Georgian government in the spring of 2008. However, after the Russia-Georgia conflict in August 2008, Standard & Poor’s and Fitch downgraded Georgia's sovereign credit ratings to "B" and "B+" with a negative outlook, respectively. Since 2009, Georgia's credit ratings have improved to the "BB" level. "Moody" determined Georgia's rating point as "Ba3" in 2010, and in 2017 it improved the rating point to "Ba2".

Despite the stable credit ratings in dynamics, the main challenge of the country's investment environment remains the significant currency risks of the state debt, weak foreign sector finances, and high dollarization, also, a high level of inflation, which directly affects the decrease in the real income of the population.

It should be noted that in 2022, against the backdrop of improved macroeconomic indicators, interest rates have increased on loans issued in national and foreign currencies. The National Bank of Georgia explains this with appropriate monetary policy and high annual inflation indicators; however, practice shows that the increase in interest rates reduces the availability of free money, which, in the future, will have a negative impact on the growth of economic activity on the part of businesses and the improvement of the indicators of the gross national product.

Conclusion

Thus, from 1996, including the data for 2022, a total of 25.4 billion USD in foreign direct investments were made in Georgia. In dynamics, the highest investment flows, including the highest reinvestment rate, were recorded in the preliminary data of 2022. The largest investor country was the United Kingdom.

In 2022, compared to 2021, Global FDI decreased by 12% to $1.295 trillion. Investment flows mainly increased in developing countries by 4%, to $916 billion, while reducing in developed economies by 37%, to $378 billion.

Georgia is among the countries with a developing economy, which, according to the data of the UNCDAT, during the years 1990-2022, received up to $25 billion of foreign direct investment, which is less than 0.1% of the total figure.

The highest GDP (at 2015 prices) per capita, in the period 2010-2022, was recorded in 2013 ($5099.8), followed by 2022 ($4233.1) and 2018 ($4064.1).

According to correlation-regression analyses, in the period 2010-2023 by quarter, the link between GDP per capita and FDI per capita was almost insignificant.

Three of the largest rating companies ("S&P Global", "Fitch" and "Moody's") have assigned Georgia the status of a country with a stable average credit risk. According to the sovereign credit ratings, the country's weaknesses are the high level of external vulnerability (including debt denominated in foreign currency) and geopolitical risks in the region.

Reference

- Pharjiani, Sh. 2015. Foreign Direct Investment on Economic Growth by Industries in Central and Eastern European Countries. International Journal of Social, Behavioral, Educational, Economic, Business, and Industrial Enginearing. Vol:9, No:11, 2015.

- Borensztein, Eduardo, Jose De Gregorio, and Jong-Wha Lee. 1998. How does foreign direct investment affect growth. Journal of International Economics 45: 115 – 35.

- Alfaro, L., Chanda, A., Kalemli-Ozcan, S. and Sayek, S. (2004) FDI and Economic Growth: The Role of Local Financial Markets. Journal of International Economics, 64, 89-112.

- Alfaro, L., Chanda, A., Kalemli-Ozcan, S. and Sayek, S. (2010) Does Foreign Direct Investment Promote Growth? Exploring the Role of Financial Markets on Linkages. Journal of Development Economics, 91, 242-256.

- Bénétrix, A., Pallan, H., Panizza, U. 2022. The Elusive Link between FDI and Economic Growth. Working Paper of Graduate Institute of International and Development Studies International Economics Department No. HEIDWP26-2022.

- BPM6, Companion document to the sixth edition of the Balance of Payments and International Investment Position Manual. International Monetary Fund (IMF) in 2014.

- www.unctad.org [Last Access 09.12.2023].

- www.geostat.ge [Last Access 09.12.2023].

- www.standardandpoors.com [Last Access 09.12.2023].

- www.fitchratings.com [Last Access 09.12.2023].

- www.moodys.com [Last Access 09.12.2023].

- www.nbg.gov.ge [Last Access 09.12.2023].

* According to the relevant methodology, the reason for the reduction of FDI may be: a non-resident entity gives up a share in favor of a resident, reclassification of a non-resident direct investor as a portfolio investor, reduction of the existing obligation of a resident enterprise to a non-resident direct investor.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Globalization and Business

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.