Enhancing Tourism in the South Caucasus through Coopetition

DOI:

https://doi.org/10.35945/gb.2024.18.011Keywords:

Tourism Policy, Coopetition, South Caucasus RegionAbstract

This article explores the concept of “coopetition” as a strategic approach for enhancing tourism development in the South Caucasus region, comprising Armenia, Azerbaijan, and Georgia. The region holds significant tourism potential but faces infrastructure gaps, limited awareness, safety standards, and accessibility. Additionally, political instability, including the Armenia-Azerbaijan conflict and the ongoing occupation of Georgian territories by Russia, has hindered growth. Fortunately, recent peace efforts between Azerbaijan and Armenia offer opportunities for collaborative tourism initiatives, potentially boosting economic stability.

Through an assessment of tourism intelligence, competitiveness, and regional dynamics, the study identifies key areas where these countries can both compete and cooperate to attract high-value tourists. Coopetition offers a strategy for enhancing the region’s competitiveness through joint marketing, shared tourist routes, and improved cross-border infrastructure while also allowing each country to utilize its unique strengths in niche tourism products. At the same time, coopetition also poses risks, such as unequal benefit distribution and coordination challenges in aligning policies, among other issues. The analysis concludes that by balancing competition with strategic cooperation, the South Caucasus countries can boost regional tourism, attract high-value visitor segments, strengthen their global market position, and contribute to lasting peace in the region.

Keywords: Tourism Policy, Coopetition, South Caucasus Region.

Introduction

The Caucasus region, often hailed as the cradle of European civilization, stands at the crossroads of Europe and Asia, serving as a vital cultural and geographical corridor. This unique positioning has profoundly influenced the societies within the South Caucasus—comprising Georgia, Armenia, and Azerbaijan—leading to a rich fusion of European and Asian cultural elements. Renowned for its natural beauty and cultural heritage, the South Caucasus offers an array of diverse tourism products that attract anyone in the world.

The historical development of tourism in the region reflects its strategic geopolitical location and abundant resources. Early tourism initiatives were influenced by foreign expertise, particularly from Europe, which provided crucial recommendations on safety standards and infrastructure development. Although technological advancements have reshaped the tourism landscape, many of the challenges from the early tourism period, such as inadequate safety standards, poor infrastructure, limited advertising, and restricted accessibility, persist today, continuing to hamper the region’s full tourism potential.[1] Addressing these challenges through collaborative efforts among the three countries, with support from European partners, could enhance the region’s tourism potential and facilitate sustainable growth.

A 2017 study examining the relationship between tourism competitiveness factors and performance in Azerbaijan, Georgia, and Armenia from 2007 to 2015 found that Azerbaijan led in tourism performance, primarily due to its oil and gas revenues. Furthermore, the study identified the Human, Cultural, Natural Resources Index as the most significant contributor to competitiveness, highlighting the need for enhanced regional cooperation and sectoral development to strengthen tourism in the South Caucasus.[2]

The instability and conflicts have significantly undermined tourism development in the region. Georgia continues to grapple with the effects of its two conflict zones occupied by Russia, while the dispute between Armenia and Azerbaijan over the Karabakh region has severely impacted tourism flows. Additionally, the Russia-Ukraine conflict, despite being geographically distant, has further harmed the region’s image among long-haul tourists unfamiliar with the Caucasus region.[3] Recent developments, such as conflict resolution efforts between Armenia and Azerbaijan, suggest a more favorable environment for collaborative initiatives. Tourism, with its potential to boost employment, balance of payments, reduce poverty, and many other economic variables, could also serve as a tool for peacebuilding, helping to address political and economic challenges and fostering long-term stability in the South Caucasus.

Environmental risks also pose a significant threat. The mountainous terrain, while a tourist attraction, exposes the region to natural disasters, necessitating advanced disaster management strategies. In Georgia, where 54% of the land is mountainous, natural processes have caused extensive damage to the tourism sector and related industries.[4] Natural disasters can also be linked to global warming. The country’s geographic and climatic traits make it susceptible to various calamities, such as floods, droughts, storms, landslides, mudslides, and avalanches.[5] Collaboration between countries on disaster management and climate adaptation strategies is essential, as limited resources make regional cooperation crucial for enhancing the safety of both residents and tourists.

Despite these obstacles, the governments of Georgia, Armenia, and Azerbaijan recognize tourism as a critical driver of economic development. They are increasingly focusing on promoting their unique attractions, including wine regions, mountain landscapes, ancient monasteries, and cultural heritage, to attract high-value visitors from Europe, the U.S., and other global markets. However, the region remains heavily reliant on tourists from the post-Soviet states. Barriers to reaching high-value markets include limited financial resources, low international visibility, and the economic and political limitations of the region’s small nations.

This paper examines the concept of ‘coopetition’—a blend of competition and cooperation—as a potential strategy to enhance the region’s appeal, focusing on perspectives such as the motives of coopetition and its determinants, as well as its potential positive and negative outcomes for the three tourism destinations.

Previous research indicates that tourism destinations with high market commonality tend to form stronger business associations, fostering robust coopetition networks, while those with low commonality rely more on long-term firm strategies.[6] Destinations also tend to benefit from factors like interdependence, complementarity, shared goals, and geographical proximity, which make coopetition relationships more viable.[7]

A long-term vision for tourism, along with strengthened associations or other collaborative frameworks among Azerbaijan, Armenia, and Georgia, could enable these countries to effectively use coopetition for mutual benefits. Given their shared tourism products, including cultural heritage and natural landscapes, such collaboration could significantly boost their competitive advantage in the global tourism market.

The study will analyze the tourism product commonalities, target markets, and long-term visions of the three South Caucasus countries by assessing policy documents, national statistics, UNWTO data, and the World Economic Forum’s Travel and Tourism Competitiveness Index. Finally, it will identify areas where cooperation can maximize benefits and mitigate potential risks associated with coopetition.

Tourism Policy and Product Commonalities in the South Caucasus Region

Attracting both high-value and responsible tourists in the region requires effective policy and strategic planning, which are essential but proved to be insufficient. Policymakers, planning officials, and stakeholders of the three countries must recognize emerging trends and implement coordinated measures that promote sustainable growth and high-quality tourism offerings, benefiting both visitors and local communities.

Tourism policy in this study is broadly defined to encompass marketing, planning, and sustainability. It refers to a framework of actions, guidelines, directives, and principles that guide the development of tourism within an ethical context.[8] These policies, whether legislative, administrative, or judicial, shape the growth and development of the tourism sector. They are often embedded in official documents, reflecting a nation’s vision for tourism planning, product development, marketing, and sustainable practices.[9] This chapter analyzes the strategic documents of Georgia, Armenia, and Azerbaijan to gain insights into each country’s tourism policy, highlighting the potential for regional collaboration.

Georgia is currently transitioning from its 2015-2025 Tourism Strategy to a new plan that is expected to extend until 2035. This new strategy aims to integrate tourism and marketing strategies into a single, comprehensive document—moving away from the previous approach where strategic and marketing goals were addressed separately. The 2015-2025 strategy, developed with World Bank support, emphasized balanced growth through aligning resources and stakeholder needs, with a strong focus on attracting high-value tourists. Specifically, the 2025 Strategy vision positioned Georgia as a year-round, high-quality tourist destination renowned for its cultural and natural heritage, exceptional hospitality, and world-class services. Key investments targeted infrastructure, education, and the promotion of unique Georgian experiences, aiming to enhance global competitiveness.[10]

To complement the strategic approach, Georgia’s marketing strategy identified three core tourism products: wine and gastronomy, nature and adventure, and cultural heritage. These focus areas were selected based on competitive analysis and emerging global trends, which highlighted demand for these experiences. Other segments such as health and wellness, city breaks, MICE tourism, and coastal tourism also play a significant role, ensuring diverse offerings for identified target markets.[11]

Armenia’s tourism policy, outlined in the “Tourism Doing Business – Investing in Armenia” publication, emphasizes the country’s appeal through its cultural heritage, scenic landscapes, and niche tourism offerings like cultural, adventure, and gastronomy tourism. The document highlights the government’s pro-investment stance, underscored by infrastructure upgrades and the influx of international hotel chains. It argues that the Government Programme 2021-2026 in Armenia aims to attract 2.5 million international visitors through increased direct flights, enhanced visa regulations, and improved global visibility. On the other hand, the Tourism Committee’s 2025-2029 Strategy focuses on balanced regional growth, improved service quality, and developing Destination Management Organizations (DMOs) to diversify tourism products, including agritourism and specialized gastronomy tourism. Furthermore, Armenia promotes underdeveloped regions like Syunik, Vayots Dzor, Gyumri, and Dilijan to expand its tourism offerings beyond the capital. Moreover, strategic initiatives such as the “Armenia, The Hidden Track” campaign aim to attract high-value tourists, increase spending, and showcase the country’s cultural and natural appeal globally.[12]

Azerbaijan’s 2023-2026 Tourism Strategy serves as a roadmap for aligning tourism development with broader national socio-economic goals. The strategy emphasizes sustainability, regional development, and competitiveness through a nine-pillar model, with the Azerbaijan Tourism Board (ATB) playing a key role, particularly since the launch of a new country brand in 2018 aimed at repositioning Azerbaijan as a sustainable tourism destination. On the other hand, Product development initiatives center around providing authentic and immersive experiences in nature, culture, and wellness. This includes the creation of cultural heritage routes, the design of recreational zones, and a focus on sustainable tourism that respects local communities. The overarching goal is to position Azerbaijan as a competitive, year-round destination offering diverse and high-quality tourism experiences.[13]

Georgia, Armenia, and Azerbaijan share similar goals in their tourism strategies, such as attracting high-value tourists, improving service quality, and promoting regional development. Analyzing their policies reveals shared priorities like sustainable growth, investment in tourism infrastructure, and marketing strategies that emphasize cultural heritage and unique experiences.

These commonalities in vision present opportunities for cooperation. The South Caucasus Counties can utilize their complementary tourism products and develop joint marketing campaigns, cross-border tourism offerings, and coordinated standards that enhance the South Caucasus’ appeal as a regional destination. These efforts can amplify the positive effects of regional tourism growth.

Tourism Intelligence and Trends in the South Caucasus: A Comparative Analysis of Armenia, Azerbaijan, and Georgia

The assessment of tourism statistics across Armenia, Azerbaijan, and Georgia reveals substantial disparities in data collection, methodology, and availability, complicating direct comparisons. Georgia leads in terms of data accessibility and clarity, providing a comprehensive range of tourism-related statistical indicators. Its tourism intelligence includes four Tourism Satellite Account (TSA) tables, offering a detailed picture of the sector’s demand side economic impact. However, Georgia’s statistical system lacks specific information about organized tourism, which would enhance its understanding of tourism dynamics. Azerbaijan, in contrast, covers both organized and non-organized tourism but offers a limited set of variables. Moreover, the absence of a TSA and insufficient methodological explanations weaken the overall reliability of its data. Armenia lags in terms of tourism research, having only recently reintroduced the International Visitor Survey in 2023 after an 11-year gap. Its data dissemination is also hindered by methodological inconsistencies and a lack of detailed explanations.

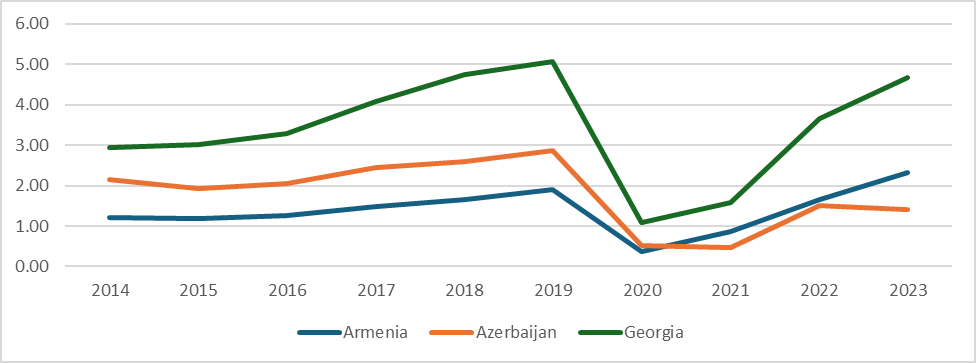

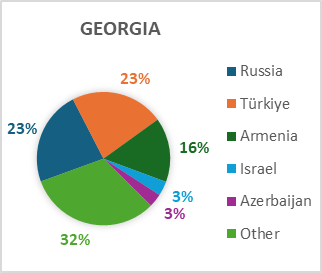

Despite these differences, an analysis of the available common variables reveals important insights into the region’s tourism trends. The period from 2014 to 2023 highlights the steady pre-pandemic growth of international tourist arrivals in all three countries, followed by a sharp decline in 2020 due to the COVID-19 pandemic. By 2019, Georgia had established itself as the top destination in the region, attracting over 5 million tourist trips. Azerbaijan followed with approximately 2.9 million, while Armenia saw 1.9 million tourist trips. The pandemic resulted in significant reductions in tourist arrivals—Armenia (-81%), Azerbaijan (-82%), and Georgia (-79%). However, by 2023, Armenia had demonstrated strong resilience, surpassing pre-pandemic levels with a 22% increase in arrivals compared to 2019. Georgia also showed a solid recovery, reaching 4.67 million tourist arrivals, while Azerbaijan struggled to regain momentum, with only 1.40 million tourist trips due to continued land border restrictions.

Figure 1: International Tourist Arrivals in South Caucasus Countries 2014-2023 (mln)

Source: World Tourism Organization (2024), ‘UN Tourism Data Dashboard’, UN Tourism, Madrid, available online: <https://www.unwto.org/tourism-data/global- and-regional-tourism-performance>.

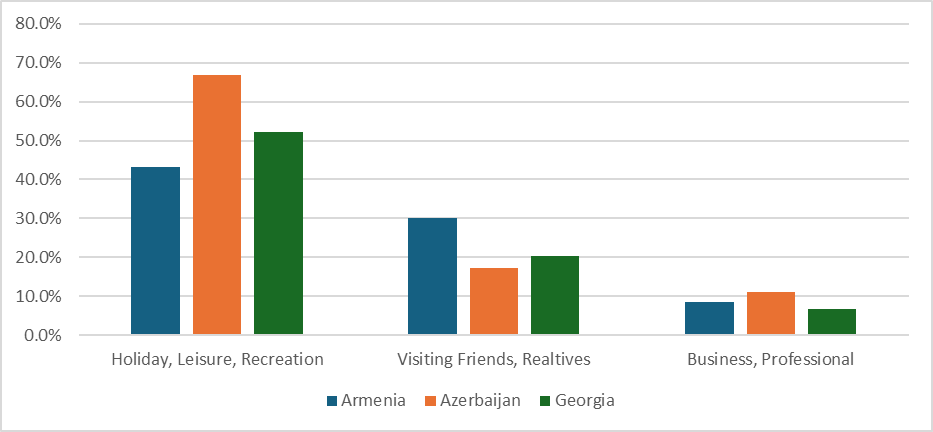

Examining the purpose of international visits to South Caucasus Countries provides insight into the visitor segment structure in each country. Azerbaijan stands out, with 66.9% of its international visitors arriving for holiday, leisure, and recreation purposes, positioning it as a strong leisure tourism destination. Georgia follows with 52.3%, showcasing its diverse recreational offerings, while Armenia trails with 43.1%, suggesting a need for more aggressive marketing strategies to enhance its appeal in this segment.

In contrast, Armenia leads in the “Visiting Friends and Relatives” (VFR) category, with 30.1% of its visitors motivated by familial ties, compared to Georgia (20.4%) and Azerbaijan (17.2%). This highlights the role of the Armenian diaspora in driving tourism. Meanwhile, Azerbaijan leads in business travel, with 11.0% of visitors arriving for professional reasons, positioning itself as an emerging business hub in the region, followed by Armenia (8.4%) and Georgia (6.8%).

Figure 2: International Visitor Trips by Purpose of Visit to South Caucasus Countries in 2023

Source: National Statistics Office of Georgia, State Statistical Committee of the Republic of Azerbaijan, & Statistical Committee of the Republic of Armenia.

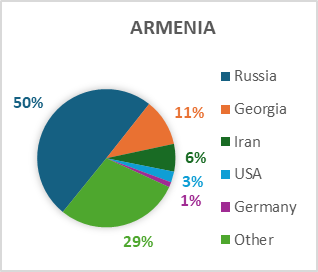

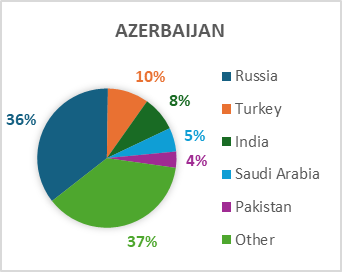

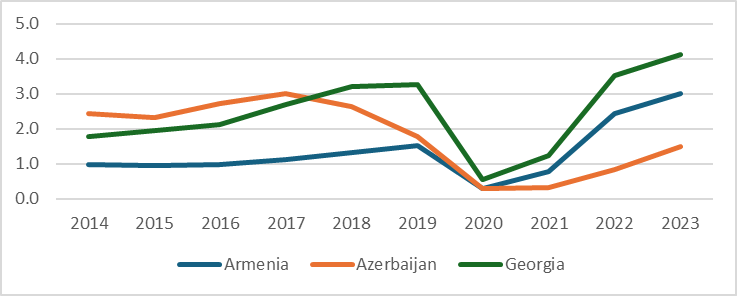

Russia is the dominant source market for all three countries, accounting for half of the arrivals in Armenia, 36% in Azerbaijan, and 23% in Georgia. This heavy reliance on Russian tourists underscores the need for diversified source markets to mitigate potential economic risks. Armenia’s second-largest source market is Georgia (11%), reflecting the close ties between the two neighbors. In contrast, Azerbaijan attracts a broader range of visitors, with Türkiye (10%) and India (8%) being key contributors, demonstrating its appeal beyond the immediate region. Georgia’s strong connections with neighboring countries, especially Türkiye and Armenia, further emphasize its role as a regional tourism hub within the South Caucasus.

Figure 3: Source Markets of South Caucasus Countries

Source: World Tourism Organization (2024), ‘UN Tourism Data Dashboard’, UN Tourism, Madrid, available online: <https://www.unwto.org/tourism-data/global- and-regional-tourism-performance>.

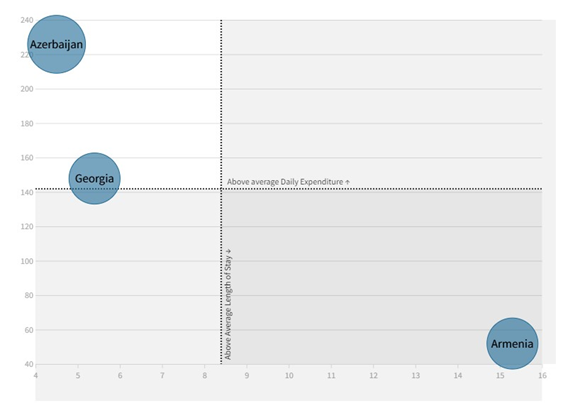

The analysis of international travel receipts from 2014 to 2023 reveals significant trends in the economic impact of tourism in Armenia, Azerbaijan, and Georgia, closely correlating with data on international tourist arrivals and source markets. Armenia’s receipts increased from $1.0 billion in 2014 to $3.0 billion in 2023, reflecting a robust recovery that aligns with its strong visitor numbers, particularly from Russia, which accounts for 50% of arrivals. In contrast, Azerbaijan’s receipts peaked at $2.7 billion in 2016 but experienced volatility, dropping to $0.3 billion in 2021 before recovering to $1.5 billion in 2023. This decline can be attributed to the limited international tourism activity during the pandemic and subsequent restrictions despite the country having a strong domestic tourism market. Georgia, consistently the leader in tourist arrivals, demonstrated a significant increase in receipts from $1.8 billion in 2014 to $4.1 billion in 2023, which correlates with its high volume of arrivals, particularly from Russia, Türkiye, and Gulf countries.

Figure 4: International Travel Receipts 2014-2023 (Bln)

Source: World Tourism Organization (2024), ‘UN Tourism Data Dashboard’, UN Tourism, Madrid, available online: <https://www.unwto.org/tourism-data/global- and-regional-tourism-performance>.

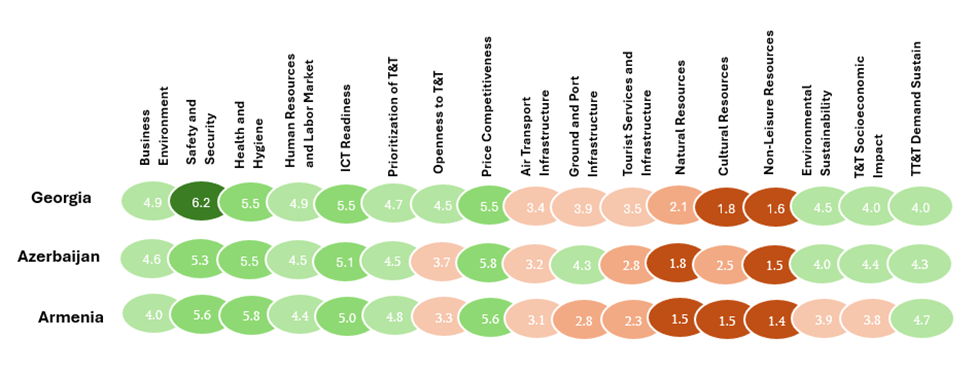

The four-quadrant graph[14] illustrates the relationship between the average length of stay and the average daily expenditure for visitors in the South Caucasus countries. The vertical axis represents the average length of stay, which is 8.4 days across the region, while the horizontal axis shows the average daily expenditure, calculated at 142 USD. The product of these two values gives the average total expenditure per visitor in the South Caucasus, amounting to 872 USD.

A key pattern observed from the graph is that the further east a country is located, the longer the average stay of international visitors. Armenia, positioned furthest east among the South Caucasus countries, has the longest average stay, with visitors staying 15.3 days. Conversely, Azerbaijan, located to the north, sees much shorter stays, averaging only 4.5 days. Georgia falls between these two extremes, with an average stay of 5.4 days. This suggests that visitors tend to spend more time in Armenia despite the relatively low daily expenditure there. The unusually long stays of visitors to Armenia require further research, as this may be attributed to methodological differences or the characteristics of the VFR (Visiting Friends and Relatives) segment, which tends to stay for longer periods.

On the other hand, the graph shows that countries located further north tend to have higher daily expenditures. Azerbaijan stands out with the highest average daily expenditure of 225.8 USD, significantly exceeding the regional average. This can be attributed to the fact that only air travelers are allowed to cross the border, which tends to generate higher expenditures in the country. Georgia also sees relatively high spending, with visitors spending an average of 147.8 USD per day. Armenia, despite having the longest stay, shows the lowest daily expenditure, with visitors spending only 51.9 USD per day.

The size of the circles in the graph indicates the total expenditure per visitor, combining both the length of stay and daily spending. Azerbaijan, despite the short average length of stay, sees a relatively high total expenditure per visitor. Georgia, with a moderate length of stay and daily expenditure, shows a total expenditure per visitor close to Armenia’s at 798 USD and 795 USD, respectively. Although Armenia has a longer stay, the lower daily expenditure results in a total expenditure that is comparable to Georgia.

The diagram below shows that Azerbaijan attracts higher-spending visitors who stay for shorter periods, while Armenia attracts visitors who stay longer but spend less per day. Georgia falls in between, balancing moderate stays with moderate spending.

Figure 5: Four Quadrant Diagram of South Caucasus Countries:

Expenditure per day & Average Length of Stay

Source: National Statistics Office of Georgia, State Statistical Committee of the Republic of Azerbaijan, & Statistical Committee of the Republic of Armenia. The diagram was constructed using Flourish.

In summary, the assessment of tourism intelligence across Armenia, Azerbaijan, and Georgia underscores both the challenges and opportunities for each country. A key challenge that needs to be addressed through coordination is the methodological differences in tourism research. While methodological differences hinder direct comparability, the analysis of common variables reveals important trends in tourism arrivals, receipts, and visitor expenditure patterns. Georgia leads in terms of overall arrivals and revenue, Armenia shows resilience in its post-pandemic recovery, and Azerbaijan attracts high-spending visitors in the region but faces challenges in fully regaining its pre-pandemic momentum due to the border closure.

Furthermore, the dominance of Russian tourists as a common source market reflects a shared reliance on this demographic. This presents both opportunities and risks, as fluctuations in Russian outbound tourism could significantly impact all three countries. Therefore, diversifying tourism is crucial for long-term stability, and this can be achieved through cooperation among the tourism sectors in the South Caucasus region.

Competitiveness among the South Caucasus Countries

The indicators provided by the World Economic Forum reveal a range of performances in Armenia, Azerbaijan, and Georgia, highlighting both strengths and areas for improvement in their tourism sectors.[15]

Armenia, ranked 72nd in the Travel and Tourism Development Index (TDDI), leads the region in prioritization of travel and tourism (4.8) and demand sustainability (4.7), reflecting strong governmental commitment and resilient tourism demand. The country also performs well in safety and security (5.6) and health and hygiene (5.8). However, challenges persist in the business environment (4.0) and ICT readiness (5.0). Furthermore, Weak infrastructure, particularly in air transport (3.1) and tourist services and infrastructure (2.8), combined with underutilized natural (2.3), cultural (1.5), and non-leisure resources (1.5), limit Armenia’s full tourism potential.

Azerbaijan, ranked 56th, leads the region in price competitiveness (5.8) and socioeconomic impact (4.4), positioning it relatively as a cost-effective destination in the region while demonstrating stronger contributions of tourism to its broader economy. Its scores in health and hygiene (5.5) and safety and security (5.3) remain reliable, ensuring a safe and stable environment for visitors. Nevertheless, Azerbaijan faces significant challenges in tourist services and infrastructure (2.8), natural resources (1.8), and non-leisure resources (1.5). Although it is the leader in cultural resources, its score remains low overall (2.5), signaling the need for improvement. These weaknesses reflect underdeveloped tourism infrastructure and limited utilization of the country’s natural and cultural assets, emphasizing the need for strategic investment to strengthen these areas and enhance its overall tourism offering.

Georgia, ranked 45th, leads the region in several indicators, particularly excelling in safety and security (6.2) and openness to travel and tourism (4.5) compared to other South Caucasus countries. The country also demonstrates relatively strong performance in the business environment (4.9), ICT readiness (5.5), and air transport infrastructure (3.4). However, like Armenia and Azerbaijan, Georgia faces challenges in its tourist services and infrastructure(3.5). Its natural and cultural resources, along with non-leisure resources, while slightly better than those of its neighbors, remain low (2.1, 1.8, 1.6), highlighting the need for more focused efforts to fully utilize these assets.

Figure 6: Heat MAP Travel and Tourism Development Index of South Caucasus Countries 2024

Source: World Economic Forum. (2024). Travel & Tourism Development Index 2024. World Economic Forum. Available online: <https://www.weforum.org/publications/travel-tourism-development-index-2024/interactive-data-and-economy-profiles-afaa00a59c>.

In summary, tourism competitiveness shows a mixed performance across Armenia, Azerbaijan, and Georgia, each with unique strengths and challenges. Armenia demonstrates strong governmental commitment to tourism, excelling in safety, security, and demand sustainability but struggling with weak infrastructure and underutilized natural and cultural resources. Azerbaijan leads in price competitiveness and tourism’s socioeconomic impact but faces significant gaps in tourist services and resource utilization. Georgia, though leading in safety, openness, and business environment, shares similar challenges in infrastructure and resource development. To unlock their full potential, all three countries must address these infrastructural and resource-related weaknesses through targeted policies and investment, which could significantly boost the region’s overall tourism appeal.

Cooperation and Competition in the South Caucasus Region

The above analysis shows that the three countries are well-suited for a coopetition strategy. However, the question remains: Does coopetition have only positive effects, or could it also present challenges and risks for the three countries? Although the positive effects are evident—such as increased regional visibility, enhanced visitor experiences, access to new markets, and international support for regional cooperation and peacebuilding efforts—coopetition can also present challenges. Balancing cooperation and competition can be costly and complex, especially in terms of resource allocation. There may be an unequal distribution of benefits if one country has a more developed tourism infrastructure. Additionally, coordination challenges in aligning priorities, policies, and resources across the three countries may arise.

To maximize the positive effects of coopetition and mitigate the negative ones, it is crucial to clearly distinguish the areas of cooperation and competition. Each country can use its unique strengths to compete for tourists at the company level while collaborating at the government level to enhance the region’s overall tourism appeal. As Schiavone and Simoni noted, cooperation occurs when companies complement one another to create a market while still competing for market share. In other words, the three countries can collaborate to attract high-value tourists yet still compete for their market share.[16]

The South Caucasus countries have already made significant strides in promoting their unique attractions and competing in the tourism market. Each nation has developed a strong focus on cultural heritage, adventure tourism, and gastronomy, emphasizing its strengths to attract a wide range of visitors.

Table 1: Potential Competitive and Cooperative Activities

|

Competition |

Cooperation |

|

Cultural Heritage: Each country highlights its unique cultural and historical assets |

Joint Marketing and Intelligence Sharing: Develop unified marketing campaigns to promote the South Caucasus as a multi-country destination, while also sharing tourism statistical insights and addressing methodological differences in tourism research. |

|

Adventure Tourism: Promote unique landscapes and adventure activities |

Shared Tourist Routes: Create cross-border cultural and heritage routes linking major UNESCO and historical sites. |

|

Gastronomy: Focus on unique wine, national dishes and culinary experiences |

Infrastructure Development: Collaborate on transportation links and facilities to improve regional accessibility and ease of travel. |

|

National Branding: Each country develops its own branding and marketing strategies to attract different tourist segments. |

Safety and Crisis Management: Coordinate on regional safety protocols, Climate Change Adaptation Strategies and emergency response strategies to enhance tourism security. |

|

Events and Festivals: Promote country-specific cultural events, music, arts, and festivals to attract tourists (e.g., Tbilisi Open Air, Yerevan Jazz Festival, Baku Formula 1). |

Sustainable Tourism Initiatives: Joint efforts to promote eco-tourism, conservation, and responsible tourism practices. |

To unlock the full potential of the region, these countries can now move towards greater cooperation. By working together on joint marketing efforts, they can present the South Caucasus as a unified and diverse destination that offers a seamless travel experience. Shared tourist routes connecting key cultural and historical sites across the region can offer a more comprehensive experience for visitors. Improving cross-border infrastructure and coordinating safety and crisis management measures will also make travel more accessible and secure. Additionally, collaborative efforts in sustainable tourism can ensure the protection of natural resources, attracting environmentally conscious travelers and fostering long-term growth in the region.

Conclusion

The South Caucasus region, encompassing Armenia, Azerbaijan, and Georgia, presents a dynamic yet complex tourism landscape shaped by unique strengths, challenges, and evolving trends. The analysis of tourism intelligence and competitiveness across these countries highlights significant disparities in data collection, market performance, and infrastructure quality.

Armenia has demonstrated resilience in its tourism sector, capitalizing on its rich cultural heritage and natural landscapes to drive growth. The Government Programme 2021-2026 aims to attract 2.5 million international visitors by enhancing direct flights and improving visa regulations. Its focus on promoting niche offerings like agritourism and specialized gastronomy tourism, alongside initiatives like “Armenia, The Hidden Track,” aims to increase spending and broaden the country’s appeal to high-value tourists. The emphasis on regional development seeks to spread the benefits of tourism more evenly, particularly in underdeveloped areas, aligning with sustainable tourism practices.

Azerbaijan has positioned itself as a destination for high-spending visitors through its strong international connectivity and a focus on providing immersive experiences in culture and wellness. The 2023-2026 Tourism Strategy promotes sustainability and regional development through a nine-pillar model, emphasizing the creation of cultural heritage routes and recreational zones. However, Azerbaijan faces challenges in regaining pre-pandemic momentum, underscoring the need to balance leisure and business tourism while enhancing its cultural offerings.

Georgia has emerged as a regional leader in tourism, offering a relatively strong business environment, comprehensive data accessibility, and the highest international tourist arrivals. However, it shares common challenges with its neighbors, including underdeveloped tourism infrastructure and reliance on a narrow range of source markets, particularly Russia. Georgia is transitioning from its 2015-2025 Tourism Strategy to a new plan that integrates tourism and marketing strategies into a cohesive framework. The focus on sustainable tourism development aims to attract high-value tourists while addressing infrastructure needs and utilizing unique experiences, such as its rich wine and gastronomy scene. Georgia’s marketing strategy highlights core tourism products and emphasizes the importance of diverse offerings, ensuring its competitiveness in the region.

The concept of coopetition—a blend of cooperation and competition—emerges as a vital strategy for Armenia, Azerbaijan, and Georgia to navigate their shared challenges and enhance their collective tourism appeal. Fostering collaboration enables these countries to develop joint marketing campaigns, create cross-border tourist routes, and establish coordinated standards that strengthen the South Caucasus’ image as a regional destination. This approach allows each country to retain its unique identity while benefiting from shared resources and experiences.

Coopetition offers an opportunity for these nations to address common challenges such as underdeveloped infrastructure and reliance on narrow source markets. Pooling resources for infrastructure development, promoting joint tourism products, and using each other’s strengths in cultural, natural, and gastronomic offerings can help Armenia, Azerbaijan, and Georgia create a more attractive and sustainable tourism environment. Additionally, coopetition can facilitate tourism data sharing among these countries, enabling them to respond effectively to global tourism trends and challenges. Collaborative efforts could lead to improved service quality, enhanced visitor experiences, and increased competitiveness in attracting high-value tourists.

Bibliography:

- Azerbaijan Tourism Board & State Tourism Agency of the Republic of Azerbaijan. (2023). Azerbaijan Tourism Strategy 2023-2026. <https://www.tourism.gov.az>;

- Bregadze, G. (2023). Assessing the value chain impacts of the Ukraine war on the tourism industry of Georgia. Globalization and Business, 8(15);

- Bregadze, G. (2023). Climate change impacts on the tourism industry in Georgia. Globalization and Business, 8(16);

- Chim-Miki, A. F., da Costa, R. A., Okumus, F. (2024). Investigating the strategic role of business associations in willingness toward tourism coopetition. Current Issues in Tourism. <https://doi.org/10.1080/13683500.2024.2333910>;

- Davituliani, T., Azmaiparashvili, M. (2023). Ecological safety of Georgian tourism. Globalization and Business, 16. <https://doi.org/10.35945/gb.2023.16.007>;

- Della Corte, V., Sciarelli, M. (2012). Can coopetition be a source of competitive advantage for strategic networks? Corporate Ownership & Control, 9(3). <https://doi.org/10.22495/cocv9i3c3art5>;

- Dwyer, L., Forsyth, P., Dwyer, W. (2020). Tourism economics and policy (2nd, Aspects of Tourism Texts, Vol. 5). Channel View Publications;

- Edgell, D. L., Sr., Swanson, J. R. (2019). Tourism policy and planning: Yesterday, today, and tomorrow (3rd). Routledge;

- Georgian National Tourism Administration. (2019). Guideline for planning inbound tourism business (4th). Georgian National Tourism Administration. <https://gnta.ge/ge/publication/guideline/>;

- Gee, C. Y., Fayos-Solá, E., World Tourism Organization, WTO Education Network. (1997). International tourism: A global perspective (1st). World Tourism Organization;

- Kantarci, K., Başaran, M. A., Özyurt, P. M. (2017). A comparative research on South Caucasus countries’ tourism performances and competitiveness factors. In Proceedings of the International Scientific Conference;

- Schiavone, F., Simoni, M. (2011). An experience-based view of co-opetition in R&D networks. European Journal of Innovation Management, 14(2). <https://doi.org/10.1108/14601061111124867>;

- Tamarashvili, T. (2023). Aspects of tourism development in the South Caucasus: Past and present. Iakob Gogebashvili State University. <https://doi.org/10.52340/idw.2023.71>;

- World Bank. (2015). Tourism strategy 2015-2025: Sustainable tourism development plan. World Bank Group;

- World Economic Forum. (2024). Travel & tourism development index 2024: Insight report. World Economic Forum;

- World Tourism Organization. (2024). Tourism Doing Business – Investing in Armenia. UN Tourism. <https://doi.org/10.18111/9789284425785>.

Footnotes

[1] Tamarashvili, T. (2023). Aspects of tourism development in the South Caucasus: Past and present. Iakob Gogebashvili State University, 480-487. <https://doi.org/10.52340/idw.2023.7>.

[2] Kantarci, K., Başaran, M. A., Özyurt, P. M. (2017). A comparative research on South Caucasus countries’ tourism performances and competitiveness factors. In Proceedings of the International Scientific Conference, 303-313.

[3] Bregadze, G. (2023). Assessing the value chain impacts of the Ukraine war on the tourism industry of Georgia. Globalization and Business, 8(15), 65–75.

[4] Davituliani, T., Azmaiparashvili, M. (2023). Ecological safety of Georgian tourism. Globalization and Business, 16, 69–70. <https://doi.org/10.35945/gb.2023.16.007>.

[5] Bregadze, G. (2023). Climate change impacts on the tourism industry in Georgia. Globalization and Business, 8(16), 60.

[6] Chim-Miki, A. F., da Costa, R. A., Okumus, F. (2024). Investigating the strategic role of business associations in willingness toward tourism coopetition. Current Issues in Tourism, 1–18. <https://doi.org/10.1080/13683500.2024.2333910>.

[7] Della Corte, V., Sciarelli, M. (2012). Can coopetition be source of competitive advantage for strategic networks? Corporate Ownership & Control, 9(3), 355. <https://doi.org/10.22495/cocv9i3c3art5>.

[8] Edgell, D. L., Sr., Swanson, J. R. (2019). Tourism policy and planning: Yesterday, today, and tomorrow (3rd ed., 12). Routledge.

[9] Gee, C. Y., Fayos-Solá, E., World Tourism Organization, WTO Education Network. (1997). International tourism: A global perspective (1st ed.). World Tourism Organization, 305.

[10] World Bank. (2015). Tourism strategy 2015-2025: Sustainable tourism development plan. World Bank Group, 4-26.

[11] Georgian National Tourism Administration. (2019). Guideline for planning inbound tourism business (4th edition). Georgian National Tourism Administration, 51. <https://gnta.ge/ge/publication/guideline/>.

[12] World Tourism Organization. (2024). Tourism Doing Business – Investing in Armenia. UN Tourism, 1-28. <https://doi.org/10.18111/9789284425785>.

[13] Azerbaijan Tourism Board & State Tourism Agency of the Republic of Azerbaijan. (2023). Azerbaijan Tourism Strategy 2023-2026, 3-18. <https://www.tourism.gov.az>.

[14] Dwyer, L., Forsyth, P., & Dwyer, W. (2020). Tourism economics and policy (2nd ed., Aspects of Tourism Texts, Vol. 5, 282). Channel View Publications.

[15] World Economic Forum. (2024). Travel & tourism development index 2024: Insight report. World Economic Forum, 37.

[16] Schiavone, F., Simoni, M. (2011). An experience-based view of co-opetition in R&D networks. European Journal of Innovation Management, 14(2), 145. <https://doi.org/10.1108/14601061111124867>.

Downloads

Downloads

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.