The Unforeseen Results of Unconventional Monetary Dominance

DOI:

https://doi.org/10.35945/gb.2024.17.005Keywords:

Unconventional monetary policy, Central banks’ balance sheet, 2008 financial crisis, Fractional reserve bankingAbstract

This empirical study investigates the implications of the substantial size of central banks’ balance sheets and the potential risks of their gradual normalization. Following the global financial crisis of 2008, central banks worldwide implemented unprecedented monetary stimulus measures, including large-scale asset purchases and unconventional policy tools like quantitative easing (QE). As a result, central bank balance sheets expanded significantly, reaching historically unprecedented levels in size and composition. While these measures played a crucial role in stabilizing financial markets and supporting economic recovery, concerns have arisen regarding the eventual reduction of these balance sheets and the possibility of disruptive market dynamics. This research examines the challenges and risks of normalizing central bank balance sheets. Furthermore, it explores the potential occurrence of “hard landing” scenarios, where sudden reductions in balance sheets could trigger financial market turmoil and economic downturns. By analyzing historical precedents and theoretical frameworks, this paper offers valuable insights into the intricate relationship between central bank balance sheets and the dynamics of financial markets. It provides policymakers and market participants with valuable perspectives on navigating the path toward monetary policy normalization.

Keywords: Unconventional monetary policy; Central banks’ balance sheet; 2008 financial crisis; Fractional reserve banking

Introduction

The aftermath of the 2008 financial crisis witnessed central banks across the globe implementing unprecedented monetary policy measures to revive struggling economies. These measures included large-scale asset purchases and quantitative easing (QE), which substantially expanded central bank balance sheets. Although this expansion played a crucial role in stabilizing financial markets and stimulating economic recovery, it has also raised concerns regarding the potential risks associated with the eventual normalization of these excessively large balance sheets. As central banks now contemplate the gradual unwinding of their unconventional policies, the possibility of a “hard landing” becomes a significant concern. This introduction establishes the context for examining the implications of central banks’ oversized balance sheets and the potential risks they entail. This complex and urgent issue can be better understood and analyzed by drawing on historical precedents and theoretical frameworks.

Academic concepts and simple reality

Before the 2008 financial collapse, the combination of lenient monetary policies and the widespread use of financial derivatives created a deceptive perception of continuous economic growth. This interdependent relationship between these two factors resulted in a misleading illusion of stability and prosperity, concealing the underlying vulnerabilities within the financial system.

The central banks’ implementation of easy money policies, which involved lowering interest rates to stimulate borrowing, spending, and investment, aimed to foster economic expansion. However, these policies had unforeseen consequences. The availability of cheap credit sparked a borrowing frenzy, as individuals and institutions accumulated substantial debt, assuming they could easily repay it due to the low interest rates. Nevertheless, nothing can endure indefinitely, especially events that are artificially stimulated.

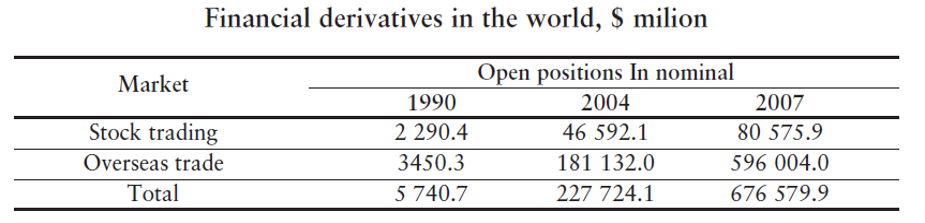

In reality, the economy lacks the extraordinary capacity to absorb and transform such a vast amount of credit into real economic growth, particularly when there is insufficient savings to support consumer demand. To conceal this reality, the financial market has constructed a false perception of prosperity by excessively relying on financial derivatives. Financial derivatives, such as mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), have long been regarded as sophisticated instruments whose value is derived from underlying assets or indices. While initially designed to manage risk, their intricate structure and lack of transparency often gave investors a false sense of security. These derivatives were bundled and traded as stable, secure assets, leading to the perception that they were low-risk investments (See Table #1). However, the complexity of these financial instruments and the utilization of subprime mortgages and other unreliable debts as underlying assets masked the inherent risks. This complexity and flawed risk assessment contributed to the eventual downfall.

Table #1. Financial derivatives in the world (million USD)

Source: (Khidasheli & Chikladze, 2019) [1].

Applying derivative instruments in the financial market can create a perception of economic growth that exceeds that of the real economy. However, it is crucial to recognize that finance serves as a means to efficiently allocate resources for the real economy rather than acting as the primary source of economic expansion. Finance plays a vital role in facilitating the effectiveness of the real economy and deserves a just portion of economic growth for its invaluable services. The eventual collision between this illusion and reality was simply a matter of time.

The financial crisis of 2007–2009 was the culmination of a credit crunch that began in the summer of 2006 and continued into 2007. Most agree that the crisis had its roots in the U.S. housing market, although I will later also discuss some factors that contributed to the housing price bubble that burst during the crisis. The first prominent signs of problems arrived in early 2007 when Freddie Mac announced that it would no longer purchase high-risk mortgages, and New Century Financial Corporation, a leading mortgage lender to risky borrowers, filed for bankruptcy. (Thakor, 2015) [2].

The accessibility of low-cost credit has significantly impacted the market, leading to a surge in the development and exchange of intricate financial derivatives. Driven by the allure of high returns, this phenomenon has fueled unprecedented borrowing and speculation. Unfortunately, this self-perpetuating cycle has obscured the true economic reality, as those involved in the financial realm have become increasingly disconnected from the authentic fundamentals. Ultimately, the 2008 financial crisis could serve as a sobering wake-up call to the fragility of this facade. When the housing market experienced a sharp decline and the true risks associated with financial derivatives were revealed, the intricate network of unsustainable debt and distorted asset values unravelled, ultimately causing a widespread financial breakdown.

The 2007-08 credit crunch has been far more complex than earlier crunches because financial innovation has allowed new ways of packaging and reselling assets. It is intertwined with the growth of the subprime mortgage market in the United States—which offered nonstandard mortgages to individuals with nonstandard income or credit profiles—but it is a crisis that occurred because of the mispricing of the risk of these products. New assets were developed based on subprime and other mortgages, which were then sold to investors in the form of repackaged debt securities of increasing sophistication. These received high ratings and were considered safe; they also provided good returns compared with more conventional asset classes. However, they were not as safe as the ratings suggested because their value was closely tied to movements in house prices. (Mizen, 2008) [3].

The phenomenon of evolution emerges from introspecting on previous mistakes, but in finance, it manifests distinctively. In the aftermath of the 2008 financial debacle, artificially low interest rates were introduced to address issues fundamentally triggered by the same factor. Furthermore, conventional academic theories were contrived solely to rationalize the notion that the root cause of the crisis would also function as its “cure”.

Another academic concept and the same reality

The extensive discourse and scrutiny of non-traditional monetary strategies have drawn focus to the contentious notion of money printing as a method to foster economic expansion. Nevertheless, a prevalent misunderstanding regarding these measures is that they bear no consequences for inflation, coupled with the assumption that accomplishing a smooth and effective transition is effortless.

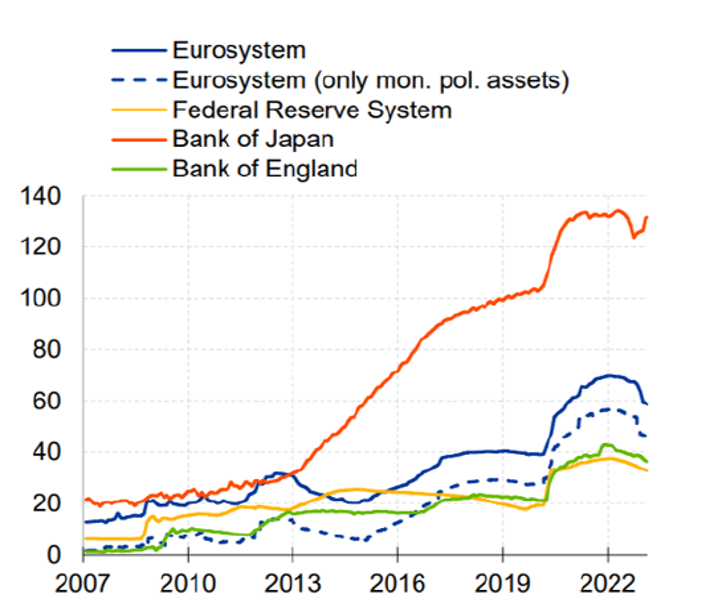

Printing money, often carried out through implementing quantitative easing (QE), involves central banks injecting significant amounts of money into the financial system to boost economic activity. While this strategy may result in a temporary boost, assuming that these measures can be maintained indefinitely without triggering inflationary pressures is flawed. (See Fig. #1)

Fig. #1. Central banks’ balance sheet (% of GDP)

Source: (Wyplosz, 2023) [4].

On 1 March, the ECB started quantitative tightening (QT) after eight years of balance sheet expansion. At the peak in 2022, the Euro system held monetary policy assets corresponding to around 56% of the euro area GDP. This was substantial both from a historical perspective and an international comparison. The first wave of balance sheet expansion was a response to the low-inflation environment prevailing in the aftermath of the euro area sovereign debt crisis. Between 2014 and 2016, headline inflation ran persistently below our target of 2%, averaging just 0.3%. (Schnabel, 2023) [5].

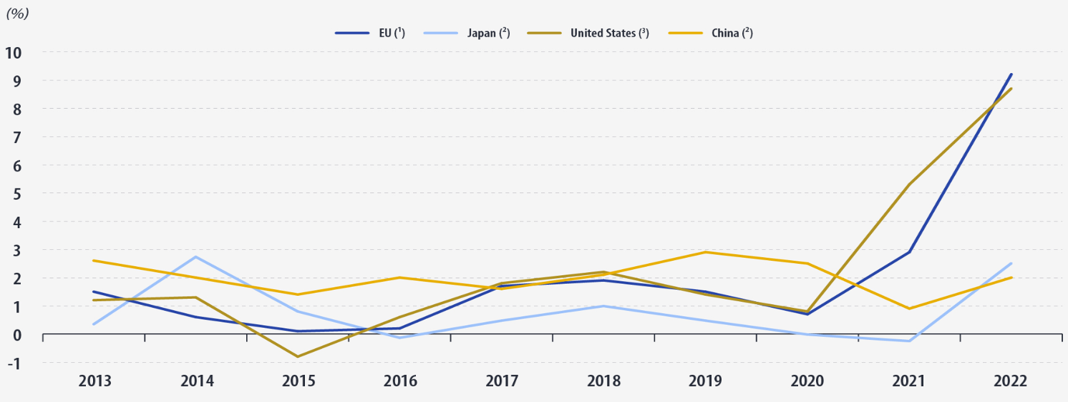

Infusing significant liquidity into the economy via non-traditional monetary measures entails the potential hazard of inflation. Although the immediate effect on consumer prices may not be immediately discernible, the surplus money supply can generate inflationary strains gradually. The notion of a costless strategy of printing money for economic advancement overlooks the fundamental economic principle that continuous monetary expansion without proportional augmentations in actual economic production can undermine the worth of a currency. (See Fig. #2)

Fig. #2 HICP annual average inflation rates (2013-2022)

Source: (Eurostat, 2023) [6].

By late 2014, the monetary base had topped US$4 trillion. But where was the inflation? It didn’t happen because people weren’t borrowing, and/or the banks weren’t lending. U.S. bank excess reserves held on deposit at the Fed had historically been an even more quaint US$2 billion or less, but after 2008, they put the flood of cash on deposit at the Fed, accumulating US$2.6 trillion in excess reserves by late 2014. This resulted in a declining velocity of circulation, which neutralized the effect of the monetary expansion. (McKitrick, 2022) [7].

Inflation snowball

In 2008, Queen Elizabeth II famously asked the London School of Economics (LSE) professors about the global financial crisis: “Why did no one see it coming?” If Charles III were following in the footsteps of his late mother, he would surely ask a similar question today, but about high inflation. This question is more compelling for two reasons. First, before the recent inflation spike to levels not seen in 40 years, many central banks in advanced economies were overwhelmingly concerned about low inflation. Second, they confidently contended that inflation was transitory and failed to restrain it even as prices rose rapidly (Shirakawa, 2023)[8].

The global financial crisis profoundly impacted the world’s markets, resulting in a severe financial crunch characterized by heightened uncertainty and a reluctance among investors to take risks. In response to this crisis, central banks, particularly the Federal Reserve, implemented unconventional monetary policies such as quantitative easing (QE). One of the main goals of QE was to address the financial crunch by injecting liquidity into the financial system. This injection of liquidity aimed to stabilize the financial markets, restore confidence, and prevent a collapse of the entire system. As a result of increased uncertainty and a desire for safety, investors turned to traditionally safer assets, such as government bonds. Through QE, central banks actively purchased these government bonds and other financial assets, leading to a surge in demand for these safe-haven assets. The heightened demand for safe assets, in turn, led to lower yields on government bonds.

The lower yields on government bonds had a cascading effect on the wider economy. It influenced interest rates across the financial spectrum, including borrowing costs for businesses and consumers. The cost of borrowing remained relatively low, which encouraged investment and spending. Furthermore, the financial crunch and the flight to safety influenced the behaviour of both consumers and businesses. In the face of economic uncertainties, households prioritised saving over spending, while businesses adopted a cautious approach and delayed investment decisions. This environment of subdued demand further mitigated inflationary pressures.

Moreover, the preference for holding liquid and secure assets, driven by seeking safety, contributed to a lower velocity of money—the rate at which money circulates in the economy. When money circulates slowly, it has a dampening effect on overall demand and, subsequently, on inflation. However, implementing non-traditional monetary measures, such as the extensive purchase of assets and the maintenance of low interest rates, started to have noticeable effects on the economy. As confidence was restored and economic activities gained momentum, the surplus liquidity injected into the financial system began circulating faster. This accelerated velocity of money and a stronger demand for goods and services created favourable conditions for the emergence of inflationary pressures.

Various factors converged to contribute to inflation in the later stages of unconventional monetary policy. Businesses, buoyed by a more positive outlook, increased their investments, while consumers became more inclined to spend. The combination of heightened demand and a swifter money circulation gradually pushed prices upwards.

The faith and notions about “too big to fail” or “anticyclical monetary policy” were merely wrong, and it is an empirical fact, but the truth is that both cases were predictable. Before 2008, the financial derivative market created an illusion that finances were separated from the real economy and existed separately. After 2008, the same circus continued in different formulations about monetary policy’s ability to eliminate recession and the outcomes of the financial crisis. Figuratively, the plot is the next: “For filling the hole, we have to dig dipper”. Therefore, we have Conventional results of unconventional monetary policy: central banks’ balance sheets are unprecedentedly high, credit markets are overheated, prices are skyrocketing, and economic growth is slowing down globally. The same picture that we had in 2008, but now it is bigger. (Khidasheli, 2022) [9].

“Soft landing” dilemma

After experiencing those peaceful times, when central bank independence came to be widely accepted, central banks started to deploy unconventional monetary policies. There was a somewhat naïve assumption that the policy could be unwound easily enough when necessary. Unfortunately, the world has changed. The environment that fostered benign supply-side factors is under attack from many directions: heightened geopolitical risk, rising populism, and the pandemic have disrupted global supply chains. Central banks now face a trade-off between inflation and employment, making unwinding challenging (Shirakawa, 2023).

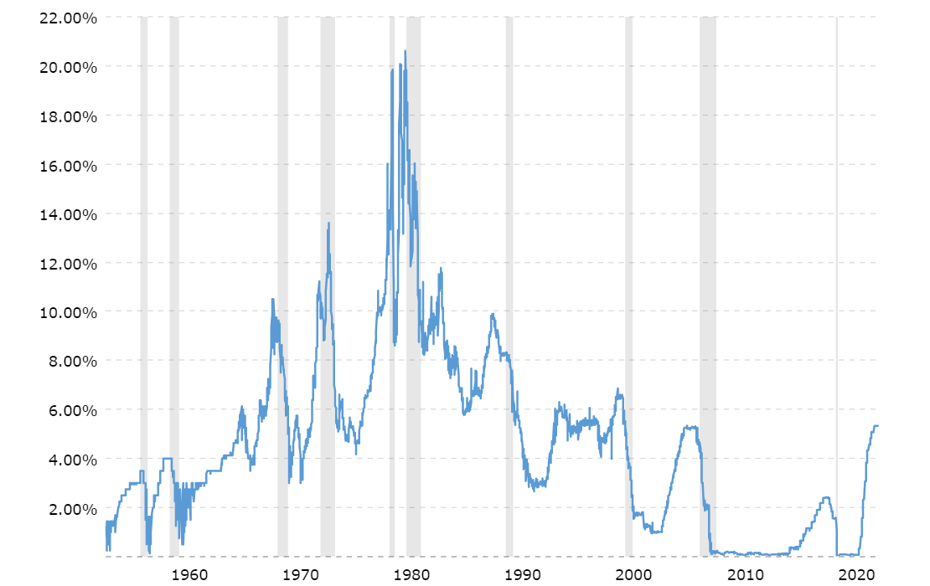

The prolonged implementation of non-traditional monetary measures led to inflationary pressures and posed a significant risk of excessive reliance on the financial sector and the overall economy on the “mighty” central banks. This form of dependence deviates from the principles of capitalism and market orientation, resulting in severe price distortion effects that contribute to the inefficient allocation of resources and the detachment of the financial system from its intended role as an efficient allocator of resources (See Fig. #3)

Fig. #3 The Effective Federal Funds Rate, 1960–2021

Source: (St. Louis Fed Economic Data, 2024) [10].

Now, in an environment that compels central banks to raise rates to combat inflation, their goals of inflation stability and financial stability conflict. The reliance of the private sector, especially the capital markets, on central bank liquidity has led to financial dominance, in which concerns about financial stability restrict monetary policy. In such an environment, monetary tightening could wreak havoc on the financial sector and further render the economy vulnerable to even small disturbances. The extent of financial dominance depends on whether private banks are sufficiently capitalized to withstand losses and on the smoothness of private bankruptcy proceedings. A well-functioning insolvency law would insulate the system from spillover effects from the failure of an individual institution and make it less likely that a central bank would feel compelled to bail it out. These issues make it difficult for central banks to bring down inflation without causing a recession—and somewhat undermine their de facto independence. (Rajan, 2023) [11].

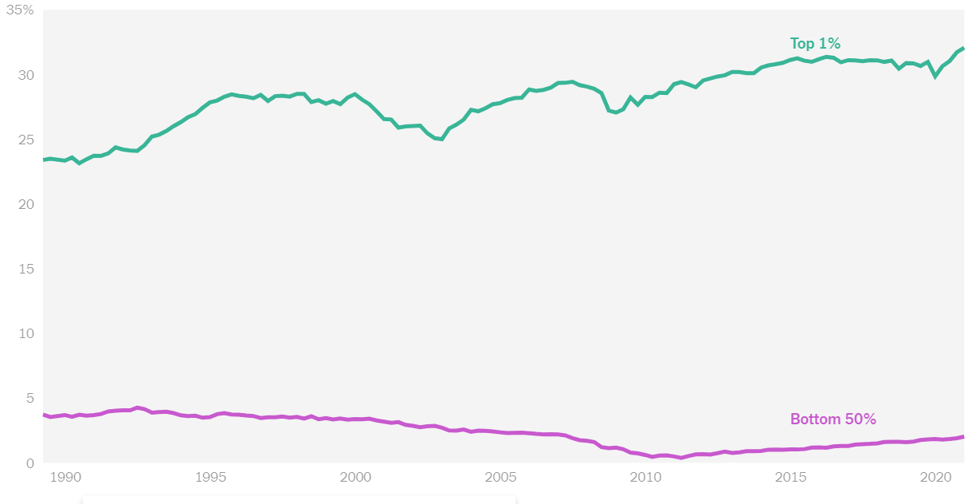

The above-mentioned academic perspectives revolve around the predicament central banks face in determining their rightful position and role. The extended efforts to “facilitate” stability within the financial sector yield conflicting outcomes concerning the allocation of resources, the influence of market forces, and the disparity in wealth distribution (See Fig #4)

Fig. #4. Share of US nation’s wealth net worth by social groups

Source: (Petrou, 2021) [12].

Yet stopping the postmortem at this point is probably overly generous to central banks. After all, their past actions reduced their room to manoeuvre, not only for the outlined reasons. Take the emergence of fiscal dominance (whereby the central bank acts to accommodate the government’s fiscal spending) and financial dominance (whereby the central bank acquiesces to market imperatives). They are not unrelated to central bank actions of the past few years. (Rajan, 2023).

The emphasis on acquiring assets and maintaining low interest rates tends to inflate the values of financial assets, thereby favouring individuals with substantial holdings. Those with greater wealth, often characterized by significant investments in stocks and real estate, witness a disproportionate increase in their overall net worth. Consequently, this exacerbates the existing wealth disparity as the affluent segment benefits more prominently from the surge in asset prices.

Conversely, the impact of interest rates affects savers and borrowers in contrasting ways. While borrowers may relish the advantage of reduced interest payments, individuals who rely on interest income, such as retirees, may experience a decline in their earnings. This disparity in income distribution particularly affects those with fixed incomes who heavily rely on interest returns for their sustenance, thereby contributing to income inequality (See Fig. #4).

In a free-market economy, where there is no fractional reserve banking practice, the source of credit resources is savings, temporarily free money funds, which, through the banks as the mediators, flow from the savings holders to business operators in the form of loans. The existence of savings is, on the one hand, the means for obtaining credit resources for business, and on the other hand, the indicator of the existence of additional demand, which should provide support for economic growth, as well as the application of the additional issue. Everything changes in the conditions of a fractional reserve system when the source of the loan is not real savings but a monetary multiplier (Khidasheli & Chikladze, 2019).

The protracted implementation of non-traditional monetary policies presents obstacles that limit the scope for achieving a smooth economic transition. Although these policies initially aim to stimulate economic activity and alleviate the effects of financial crises, their prolonged usage may give rise to complexities that impede a seamless shift toward a more sustainable economic environment.

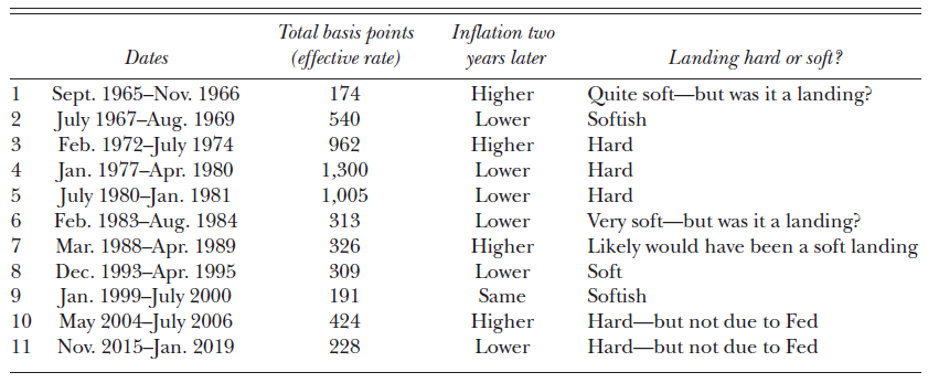

The continuation of extremely low interest rates can contribute to the accumulation of financial imbalances. In a low-rate setting, investors, in search of higher returns, may engage in riskier behaviours, leading to inflated asset prices. When these imbalances eventually occur, correction can be sudden and disruptive, making it challenging to orchestrate a gentle economic landing (See table #2).

Table #2. The Eleven Monetary Policy Tightening Since 1965

Source: (Blinder, 2023) [13].

The Fed cannot default or go bankrupt because it can always create reserves to cover its losses. Most of the time, the Fed’s earnings on its balance sheet are positive, and it remits any profits above its operating costs back to the Treasury. In the case of a loss, the Fed would halt its remittances to the Treasury until it had offset its losses with subsequent profit. (Sablik, 2022) [14].

The heavy reliance on non-traditional measures, such as quantitative easing, may distort market mechanisms. Markets become accustomed to interventions by central banks, creating a dependency that, when unwound, can result in heightened uncertainty and turbulence in the market. This challenges the central bank’s ability to engineer a gradual and controlled economic transition.

Conclusions:

The 2008 financial crisis profoundly impacted the global economy, revealing the inherent vulnerabilities present in fractional reserve banking. This practice, which allows banks to create money through lending based on only a fraction of reserves, proved fragile and susceptible to collapse during economic downturns. Despite this realization, there has been a lack of meaningful reform to address the fundamental flaws in the system’s operation.

Instead of tackling the underlying structural deficiencies, the response to the crisis primarily focused on short-term stabilization measures. Central bank intervention and accommodative monetary policies were relied upon as quick fixes to stimulate economic growth. However, these policies have only exacerbated the vulnerabilities within the system. They have encouraged excessive risk-taking and speculative behaviour, leading to the inflation of asset bubbles and widening wealth inequality.

Furthermore, the failure to address the structural issues within the financial system has left us vulnerable to future crises. The proliferation of complex financial products, opaque derivatives markets, and interconnectedness among financial institutions continue to pose significant risks. Comprehensive reform is necessary to ensure the stability and resilience of the financial system.

Printing money is not an effective solution as it fails to generate or sustain prosperity. In addition, it disrupts the price function and results in the misallocation of resources. Fiat money, in and of itself, cannot be consumed nor directly utilized as a producer’s good in the productive process. It is essentially unproductive, serving as deadstock that yields no tangible output. According to Say, commodities are ultimately paid for not with money but with other commodities. Money simply serves as a commonly accepted medium of exchange, playing a role solely as an intermediary. Ultimately, sellers aim to receive other commodities in exchange for the goods they sell.

The policies initially intended to tackle the fundamental reasons behind the 2008 financial crisis inadvertently prolonged the cycle of financial instability and worsened the inherent structural weaknesses of the global economy. Unconventional monetary measures, such as money printing and aggressive asset acquisitions, may have offered temporary respite, but they ultimately fell short of addressing the underlying problems associated with the fractional reserve system. Going forward, policymakers need to acknowledge the constraints of such approaches and shift their attention toward implementing sustainable reforms that foster financial stability, accountability, and long-term economic resilience.

References

- Khidasheli, M., & Chikladze, N. (2019). Financial system stability threats after 2008 anti-cyclical policies. Social Sciences Bulletin, Daugavpils University. p. 24-41. Social Sciences Bulletin: https://du.lv/wp-content/uploads/2019/07/SZV_2019-1_DRUKA.pdf [Last Access: 05.10.2023].

- Thakor, A. V. (2015). The Financial Crisis of 2007-09: Why Did It Happen and What Did We Learn? The Review of Corporate Finance Studies. p. 155–205. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2372449 [Last Access: 05.10.2023].

- Mizen, P. (2008). The Credit Crunch of 2007-2008: A Discussion of the Background, Market Reactions, and Policy Responses. Federal Reserve Bank of St. Louis Review. p. 531-567. Federal Reserve Bank of St. Louis: https://files.stlouisfed.org/files/htdocs/publications/review/08/09/Mizen.pdf [Last Access: 05.10.2023].

- Wyplosz, C. (2023). Big central banks. Brussels: European Parliament, Economic Governance and EMU Scrutiny Unit. https://www.europarl.europa.eu/RegData/etudes/IDAN/2023/747867/IPOL_IDA(2023)747867_EN.pdf [Last Access: 05.10.2023].

- Schnabel, I. (2023, March). Back to normal? Balance sheet size and interest rate control. European Central Bank: https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp230327_1~fe4adb3e9b.en.html [Last Access: 05.10.2023].

- Eurostat. (2023). https://ec.europa.eu/eurostat/fr/web/products-eurostat-news/-/ddn-20230309-2 [Last Access: 05.10.2023].

- McKitrick, R. (2022). Inflation—why now and not post-2008? https://www.fraserinstitute.org/article/inflation-why-now-and-not-post-2008 [Last Access: 05.10.2023].

- Shirakawa, M. (2023). It’s time to rethink the foundation and framework of monetary policy. Finance & Development. p. 18-20.

- Khidasheli. (2022). Conventionl results of unconventional monetary policy. Economic Profile. p. 18-21.

- St. Louis Fed Economic Data. (2024). St. Louis Fed: https://fred.stlouisfed.org/series/FEDFUNDS [Last Access: 05.10.2023].

- Rajan, R. (2023). More focused, less interventionist central banks would likely deliver better outcomes. Finance & Development. p. 11-14.

- Petrou, K. (2021). Only the rich could love this economic recovery. https://www.nytimes.com/interactive/2021/07/12/opinion/covid-fed-qe-inequality.html [Last Access: 05.10.2023].

- Blinder, A. S. (2023). Landings, Soft and Hard: The Federal Reserve, 1965–2022. JOURNAL OF ECONOMIC PERSPECTIVES. p. 101-20.

- Sablik, T. (2022). The Fed Is Shrinking Its Balance Sheet. Econ Focus, Federal Reserve Bank of Richmond. p. 4-7.

Downloads

Downloads

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.